Revised: 6/2022

The Indiana Retirement Report is generated at the end of each payroll after the payroll is closed. The State of Indiana has 2 types of Retirement for employees and to create this retirement report the system will complete this in three steps:

•Step 1: Teacher Retirement – TRF

•Step 2: Public Employees Retirement – PERF

•Step 3: ERM Reporting – (combines TRF & PRF)

The detailed steps will assist you in completing the process to create the Indiana Retirement Report:

Step 1:

1. Select Payroll Processing

2. Select State and Federal Reporting

3. Select Your State: Choose Indiana

4. Select Teacher Retirement – TRF – Step 1

Report Screen

Complete the following items on the Indiana Retirement Report screen

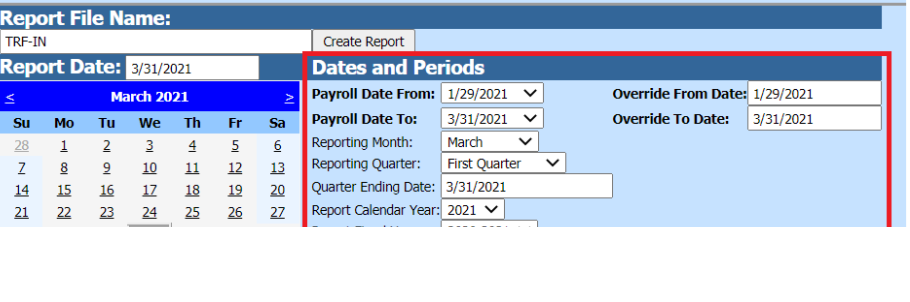

1. Dates and Periods:

•Payroll Date From: This is the starting date of the payroll(s) in the SDS payroll calendar that need to be reported on the TRF report.

•Payroll Date To: This is the ending date of the payroll(s) in the SDS payroll calendar that need to be reported on the TRF report.

•Reporting Month: select the month of your report.

•Reporting Quarter: select the quarter of your report.

•Quarter Ending Date: enter the ending date of your quarter.

•Report Calendar Year: select the correct calendar year.

•Report Fiscal Year: select the correct fiscal year.

•Period Starting: enter the start date of the reporting period.

•Period Ending: enter the end date of the reporting period.

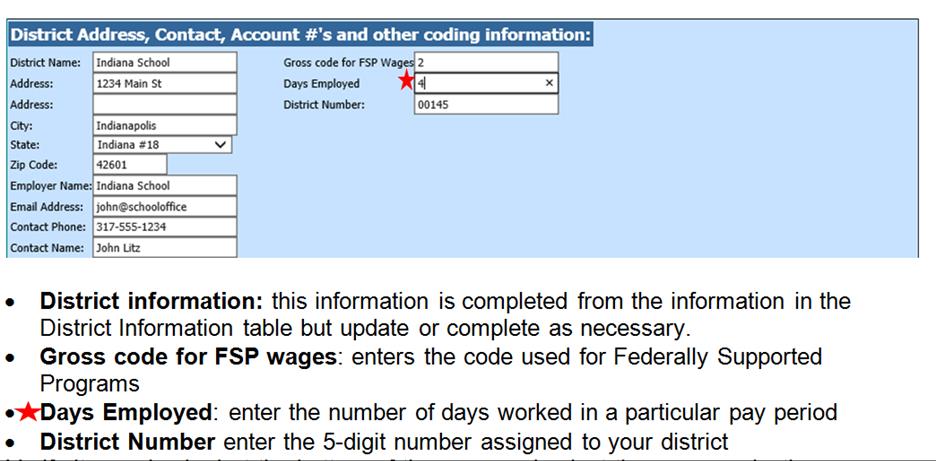

2. District Address, Contact, Account #’s and other coding information:

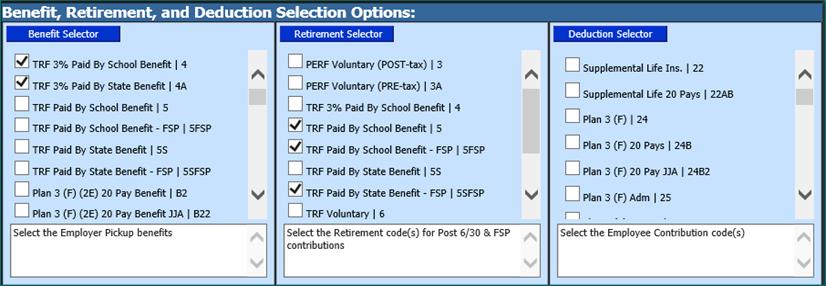

3. Verify items checked at the bottom of the page and select the proper selections under Benefit Selector, Retirement Selector and Deduction Selector that pertain to your payroll setup for TRF.

