Here are some items to consider if you are out of balance that could be caused by a date issued. Below will walk you through how to correct an expense on date.

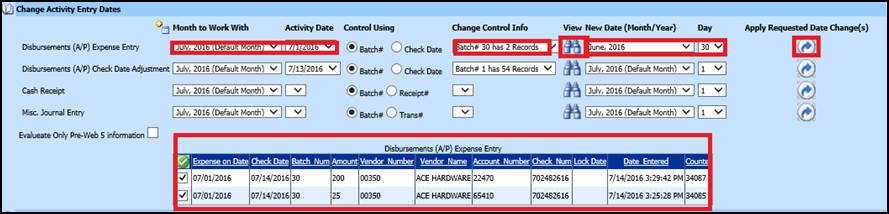

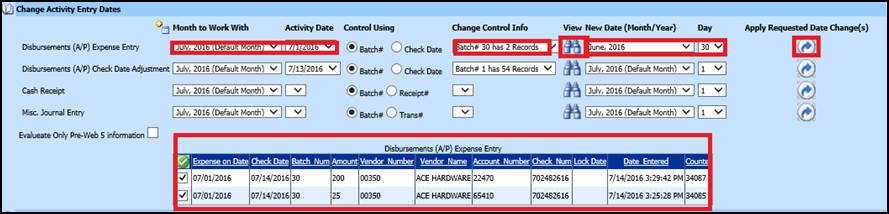

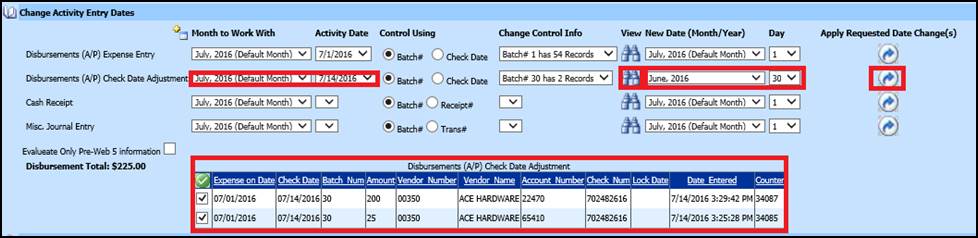

•If a check has been posted and the expense on date is not in the correct month and needs to be moved or you are checking for incorrect expense dates select the drop down under the month to work with area and select the month that the check was expensed in (e.g. July, 2016). Once the date has been selected click on the binocular button to see the items for this date.

•In the example the accounts payable items were expensed on 7/1/2016 and should have been expensed on 6/30/2016. The checks were written on 7/14/2016 so they should have been an account payable liability at the end of June.

•To move these items to June 2016 select the month of June 2016 under the New Date (Month/Year). Change the day to the proper day in the month. The last step is to use the Apply Requested Data Change(s) right arrow button.

How to Correct an Incorrect Check Date

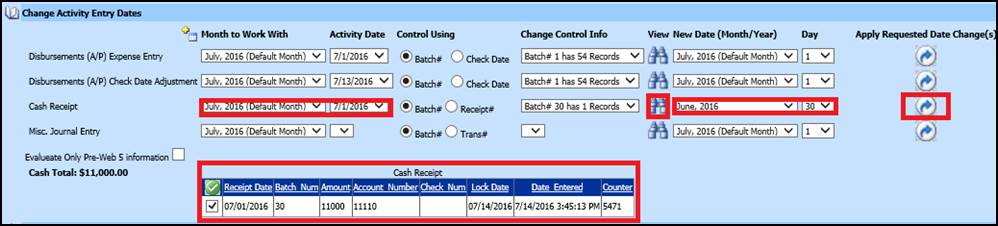

•If a check was posted with the wrong check date select the option Disbursements (A/P) Check date Adjustment. Select the month to work with selection using the drop down arrow and select the month that the check was done. Select the Activity Date that the check was run on. In the example the date of 7/14/2016 was not the correct date that should have been used on the check. By selecting the binocular button on that same row you will see the item(s) that relate with the selection.

•The check date on this selection should have been 6/30/2016. Therefore, to correct this item in the same row select the drop down in the new date (Month/Year) select the month of June 2016 and then select the correct date.

