Revised: 10/2020

Beginning with the 2020 tax year, Schedule P, Illinois Withholding Schedule, must be filed with every Form IL-941, Illinois Withholding Income Tax Return and Form IL-941-X, Amended Illinois Withholding Income Tax Return, to verify Illinois income and withholding records.

For additional information, see sample 2020 Schedule P and Form IL-941 instructions or contact your auditor: https://www2.illinois.gov/rev/taxprofessionals/Documents/Schedule-P-News.pdf

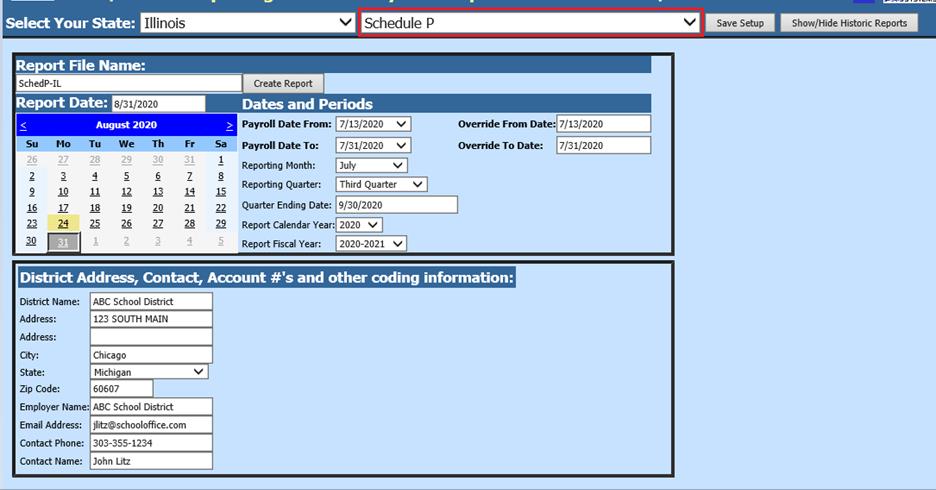

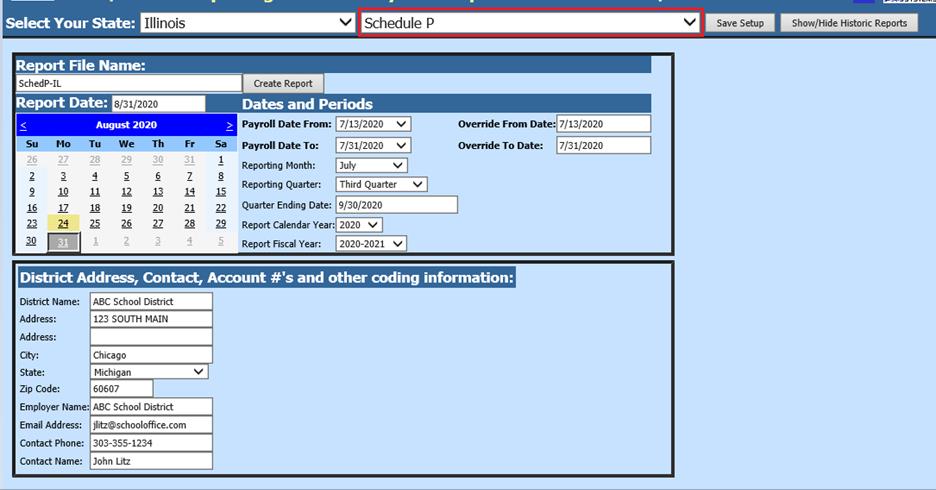

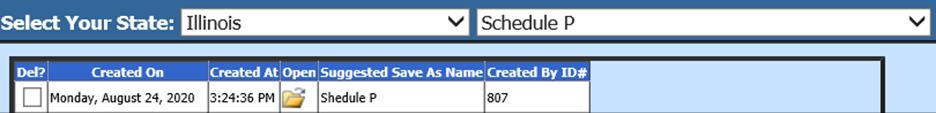

To create the file needed:

1. Select Payroll Processing

2. Select State/Federal Reporting and 3rd Party Data Export

3. Select your State: Illinois

4. From the dropdown selection, select Schedule P

Complete/verify Report settings:

5. Select Report Date

6. Select Payroll Date From

7. Select Payroll Date To

8. Select Reporting Month

9. Select Reporting Quarter

10. Select Quarter Ending Date

11. Select Report Calendar Year

12. Select Report Fiscal Year

13. Verify District Address, Contact, Account #’s and other coding information

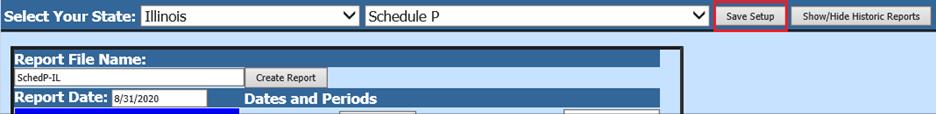

14. Select Save Setup, if any changes are made

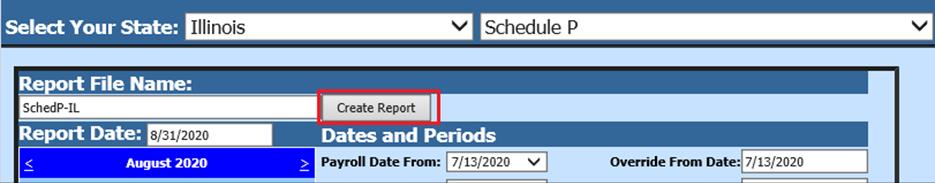

15. Select Create Report

16. The csv file is ready to be saved for submittal. Right click on file folder, save to workstation.

The file includes the following data elements:

•Employee’s Name

•Employee Social Security Number

•Employee Income for Quarter

•Amount Tax withheld for Quarter