Revised: 4/2021

Computing payroll is the final process to pull all the amounts for taxes and deductions and benefits for each employee.

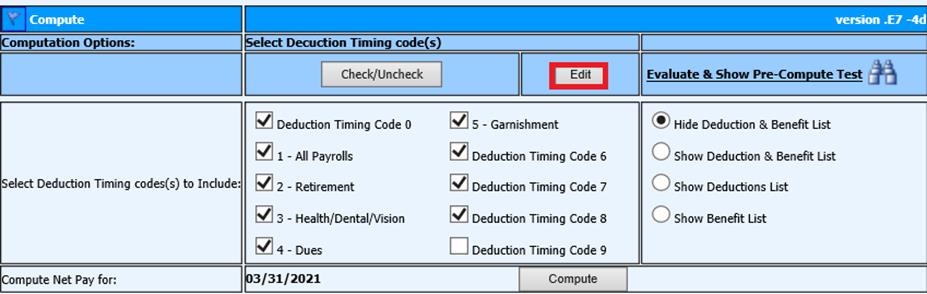

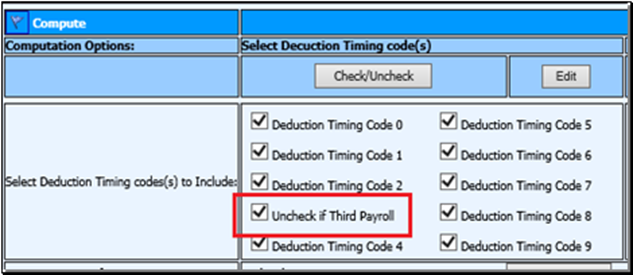

Timing Codes

The timing code numbers come from the Deduction/Benefit Master and are used to control which deduction/benefits codes are to be pulled into each payroll. When selected, the deductions/benefits with the associated number will be applied to the payroll. If deselected, the program will ignore deductions/benefits associate with that number.

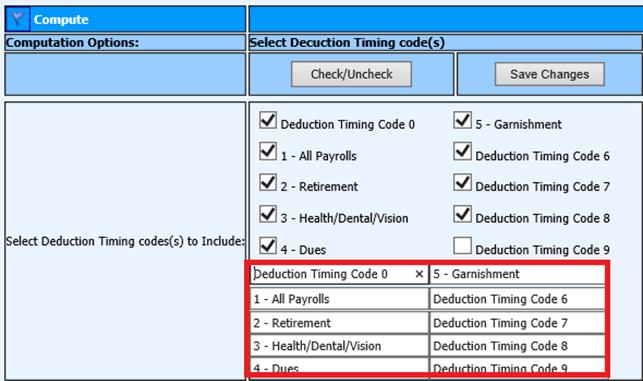

Deduction Timing Codes can be renamed to help with remembering each number assigned. Select “Edit” to change the timing code name

