Revised: 4/2021

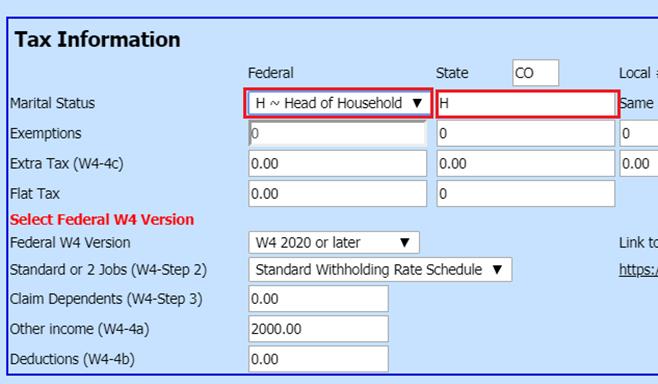

If an employee(s) has completed the 2020 W4 form with Head of Household, you will need to follow the below step to add the selection and update tax tables.

To add Head of Household, first you will need to set up the option to choose from, under Marital Status.

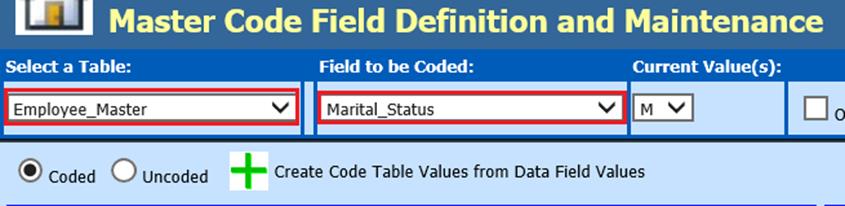

To add the Marital Status new selection:

