Revised: 4/2021

Changing Account Numbers on a

Cash Receipt entry, after it has been made permanent, can be done for any month.

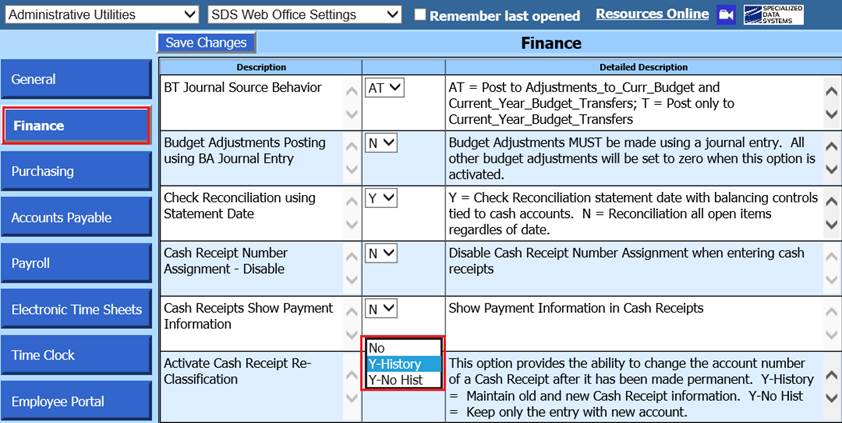

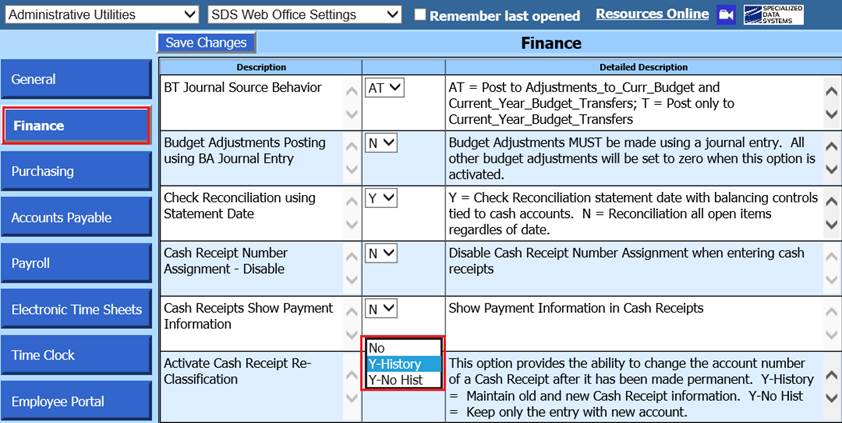

To activate this option:

1. Select Administrative Utilities then select SDS Web Office Settings

2. Select the Finance section and find “Activate Cash Receipt Re-Classification“ there are three options:

•“No” Do not allow for account number changes to permanent disbursements.

•“Y-History” Allow for account change, preserve the original disbursement entry and the reversing entry.

•“Y-No Hist” Allow for account change, delete original disbursement entry

Once this process has been activated:

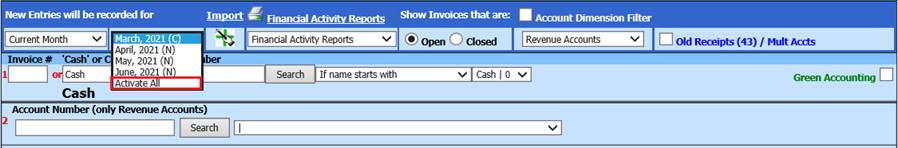

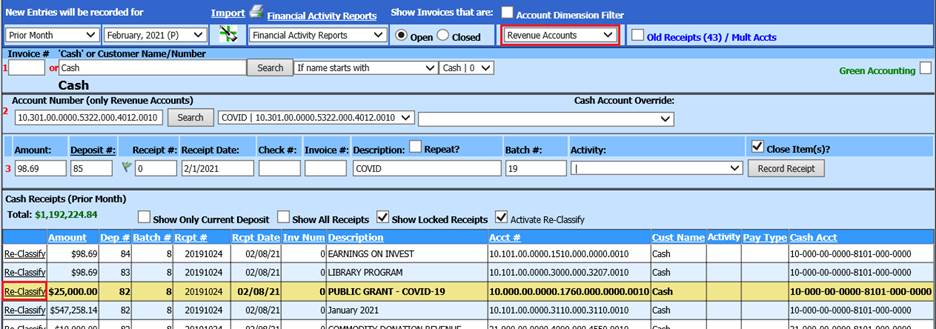

1. Select Cash Receipts

2. Select Cash Receipts

3. Search for the entry that needs to be reclassified.

o If the disbursement is in a prior month, select the down arrow next to the current Month/Year then select “Activate All”

