Added: 04/2023

This will clarify how federal payroll taxes are calculated in your database.

Annually, the IRS releases Publication 15-T (Federal Income Tax Withholding Methods).

The link below will allow you to access the current and prior year publications.

Prior Year Forms and Instructions | Internal Revenue Service (irs.gov)

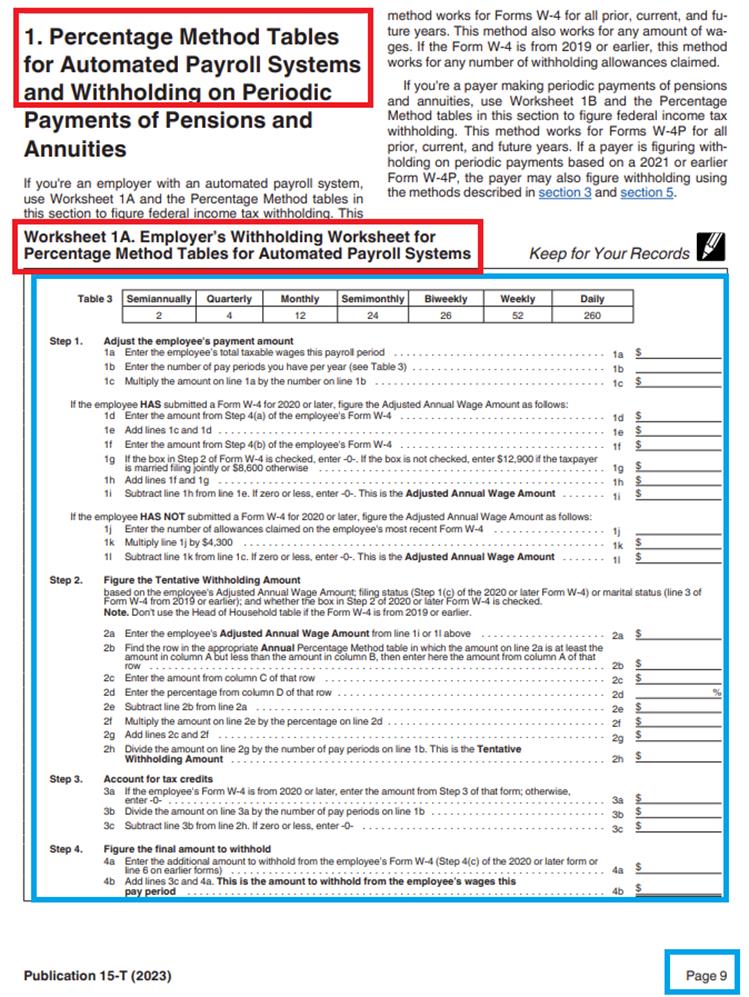

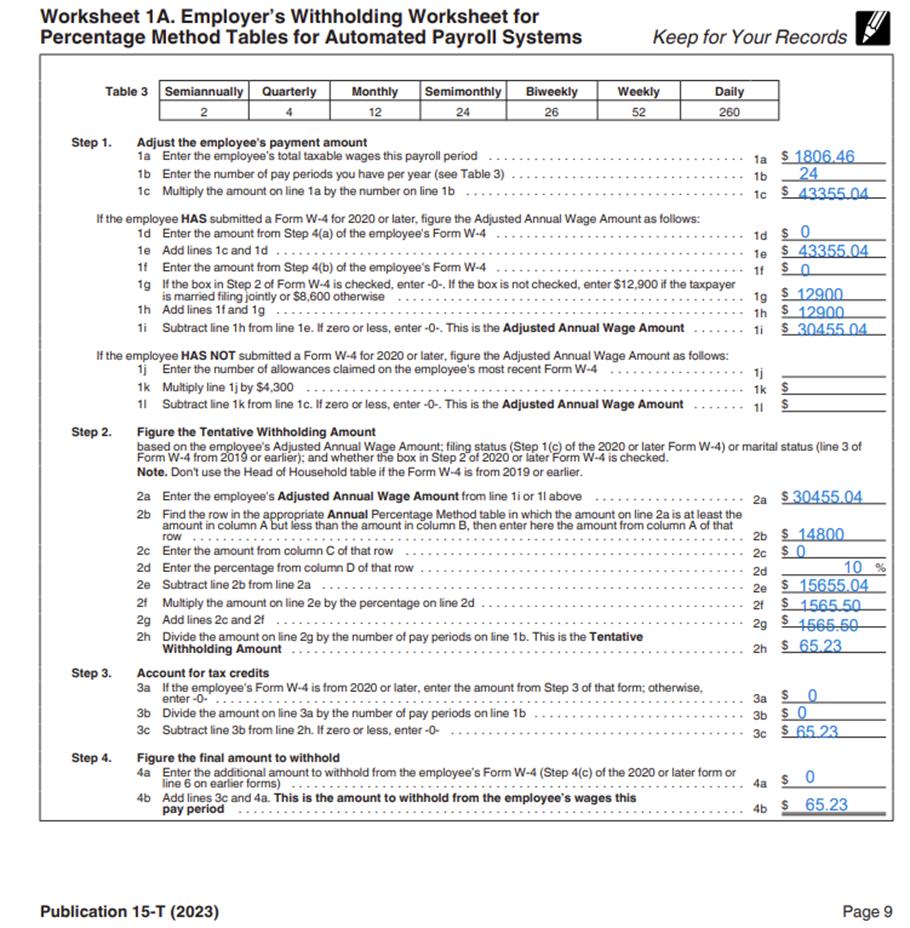

•In the 2023 publication, on page 9, you will find the Percentage Method Tables for Automated Payroll Systems.

o Worksheet 1A (page 9)

