Revised: 4/2021

Set Seg is a third party administrator for the

Affordable Care Act Reporting Requirements. The report options within SDS will

allow for creation of files/reports that can be submitted to Set Seg.

The SDS Web Financial Office uses specific informational views which

organize the information needed for upload to Set Seg. SDS also uses an internal

data upload to pull data from various areas throughout the SDS program and

consolidate this information into three views that can be found in the

Entry Views dropdown menu in Employee, Contract, Deductions/Benefits. These

specific ACA views become a work area where the information for upload to Set

Seg can be reviewed/edited/changed prior to creation of the files for

submission.

Note: The first step in this

process should be the ACA Data Upload under Human Resources/Human Resources

Control Center. The ACA Data Upload will automatically place data into the ACA

Data Views within the system.

THE FIRST TIME THE ACA DATA UPLOAD UTILITY

IS RUN, THE “RESET OPTION” NEEDS TO BE UNCHECKED.

What does the ACA Data Upload do?

The automated ACA Data

Upload goes through a process of updating fields needed for ACA reporting. The

Data Upload prepares specific fields with the most common expected entry. The

data upload will do the bulk of the “prep” work so the user can spend their time

in review of the standard entry and make needed changes on those records that

are outside the normal expectancy.

What Fields are affected by the

ACA Data Upload?

•Updates the last names of dependants if blank using employees last name.

•Adds a Y to the Covered_All_12 field if all other 12 month fields are blank

•Adds a Y to the Dependent_Offered_Benefits field if blank

•Adds a Y to the Dependent_Accepted_Benefits field if blank

•Adds a Y to the Covered_All_12 field if all other 12 month fields are blank

•Adds EF to the Dependent_Offered_Benefits field if blank (EF=Employee and Family)

•Adds EF to the Dependent_Accepted_Benefits field if blank (EF=Employee and Family)

•Adds 2015 to the Coverage_Year field if blank

•Adds 1E to the Offer_Of_Coverage_All_12 field if all other 12 month fields are blank

•Adds FT to the ACA_Employee_Designation_Code field if blank

•Adds FT to the ACA_Employee_Class_Code field if blank

•Adds “Full Time” to the ACA_Employee_Class_Label field if blank

•Updates the ACA_Job_Title field if blank using Title field from the Employee Master

•Updates the ACA_Current_Status field if blank using Pay field from the Employee Master

o if Y converts to A (active)

o if N converts to G (terminated)

•Updates the ACA_PayRate field if blank (using the following hierarchy)

o Using Hourly_Rate field from the Employee Position if > 0. Also adds HY (per hour) to the ACA_PayType field and adds H (hourly) to the ACA_Pay_Type_Classification_Code field

o Using Rate_1 field from the Employee Master if > 0. Also adds HY (per hour) to the ACA_PayType field and adds H (hourly) to the ACA_Pay_Type_Classification_Code field

o Using the total of ALL Contracts in the Orig_Contract field from the Employee Contracts if Balance > 0. Also adds YY (per year) to the ACA_PayType field and adds S (salary) to the ACA_Pay_Type_Classification_Code field

•Updates the ACA_Pay_Cycle_Frequency field if blank using Tax_Table field from the Employee Master

o if >15 and < 24 adds SM (semi-monthly)

o if >24 adds BW (bi-weekly)

o if <16 adds MY (monthly)

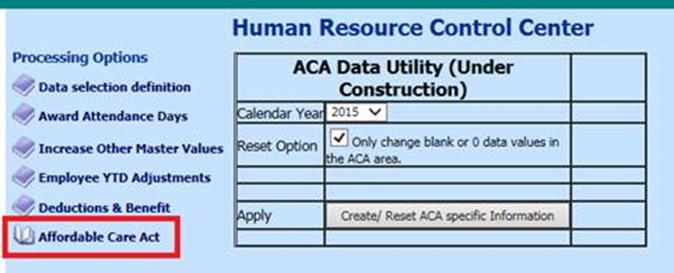

ACA Data Upload

1. Select Human Resources

2. Select Human Resources Control Center

3. Select Affordable Care Act

4. Select the Calendar Year that you are reporting ACA information for (i.e. 2015)

5. Reset Option: The default setting on this

option is to leave the checkbox checked (displaying a checkmark)

If you

have made any manual changes in the ACA views and UNCHECK this option, the

system will undo manual changes that may have already been put into place.

6. Select “Create/Reset ACA Specific Information”

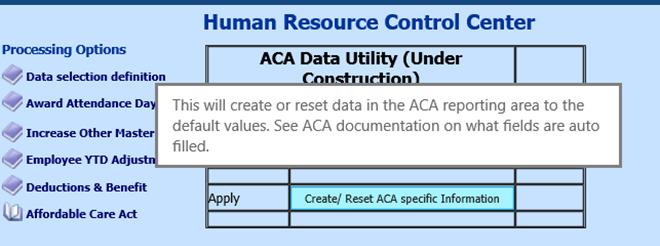

When

hovering over the “Create/Reset ACA Specific Information”, the message below

will appear for explanation.

