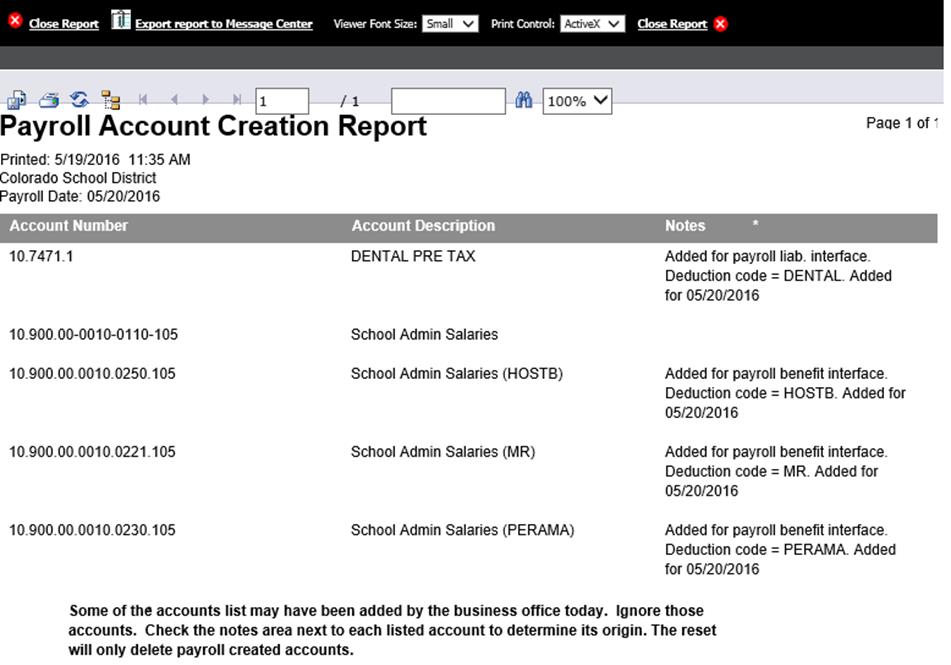

This report is found under Payroll Processing | Payday Reports and needs to be checked each payroll. If accounts have been created during payroll, the Payroll Account Creation Report will be accessible and should be reviewed to verify accounts that have been added. This report also contains new accounts added to the chart of accounts when payroll is computed.

The salary state account number that this benefit was created for is 10-900-00-0010-0110-105, the title for this is “School Admin Salaries”

The state account number for the new code added is 10-900-00-0010-0230-105, the title for this is “School Admin Salary (Pera)” If this account is correct you may change the description on the account under Budget Master (Basic Fields) by finding this new account number and changing the description and then Save.

The program looks at the salary’s state account number to apply the expense of the benefit code and uses the same numbers for each dimension unless otherwise overridden by the specific code setup within the deduction and/or benefit. In this case, Pera has an object code of 0230 which replaces the 0110 in the salary. If the program does not find a state account number with these exact numbers in the same dimensions as the salary, it will create an account.

If an account is created due to a benefit being computed on a salary account number that should not be, make any corrections within the data, compute again, and this account will automatically be removed from the Payroll Created Accounts Listing.

If you have already closed your payroll and thought you already had an account setup for the benefit, check each of the dimensions and compare to the one that was created. Make any changes necessary to match them up and then you can combine the two accounts.

To combine the two accounts search the help for “Combining Accounts”