Revision: 5/2023

A Partial Accrual is the result of SOME, but not all, payroll expenses needing to be expensed into the current Fiscal Year (FY23). For example – If your retirement expenses are budgeted to FY23, but your salaries, health insurance, dental insurance, vision insurance and all other payroll expenses for the July and August Teacher Payrolls are budgeted to FY24, you will use the Partial Payroll Accrual method. There has been an enhancement to the payroll process to allow for this Partial Accrual method to be done through payroll. No more manual Journal Entries are necessary unless you have a special circumstance.

Setting up the Payroll Expense Accrual Account

This is a one-time setup. If you have used an accrual process previously, this step should already be completed.

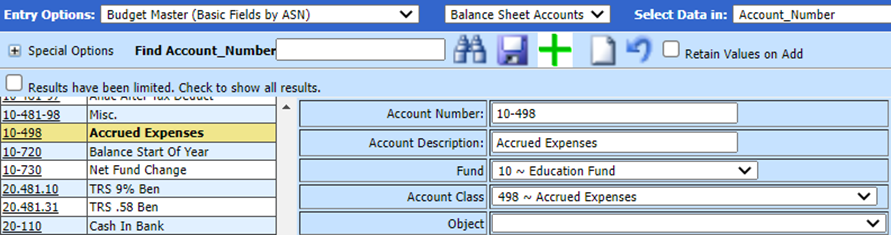

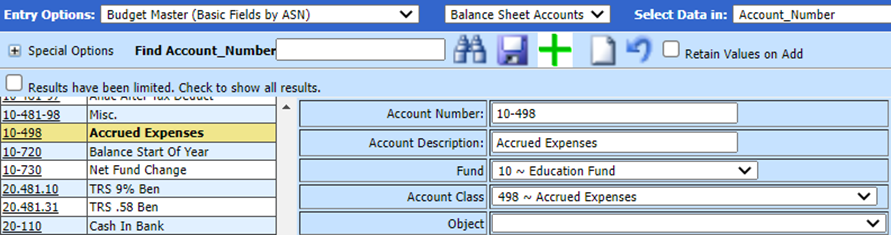

Create a Balance Sheet Account for Accrual Use

Set up a Balance Sheet Accrual Account for each fund used for the accrual payroll.

1. Select Master File and Code Entry Options

2. Select Master File Vertical Data Entry and Changes

3. Entry Options: Budget Master (Basic Fields by ASN)

4. Select the Balance Sheet Accounts

5. Select the Green + sign

6. Enter the account number, description, fund and account class (if you are unsure about the account class, please contact your auditor)

7. Select Save

See below link for more information on Budget Master Account creation:

https://help.schooloffice.com/financehelp/#!Documents/budgetmasterbasicfieldsbyasn.htm

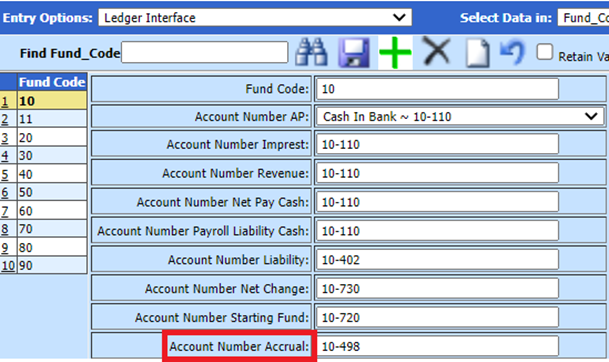

Add Accrual Account to the Ledger Interface

After creating the balance sheet accounts, add them to the corresponding fund(s) record in the Ledger Interface.

