Revised: 11/2020

We wanted to let you know that we have implemented changes to our program that will be helpful as you prepare the Annual Statement of Affairs and specifically the Employee Publication Report.

Because the deadline for publishing the Employee Publication Report is fast approaching, we wanted to share the news about these changes ASAP!

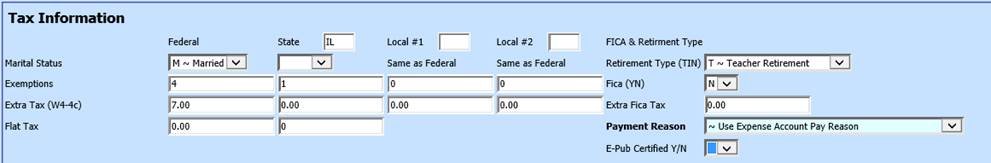

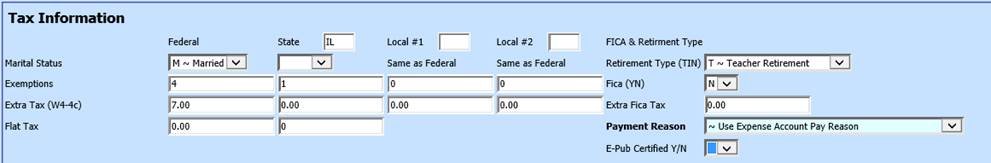

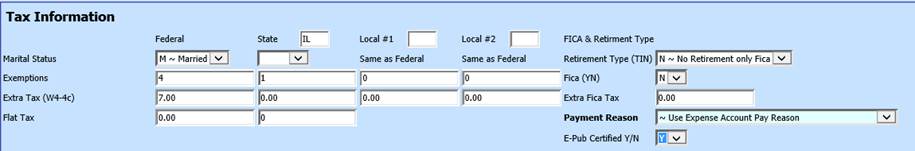

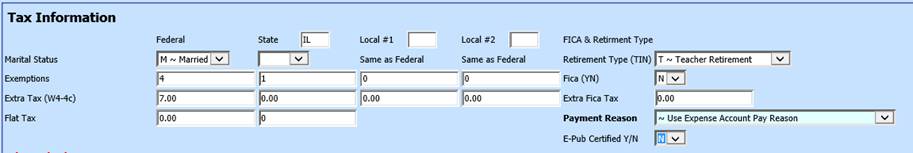

We have added a new field called “E-Pub Certified Y/N”, which can be found in the “Tax Information” section in Add, Change Employee Information.

We have also found a great way to incorporate this new field which will provide a quick and easy way to adjust ONLY the employees that NEED to be adjusted!

WHY ADD THE NEW FIELD?

Prior to adding this new field, the Employee Publication Report would look at the field “Retirement Type(TIN)” and if there was a “T”, the employee would be classified as “Certified” on the Employee Publication Report and if that field had an “I” or “N” , the employee would be classified as “Non-Certified” on the report. The Retirement Type (TIN) field is also the setting that will automatically populate in the field “Retire TIN” when a manual pay entry is entered through Gross Pay Entry and Adjustments. Because this field is being used for 2 distinct purposes, we needed a way to distinguish the setting that is needed for the Employee Publication Report.

We also reached out to ISBE for guidance on the Employee Publication Report, after receiving questions regarding if employees who worked Certified and Non-Certified positions should be listed in each category with the wages for each type of work.

The advice we received from ISBE, as shown below, indicates that each employee should be reported ONE time in the report, based on if they have a Teaching License.

Advice from ISBE:

ISBE has been advising that the salary tab should be completed based on the employee, not the specific position(s) they hold. If the employee has a teaching license, they should be placed in the certified section. If no teaching license, they should be placed in the non-certified section. An employee who holds a professional license should be placed in the certificated employee section even if all or part of their job doesn’t require a professional license. Note: A substitute teacher license is not considered a professional license.

HOW DOES THE NEW FIELD WORK?

The new field “E-Pub Certified Y/N” works in conjunction with the “Retirement Type (TIN)” field in the following way:

•If the setting in the field “Retirement Type (TIN)” represents the classification for how the employee should appear on the Employee Publication Report, you do not need to make any changes to that employee.

•If the setting in the field “Retirement Type (TIN)” is NOT representative of how the employee should be classified on the Employee Publication Report, then choose “Y” or “N” in the new field, “E-Pub Certified Y/N”, as described below

o Enter a Y, in the new field, if the employee should be classified as “Certified” on the Employee Publication Report

o Enter an N, in the new field, if the employee should be classified as “Non-Certified” on the Employee Publication Report

EMPLOYEE PUBLICATION REPORTS

1. Employee Publication Report: This is the report that will be run for Publication in the Newspaper

•Select Reports Menu Heading

•Select General Accounting Reports

•Select Payroll and Human Resources

•Select Employee Publication Report

•Select the Date Range for the report

•Preview the Report

2. Employee Publication Checklist Report-This report will report Certified and Non-Certified Staff–sorted by Full-Time or Part–Time Classification

This is an optional report that can be used if you would like SDS to provide counts on Certified/Non-Certified Staff- sorted by Full-Time or Part-Time Classifications-for reporting on Page ASA1 of the Annual Statement of Affairs.

This report will also serve as a valuable tool for Verifying the Accuracy of Employee Classifications for the Employee Publication Report and for determining which employees may need the new field “E-Pub Certified Y/N” to be populated for correct reporting.

NOTES FOR THE REPORT:

The field that determines if an employee is Full Time or Part Time is found in Add/Change Employee Information/Payroll Control Tab in the field “Full Time (YN) .

The report will include all employees who received wages during the selected report date range

To run the report:

•Select Reports Menu Heading

•Select General Accounting Reports

•Select Payroll and Human Resources

•Select Employee Publication Checklist

•Select the Date Range to be included on the report

•Preview the Report