Revised: 1/2019

The system has two tax methods for Illinois State Tax Calculation

1. The first tax method is the table that has been used by the Illinois Department of Revenue for years. To use this method do not update your tax table.

a. If you have updated the tax table and would like to go back to the original tax method, follow the instructions on how to reinstall the original Illinois State Tax Method.

2. The second tax method requires you to update the state tax table in the system to be able to use it.

a. Follow the instructions on How to Update the Illinois State Tax Method to use the second tax table.

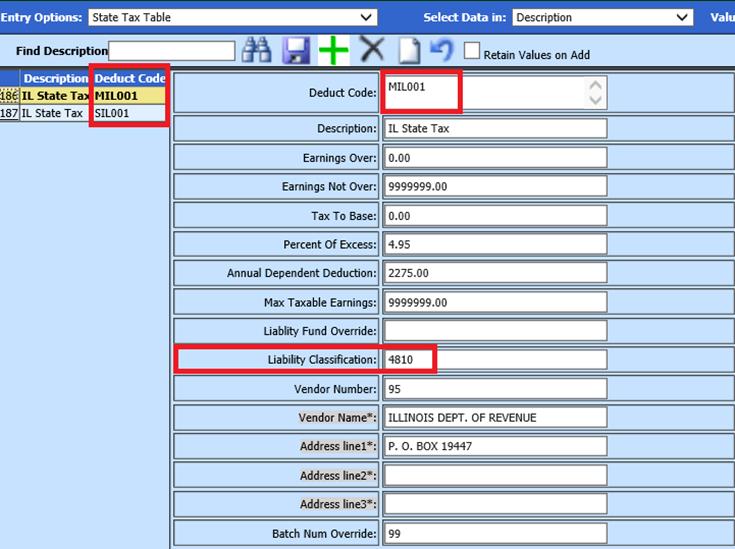

How to reinstall the original Illinois State Tax Method

1. Select Master File and Code Entry Options

2. Select Master File Vertical Data Entry and Changes

3. From the Entry Options select State Tax Table

4. Select each of the updated tax entries and delete all of them

5. Select the green plus button. Two entries need to be added back into this tax table. The only difference between the two entries will be in the Deduction Code field. The Deduction Codes need to be “MIL001” and “SIL001”.

a. Description: IL State Tax

b. Earnings Over: 0.00

c. Earnings Not Over: 9999999.00

d. Tax to Base: 0.00

e. Percent of Excess: 4.95

f. Annual Depend Ded 2275.00

g. Max Taxable Earn: 9999999.00

h. Liability Classification: Liability classification for state taxes (user defined)

i. Vendor Number: Vendor number

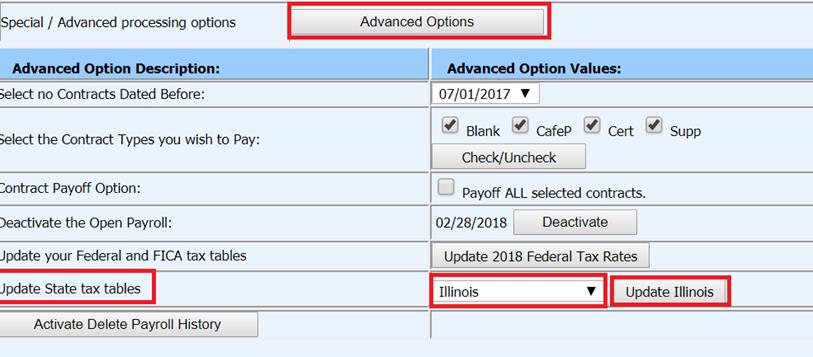

How to Update the Illinois State Tax Method to use the second tax table

1. Select Payroll Processing

2. Select Activate / Open a Payroll

3. Select Advanced Options

4. Select the state of Illinois and the select “Update Illinois”

The Illinois Tax Structure has two types of “allowances”

1. Basic Allowances: This amount relates to Line 1 of the IL –W4 form.

a. The state tax table in the system allows for (0 to 15) allowances.

2. Additional Allowances. This amount relates to Line 2 of the IL –W4 form.

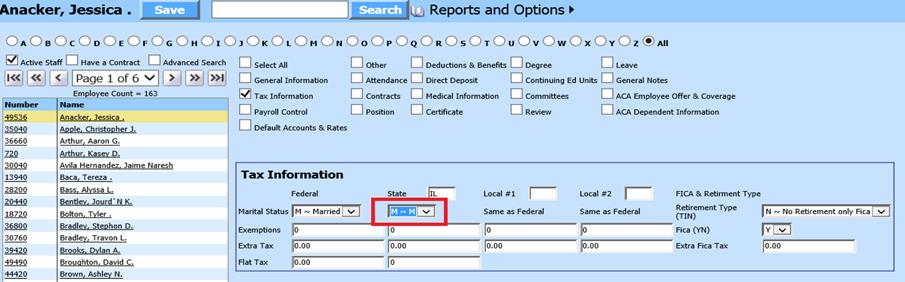

Setting up the Basic Allowances

1. The information from line 1 of the IL – W4 form has to be entered into the State Marital Status field.

a. Go to Human Resources or Payroll Processing

b. Select Add, Change Employee Information

c. Select the Tax Information option

2. In the field State Marital Status you can enter in the following based on the information from Line 1 of the IL W4 form for each employee.

a. 0-9 – represents 0 through 9 basic allowances

b. NOTE: If you have more than 9 basic allowances please contact SDS support for assistance.