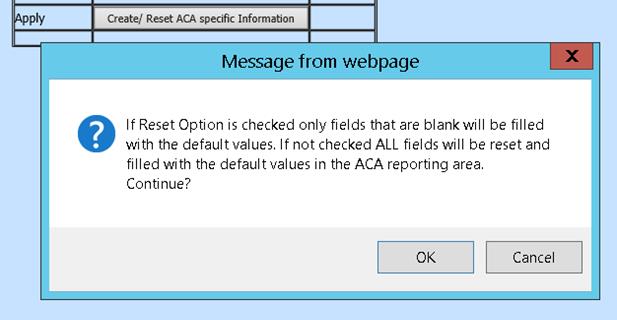

The warning message below will display after selecting

the Create/Reset button.

7. When it's done it will show a pop up that says "Done". Click OK and proceed to the next section.

Affordable Care Act (ACA) Views

To access the views where the ACA data will be

collected for submission to Set Seg follow the steps below:

1. Select Human Resources or Payroll Processing

2. Select Employees, Contract, Deductions/Benefits, etc. (Regular or Horizontal View)

3. Select the "Entry Views" Drop Down Menu to view the 3 views listed below: (You may have to use the scroll bar to scroll up to see these items at the top of the list)

o ACA Dependent Information

o ACA Employee Demographics

o ACA Employee Status Pay and Job

Preliminary Steps for Set

Seg Processing and Reporting

Security Settings

Make sure that any

user that will be working with entry, processing of data, or generating

reports/files for Set Seg have Security Rights to the below program areas.

To change a user’s security, enter Administrative Utilities

| Security - Application Area. Select the user and make sure they

have all access to the below areas:

•Human Resources Control Center

•Human Resources or Payroll Processing: Employees, Contracts, Deductions/Benefits views for ACA (listed above)

•Employee Information Changes (Horizontal)

•Payroll Processing State/Federal Reporting

Employee/Dependent Information Entry

If

dependent names are known for employees, a record can be initiated for each

dependent.

1. Select Human Resources or Payroll Processing/Employee Information Changes (Horizontal)

2. Select Employees Information Changes (Horizontal)

3. Select the Entry Views dropdown menu and select ACA Dependent Information

4. Place a checkmark in the option Q-List and

Add Option

5. Select the employee from the Q-List at the left side of the screen.

6. Select to Add a Dependent Record for the

employee using the “Add” icon

o Select the checkbox "Auto add if no records

found." next to the “Add” icon  to automatically add a record for the

selected employee if one does not exist.

to automatically add a record for the

selected employee if one does not exist.

7. Enter the Dependent First/Middle Name and other information, as available. Other information can be added at a later time, if necessary.

8. Dependent Last Name can be left Blank if the Last Name will be the same as the employee. The ACA Data Upload will automatically fill this field with the employee last name.

o * If the dependent Last Name is different than the employee’s last name, enter the last name of the dependent. The ACA Data Upload will not overwrite a last name that is different than the employee’s last name.

9.  Save once you are done.

Save once you are done.

View/Edit of the ACA Data

After the Mass Load of the

ACA data, the data should be reviewed.

Information from several areas are retrieved and evaluated to fill the fields

for ACA Reporting.

We suggest you review your data. You can

review it by accessing the following areas:

1. Select Human Resources or Payroll Processing

2. Then Select Employees, Contracts, Deductions/Benefits or Select Employee Information (Horizontal)

o What's the difference in the different views?

§ Review of the Data through “Employees, Contracts, Deductions/Benefits” will show a vertical view of the information for each employee in the ACA Views.

§ Review of the Data through “Employee Information Changes (Horizontal)” will show a horizontal view display of records that is conducive to review of groups of employee records at one time.

What to

Review

ACA Dependent

Information View

The ACA Dependent Information View holds a record

for each dependent of each employee.

1. Make sure that there is a record for each dependent of each employee

o To Add a Dependent Record

1. Select Human Resources or Payroll Processing/Employee Information Changes (Horizontal)

2. Select the Entry Views dropdown menu and select ACA Dependent information

3. Place a checkmark in the option Q-List and Add Option

4. Select the employee from the Q-List at the left side of the screen.

5. Select to Add a Dependent Record for the employee using the “Add” icon

6. Select the checkbox next to the “Add” icon to automatically add a record for the selected employee if one does not exist.

2. Check the Fields that were filled by the ACA Data Utility (run through Human Resources Control Center)

o Coverage Year System auto adds the Year selected in the ACA Data Utility

o Dependent Offered Benefit System auto adds a Y

o Dependent Accepted Benefit System auto adds a Y

o Covered_All_12 System auto adds a Y

3. Edit any dependent records that should have a

different setting than the

automated answers placed by the ACA Data Utility.

o Example: If a dependent was not covered all 12 months of the year, go to that dependent record and remove the “Y” in “Covered_All_12” and place a “Y” in the specific months, January through December, that the dependent was covered.