Type over the Deduction Timing Code to rename it with a specific name

Save after changing name

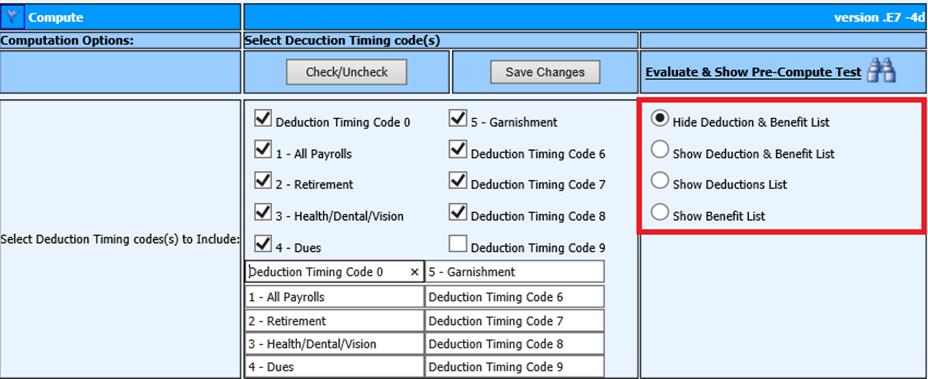

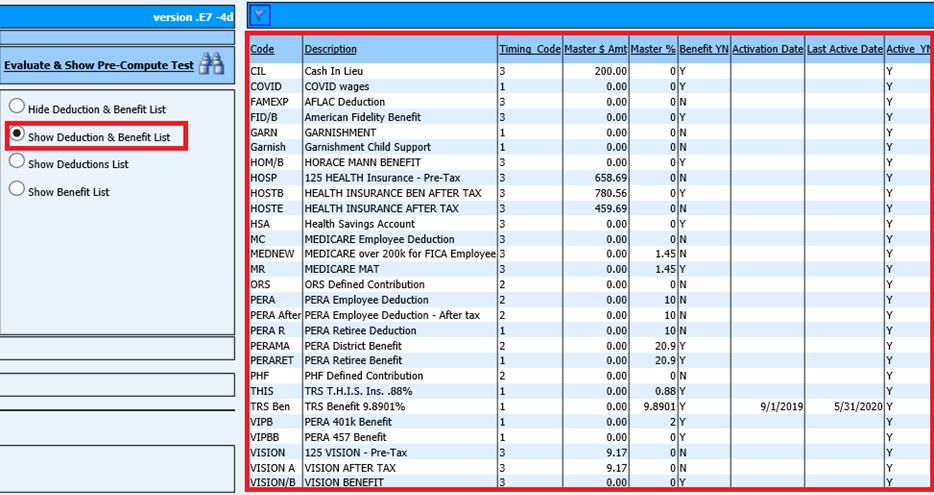

Additional Options to view:

Hide Deduction & Benefit List – all deductions and benefits are hidden

Show Deductions List – allows you to see both active deductions and benefits together with specific information attached to each one

Show Deduction List – will show active deductions only

Show Benefit List – will show active benefits only

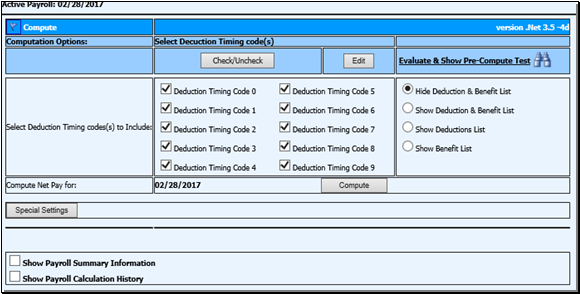

Compute Process

1. Select the Appropriate Timing Codes for payroll, from the Select Deduction Timing Codes to Include.

3. Select the “Compute” button.

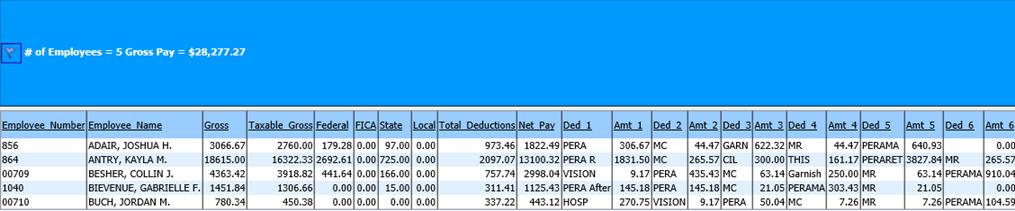

4. After the payroll has computed the Payroll Register Detail Report will display.

Notes:

§ If changes need to be made to the payroll, after the compute, you will need to compute again

§ Computing a payroll will remove all check numbers and voucher numbers if they had been run

§ You can compute as many times as you need to until check/vouchers are cut and direct deposit file is sent to bank

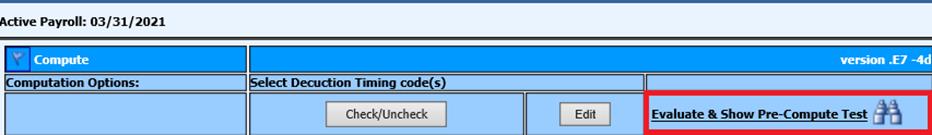

Evaluate & Show Pre-compute Test

Selecting this option brings up a gross to net grid on the screen for review with an employee count and total gross.