•After making sure the changes are correct select the arrow button under apply requested date. The system will then correct the check date on this check.

How to Correct a Cash Receipt

•If a cash receipt was posted with the wrong date select the option Cash Receipt. Then select the month to work with drop down and select the month that the receipt to be corrected was done in. In the example the date of 7/1/2016 shows. The date this should have been was 6/30/2016. Once the date has been selected click on the binocular button to see the items for this date.

•To make the change on this cash receipt select the month of June 2016 under the New Date (Month/Year). Then select the date of the receipt.

•Once you have verified the changes select the apply request date.

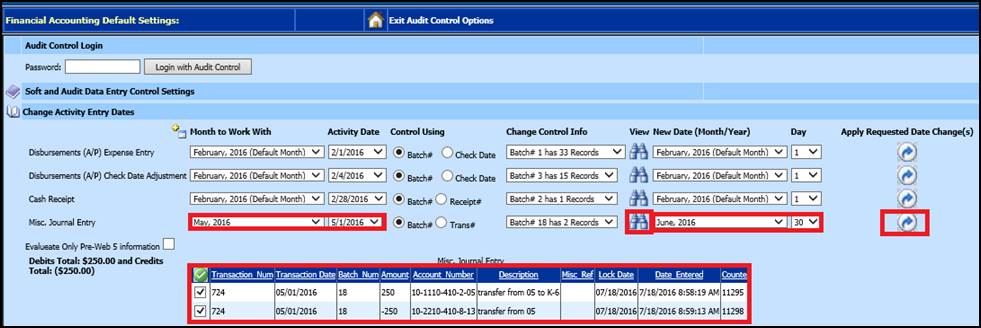

How to Correct a Journal Entry

•If a journal entry has not been posted to the correct month select the month the entry was posted into or select *All dates and find the date. Then select the binocular button to see a list of the items in that transaction.

•Then select the month the journal entry should have been posted into and the date. After verify the information select then apply posted date and the journal entry will be moved into the correct month.

There is an amount in the Accounts Payable account. Where

is it coming from?

As invoices are posted into your system they are automatically debiting the account that you posted the invoice to in the accounts payable disbursements area. The credit side of the entry is posting to the accounts payable account that is setup in the ledger interface.

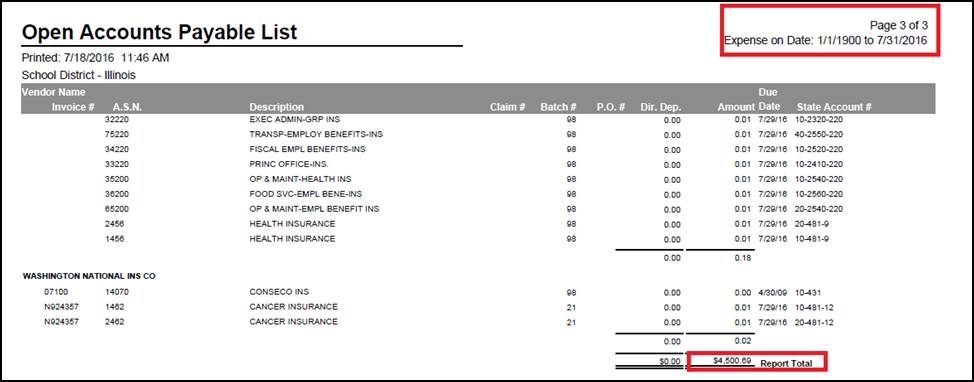

•The way to find out what makes up this amount in the accounts payable account is to run an open accounts payable report.

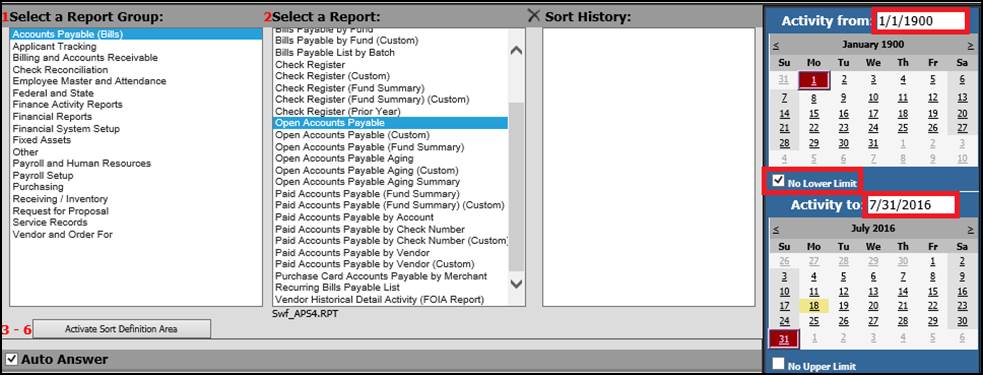

•Go to reports than general accounting reports. Then select accounts payable (bills). Next select the Open Accounts Payable report. On the dates select no Lower Limit on the first calendar and then on the second calendar select the date of the balance sheet.

•This report will go back to the date in time of the balance sheet. The system goes back through the invoices that have been posted to determine what was open as of the date selected on the report even if that item has currently been paid.

What does the expense on date mean and how does it work?

•The expense on date is the date the entry will post to the financials.

•Accounts Payable example. If the invoices have an expense on date of 9/1/2015 those invoices will post to those account numbers in the financials in the month of September. At the time the invoice is created the credit side of the entry will post to the accounts payable account that is setup in the ledger interface.

•Once the invoice has a check date and a check number and has been posted the accounts payable account will be debited and the cash account will be credited.

•If the invoice has an expense on date of 9/1/2015 but the check is not written until 10/5/2015 the expense account that the invoices was posted to will show as a debit in the September 2015 financials and the credit side will go to the accounts payable account in September. In the October financials once the check has been written and posted the accounts payable account will be debited and the cash account will be credited in the October financials.

My payroll cash is posting to the wrong account. What do I do?

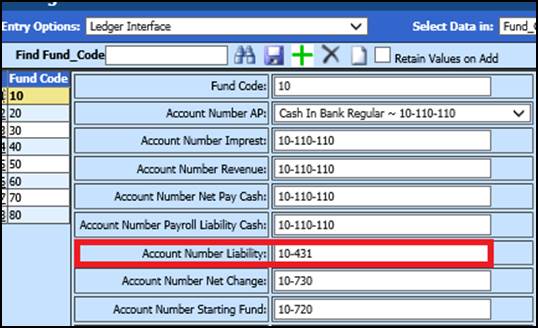

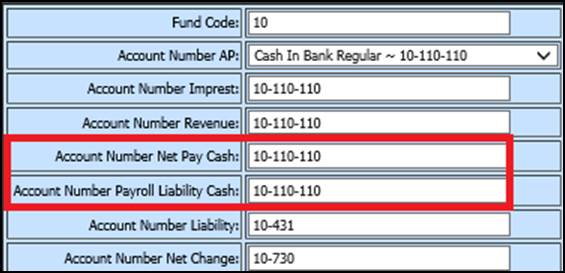

•Postings to Payroll are controlled by the accounts that are in the ledger interface.

•Go to Master File and Code Entry and then Master File Data entry and Changes.

•Next from the entry options select Ledger Interface.

•There are two fields that need to be verified. Account Number Net Pay Cash and Account Number Payroll Liability Cash. If your net pay or payroll liabilities are not posting to the account you want them to post to than these fields need to be changed.

General Accounting Reports

A new way to run

reports by date ranges. Below are a few examples to help with the new

process.

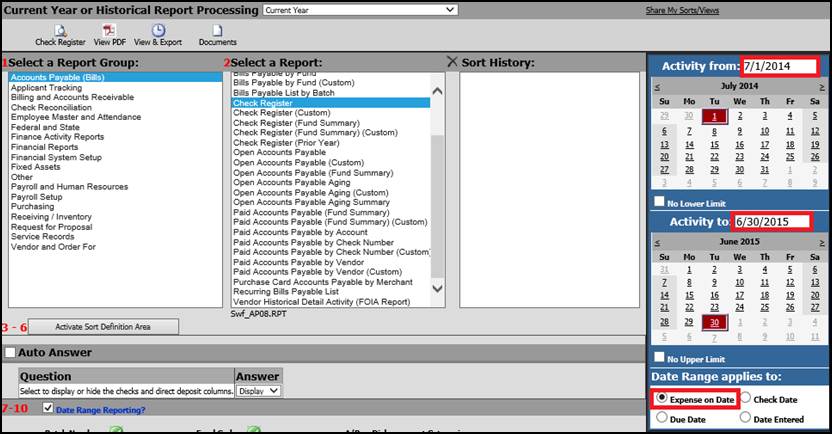

1. How do you run a check register for the prior fiscal year?

o Select the General Accounting Reports

o Select the report group Accts Payable (bills)

o Select the report check register

o On the calendar enter the dates of the prior fiscal year. Example 7/1/2014 thru 6/30/2015

o There is no need to use the historical database. The current database is what needs to be used.

2. There is also a new option at the bottom of the calendar selection area. This option will let you choose how you want the report to view. The check register will default this control option to check date. If you want the check register to run by expense on date change the option and preview the report. The report will be by expense on date. This new control option is available on many of the reports in the General Accounting report area.