4. Review all other fields in the ACA Dependent

Information view to ensure that

each record is accurate and complete.

Make manual changes to any individual records in any fields as needed.

Select the diskette icon to “Save” all entries each time you move between pages

of records.

OR

If there is a field that is not automatically

filled by the ACA Data Utility but that should be filled with the same

information for each dependent’s record, the Employee Information Changes

(Horizontal) screen allows for mass data changes to specific fields.

Mass Changes to a Specific

Field

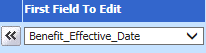

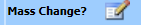

This example will take you

through the steps to change all the data in Benefit_Effective_Date field to

1/1/2015. The fields and input discussed in this example may be modified to

match your mass change need.

1. Select Employee Information Changes (Horizontal).

2. Select the Entry Views dropdown Menu and select ACA Dependent Information

3. Select “First Field to Edit” in the mid center of the screen and select “Benefit_Effective_Date” from the drop down menu.

4. This will move the selected field to display as the first column on the screen

5. Select the Mass Change button

6. This will open the “Mass change of data available with the entry view”.

o Step 1 Change Field: Select drop down and choose Benefit_Effective_Date field

o Step 2 Replace selected value: Select drop down and choose a blank (if all records are currently blank) or select a value that you wish to replace with a new value.

o Step 3 Change by entering a new value: Enter 1/1/2015 (for this example).

o Step 4 Apply mass change: Select Prepare to Make Change button

o Data is prepared and screen indicates what changes will occur next to the “Prepare to Make Change” button.

o Select the Mass Change button under step 4 to make the changes if you agree with the indicated changes

ACA Employee Demographics

View

The ACA Employee Demographics

View holds personal information of each employee. Much of this information

should automatically be populated in the ACA Employee Demographics View if it

had been entered into the Employee’s Master record.

1. Select Employee Information Changes (Horizontal) under Human Resources or Payroll Processing to Add/Edit the information for this view.

2. Add any additional employee demographic information, as needed.

3. Review all other fields in the ACA Employee Demographics View to ensure that each record is accurate and complete.

ACA Employee Status Pay and

Job

The ACA Employee Status Pay and

Job view shows information regarding each employee’s status, pay information,

and insurance coverage.

1. Check the Fields that were filled by the ACA Data Utility (run through Human Resources Control Center)

o ACA Current Status System auto adds an “A” if the Pay field in the Master is “Y”. System auto adds a “G” if the Pay field in the Master is “N”.

o ACA Pay Rate and ACA Pay Type Classification Code - System auto fills the Pay Rate based on this hierarchy/order

1. If the Hourly_Rate field from the Employee Position is > 0, the system auto adds HY (per hour) to the ACA_PayType field and adds H (hourly) to the ACA_Pay_Type_Classification_Code field.

2. If the Rate_1 field from the Employee Master if > 0, the system auto adds HY (per hour) to the ACA_PayType field and adds H (hourly) to the ACA_Pay_Type_Classification_Code field.

3. If the Orig_Contract field from the Employee Contracts if > 0, the system auto adds YY (per year) to the ACA_PayType field and adds S (salary) to the ACA_Pay_Type_Classification_Code field.

o ACA Pay Cycle Frequency System auto fills this field based upon the entry in the Employee Master/Tax Table Field. The following values are auto assigned based on the Tax Table Field entry.

1. If the Tax Table entry is >15 and < 24 the system auto adds SM (semi-monthly)

2. If the Tax Table entry is >24, the system auto adds BW (bi-weekly)

3. If the Tax Table entry is > 16, the

system auto adds MY (Monthly)

o ACA Job Title System auto adds information from the Employee Master field “Title”

o Adds EF to the Dependent_Offered_Benefits field if blank (EF=Employee and Family)

o Adds EF to the Dependent_Accepted_Benefits field if blank (EF=Employee and Family)

o Adds 2015 to the Coverage_Year field if blank

o Adds 1E to the Offer_Of_Coverage_All_12 field if all other 12 month fields are blank

o Adds FT to the ACA_Employee_Designation_Code field if blank

o Adds FT to the ACA_Employee_Class_Code field if blank

o Adds “Full Time” to the ACA_Employee_Class_Label field if blank

2. Edit any employee Status/Pay records that should have a different setting than the automated answers placed by the ACA Data Utility.

3. Review all other fields in the ACA Employee

Status Pay and Job View to ensure that each record is accurate and complete.

Make manual changes to any individual records in any fields as needed.

Select the diskette icon to “Save” all entries each time you move between pages

of records.

OR

If there is a field that is not automatically

filled by the ACA Data Utility but that should be filled with the same

information for each employee’s record, the Employee Information Changes

(Horizontal) screen allows for mass data changes to specific fields.

