Revised: 12/2020

Medicare only Employees

The

Additional Medicare Tax Setup will allow you to continue to compute Medicare

after reaching $200,000 in wages. This process affects the Employee

Portion ONLY and not the Employer Match. Medicare only. You only

need to change the Deduction code currently using for the Medicare

deduction.

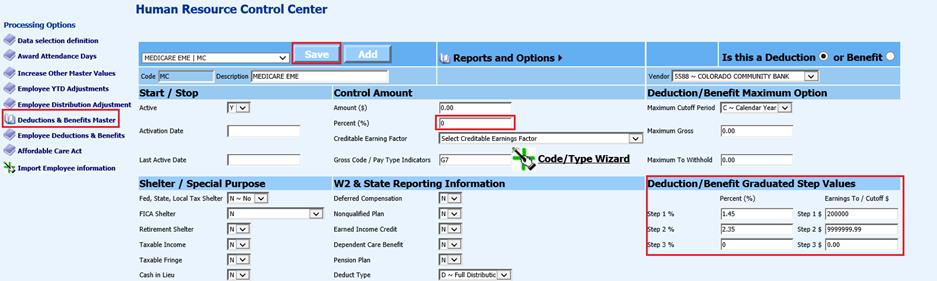

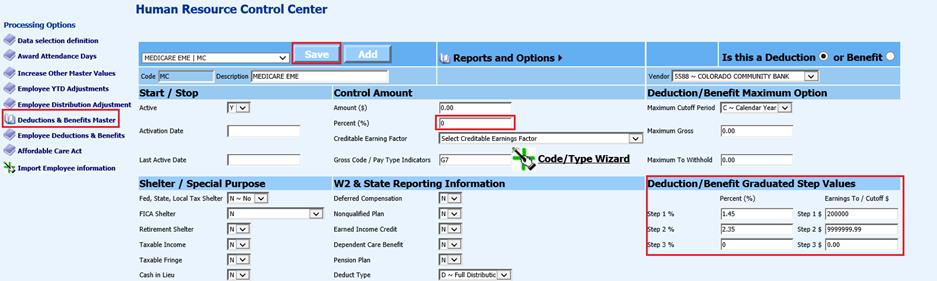

1. Select Human Resources

2. Select Human Resources Control Center

3. Select Deduction & Benefit Master

4. Select deduction code : MC (Medicare, Employee Deduction)

5. Set the percentage amount in the Percent field of the deduction code to zero.

6. Deduction/Benefit Graduated Step Values: Complete the following fields:

o Cutoff Period needs to be coded with a “C” (for Calendar Year)

o Set the Step1 Earnings To: 200000.00

o Set the Step1 Percent: 1.45

o Set the Step2 Earnings To: 9999999.99

o Set the Step2 Percent: 2.35

o Set the Step3 Earnings to: 0.00

o Set the Step3 Percent: 0.00

7. Select Save

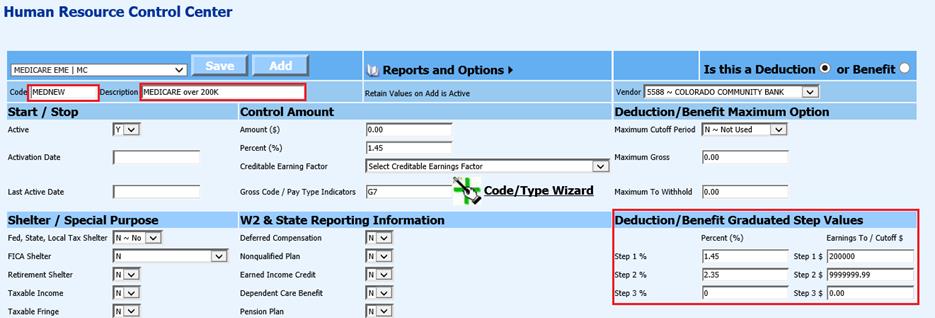

Medicare over 200K for FICA

Employees

This additional tax is on the employee portion only and

not the employer match.

1. Select Human Resources

2. Select Human Resources Control Center

3. Select Deduction & Benefit Master

4. Select “Add” to add a new code

o Create a new Deduction code: MEDNEW

o Complete required fields for timing code, liability account number, vendor, etc.

5. Set the percentage amount in the Percent field of the deduction code to zero.

6. Deduction/Benefit Graduated Step Values: Complete the following fields:

o Set the Gross code Indicator to G3

o Cutoff Period needs to be coded with a “C” (for Calendar Year)

o Set the Step1 Earnings To: 200000.00

o Set the Step1 Percent: 0

o Set the Step2 Earnings To: 9999999.99

o Set the Step2 Percent: 0.9

o Set the Step3 Earnings to: 0.00

o Set the Step3 Percent: 0

7. Select Save