Revised: 7/2021

The cash in lieu of a fringe benefit option replaces the need to setup a secondary time card or contract for the cash in lieu of a fringe benefit. This will apply the benefit, to be added, to the base Gross Pay. Using this benefit setup, no payroll liability will be created and there will be a debit to the expense and credit to decrease cash included in the Payroll Transaction that is created by the system.

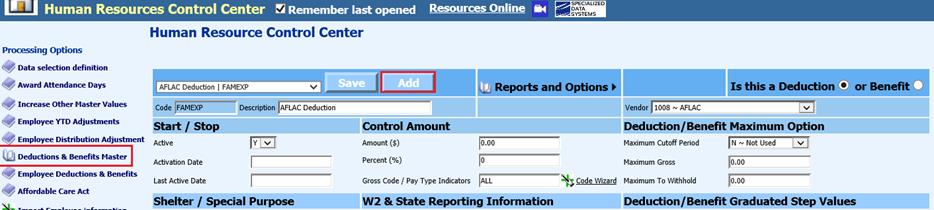

1. Select Human Resources

2. Select Humam Resources Control Center

3. Seelct Deductions & Benefits Master

4. Select the Add button

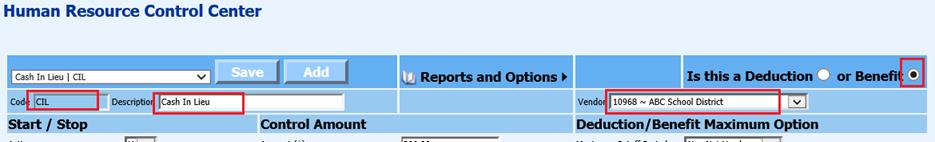

5. Select the bullet next to Benefit

6. Enter new Benefit Code: i.e. CIL

7. Enter Description: i.e. Cash in Lieu

8. Select your school as the Vendor

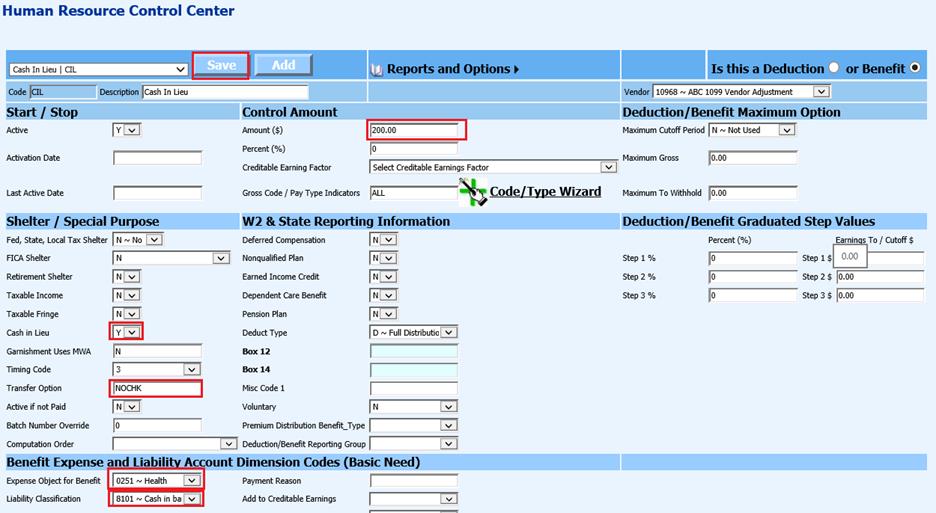

9. Enter the Cash in Lieu Amount or leave as Zero, if applying the amount to the employee individually.

10. Cash in Lieu: This field must be marked with a “Y”.

11. The “Transfer Option” field should have “NOCHK”

12. Enter Expense Object for Benefit

13. Enter the cash liability code in the Liability Classification field

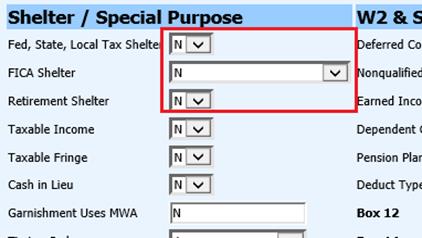

14. Other fields that need to be looked at closely are “Tax Shelter YN”, “FICA Shelter YN”, and “Retirement Shelter YN”. If the cash in lieu should increase the Taxable gross, FICA gross or Retirement gross then a “T” must be entered into these fields. (consult your auditor if you have any questions about this)

15. Once all fields have been completed, select Save