1. Master File Vertical Data Entry and Changes

2. Entry Options: Select Ledger Interface

3. For each fund being used, key the accrual number in the “Account Number Accrual” field:

4. Select Save

See below link for more information on Ledger Interface:

https://help.schooloffice.com/financehelp/#!Documents/ledgerinterface1.htm

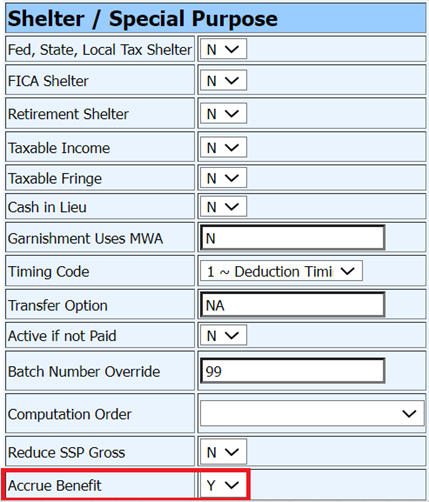

Setting up Benefits for Partial Accrual

This is a one-time setup. This is the first year for implementing this setup, therefore, it must be done to allow for these benefits to be accrued with this method.

1. Select Human Resources

2. Select Human Resources Control Center

3. Select Deductions & Benefits Master

4. Locate the benefit codes necessary for accrual

5. Locate the “Accrue Benefit” field and set it to “Y”

6. Select Save

Processing the July and August Payrolls

•Process and complete your June 2023 payrolls

•When done with the June payrolls, we recommend that you print out the Open Contract Report, located in the General Accounting Reports/Employee Master and Attendance Group, in case your auditors want that information.

•July and August payrolls will be processed one at a time. You will follow the normal payroll processes up to the point of checks and vouchers.

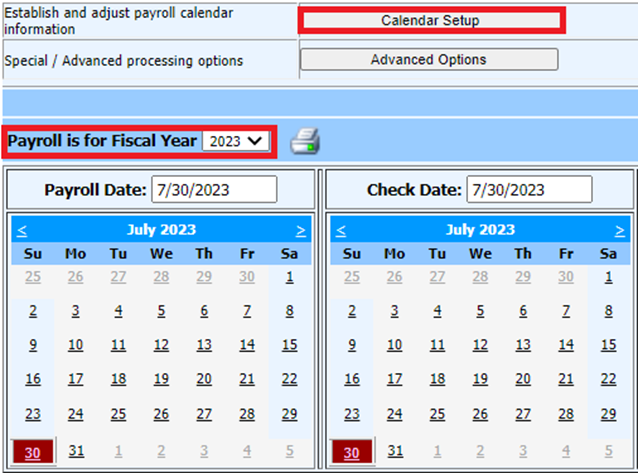

•Illinois Clients – When setting the payroll calendar dates, choose the Fiscal Year based on what year the creditable earnings were earned. *The Payroll Date may be 8/1/23, but the wages were earned in Fiscal Year 2023*

- Before Activating your payroll, ensure that you are selecting the appropriate Payout Category for the contracts you are needing to pay:

1. Complete the entire payroll process (Enter, compute, and verify the payroll)

2. No checks or vouchers will be printed, and the direct deposit file will not be created at this time. You will go straight to closing the payroll.