ACA Benefits Type Offered

and Benefits Type Accepted

Benefits

Type Offered

Enter one of the

following valid codes for the Benefits Type Offered:

No = No Benefits

Offered

E = Employee Only

ED = Employee and Dependent(s) (Not

Spouse)

ES = Employee and Spouse (No Dependent(s))

EF =

Employee and Family. The system will convert this code to EDS when the file is

created to be sent to Set Seg

Benefits Type

Accepted

Enter one of the

following valid codes for the Benefits Type Accepted:

No = No Benefits

Accepted

E = Employee Only

ED = Employee and Dependent(s) (Not

Spouse)

ES = Employee and Spouse (No Dependent(s))

EF =

Employee and Family. The system will convert this code to EDS when the file is

created to be sent to Set Seg

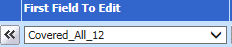

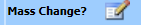

Mass Changes to a Specific Field

This example will take you through the steps to change

all the data in Covered_All_12 field to a “Y”. The fields and input discussed in

this example may be modified to match your mass change need.

1. Select Employee Information Changes (Horizontal).

2. Select the Entry Views dropdown Menu and select ACA Employee Status Pay and Job.

3. Select “First Field to Edit” in the mid center of the screen and select “Covered_All_12” from the drop down menu.

4. This will move the selected field to display as the first column on the screen

5. Select the Mass Change button

6. This will open the “Mass change of data available with the entry view”.

o Step 1 Change Field: Select drop down and choose Covered_All_12 field

o Step 2 Replace selected value: Select drop down and choose a blank (if all records are currently blank) or select a value that you wish to replace with a new value.

o Step 3 Change by entering a new value: Enter the letter “Y”.

o Step 4 Apply mass change: Select Prepare to Make Change button

7. Data is prepared and screen indicates what changes will occur next to the “Prepare to Make Change” button.

8. Select the Mass Change button under step 4 to make the changes if you agree with the indicated changes

SDS Database Layout for Set Seg Reporting

Each of the Set Seg Reports are

listed below in separate grids showing the field name set by Set Seg for the

report, the length each field will hold on the report, the Table and Field from

where the information will be pulled from within the system, and for some

fields, the format of the data.

The information in these grids is

instrumental in allowing SDS users to be able to quickly find the location of

each field used for ACA reporting to Set Seg. If a change or edit needs to be

made to a specific field or to a specific location in the file, these grid

layouts will help for locating the needed field and making the needed

changes.

