Revised: 1/2020

The Form W-4 is changing in 2020, and the new one goes into affect on January 1st.

We have been busy making changes to the system, to help make the transition as straight forward as possible for you.

Key Points to Keep in Mind:

1. Only employees, who start on or after 1/1/2020 and existing employees, who want to adjust their withholdings, have to fill out and submit the new Form W-4.

2. If an employee does NOT fill out a new W4, no change to their record is needed. We have preset all your employees to process as they should using 2019 and earlier W4 forms.

3. If you have questions on Form W-4 please go directly to the IRS

Updates to your SDS System have been made to the following areas:

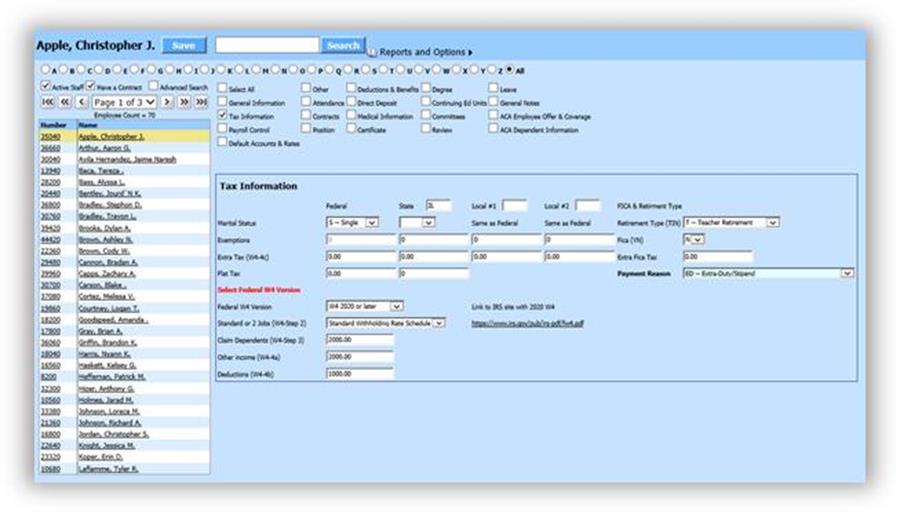

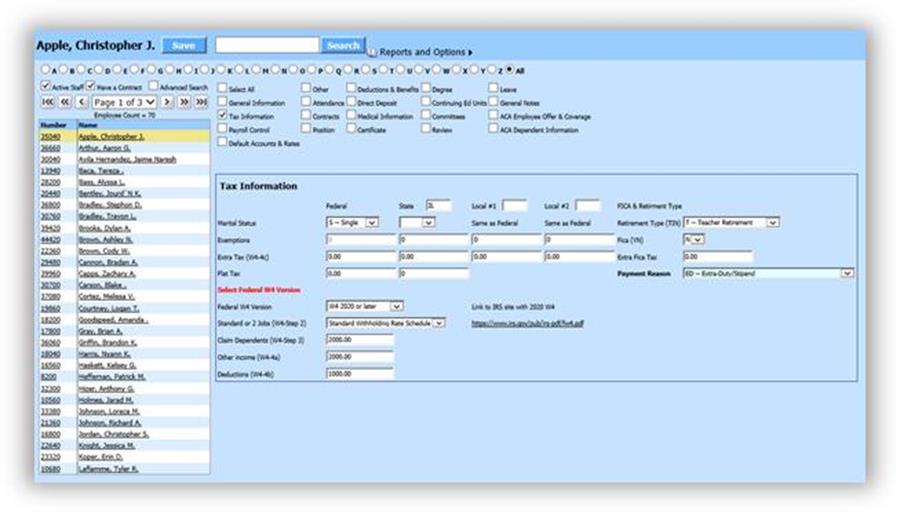

Payroll Processing |Add, Change Employee Information:

1. We added new fields to the “Tax Information” display. Check the box next to “Tax Information” to see the fields.

2. We added a link to the IRS web site with the 2020 W4 for your questions and reference. https://www.irs.gov/pub/irs-pdf/fw4.pdf

3. Each new field added to SDS is explained in detail on the IRS site https://www.irs.gov/pub/irs-pdf/fw4.pdf .

Payroll Project Changes to Two Areas:

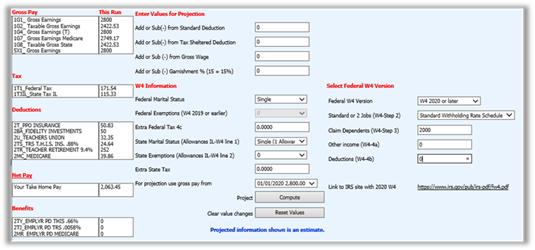

1. Payroll Processing – “Individual Employee Payroll Projection”

2. Employee Portal - “Project Your Pay If You Change a Deduction”

The same data fields and link that were added to the Employee Add and Change Screen have been added to the Projection Screen.

This provides a quick way for you and your staff to check out, how a change to W4 information will affect their federal tax deduction. The projection uses the federal tax tables installed for your district. This week, the tax will compute using the 2019 tax tables. When the first payroll for 2020 is opened your tax tables will be updated after you confirm the install process.

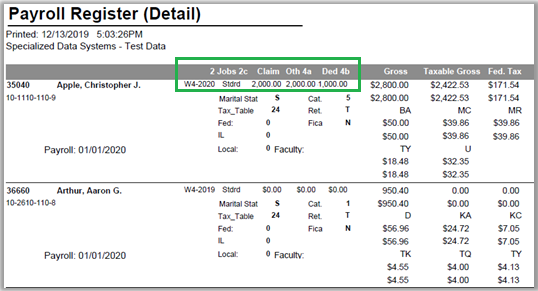

When you process a payroll, other than entering some different information for the W4, nothing else will look different except for the standard payroll register.

The payroll register for each employee prints information used to compute federal tax. The report has been updated to include the new W4 fields.