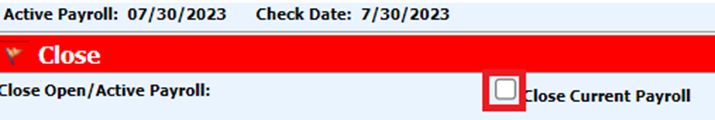

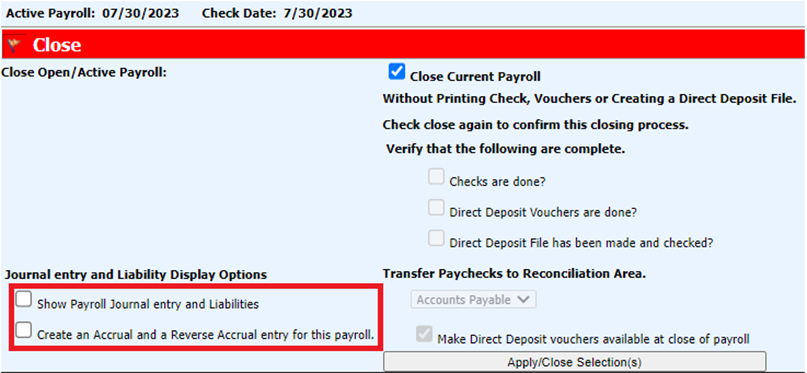

3. Select Close / Make Active Payroll Permanent

4. Select “Close Current Payroll”

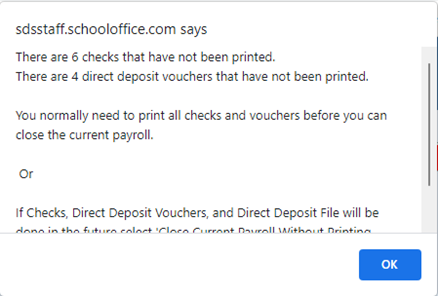

5. A message will appear that vouchers/checks have not been printed, but you can continue. Select OK.

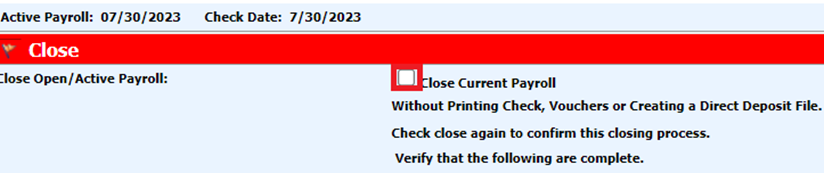

6. Select “Close Current Payroll Without Printing Check, Vouchers or Creating a Direct Deposit file”

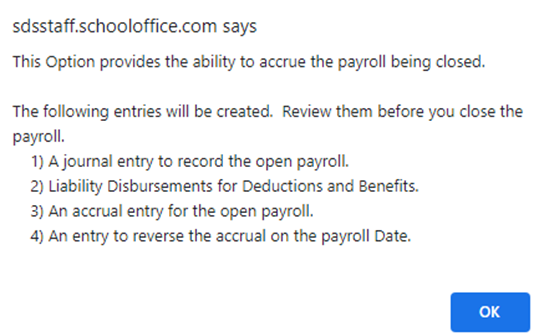

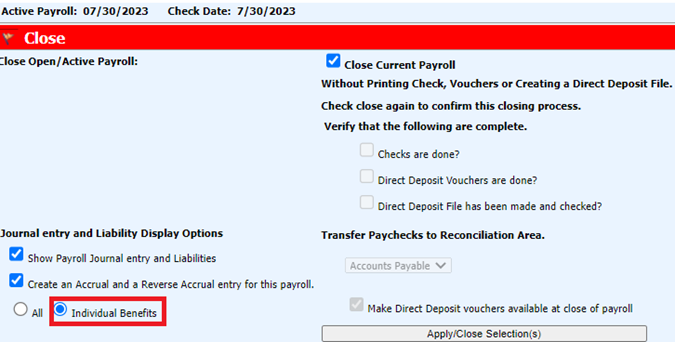

7. Select “Create an Accrual and a Reverse Accrual entry for this payroll”

8. A message will appear. Select OK.

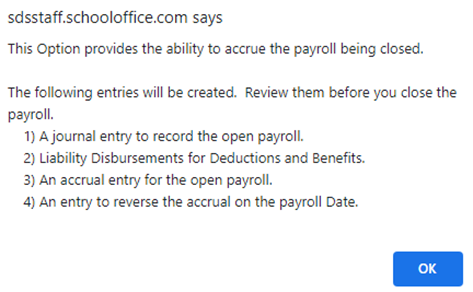

9. Select “Individual Benefits”

10. The same message will appear again. Select OK.

11. June 30, 2023 will be the default accrual date on the calendar. That accrual date can be used for each payroll.