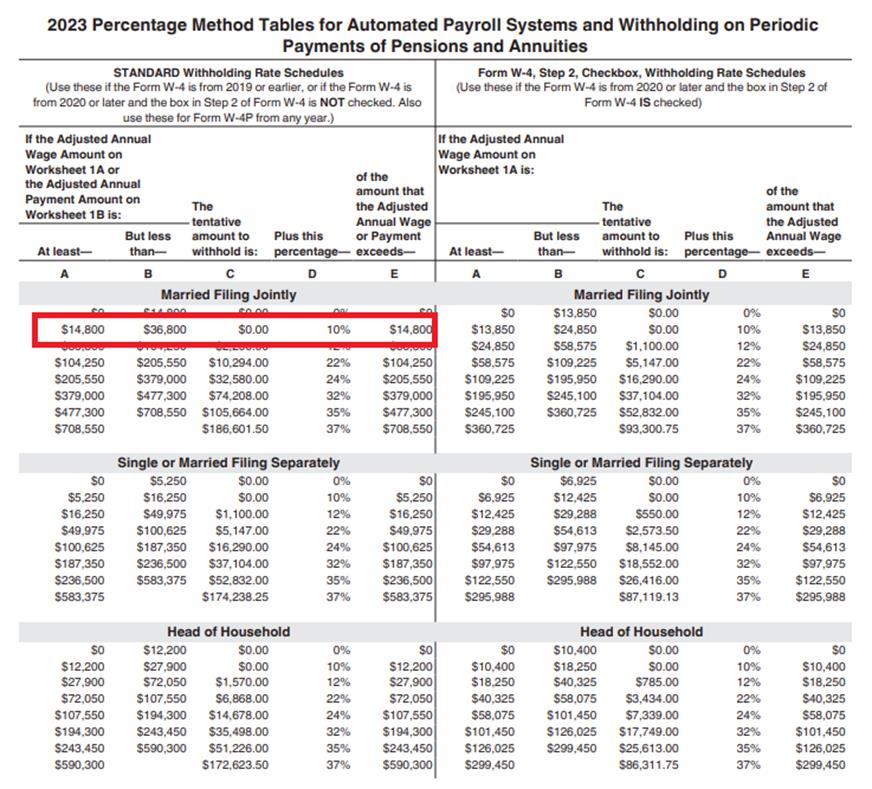

§ Step 2 references page 11

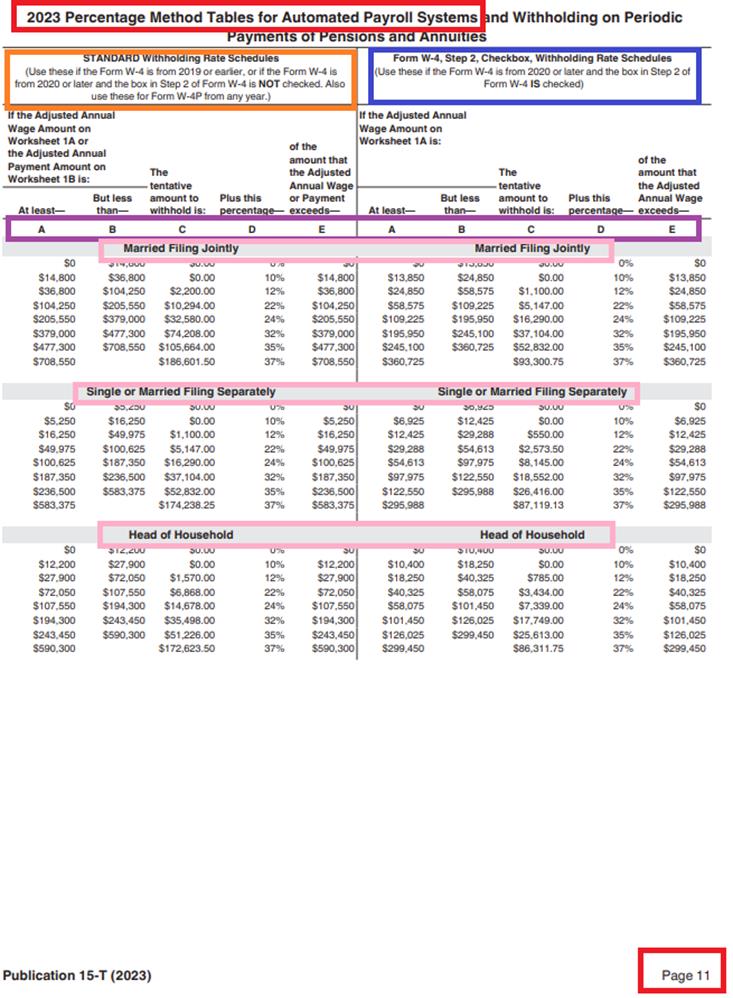

1. Select Payroll Processing or Human Resources

a. Select Add, Change Employee Information

i. Select the employee’s name

ii. Check mark: Tax Information AND Payroll Control

1. You will need this information to complete Worksheet 1A, referenced above

2. Select Look and Browse

a. Select Employee Information

i. Select the employee’s name

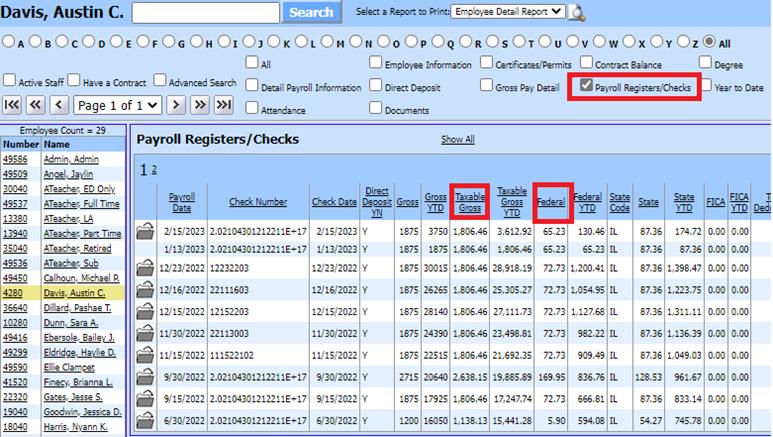

ii. Check mark: Payroll Registers/Checks

1. You will use the Taxable Gross amount to complete Worksheet 1A, referenced above

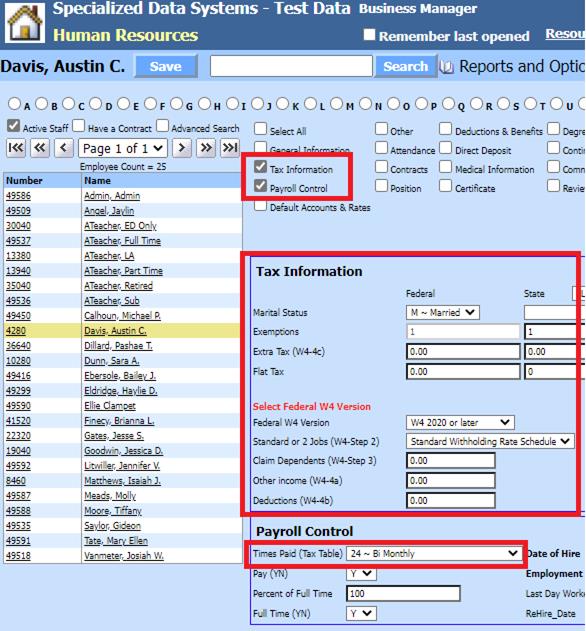

This is a completed Worksheet 1A using Austin Davis’ 02.15.23 taxable gross wages.