Employee Information Report Layout

|

Field name |

Field Length |

Table & Field used |

Format |

|

|

|

|

|

|

SSN |

9 |

Employee_Master.Social_Sec_Numb |

|

|

FEIN |

9 |

Screen Prompt - FEIN Number |

|

|

EmployeeID |

255 |

Employee_Master.Employee_Number |

|

|

CurrentStatus |

1 |

Employee_SR_2.ACA_Current_Status |

|

|

MostRecentHireDate |

10 |

Employee_Master.Hire_Date |

mm/dd/yyyy |

|

**** Note: MostRecentHireDate Rehire date used if entered |

|

*** Employee_Master.ReHire_Date |

|

|

TerminationDate |

10 |

Employee_Master.Termination |

mm/dd/yyyy |

|

FirstName |

255 |

Employee_Master.Employee_First_Name |

|

|

LastName |

255 |

Employee_Master.Employee_Last_Name |

|

|

MiddleName |

255 |

Employee_Master.Employee_Middle_Name |

|

|

PayRate |

10 |

Employee_SR_2.ACA_PayRate |

99999999.99 |

|

PayType |

2 |

Employee_SR_2.ACA_PayType |

|

|

PayCycleFrequency |

2 |

Employee_SR_2.ACA_Pay_Cycle_Frequency |

|

|

HomeAddressLine1 |

255 |

Employee_Master.Street_Address_One |

|

|

HomeAddressLine2 |

255 |

Employee_Master.Street_Address_Two |

|

|

HomeAddressCity |

255 |

Employee_Master.City |

|

|

HomeAddressState |

2 |

Employee_Master.State |

|

|

HomeAddressZIP |

9 |

Employee_Master.Zip_Code |

|

|

HomeAddressCountry |

3 |

Default - USA |

|

|

NotificationEmail |

255 |

Employee_Master.Email_Name |

|

|

DateOfBirth |

10 |

Employee_Master.Birth_Date |

mm/dd/yyyy |

|

Gender |

1 |

Employee_Master.Sex |

|

|

EmployeeClassCode |

255 |

Employee_SR_2.ACA_Employee_Class_Code |

|

|

EmployeeClassLabel |

255 |

Employee_SR_2.ACA_Employee_Class_Label |

|

|

ACAEmployeeDesignationCode |

2 |

Employee_SR_2.ACA_Employee_Designation_Code |

|

|

ACAEmployeeCategoryCode |

255 |

Employee_SR_2.ACA_Employee_Category_Code |

|

|

ACAPayTypeClassificationCode |

1 |

Employee_SR_2.ACA_Pay_Type_Classification_Code |

|

|

JobTitle |

255 |

Employee_SR_2.ACA_Job_Title |

|

Payroll Details Report Layout

|

Field name |

Field Length |

Table & Field used |

Format |

|

|

|

|

|

|

SSN |

9 |

Employee_Master.Social_Sec_Numb |

|

|

FEIN |

9 |

Screen Prompt - FEIN Number |

|

|

TransactionID |

255 |

Not Required |

|

|

PayDate |

10 |

Time_Cards.Payroll_Date |

|

|

PayPeriodStartDate |

10 |

Screen Prompt - Payroll Date From |

mm/dd/yyyy |

|

PayPeriodEndDate |

10 |

Screen Prompt - Payroll Date To |

mm/dd/yyyy |

|

PayRate |

10 |

Employee_SR_2.ACA_PayRate |

99999999.99 |

|

PayType |

2 |

Employee_SR_2.ACA_PayType |

|

|

PayCycleFrequency |

2 |

Employee_SR_2.ACA_Pay_Cycle_Frequency |

|

|

CompensationType |

255 |

Time_Cards.Contract_Type_Code |

|

|

AdjustmentKey |

255 |

Not Required |

|

|

HoursWorked |

10 |

(Time_Cards.Reg_Hrs + Time_Cards.OT_Hrs + Time_Cards.Retirement_Hrs_Days) |

99999999.99 |

|

GrossPay |

10 |

Time_Cards.Gross_Pay |

99999999.99 |

|

W2Box1Deductions |

10 |

Employee_Ytd_Detail_History - Tax sheltered deductions |

99999999.99 |

|

EmployeeId |

255 |

Employee_Master.Employee_Number |

|

|

GLAccountCode |

255 |

Time_Cards.Account_Number |

|

|

ORSWageCode |

255 |

Time_Cards.Employee_Wage_Code |

|

Leave of Absence

Information Report Layout

|

Field name |

Field Length |

Table & Field used |

Format |

|

SSN |

9 |

Employee_Master.Social_Sec_Numb |

|

|

FEIN |

9 |

Screen Prompt - FEIN Number |

|

|

LOAReasonCode |

255 |

Employee_Leave.Leave_Reason |

|

|

LOAReasonLabel |

255 |

Employee_Leave.Leave_Reason |

|

|

LOAStartDate |

10 |

Employee_Leave.Leave_Start_Date |

mm/dd/yyyy |

|

LOAEndDate |

10 |

Employee_Leave.Leave_End_Date |

mm/dd/yyyy |

|

LOAHours |

10 |

Employee_Leave.Total_Leave_Work_Days |

99999999.99 |

|

EmployeeId |

255 |

Employee_Leave.Employee_Number |

|

Offer of Coverage Report Layout

|

Field name |

Field Length |

Table & Field used |

Format |

|

|

|

|

|

|

EmployerFEIN |

9 |

Screen Prompt - FEIN Number |

|

|

EmployeeFirstName |

255 |

Employee_Master.Employee_First_Name |

|

|

EmployeeLastName |

255 |

Employee_Master.Employee_Last_Name |

|

|

EmployeeSSN |

9 |

Employee_Master.Social_Sec_Numb |

|

|

EmployeeID |

255 |

Employee_Master.Employee_Number |

|

|

JobTitle |

255 |

Employee_SR_2.ACA_Job_Title |

|

|

BenefitsEffectiveDate |

10 |

Employee_SR_2.Benefit_Effective_Date |

mm/dd/yyyy |

|

MonthlyCostEmployeeOnly |

10 |