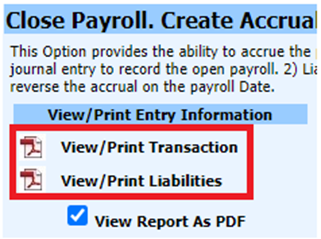

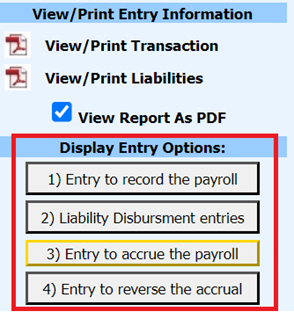

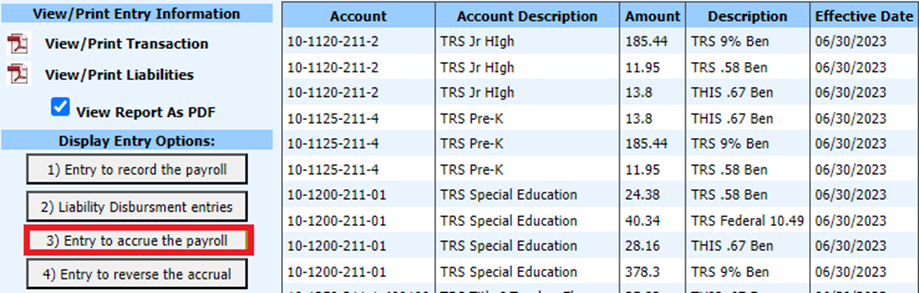

o The “View/Print Transaction” and “View/Print Liabilities” will produce the Payroll Transaction report and the Payroll Liability report for the payroll date.

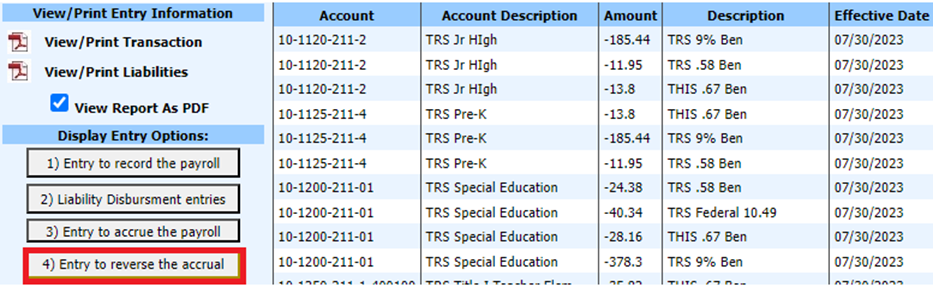

o When selected, the options in the Display Entry Options section will show the journal entries for each selection or the liability disbursement entries.

o These are demonstrated in the following screen shots:

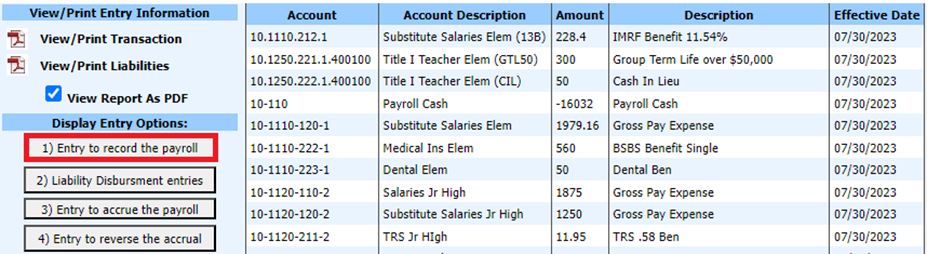

Entry to Record the Payroll – Shows the journal entry that will post for the payroll date in the “Effective Date” column. This will post the expenses and liabilities.

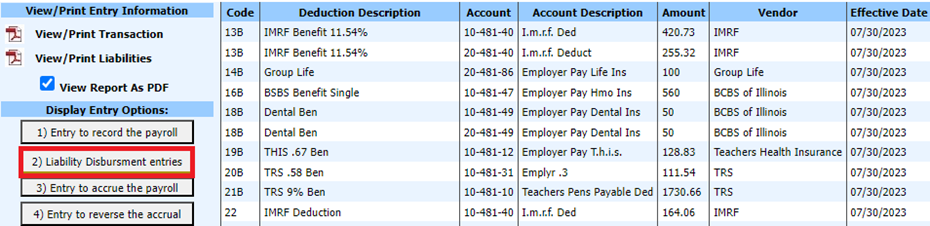

Liability Disbursement Entries – This is a list of the liabilities for the payroll date in the “Effective Date” column.

