Revised: 8/2021

Creating the Federal Paper Report

1. Select Payroll Processing

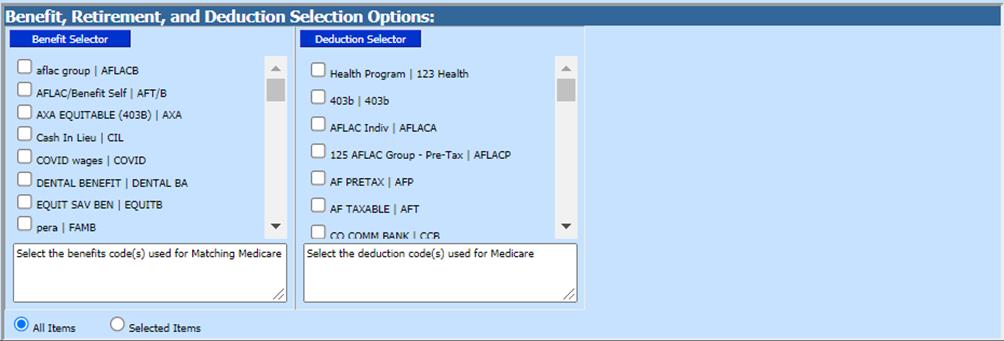

2. Select State and Federal Reporting and 3rd Party Data Export

3. Select your State: Select your state from the state dropdown selection

4. Select Quarterly 941 Report

5. Select Report Date

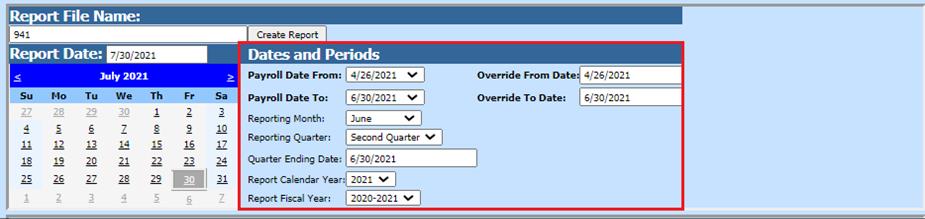

Dates and Periods:

•Payroll Date From: This is the starting date of the payroll(s) in the SDS payroll calendar that need to be reported.

•Payroll Date To: This is the ending date of the payroll(s) in the SDS payroll calendar that need to be reported.

