Revised: 4/2021

You may reimburse an employee through payroll using a

non-payroll account. The employee must have a time card being processed in the

payroll in order to use this process.

Entering a Reimbursement:

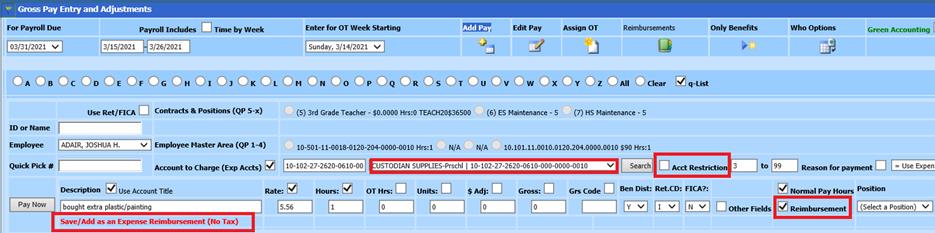

1. Select Payroll Processing

2. Select Gross Pay Entry and Adjustments

3. Select the alpha dot for the first letter of the employee’s last name.

4. Select the employee.

5. Put a check mark into the Reimbursement box at the end of the Number 3 area.

6. In the Number 2 area enter the account number or search for the account number.

7. In the Number 3 area enter the reimbursement amount in the rate area.

8. Enter a 1 for the hour area.

9. The rest of the items on the screen are ignored by the program.

10. Select the Number 4 button, pay (or enter) and the entry will be recorded. Note: No Tax will be taken out and all reimbursement amounts will be added to Net Pay.

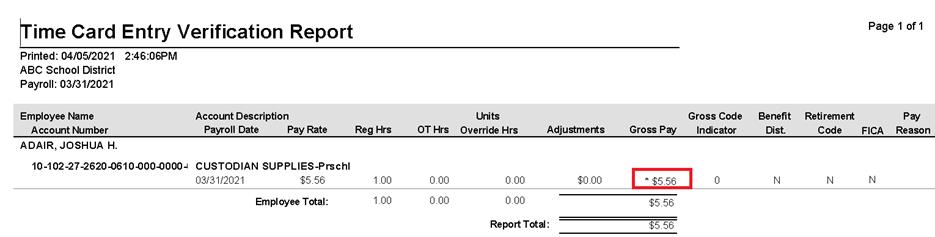

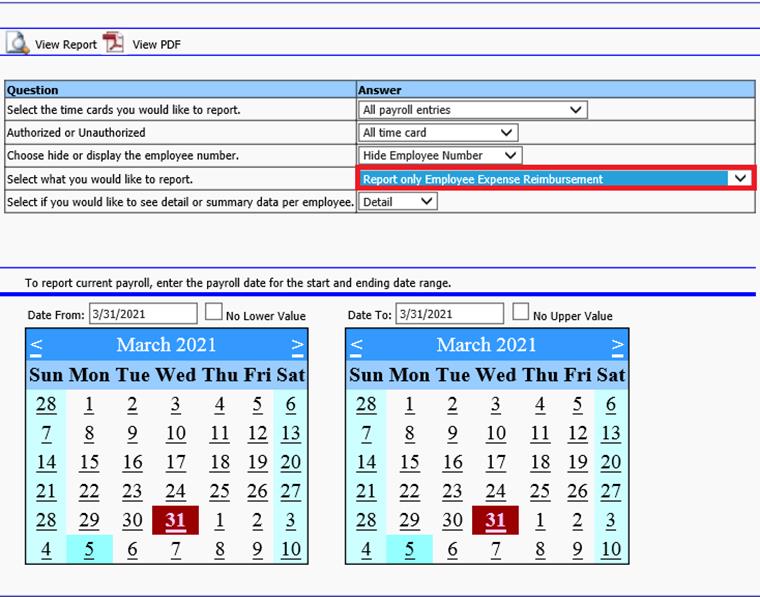

11. When all reimbursements have been entered select Payday reports.

12. Run the Gross Pay by Employee and the Gross Pay by Account reports. In the parameter selections, select Employee Expense Reimbursement option.

13. Verify these reports for accuracy. . The Expense reimbursement entry will have a asterisk by the amount of gross pay.