Employee_SR_2.Employee_Share_All |

mm/dd/yyyy |

|

BenefitsTypeOffered |

3 |

Employee_SR_2.Offered_Benefits |

|

|

BenefitsTypeAccepted |

3 |

Employee_SR_2.Accepted_Benefits |

|

|

AcceptedPlanIsSelfInsured |

1 |

Default is zero |

|

Dependent Offer Report

Layout

|

Field name |

Field Length |

Table & Field used |

Format |

|

|

|

|

|

|

EmployerFEIN |

9 |

Screen Prompt - FEIN Number |

|

|

EmployeeFirstName |

255 |

Employee_Master.Employee_First_Name |

|

|

EmployeeLastName |

255 |

Employee_Master.Employee_Last_Name |

|

|

EmployeeSSN |

9 |

Employee_Master.Social_Sec_Numb |

|

|

EmployeeID |

255 |

Employee_Master.Employee_Number |

|

|

JobTitle |

255 |

Employee_SR_2.ACA_Job_Title |

|

|

DependentFirstName |

255 |

Employee_Supplemental_Info_2.Dependent_First_Name | |

|

DependentMiddleName |

255 |

Employee_Supplemental_Info_2.Dependent_Middle_Name | |

|

DependentLastName |

255 |

Employee_Supplemental_Info_2.Dependent_Last_Name |

|

|

DependentSuffix |

255 |

Not used |

|

|

DependentType |

1 |

Employee_Supplemental_Info_2.Dependent_Type |

|

|

DependentSSN |

9 |

Employee_Supplemental_Info_2.Dependent_SSN |

|

|

DependentDOB |

10 |

Employee_Supplemental_Info_2.Dependent_DOB |

mm/dd/yyyy |

|

BenefitsEffectiveDate |

10 |

Employee_Supplemental_Info_2.Benefit_Effective_Date |

mm/dd/yyyy |

Set Seg Reporting

The Reports and Files for

submission to Set Seg are produced under Payroll Processing |State/Federal

Reporting.

** CURRENT PAYROLL

MUST BE CLOSED PROR TO CREATING THE PAYROLL DETAIL FILE**

The

steps are listed below for each report.

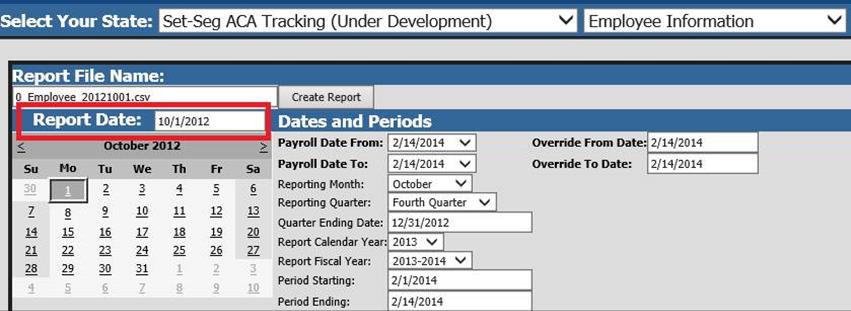

Employee Information Report

1. Select Payroll Processing

2. Select State/Federal Reporting

3. In the “State” dropdown menu, select “Set-Seg ACA Tracking”

4. In the “Select a Report” dropdown menu, select “Employee Information”

5. Enter the Set Seg Account # in the center right of the screen

6. Select the starting date for the report on the calendar or type the date into the field “Report Date”.

o The system will use the date in the “Report Date” field as the starting date for the report. The report will include any employee that has a termination date that lies on or after the starting date for the report. If an employee has a termination date that was before the “Report Date” selected, the employee will not be included on the report.

o Ex: If the report should reflect all information from 10/1/2012 forward, enter 10/1/2012 in the “Report Date” field. All Employees with a termination date prior to 10/1/2012 will NOT be included on the report.

o If the report should reflect all information from 10/1/2013 forward, enter 10/1/2013 in the “Report Date” field. All Employees with a termination date prior to 10/1/2013 will NOT be included on the report.

7. Select “Create Report”

o When the Report is created, it will be listed at the top of the screen in the file grid.

o TO VIEW THE DATA ON THE FILE

§ To view the file, double click on the folder. This action will open the folder for viewing in Excel.

§ After viewing the file, close the report and answer “NO” when asked if changes should be saved.

o TO SAVE THE FILE FOR SUBMISSION

§ Right click on the folder and select “Save Target As”.

§ Save the file to a desired location on your computer.

§ Retain this location for browsing the report upon submission to Set Seg

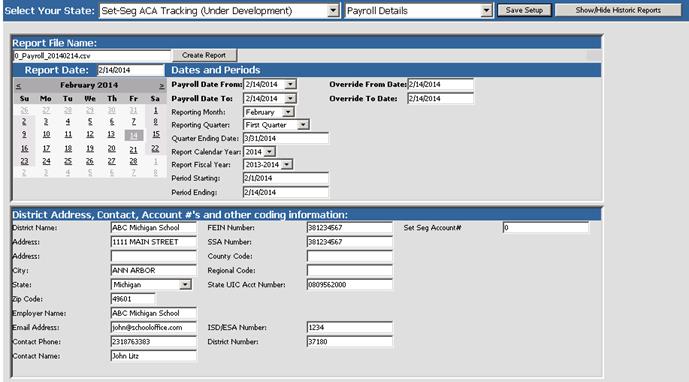

Payroll Details Report

1. Select Payroll Processing

2. Select State/Federal Reporting

3. In the “State” dropdown menu, select “Set-Seg ACA Tracking”

4. In the “Select a Report” dropdown menu, select “Payroll Details Report”

5. The Date Selection is very important for this report.

6. Enter the dates for the Payroll Period being Reported in the following areas:

o Payroll Date From:

o Payroll Date to:

o Period Starting:

o Period Ending:

o EX: If the report should reflect data starting from

2012, select a 2012 date in the “Payroll Date From” field

If the report

should reflect data starting from 2013, select a 2013 date in the “Payroll Date

From” field

7. Enter the Set Seg Account # in the center right of the screen

8. Select “Create Report”

9. When the Report is created, it will be listed at the top of the screen in the file grid.

o TO VIEW THE DATA ON THE FILE

§ To view the file, double click on the folder. This action will open the folder for viewing in Excel.