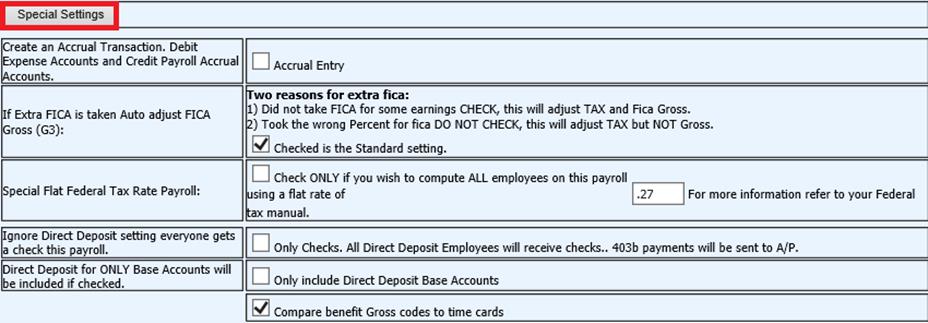

Special Settings

The special settings area contains several payroll computation options. They include creating a payroll accrual transaction paying off selected contract types, computing payroll with a flat rate for federal tax, and turning off direct deposit for everyone on the payroll.

If special settings are being used for your payroll these selections must be chosen before selecting the “Compute” button.

o To create an Accrual Transaction, Debit Expense Account and Credit Payroll Accrual Accounts – Creates an accrual payroll transaction journal entry to post for the end of a fiscal year (see accrual payroll instructions http://help.schooloffice.com/financehelp/#!Documents/payrollaccrualandreverseaccrual.htm

o If Extra FICA is taken Auto Adjust FICA Gross(G3) – In the employee master there is a field for Extra FICA using this setting will adjust the FICA gross accordingly

o Special Flat Federal Tax Rate Payroll - Used for setting a flat federal tax percentage for the payroll

o Ignore Direct Deposit setting everyone gets a check this payroll – no vouchers or direct deposit file because everyone gets a check

o Direct Deposit for ONLY Base Accounts will be included if checked – The Base Account setting is in the Employee Direct Deposit settings. If the payroll is to only go to the Base Account check this box. Used for smaller payrolls that may not have enough net income to cover depositing to 2 or more accounts.

o Compare benefit Gross codes to time cards – If unchecked the program ignores gross code settings for distribution

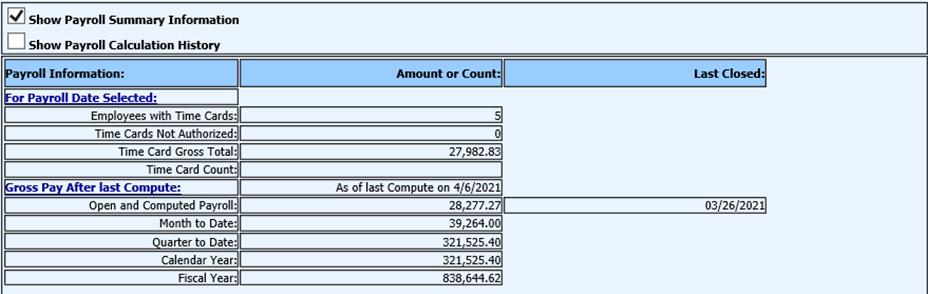

Show Payroll Information

The Show Payroll Information gives an overview of gross for current payroll and payroll periods

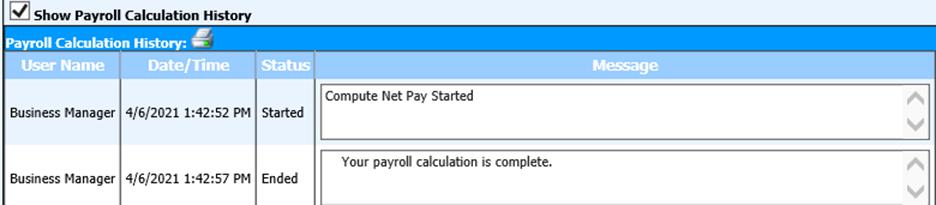

Show Payroll Calculation History

The Show Payroll Calculation History provides a list of times and user that computed payroll along with information the program found.