3. In the State Marital Status field if you only have the M and S for selections you can add the other allowances that are needed. Do this by selecting the link below. http://help.schooloffice.com/financehelp/#!Documents/mastercodefielddefinitionandmaintenance.htm

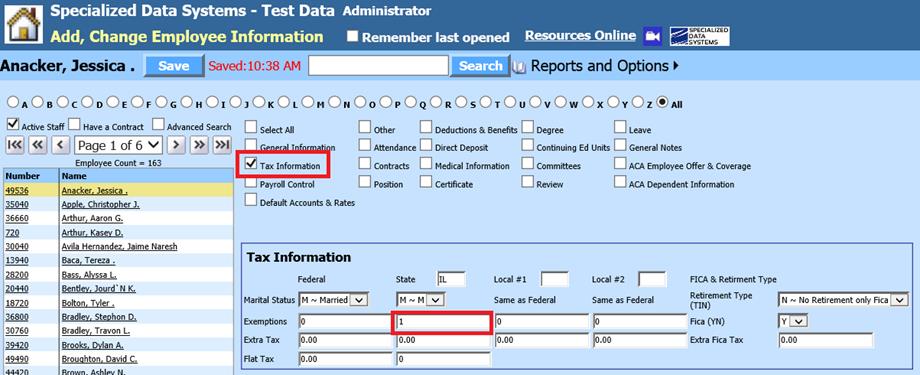

Setting up the Additional Allowances

1. The information from line 2 of the IL –W4 form has to be entered into the State Exemption field.

a. Go to Human Resources or Payroll Processing

b. Select Add, Change Employee Information

c. Select the Tax information option

2. In the field Exemptions for the state enter in the information from the IL – W4 form that is on line 2 for each employee.

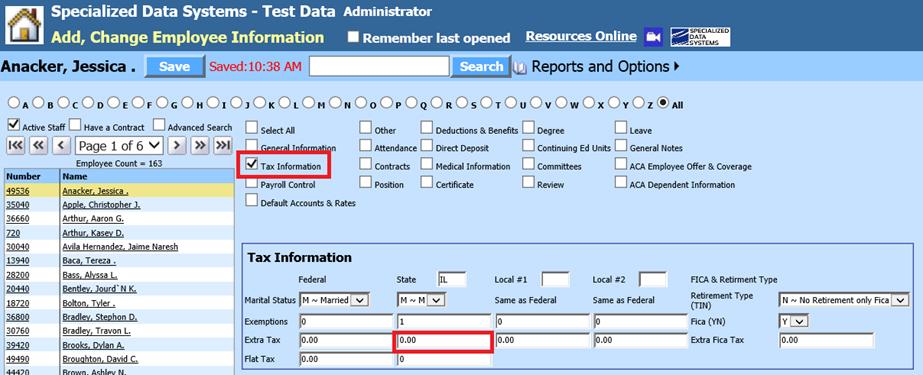

Setting up Extra State Tax

1. The information from line 3 of the IL – W4 form has to be entered into the State Extra Tax field.

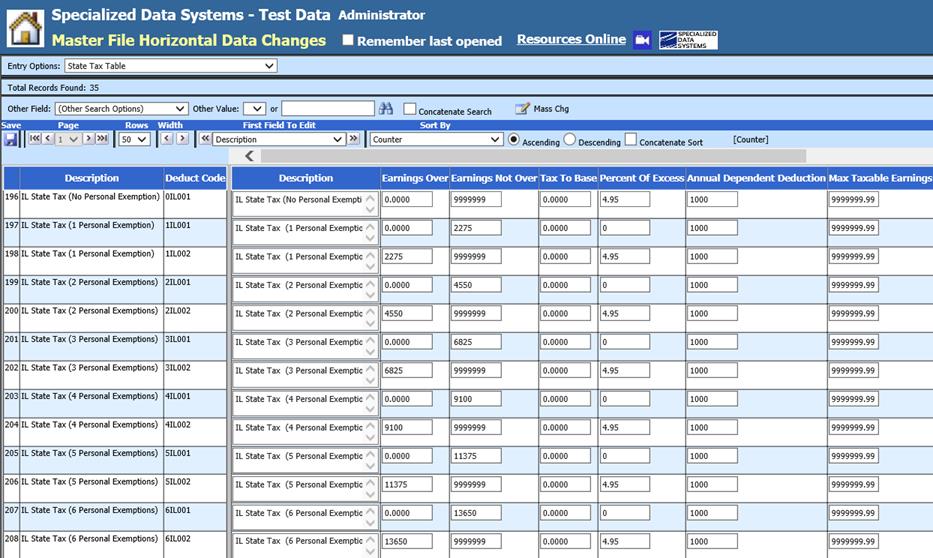

The Illinois State Tax Table in WFO

1. The Illinois State tax table in the system is located in:

a. Master File and Code Entry Options

b. Select either Master File Vertical Data Entry and Changes or Master File Horizontal Data Changes

c. From the Entry Options select State Tax Table