•Reporting Month

•Reporting Quarter

•Quarter Ending Dates

•Report Calendar Year

•Report Fiscal Year

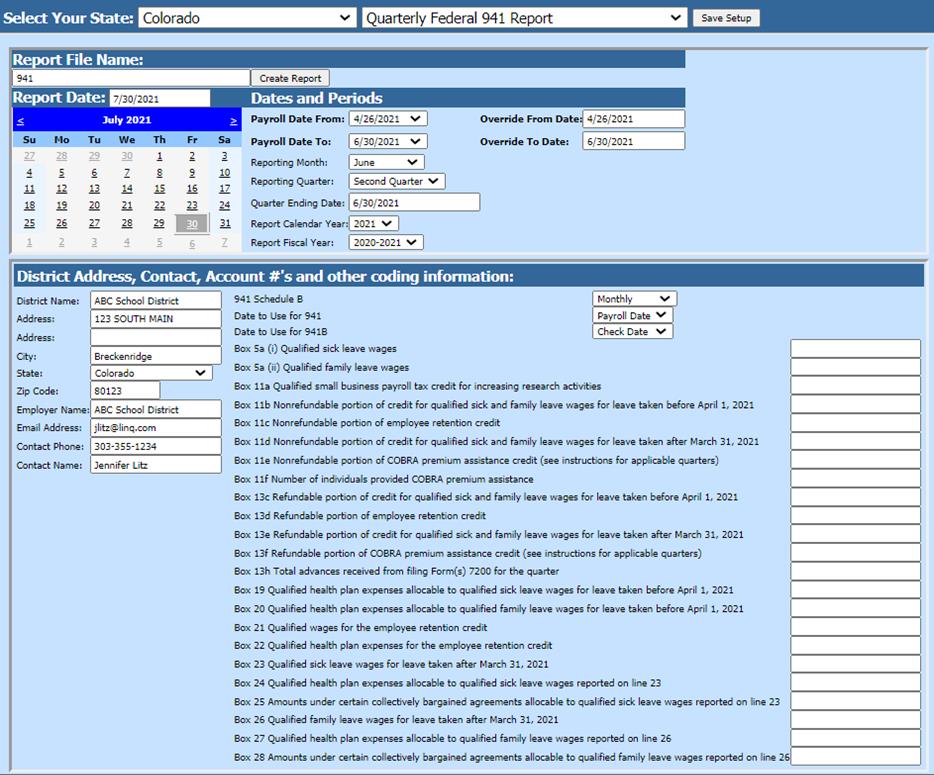

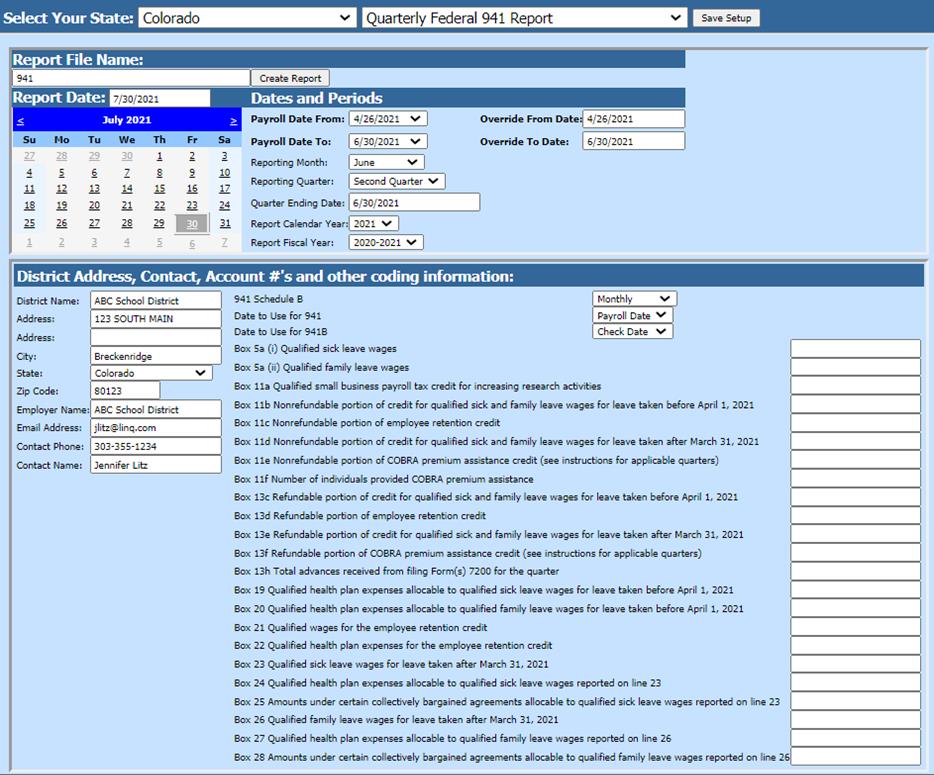

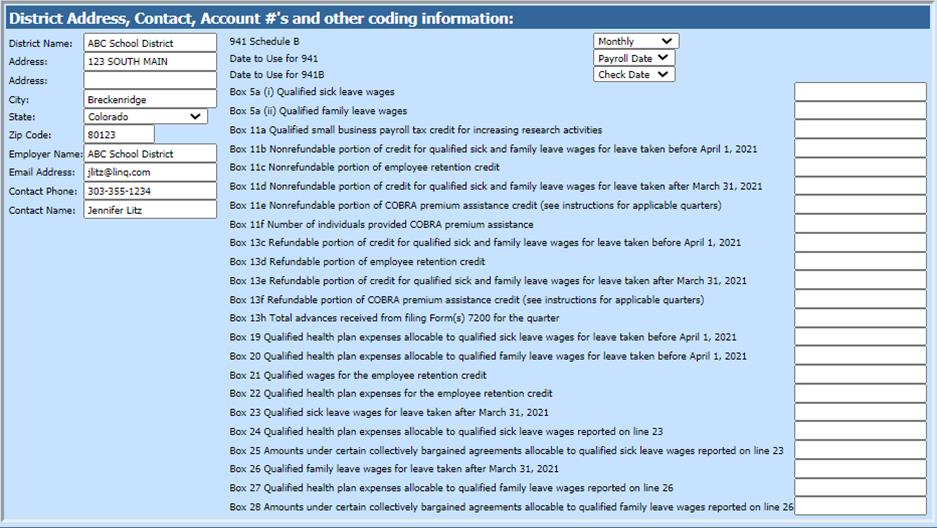

District Address, Contact, Account #’s and other coding information:

o Verify/Update 941 Schedule B and Box options:

§ Monthly or Semi-Weekly reporting

§ Date to use for 941 reporting

§ Date to use for 941B reporting

§ “Box” fields: update fields as needed for 941 reporting

Benefit, Retirement, and Deduction Selection Options

•Benefit Selector select the benefit codes for the report (if Medicare applies to your state)

•Deduction Selector select the deduction codes for the report (if Medicare applies to your state)

6. Once completed: Select Save Setup

7. Select Create Report

8. A report will display on the screen. Print the report and use it in filing your 941 reports.

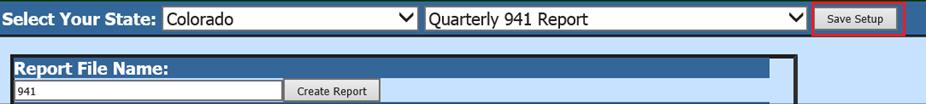

Printing the Federal 941 Reports

1. After 941 paper report is created, you can select the 941 reports to print:

o 941 Paper Report

o 941 Federal Format

o 941 Schedule B

2. Select Print Report. This displays the pages of the Federal 941 reporting completed with all the proper information that has been gathered in the system from all the payrolls that have been processed for the quarter reported.

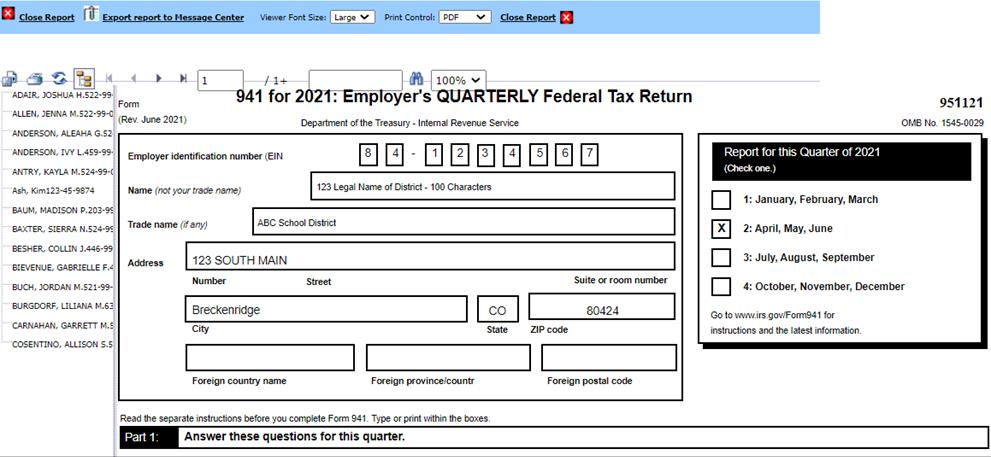

941 Paper Report example:

941 Federal Format example:

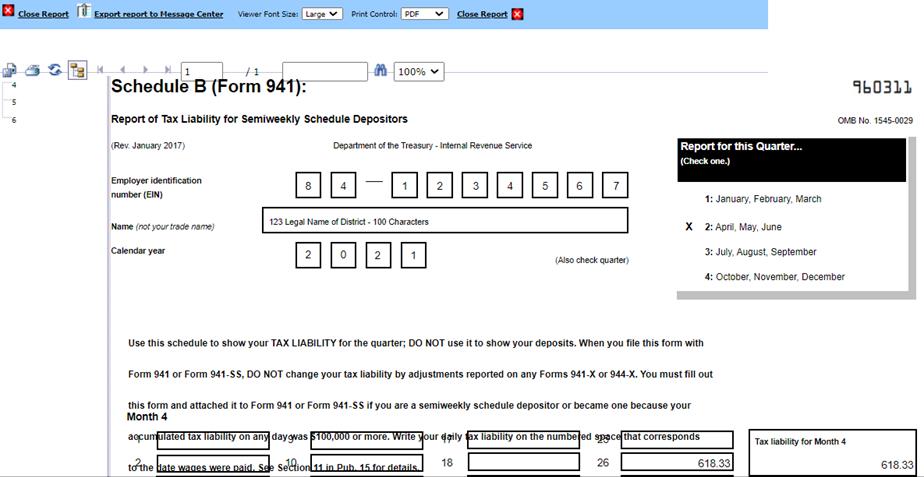

941 Schedule B example: