Revised: 4/2021

The Wage Garnishment process in

SDS follows the federal government’s guidelines for garnishments based on

minimum wage. If the Garnishment is a percentage of income, the system will

apply the percentage against the employee’s disposable income.

Setting up a Wage Garnishment

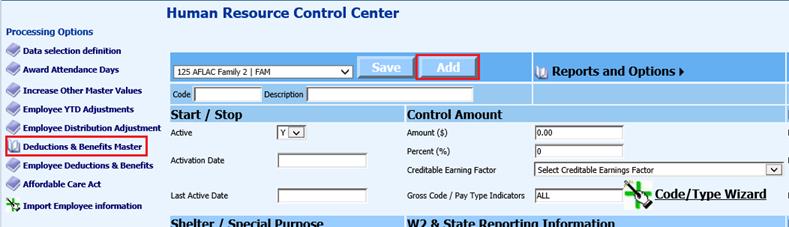

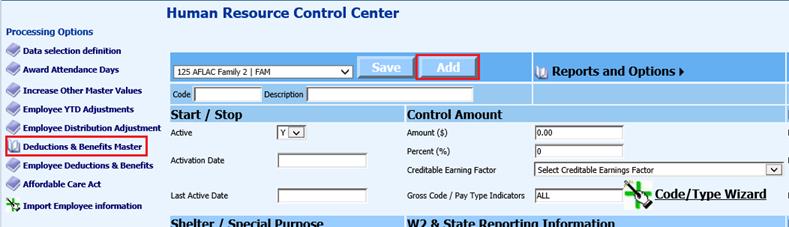

1. Select Human Resources

2. Select Human Resources Control Center

3. Select “Add”

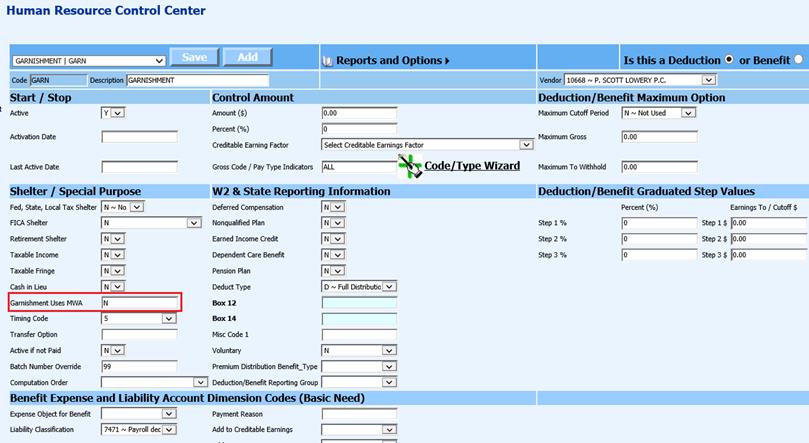

4. Enter in the needed information for new code. See below link for additional detail on Deduction and Benefit Master setup: http://help.schooloffice.com/FinanceHelp/#!Documents/humanresourcescontrolcenterdeductionsbenefitsmaster1.htm

5. Garnishment Uses MWA: Update with the needed codes. This field has specific requirements for a garnishment code, that will instruct the payroll computation program to evaluate the amount of a wage garnishment and apply the federal Minimum Wage Amount rules.

•Blank: Not a garnishment or Do not use the Minimum Wage rules

•N: Not a garnishment or Do not use the Minimum Wage rules

•G: Standard Wage Garnishment

•C: Child Support

•S: you will need one code for each type of garnishment. In the Employee Master “deductions” view, when the garnishment is assigned to the employee, the vendor that this employee’s garnishment is to be paid to can be assigned to the employee.

Deduction setup for Garnishment withholding

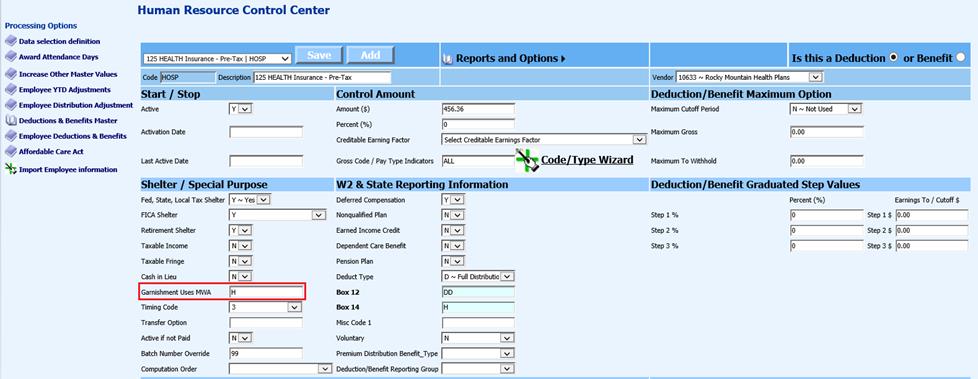

With the garnishment process using the Minimum Wage rules, other deduction records may need to be updated and coded in the field “Garnishment use MWA”. This fields is also used to identify the needed information for proper payroll computation.

1. Update the field “Garnishment (Uses MWA) in the needed Deductions with the following required codes

•H= Health Insurance Premiums charges to an employee each payroll period

•R= Involuntary Retirement Payments

•T= Other Taxes

2. Select Save

Assigning the Garnishment Code to the Employee

There are a three different methods of setting up an employee garnishment: Through Human Resources Control Center, Add, Change Employee Information, and within the Employee Demographics Vertical Entry View.

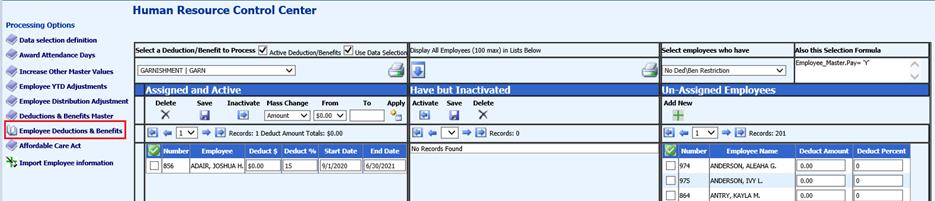

Garnishment setup using Human Resources Control Center:

1. Select Employee Deductions & Benefits

2. Select employee and assign the garnishment information.

o Deduct $: Enter amount, if the garnishment is a fixed amount.

o Deduct %: Enter percent, if the garnishment is a percentage.

o Start date: Enter the start date of the garnishment.

o End Date: Enter the end date of the garnishment.

3. Select Save

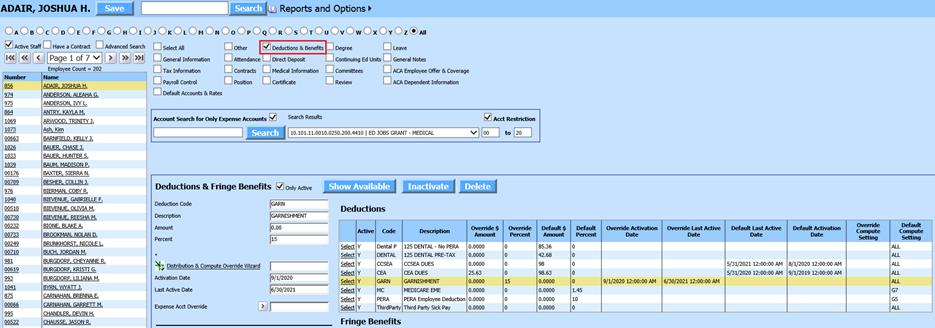

Garnishment setup using Add, Change Employee Information

1. Select Human Resources or Payroll Processing

2. Select Add, Change Employee Information

3. Select Deductions & Benefits

4. Select the employee and assign the garnishment code.

•Amount: Enter amount, if the garnishment is a fixed amount.

•Percent: Enter percent, if the garnishment is a percentage

•Activation Date: Enter the start date of the garnishment.

•Last Active Date: Enter the end date of the garnishment

5. Select Save

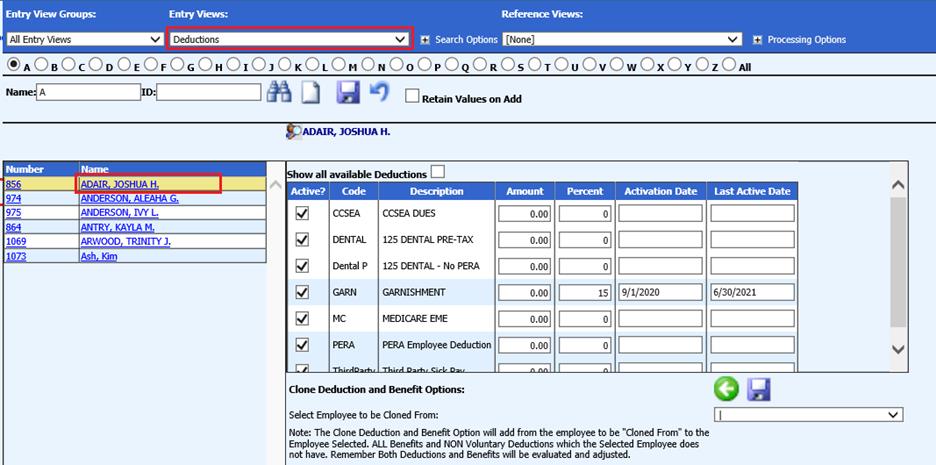

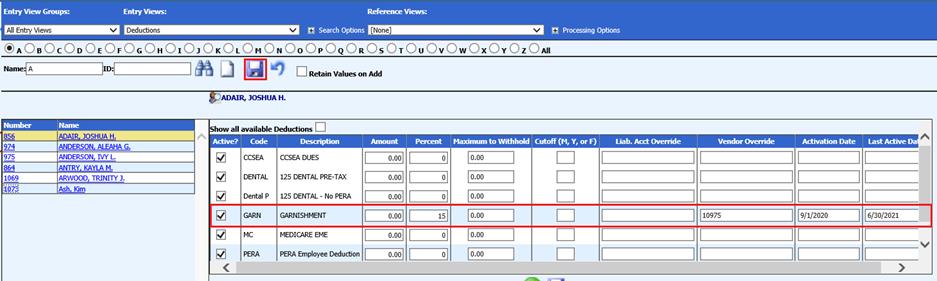

Garnishment setup using Employee Demographics Vertical entry view

This entry view will allow you to use the Vendor Override field for the garnishment.

1. Select Human Resources or Payroll Processing

2. Select Employee, Contracts, Deductions/Benefits, etc.

3. Entry Views: Select Deductions

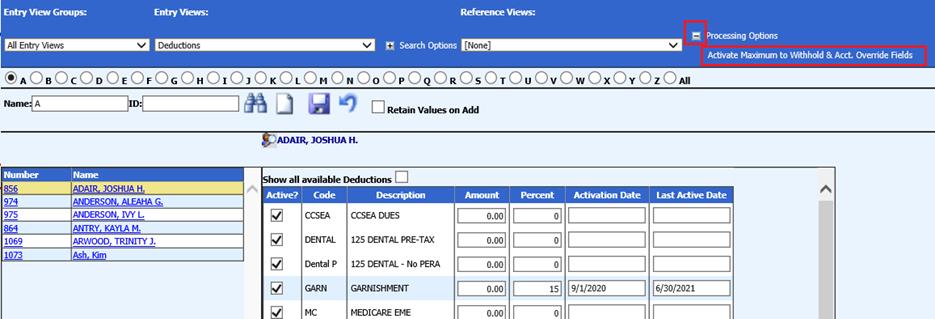

4. + Processing Options

a. Select Activate Maximum to Withhold & Acct. Override Fields

5. Select the employee and assign agarnishment code.

a. Amount: Enter amount, if the garnishment is a fixed amount.

b. Percent: Enter percent, if the garnishment is a percentage

c. Maximum to Withhold: Enter total amount to withhold, or leave blank.

d. Activation Date: Enter the start date of the garnishment.

e. Last Active Date: Enter the end date of the garnishment

6. To use the Vendor Override to apply payment to a different vendor from the Deduction Master setup, enter the new vendor number in Vendor Override field.

7. Select Save

Understanding the

Garnishment Calculation

“Wage Garnishment Calculator” used for

processing garnishments, see link:

http://www.money-zine.com/calculators/loan-calculators/wage-garnishment-calculator/