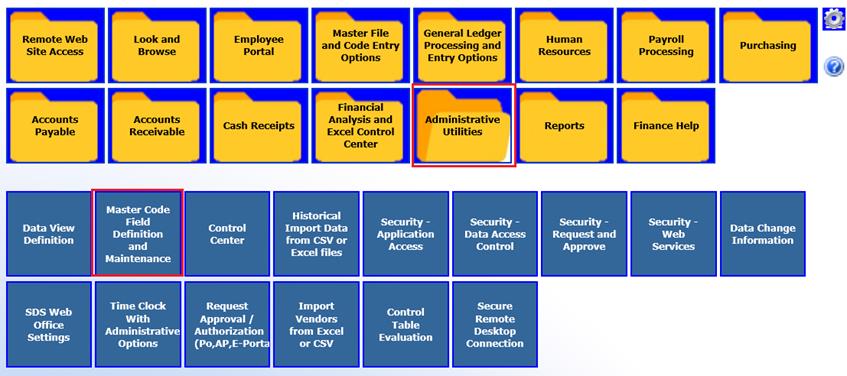

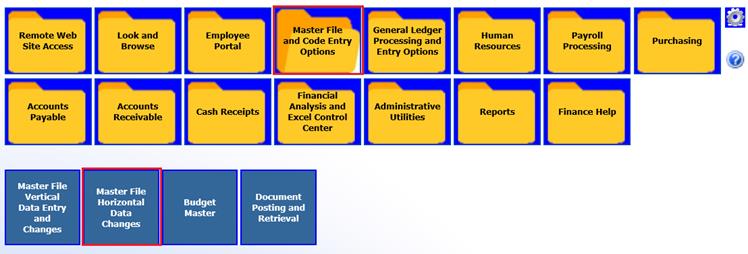

1. Select Administrative Utilities

2. Select Master Code Field Definition and Maintenance

3. Select a Table: Select Employee Master

4. Field to be Coded: Select Marital_Status

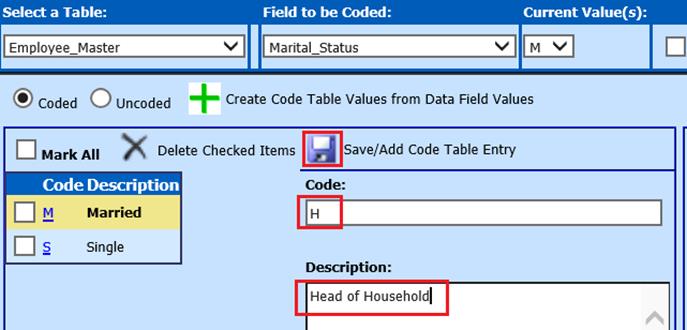

5. Code: Enter “H”

6. Description: Enter “Head of Household

7. Select “Save/Add Code Table Entry”

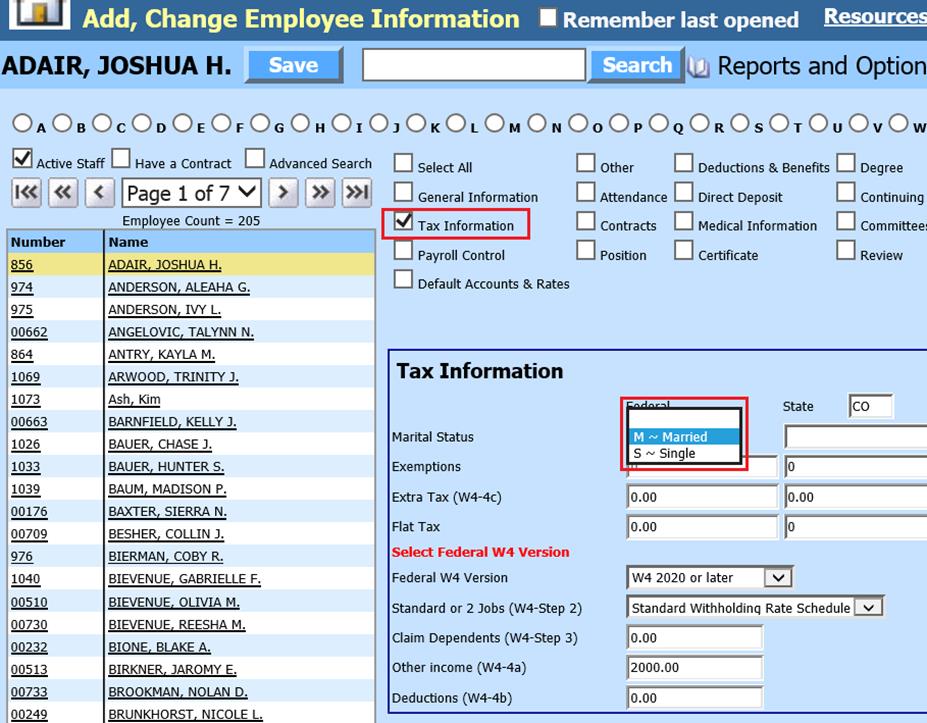

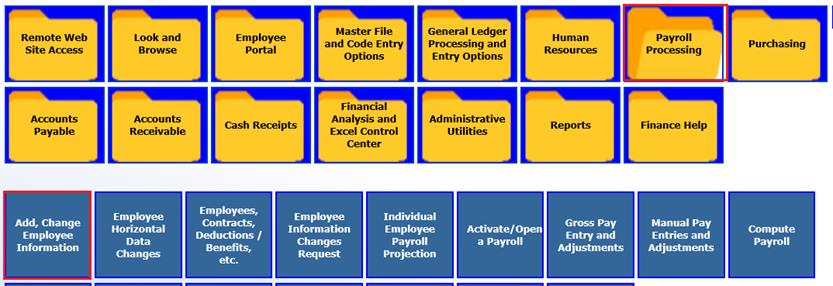

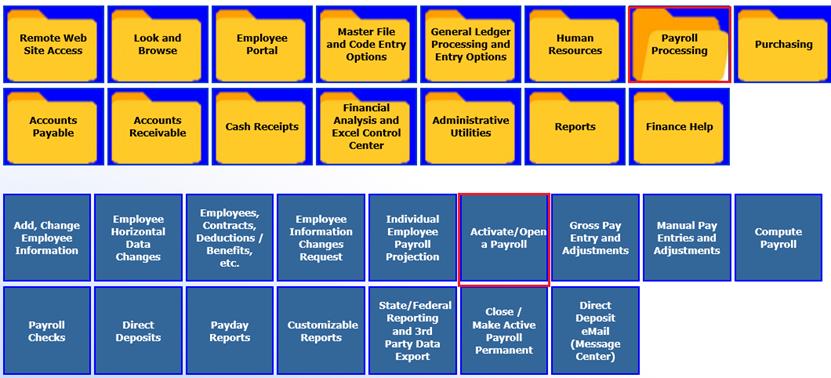

8. Select Payroll Processing

9. Select Add, Change Employee Information

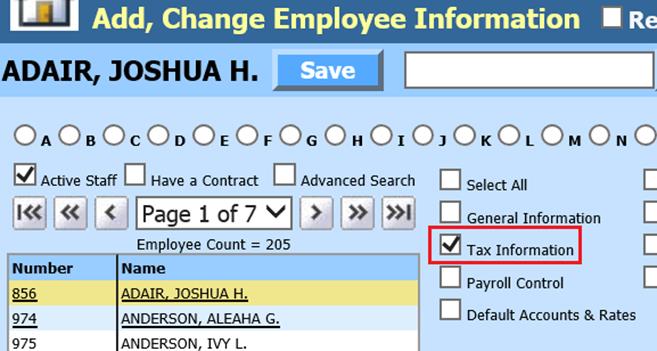

10. Select Employee and check mark Tax Information field

11. Update Federal Marital Status with “H”

12. Update State Marital Status with appropriate code: “M, S, H”

13. Continue updating required Tax Information fields.

Note: If you have specific questions on what to put in these W4 fields, please contact the IRS, your auditor or accountant for assistance.