Entry to Accrue the Payroll – This is the journal entry that will post to June to accrue these individual benefits. This entry will debit (+) the expense accounts and credit

(-) the Accrual Account that was set up.

Entry to reverse the accrual – This is the entry that will post for the payroll in the “Effective Date” column to reverse the expenses from “Entry to record the payroll” transaction. This entry will credit (-) the expenses and debit (+) the accrual account so that it nets to zero.

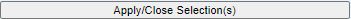

12. Select

13. Select OK to the message

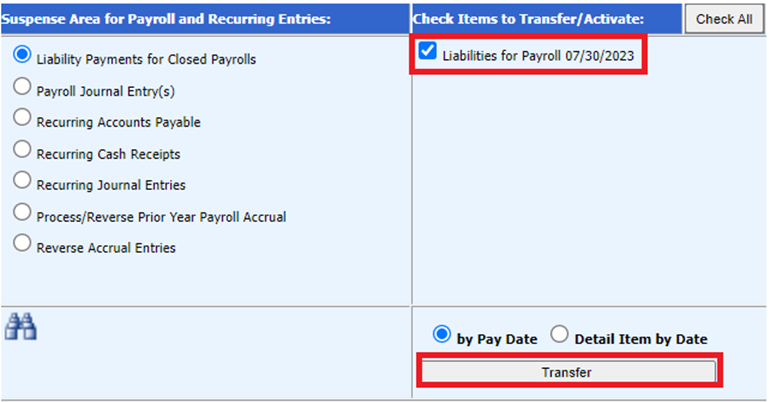

14. Go to General Ledger Processing on the Main Menu

15. Select Transfer Payroll Data and Recurring Entries

16. Select Liability for Closed Payrolls

17. Select Transfer

18. Select OK to the messages

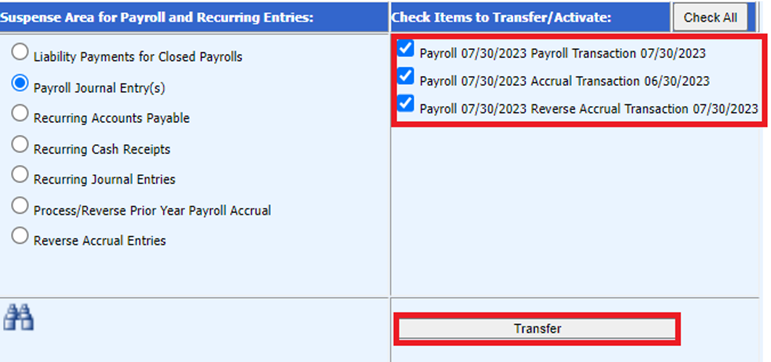

19. Select Payroll Journal Entry(s)

20. Select each of the Payroll Journal Entries. There will be 3 journal entries to transfer.

a. The Accrual

b. The Reverse Accrual

c. The Payroll Transaction for the payroll date

21. Select Transfer

22. Select OK to the messages

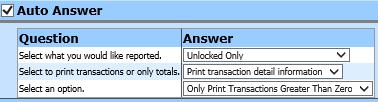

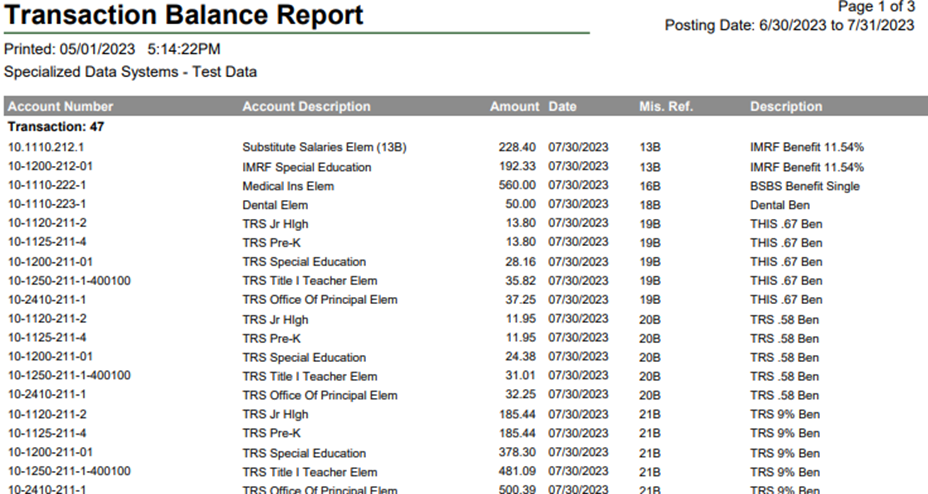

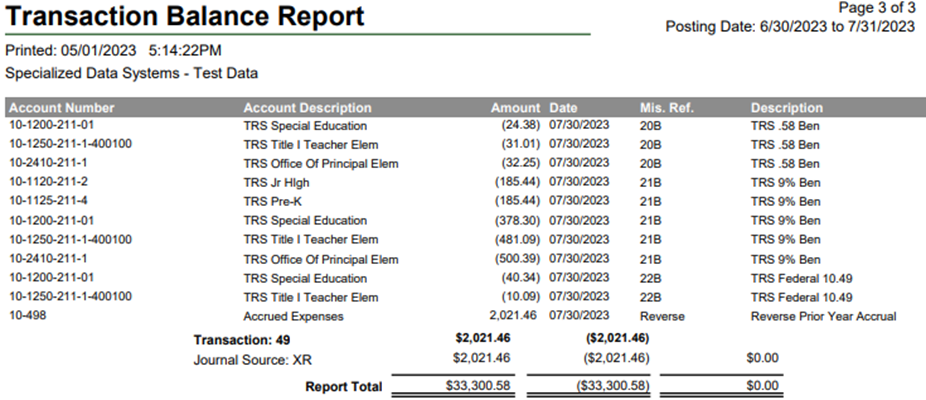

23. Run a Transaction Balance report for the 3 transactions.

a. Select Reports

b. Select General Accounting Reports

c. Select Finance Activity Reports

d. Select Transaction Balance Report

e. Set the calendar date to include the accrual date and the payroll date

f. Set the Auto Answer questions to the below settings:

g. Preview/Print the report (if other transactions show on the report, make them permanent, so that you will only see the payroll and accrual you are processing. Go to the report area and print the report.)

24. Make the Payroll and Accrual Transactions Permanent

a. Select General Ledger Processing and Entry Options

b. Select Make New Transactions Permanent

c. Select 6/2023

d. Select the transaction

e. Select Post Selected Ledger

f. Select 7/2023 (or 8/2023) and repeat the process

Partial Payroll Accrual Processing has been completed.

Processing Checks, Vouchers, Creating a Direct Deposit file, and Paying Liabilities for Accrued Payrolls

The week of your actual payroll date, you will print the checks & vouchers, create a direct deposit file, and pay the liabilities. If any liabilities need to be paid in June, it is okay to do that. The checks would have a June date, which is when the entries would post to cash.