§ After viewing the file, close the report and answer “NO” when asked if changes should be saved.

o TO SAVE THE FILE FOR SUBMISSION

§ Right click on the folder and select “Save Target As”.

§ Save the file to a desired location on your computer.

§ Retain this location for browsing the report upon submission to Set Seg

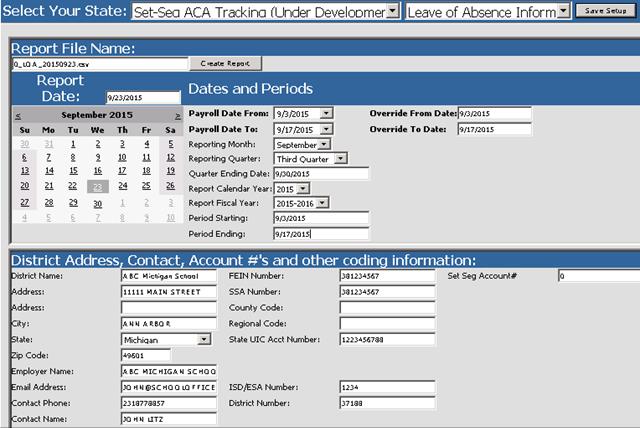

Leave of Absence Information Report

1. Select Payroll Processing

2. Select State/Federal Reporting

3. In the “State” dropdown menu, select “Set-Seg ACA Tracking”

4. In the “Select a Report” dropdown menu, select “Leave of Absence Information Report”

5. The Date Selection is very important for this report.

6. Enter the dates for the Payroll Period being Reported in the following areas:

o Payroll Date From:

o Payroll Date to

o Period Starting:

o Period Ending:

o EX: If the report should reflect data starting from

2012, select a 2012 date in the “Payroll Date From” field

If the report

should reflect data starting from 2013, select a 2013 date in the “Payroll Date

From” field

7. Enter the Set Seg Account # in the center right of the screen

8. Select “Create Report”

9. When the Report is created, it will be listed at the top of the screen in the file grid.

o TO VIEW THE DATA ON THE FILE

§ To view the file, double click on the folder. This action will open the folder for viewing in Excel.

§ After viewing the file, close the report and answer “NO” when asked if changes should be saved.

o TO SAVE THE FILE FOR SUBMISSION

§ Right click on the folder and select “Save Target As”.

§ Save the file to a desired location on your computer.

§ Retain this location for browsing the report upon submission to Set Seg

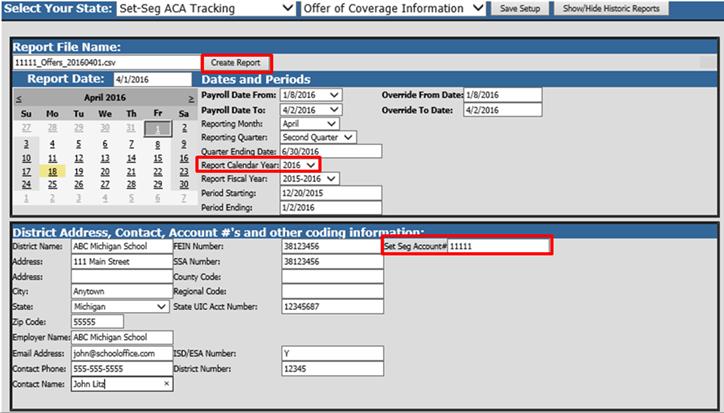

Offer of Coverage

Information Report

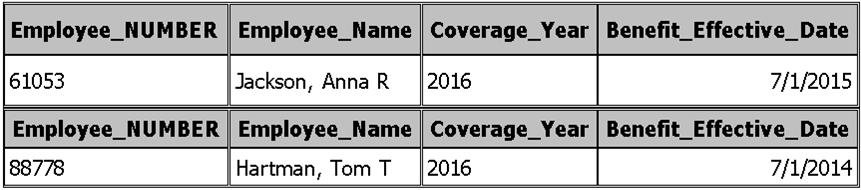

NOTE: TO

BE INCLUDED ON THE REPORT, AN EMPLOYEE MUST MEET THE FOLLOWING CRITERIA in the

ACA OFFER AND COVERAGE VIEW:

