Revised: 4/2021

NOTE: If a payroll is open it must be deactivated before using the void process.

Step #1

Upon voiding the payroll check, this process will also complete all necessary entries, in the month selected of activity.

1. Select General Ledger Processing and Entry Options

2. Select Void Payroll / Disbursement Check(s)

3. Check Type: Select Payroll

4. Select Check Date

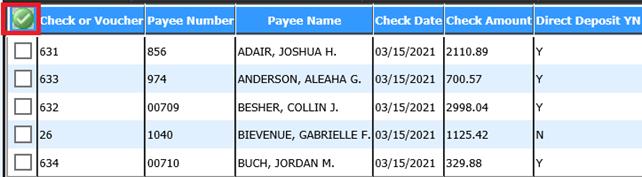

5. Select the check(s) you wish to void

•Selecting the green circle will check mark all checks listed

•Check mark just the check(s) to be voided

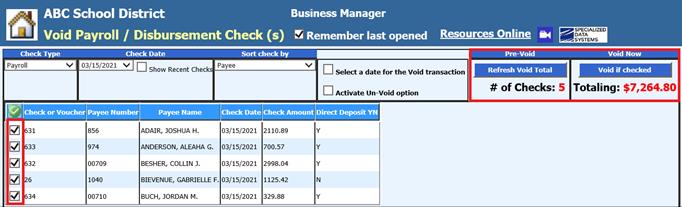

Or multiple checks

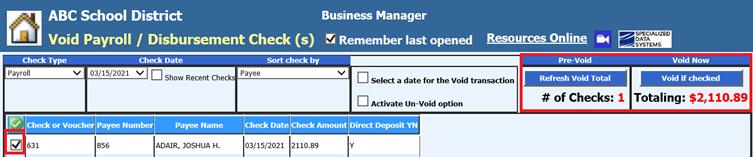

6. Pre-Void: Refresh Void Total

•This will display how many checks and list the total of all checks to be voided

7. Select the button “Void if checked”

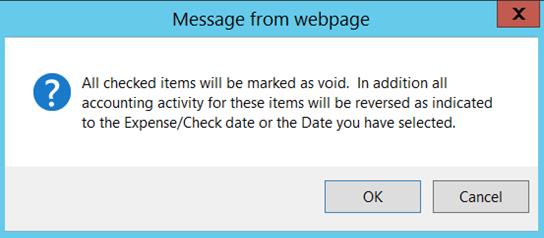

8. A message box will display – select OK

•If need to stop the voiding process, select “Cancel”

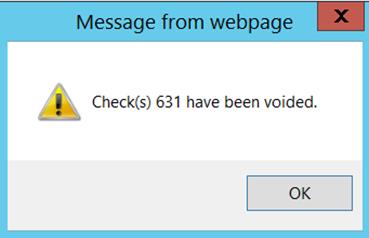

9. A message from webpage will display, confirming voiding has been completed.

10. Select OK

•If need to stop voiding process, select “Cancel”

11. A message from webpage will display, confirming voiding has been completed

Step #2

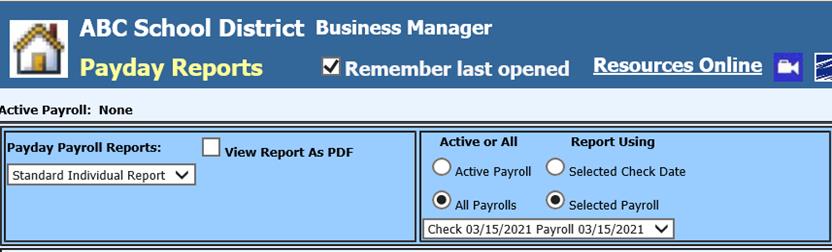

Payroll voided checks

View the Voided payroll reports for verification of voiding items

1. Select Payroll Processing

2. Select Payday Reports

3. Select Payroll date for voided entry(s)

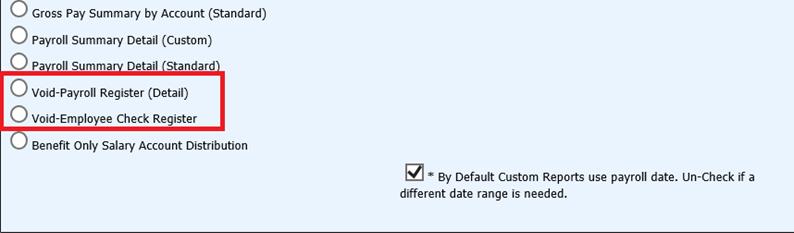

4. There are two reports available

•Void-Payroll Register (Detail)

•Void-Employee Check Register

Step #3

Transfer of Payroll Data

The transfer of these voids can be done with the next payroll that is processed.

o Select General Ledger Processing and Entry Options

o Select Transfer Payroll Data and Recurring Entries

o Select Liability Payments for closed Payrolls

o Select Transfer

o Select Journal Entry(s) for closed payrolls

o Select Transfer

o Payroll Journal entries will be posted by the payroll date.

1. Printing Payroll Liability Checks & Vouchers

The void liabilities can be combined with the next payroll liability checks to lower the dollars being paid. This way the dollars will be correct when processing your quarterly 941.