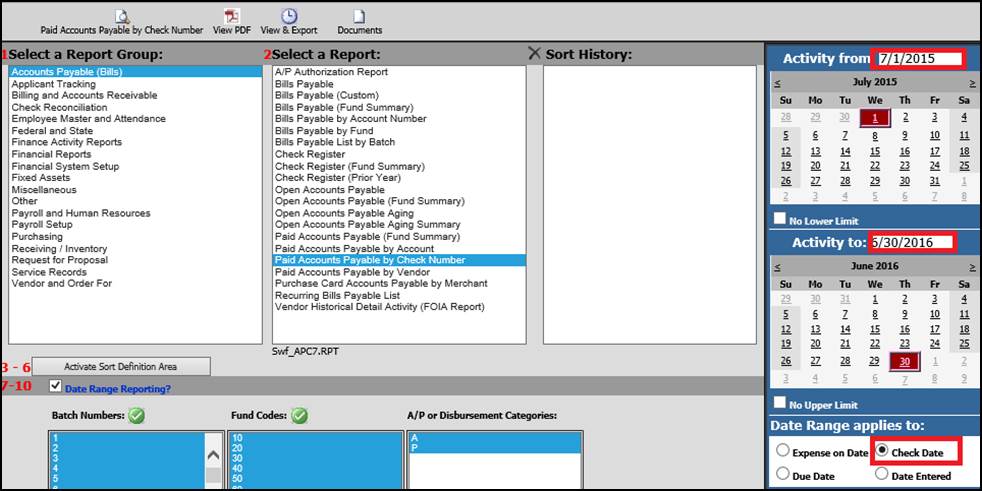

3. How to run a Paid accounts payable report by check date?

1. Select the General Accounting Reports

2. Select the report group Accts Payable (bills)

3. Select the Paid Accounts Payable by Check Number

4. Select the date range that is desired

5. Change the control option at the bottom of the calendar to check date instead of the default of

6. Expense on date

7. Preview the report. The report once the default is changed will show the report by check date.

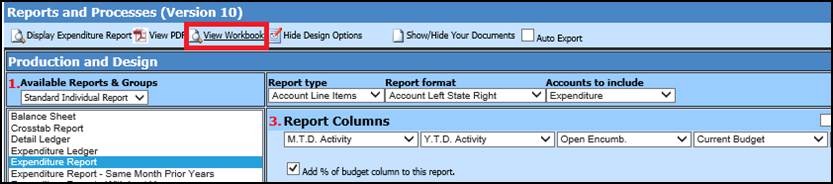

Financial Reports

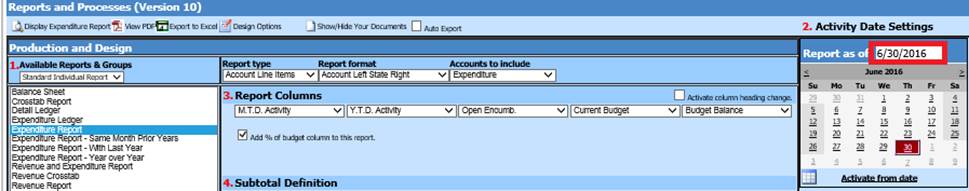

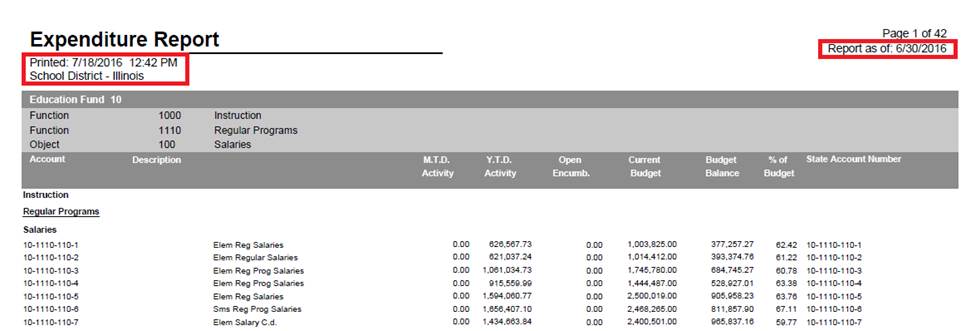

1. How do I run a June 2016 financial report after I have moved into a new month in the new fiscal year?

1. Go to Reports and then Financial Reports on the menu tree.

2. Then select the desired report.

3. To run a report for the end of June 2016 and change the report date to 6/30/2016 or enter in the date and select the enter key.

4. To see only the accounts with activity select the option to include only active accounts.

5. Then select the display button.

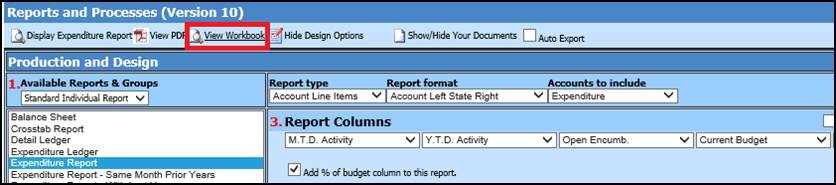

2. Below will walk you through how to send any of the financial reports to Excel.

1.

In the Financial reports area select the desired report. Then select the Export

to Excel option.

2. After this option is selected the system will tell you to open the worksheet. Select this option.

3. The Excel sheet will open.

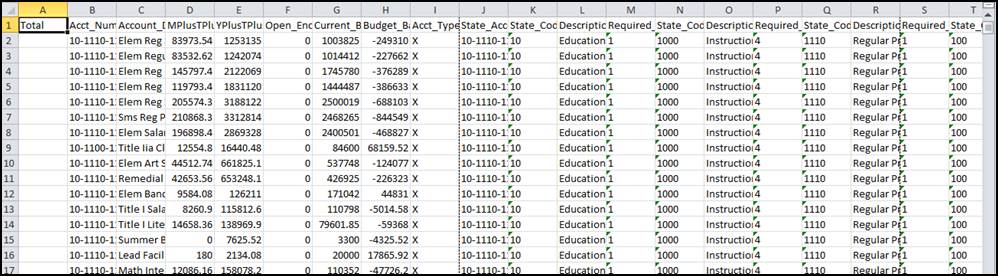

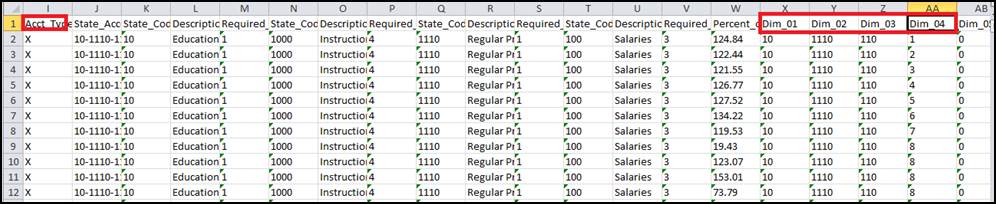

4. This file is loaded with more information than your regular expenditure report. It also brings over your dimension codes which makeup the state account number.