1. MUST HAVE INFORMATION IN THE FOLLOWING 2 FIELDS:

o BENEFIT EFFECTIVE DATE

o COVERAGE YEAR

2. THE COVERAGE YEAR MUST BE THE SAME AS THE YEAR BEING REPORTED

Example of Employees who WOULD be included on the report

for the 2016 Calendar Year

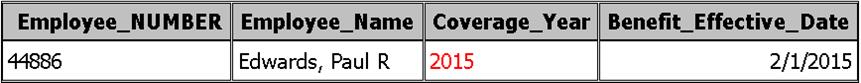

Example of an employee who would NOT be reported on the

report for the 2016 Calendar Year

1. Select Payroll Processing

2. Select State/Federal Reporting

3. In the “State” dropdown menu, select “Set-Seg ACA Tracking”

4. In the “Select a Report” dropdown menu, select “Offer of Coverage Information”

5. Select the Calendar Year being reported from the dropdown in the field "Report Calendar Year"

6. Enter the Set Seg Account # in the center right of the screen

7. Select “Create Report”

o When the Report is created, it will be listed at the top of the screen in the file grid.

o TO VIEW THE DATA ON THE FILE

§ To view the file, double click on the folder. This action will open the folder for viewing in Excel.

§ After viewing the file, close the report and answer “NO” when asked if changes should be saved.

o TO SAVE THE FILE FOR SUBMISSION

§ Right click on the folder and select “Save Target As”.

§ Save the file to a desired location on your computer.

§ Retain this location for browsing the report upon submission to Set Seg.

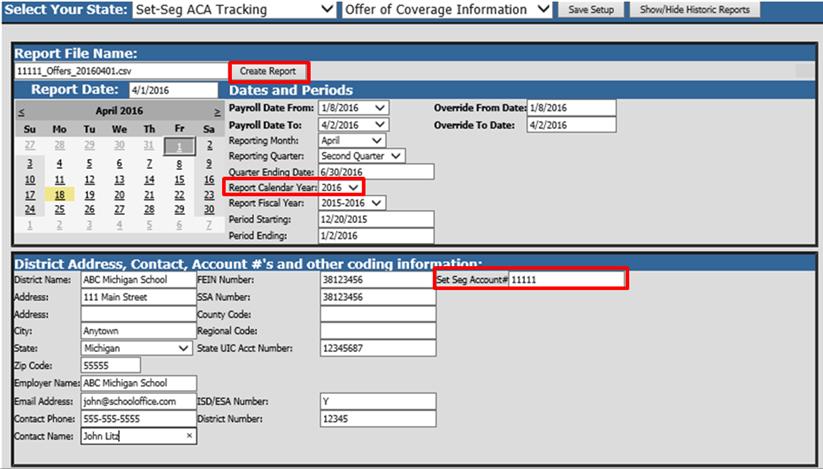

Dependent Offer Information

Report

NOTE: TO BE INCLUDED ON THE DEPENDENT OFFER INFORMATION REPORT, A

DEPENDENT RECORD MUST MEET THE FOLLOWING CRITERIA IN THE ACA DEPENDENT

INFORMATION VIEW:

1. MUST HAVE INFORMATION IN THE FOLLOWING 2 FIELDS:

o BENEFIT EFFECTIVE DATE

o COVERAGE YEAR

2. THE COVERAGE YEAR MUST BE THE SAME AS THE YEAR BEING REPORTED

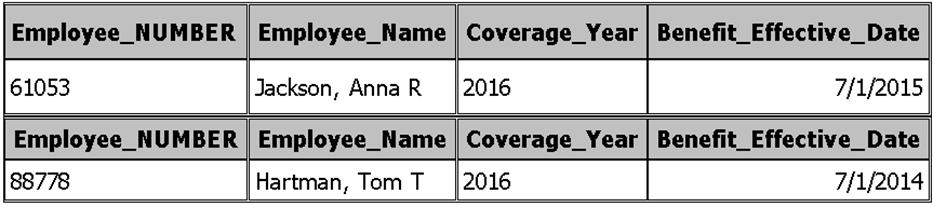

Example of Dependents who WOULD

be included on the report for the 2016 Calendar Year

Example of a dependent who would NOT

be reported on the report for the 2016 Calendar Year

1. Select Payroll Processing

2. Select State/Federal Reporting

3. In the “State” dropdown menu, select “Set-Seg ACA Tracking”

4. In the “Select a Report” dropdown menu, select “Dependent Offer Information”

5. Select the Calendar Year being reported from the dropdown in the field "Report Calendar Year"

6. Enter the Set Seg Account # in the center right of the screen

o

7. Select “Create Report”

o When the Report is created, it will be listed at the top of the screen in the file grid.

o TO VIEW THE DATA ON THE FILE

1. To view the file, double click on the folder. This action will open the folder for viewing in Excel.

2. After viewing the file, close the report and answer “NO” when asked if changes should be saved.

o TO SAVE THE FILE FOR SUBMISSION

1. Right click on the folder and select “Save Target As”.

2. Save the file to a desired location on your computer.

3. Retain this location for browsing the report upon submission to Set Seg