Activate the Payroll to Process

1. Select Payroll Processing

2. Select Close / Make Active Payroll Permanent

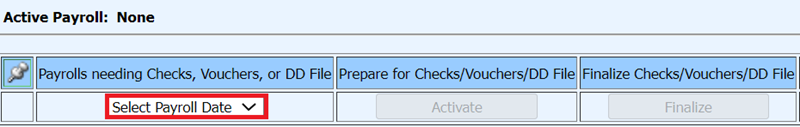

3. Select the down arrow next to Select Payroll Date in the “Payrolls needing Checks, Vouchers, or DD File” section

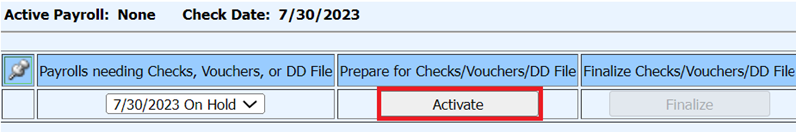

4. Choose the payroll date you want to process and select “Activate”

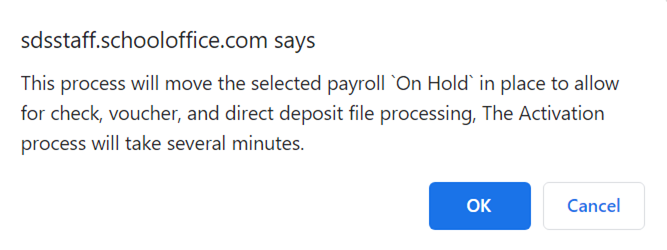

5. Select OK to the message

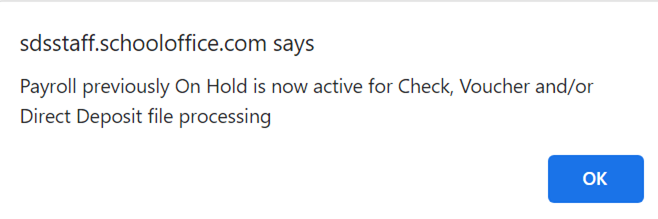

6. Select OK to the next message

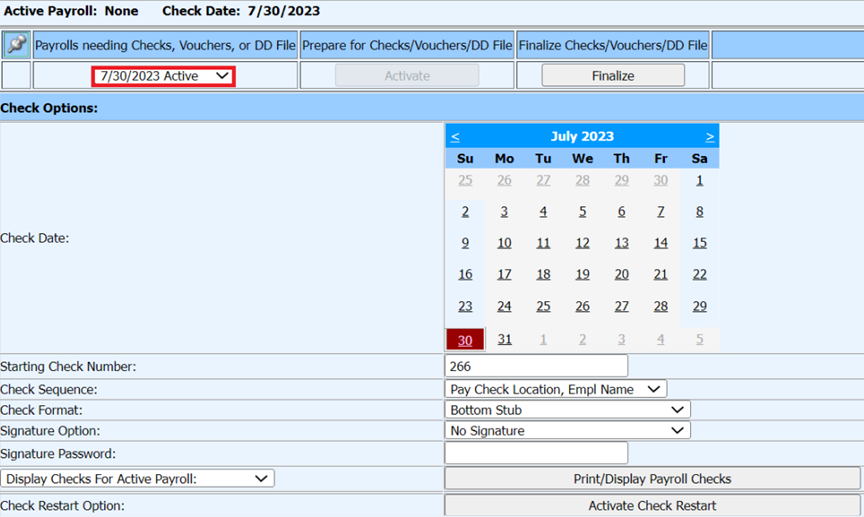

Run the Payroll Checks

1. Select Payroll Processing

2. Select Payroll Checks

3. Select the payroll date to process in the “Payrolls needing Checks, Vouchers, or DD File” section

4. Complete the fields to print the checks

5. Follow normal process for printing the checks

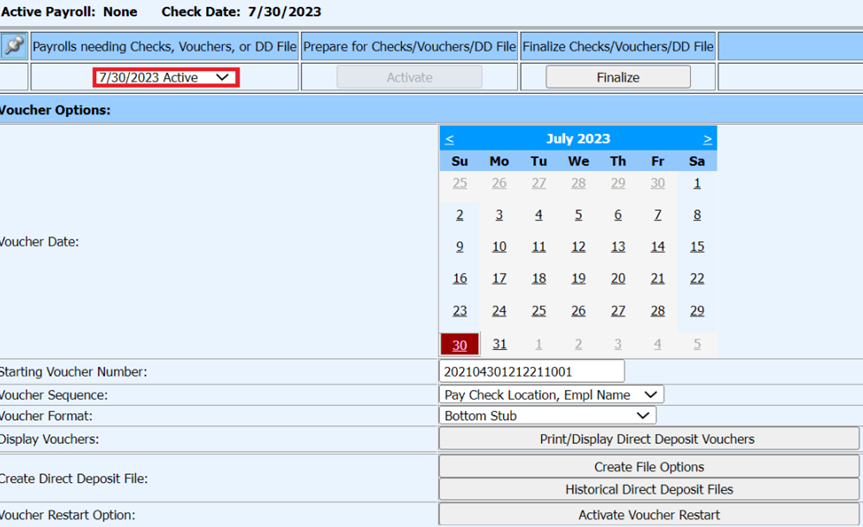

Run the Direct Deposit Vouchers and Create the File

1. Select Payroll Processing

2. Select Direct Deposits

3. Select the payroll date to process in the “Payrolls needing Checks, Vouchers, or DD File” section

4. Complete the fields to run the vouchers

5. Follow the normal process for running the vouchers

6. Select Create File Options

7. Follow the normal process for creating and submitting the file to the bank

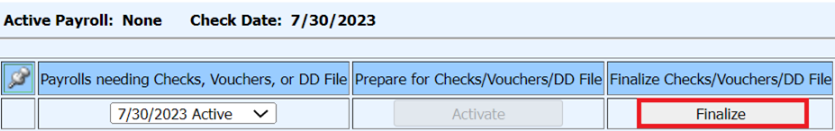

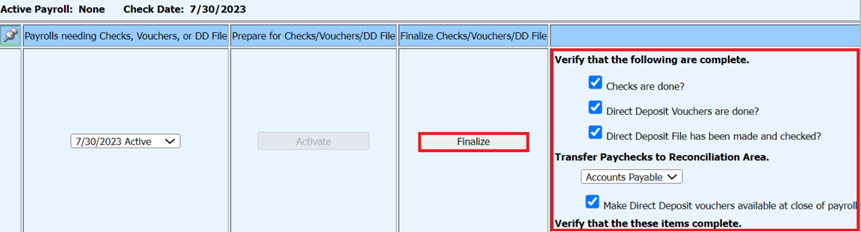

Finalize the Payroll

1. After running the vouchers, checks and creating the direct deposit file, select Finalize from any of the following screens:

a. Payroll Checks

b. Direct Deposits

c. Close/Make Active Payroll Permanent

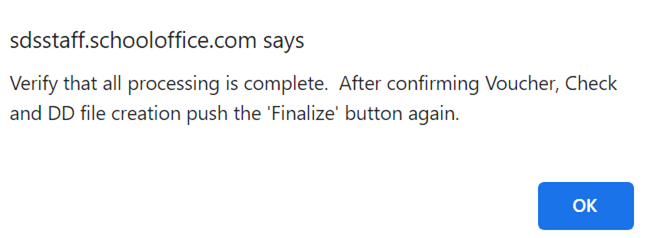

2. Select OK to the message

3. Verify tasks are complete

4. Select Finalize

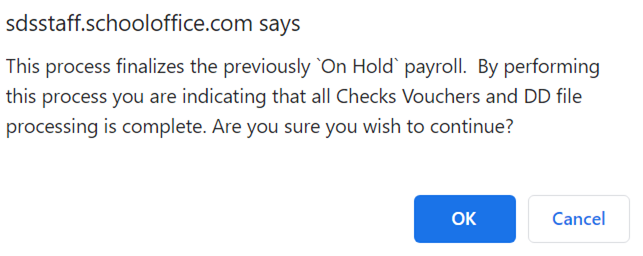

5. Select OK to the message

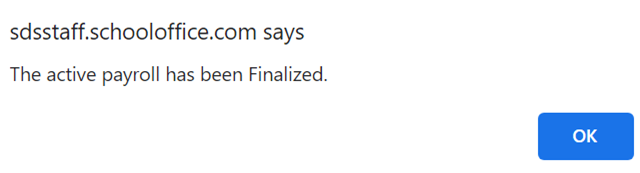

6. Select OK to the last message

Pay the Payroll Accrual Liabilities

1. Follow the normal processes for paying the liabilities

2. When selecting a check or voucher date for the accrued liabilities, use a check date within the month you are sending the payment regardless of the payroll date.