***The amount withheld on Austin Davis’ 02.15.23 payroll matches line 4b above.

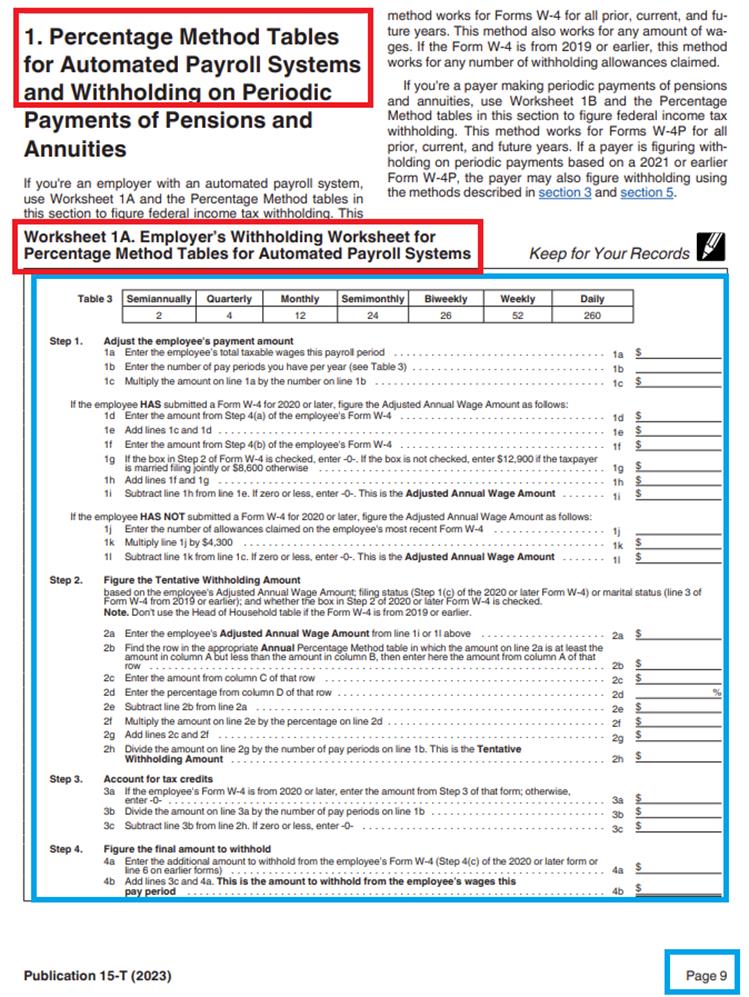

***Step 2 references this table on page 11:

Additional helpful links on this topic:

The IRS also has a Tax Withholding Estimator to reference using the link:

Tax Withholding Estimator | Internal Revenue Service (irs.gov)

Our Help Document on entering a W4:

Entering an Employee Tax Information (schooloffice.com)