Revised: 3/2021

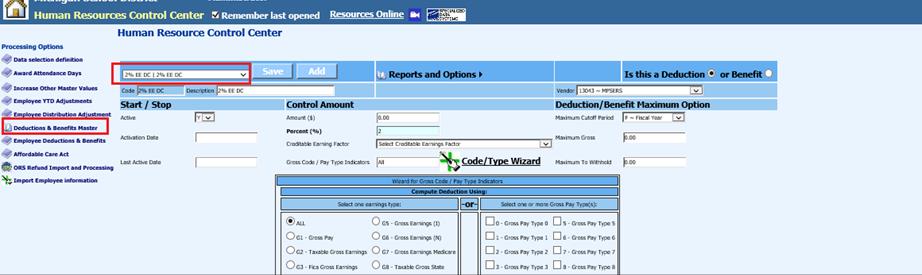

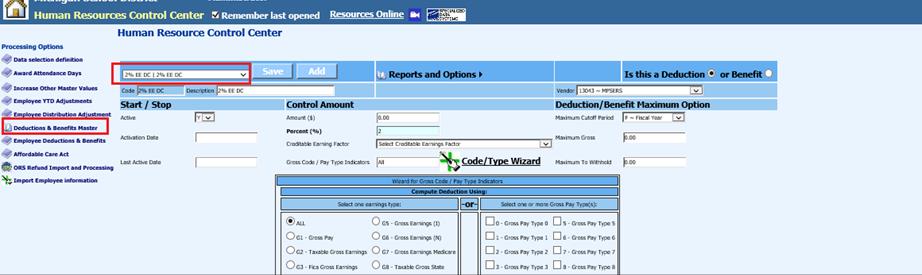

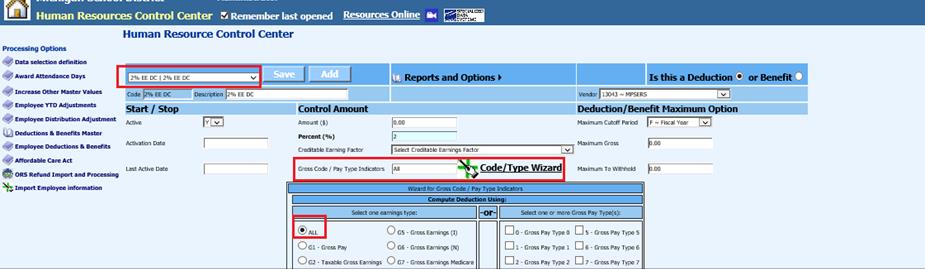

For the program to be able to calculate for Defined Contribution only, you must denote these deduction/benefits through the Deduction/Benefit Master as follows:

Defined Contribution Deduction/Benefits

1. Select Human Resources

2. Select Human Resources Control Center

3. Select Deduction/Benefit Master

4. Select a deduction or benefit that should be denoted as a “Defined Contribution” Retirement Item.

5. Set the Gross Code / Pay Type Indicators to ALL and save.

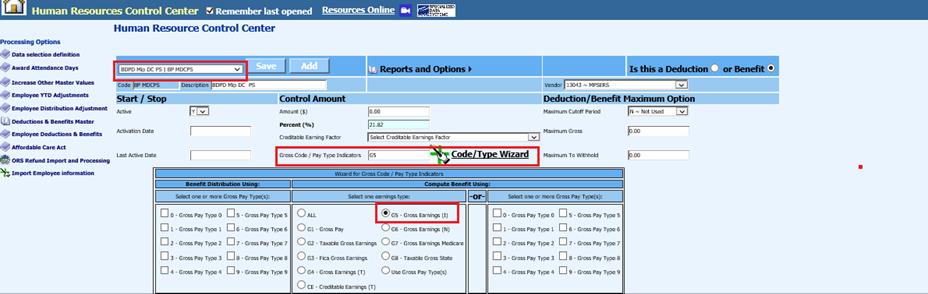

Pension Plan Employee and Employer Deductions and Benefits

6. Select Human Resources

7. Select Human Resources Control Center

8. Select Deduction/Benefit Master

9. Select a deduction or benefit that should report for the Detail 2 and not the Detail 4 portion of reporting.

10. Set the Gross Code / Pay Type Indicators to G5 and save.

Enter Wages with a Ret-N

11. When entering wages through Gross Pay Entry or updating the Employee Contracts to calculate on detail 4 only, you must set the Retirement selection to an “N”.

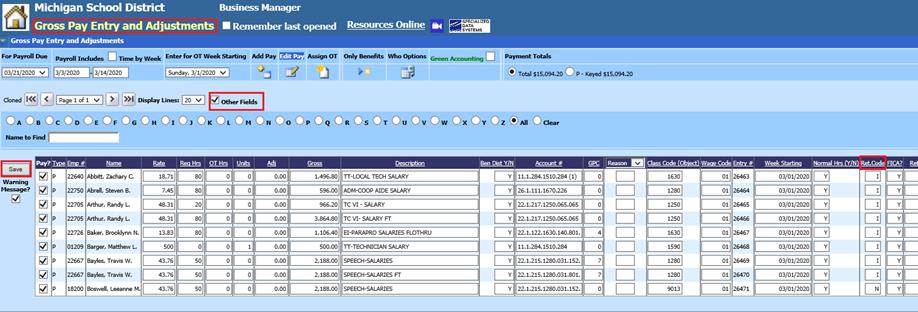

Gross Pay and Entry / Add Pay screen

a. Select Payroll Processing

b. Select Gross Pay Entry and Adjustments

c. Select “Other Fields”

d. Ret Code: Enter “N”

e. Select Save

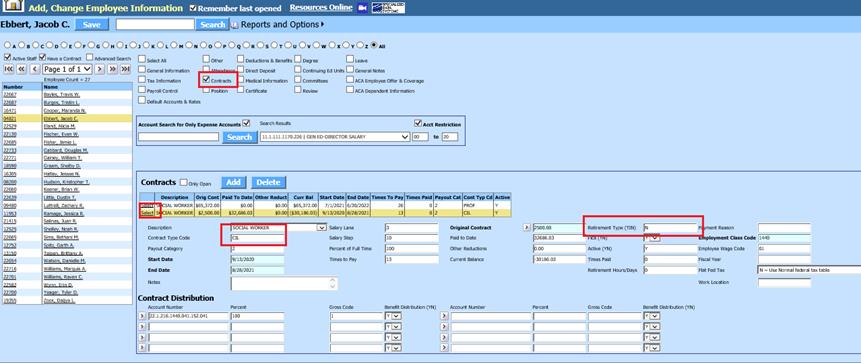

Add, Change Employee Information Screen / Contracts

a. Select Contracts

b. Highlight contract to adjust.

c. Contract Type Code: Update contract type code

d. Retirement Type (Y/N): Enter “N”

e. Select Save