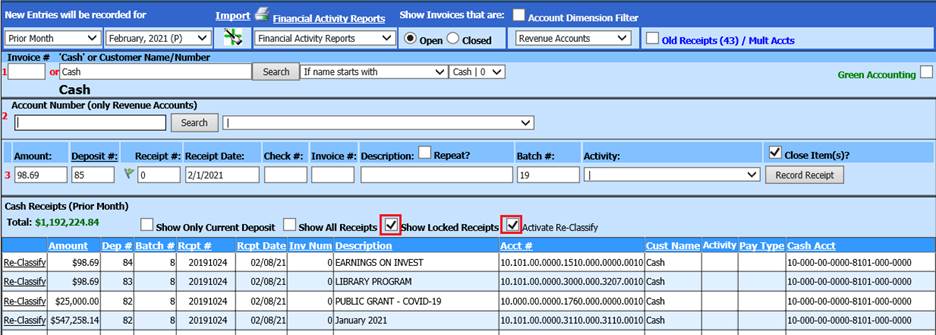

4. Select Show Locked Receipts

5. Select Activate Re-Classify

6. Select Account Type

7. Select Re-classify

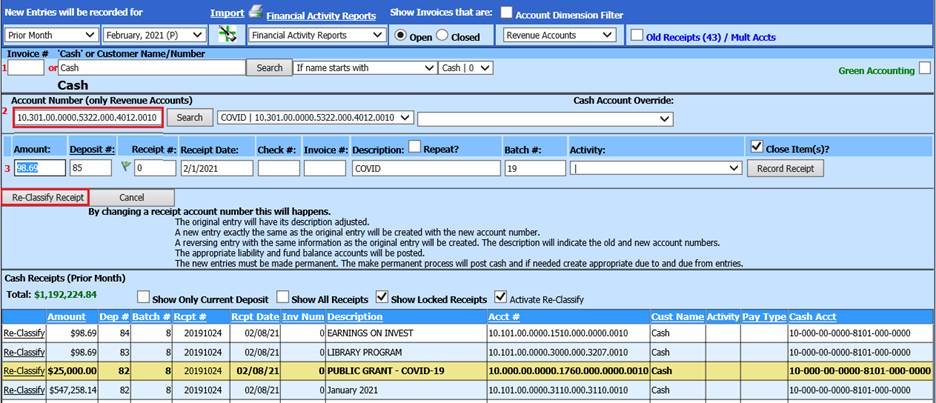

8. Enter new account number

9. Select Re-Classify Receipt

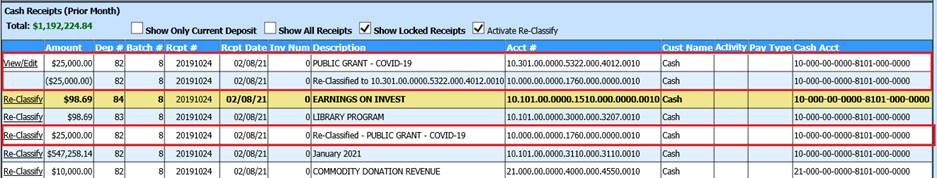

10. The Description has been updated and account adjusted

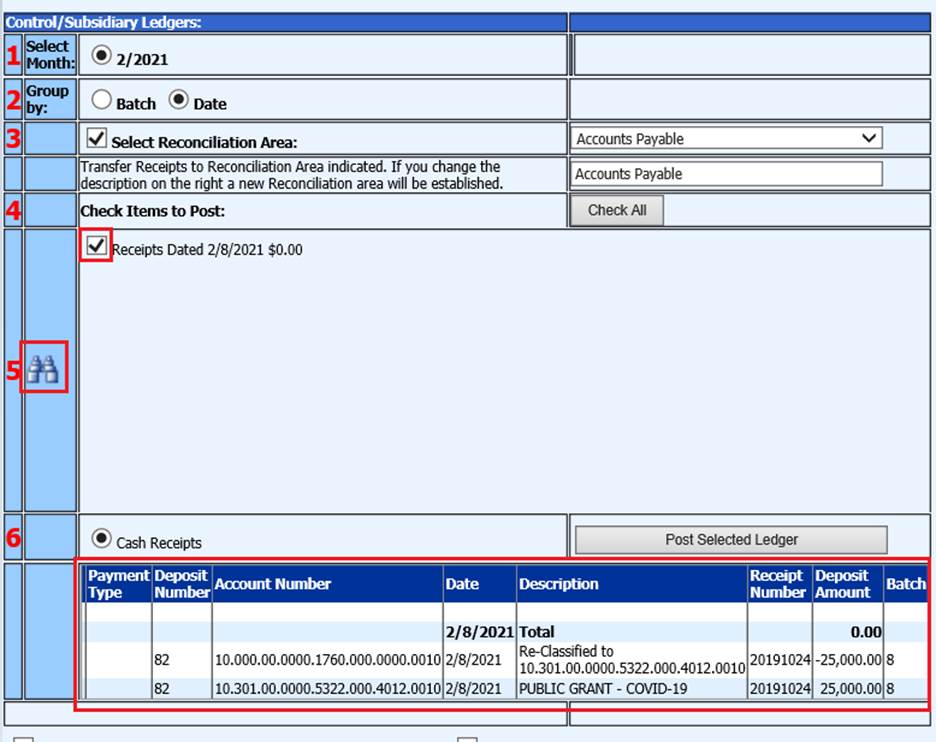

11. The transaction must be made permanent for the Reclassify to update records

12. Select Make Cash Reciepts Permanent

o 1 Select the month: Select the month to make entries permanent (all receipts for the month selected will show in Section 5)

o 2 Group by: Date is the default, if you want to post by batch choose “Batch”

o 3. Select Reconciliation Area: From the drop down select the check reconciliation area you want a select group of checks to post to for check reconciliation purposes.

o If the reconciliation area is not listed that you need to post a group of checks to, you can create a new check reconciliation group. To create a new check reconciliation group, enter the name needed into the field next to “Transfer Receipts to Reconciliation Area indicated.”

o 4. Check items to Post: Select the items being made permanent or select Check All.

o 5. Use the Binoculars to preview the Items to be made permanent.

13. Select Post to Ledger