14. Select Save

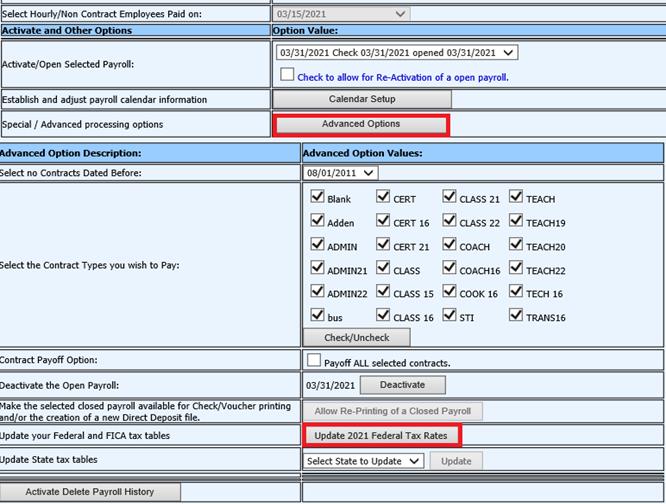

15. Select Activate/Open a Payroll

16. You must have an Active Payroll date

17. Once you have an opened payroll; Select Advanced Options

18. Select “Update 2021 Federal Tax Rates”

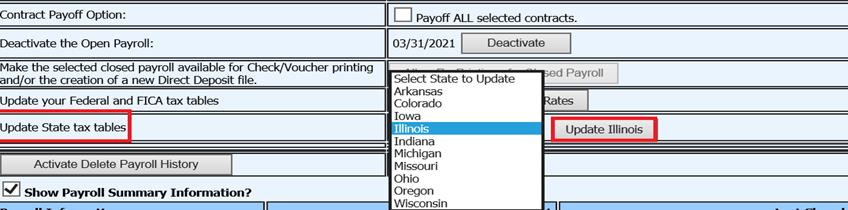

19. Update State tax tables: Choose your State from the dropdown selection

20. Select Update

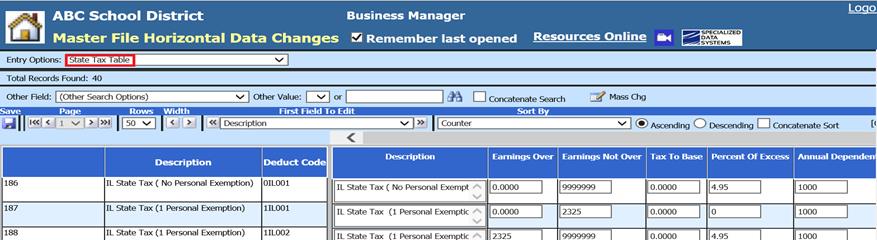

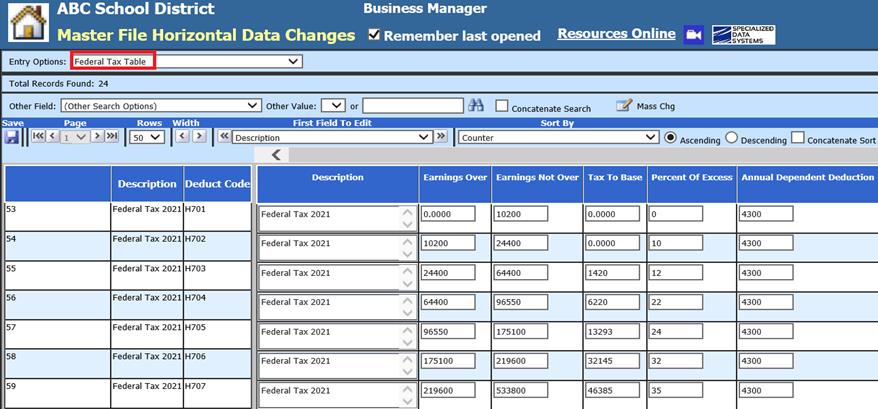

Verify Tax Tables

1. Select Master File and Code Entry Options

2. Select Master File Horizontal

3. Entry Options: Select Federal Tax Table

4. If you have updated your State Tax Table: From Entry Options: Select State Tax Table.