Revised: 4/2021

Note: Please be sure to have a good backup before

utilizing this option. If you are hosted by SDS there will be a backup from the

previous evening.

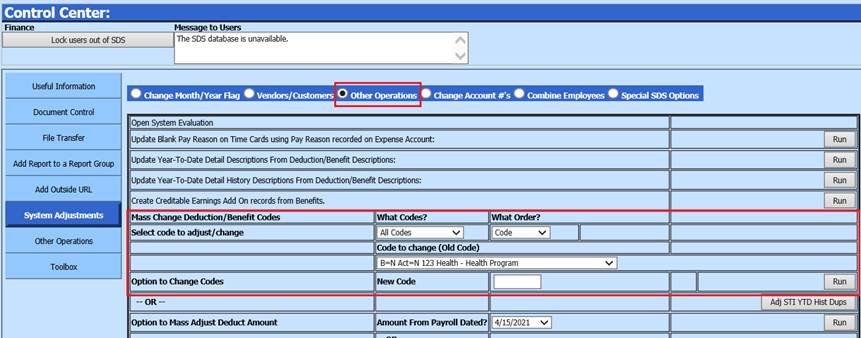

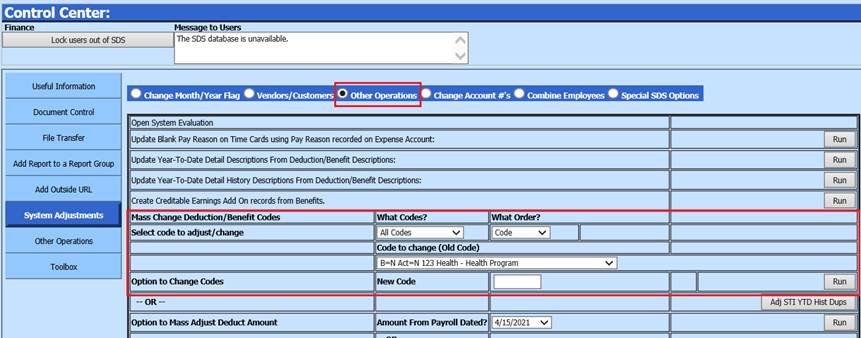

Mass Change Deduction/Benefit

Codes:

Example: let’s say that you have an insurance benefit code

AF PRETAX and the description is Single Insurance Coverage. By using the

instructions below you can rename the AF PRETAX to ”AFLAC PTax”. You can use up

to 10 characters for the code. When a change is made using this option all

references to the code are changed. This includes the deduction master, employee

records, state reporting, and historical transactions and more.

•What Codes? will restrict what codes show in the Old Code dropdown

list. Six selections are available, All Codes, Only Active Codes, All

Deductions, Only Active Deductions,

All Benefits, or Only Active

Benefits.

•What Order? will arrange the Old Code dropdown list in code sequence or alphabetical sequence using the deduction description

•Old Code: Select the Old Code from the dropdown list

•New Code: Enter the new code in the text box

•Select the “Run”

Note: If the code is changed and you want

the old code back then simply do another change reversing what had been done.

If an error of any kind happens during the process no changes will be

made to any part of the system.

An entry is made in the history area

indicating who made the change and what was changed.

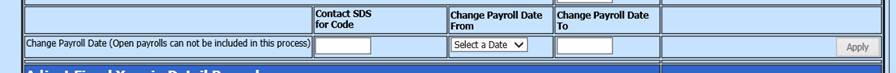

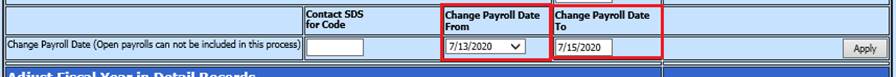

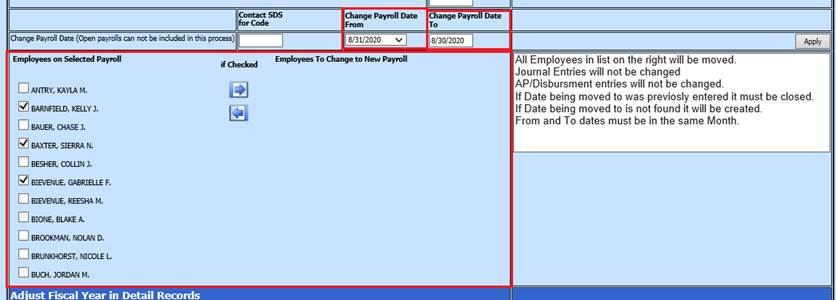

Change Payroll Date (Open payrolls can not be included in this process)

Three processing options are available with the “Change Payroll Date” option

•Mass change a closed payroll date

•Move selected employees from one payroll date to another

•Delet a Void payroll date

1. Mass Change a closed payroll date

a. This process will Mass change the payroll date selected. All entries and transactions related to the “From” payroll will be changed to the “To” payroll date. This option does allow the From and To dates to be in different months.

2. Move selected employees from one payroll date to another

a. This process will move selected employees from one payroll date to another. Review the information below the “Apply” button

b. Example below will transfer payroll information for the selected employees from payroll date to . The payroll date will remain in the system with employees not moved. Also, the original journal entry and liability disbursements will remain connected to the original payroll date.

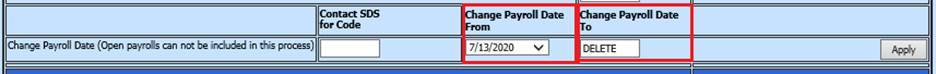

3. Delete a Void payroll date

a. This process will Delete all information related to the selected payroll date. Before a payroll can be removed, it must first be Voided. If any employees on the selected payroll date have not been voided, the process will not be allowed to continue.