Revised: 5/2023

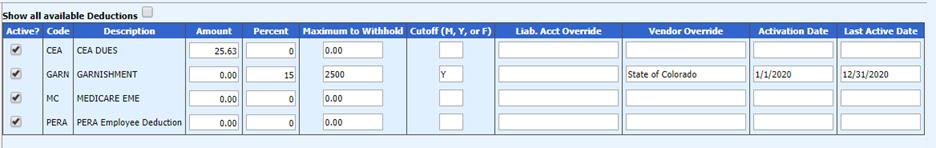

This allows Maximum to Withhold amounts to be entered on

each individual employee benefit/deduction and designate period cutoffs (i.e.

calendar, fiscal or month). Below are the processing options to set up Liability

Account, Vendor Override options and Activation dates.

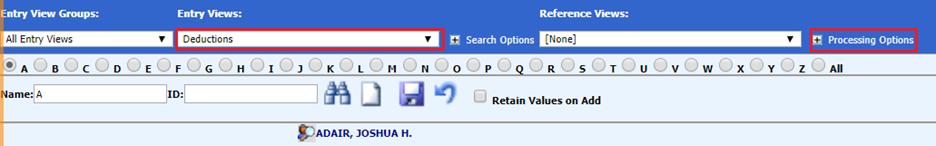

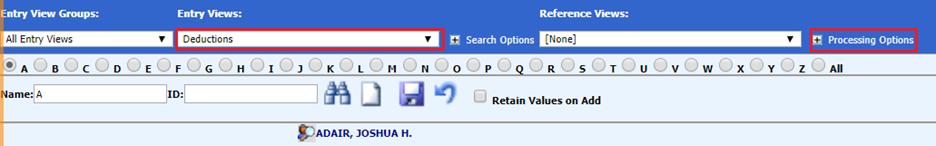

1. Select Human Resources or Payroll Processing

2. Select Employees, Contracts, Deductions/ Benefits, etc.

3. Entry Views: Select the Deductions or Benefits table

4. Select Employee

5. Select the + next to Processing Options

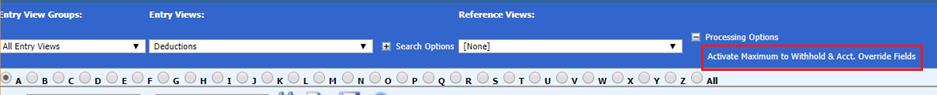

6. Select Activate Maximum to Withhold & Acct. Override Fields

•Maximum to Withold: Enter the Maximum to Withhold.

•Cutoff (M,Y, or F): Enter cut off period for the maximum to withhold, Y= Calendar Year, F= Fiscal Year and M= Month

•Liab. Acct Overridez: Enter Liab. Acct. Override, as needed

•Vendor Override: Enter Vendor Override, as needed

•Activation Date: Enter Activation Date, as needed

•Last Active Date: Enter Last Active Date, as needed *Last active date must be at least one day after the last payroll date (i.e. payroll date 5/30/23- if you want the deduction to process on that payroll, the last active date must be 5/31/23)

7. Select  to save.

to save.