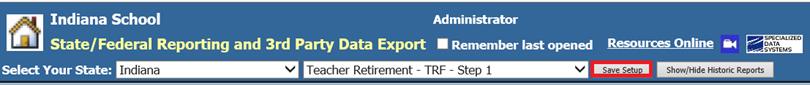

4. Make sure that you select Save Setup to ensure the program keeps the data:

Step 2:

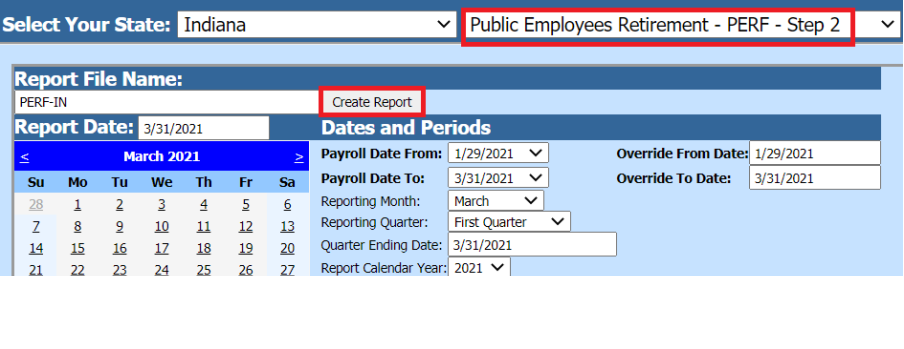

1. Select the Public Employees Retirement – PRF – Step 2

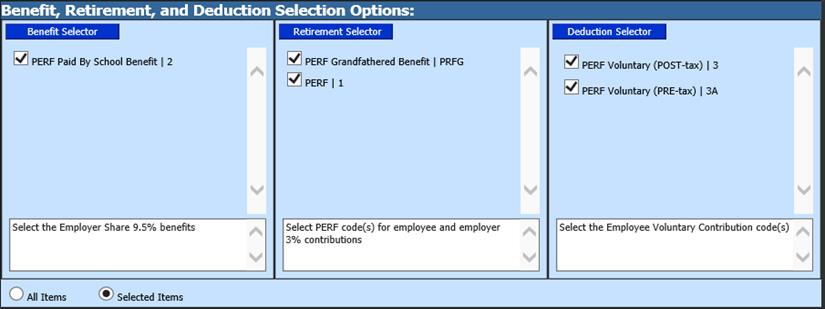

2. Verify the items checked at the bottom of the page and select the proper selections under Benefit Selector, Retirement Selector and Deduction Selector that pertain to your payroll setup for PERF.

o Benefit Selector: select the Employer Share 9.5% benefits

o Retirement Selector: select PERF code(s) for employee and employer 3% contributions

o Deduction Selector: select the Employee Voluntary Contribution code(s)

3. Save setup when done so they are saved for future reporting.

4. Select Create Report

Step 3:

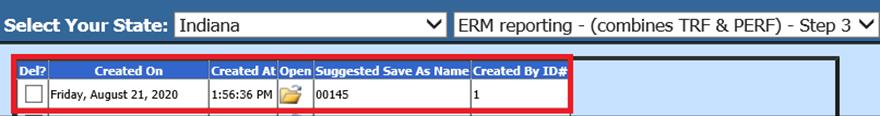

1. Select the ERM reporting – (combines TRF & PERF) – Step 3

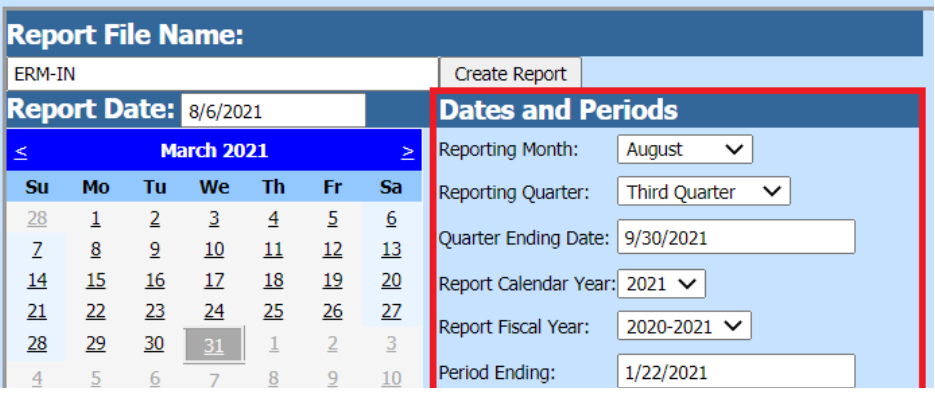

2. Complete the Dates and Periods as these fields are different.

•Reporting Month: select the month of your report.

•Reporting Quarter: select the quarter of your report.

•Quarter Ending Date: enter the ending date of your quarter.

•Report Calendar Year: select the correct calendar year.

•Report Fiscal Year: select the correct fiscal year.

•Period Ending: enter the date the reporting period ends.

3. Select the “Save Setup” button.

4. To create the file, select the Create Report button. The file that is created will be listed at the top of the screen when first created.

5. The system will retain the files that have been created. These files can be viewed by selecting the “Show/Hide Historic Reports” button. All files created will have a date and time stamp on them for when they were created.