Revised: 11/2020

This setting allows a deduction

to compute a Percentage of Gross plus the Value in the Deduction amount times

the number of hours worked. This has been designed to meet the deduction

requirements for some unions that have specific requirements for

calculation.

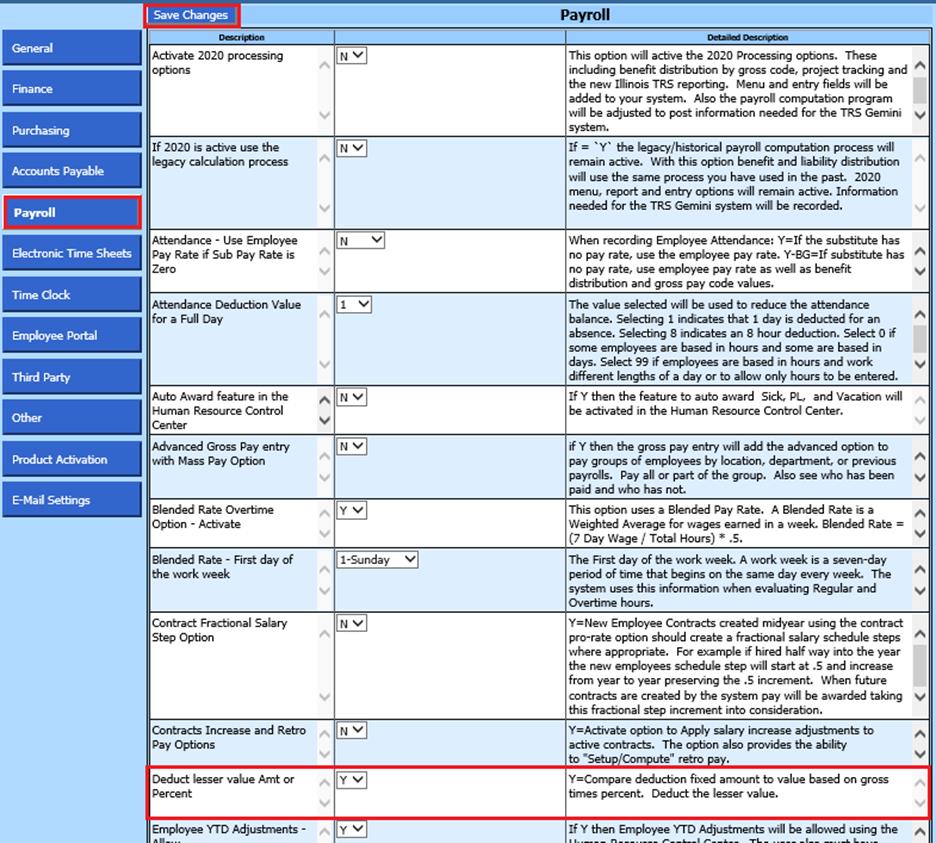

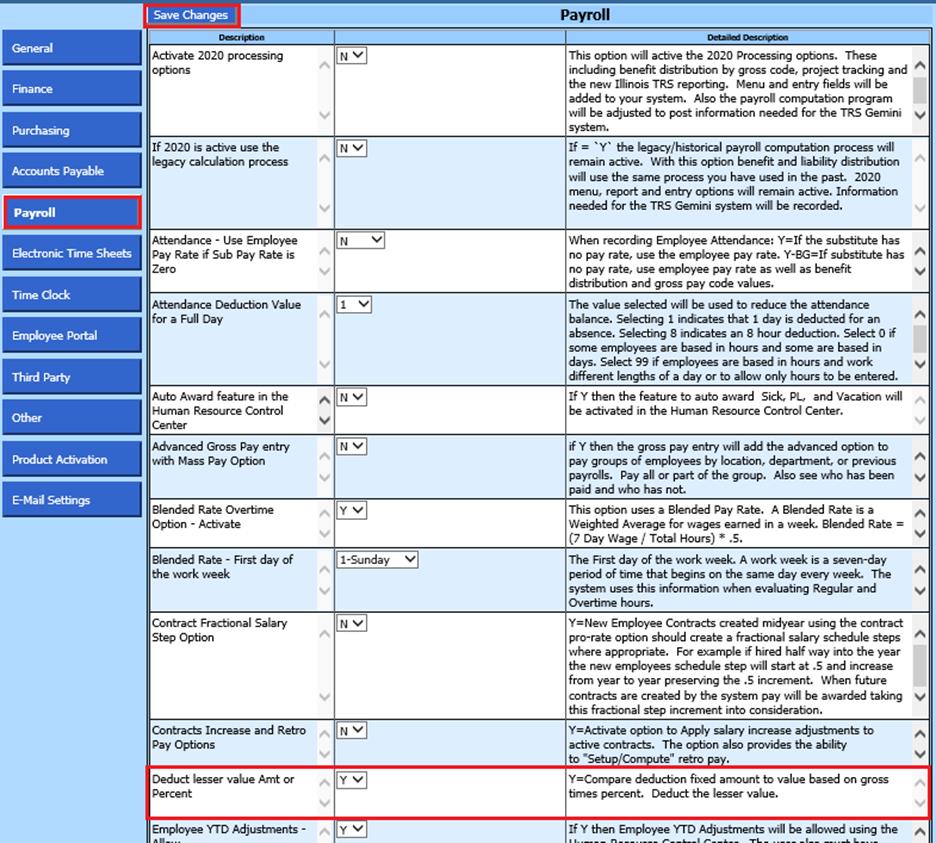

1. Select Administrative Utilities

2. Select SDS Web Office Settings

3. Select Payroll

4. Change Deduct lesser value Amt or Percent to a “Y”

5. Save Changes

6. Log out/in for changes

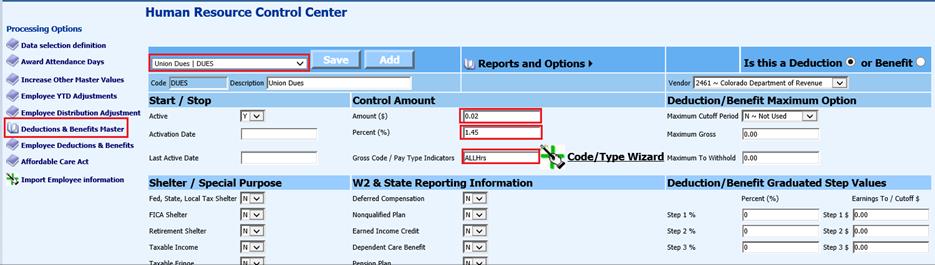

Adjust Deduction Master settings

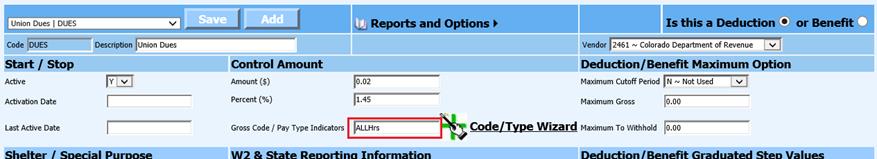

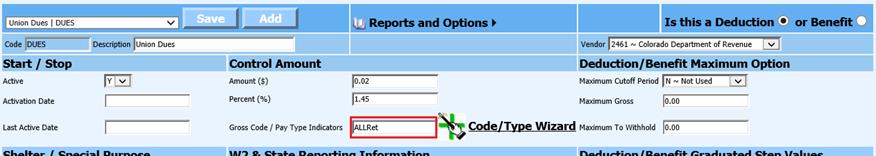

1. Select Human Resources

2. Select Human Resources Control Center

3. Select Deduction & Benefit Master

4. Select Deduction code

5. Gross Code/Pay Type Indicators: Enter the normal gross code values or the word “ALL” as needed

6. To the right of the Gross Codes in the same field enter

•“Hrs” for all hours regular, overtime, and retirement hours

•“Reg” for only regular hours

•“Ret” for only retirement hours

7. Code entry: Example of all gross earnings types for all hours worked the entry in the Gross Code Indicator field would be “ALLHrs”.

8. Fill in the percentage and deduction amount field

o The above setup is an example of how this computation

would work if person worked 1000 hours:

1000 hours x 1.45% = $14.50

1000

hours x .002 = $2.00

$14.40 + $2.00 = $16.50

**Note: When this option is activated, verify the deductions

used have both percent and amount fields completed.