Revised: 8/2021

Annual reporting is

the process by which employers provide ETF with calendar year hours, earnings,

employee-paid required contributions, and additional contributions (if any) for

all their WRS participating employees actively employed at year’s end. All WRS

employers are required to submit an annual report.

•Wisconsin Annual Report: This report is run 2 times a year. January – June and January – December of each year and reports hours worked and wages earned during the specific time.

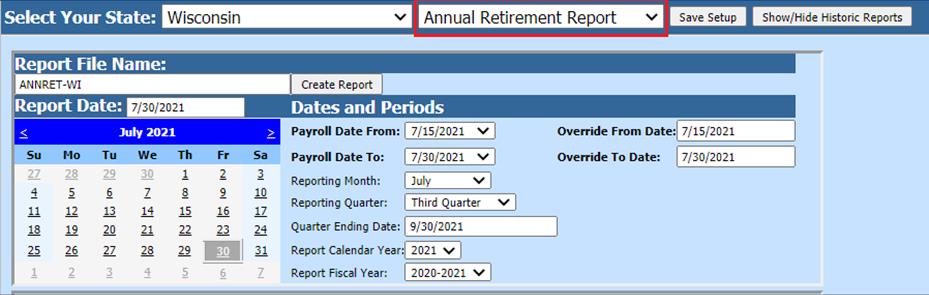

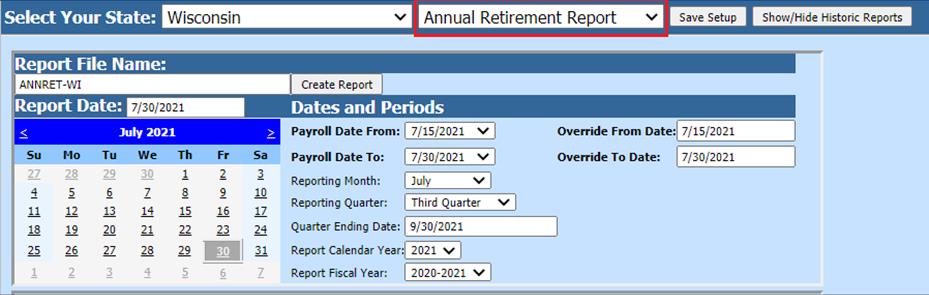

Report location

1. Select Payroll Processing

2. Select State and Federal Report

3. Select Your State: Wisconsin

4. Select Annual Retirement Report

5. Enter Dates and Periods for reporting

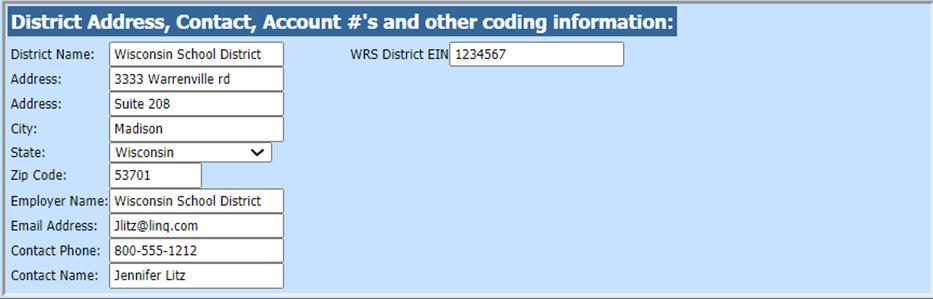

6. Verify the District Address, Contact, Account #’s and other coding information

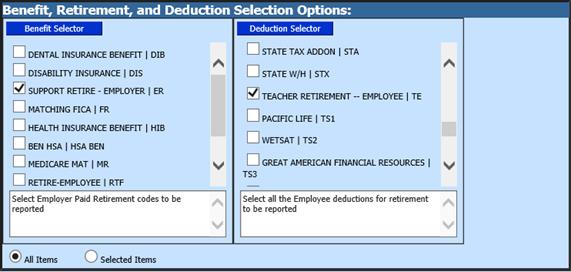

7. Select/Verify the Benefit, Retirement and Deduction Selection Options:

o Under the Retirement Selector, select the retirement code(s) used to deduct Retirement.

o Under the Deduction Selector, select the deduction code(s) used to deduct retirement

8. Save Setup

9. Select Create Report

10. A message will appear when it is complete, select Ok

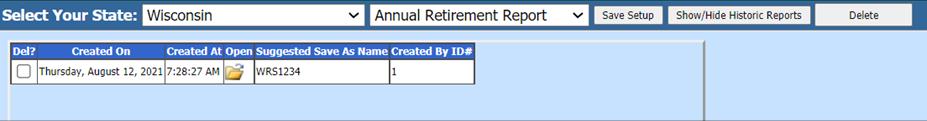

11. The file that

is created will be listed at the top of the screen when first created. When you

re-enter this area, it will be displayed under Show/Hide Historic Reports. All

files created will have a date and time stamp on them for when they were

created.

Report field name where data located Table & field

in database

Social Security

Number

Employee_Master (Social_Sec_Numb)

Employer WRS

EIN#

WRS District EIN field on initial Screen input (7 digits)

Report

Date

Report Date selected on initial Screen input

Transaction

ID

"P" - (constant)

Transaction

Type

"000" - (constant)

Action

Date

Report Date selected on initial Screen input

Last Earnings

Date

Employee_Master (Termination)

Employee Last

Name

Employee_Master (Employee_Name)

Employee First

Name

Employee_Master (Employee_Name)

Employee Middle

Init

Employee_Master (Employee_Name)

Sex

Indicator

Employee_Master (Sex)

Birthdate

Employee_Master (Birth_Date)

Fiscal Year

Hours

Time_Cards (Reg_Hrs + Ot_Hrs + Retirement_Hrs_days)

Fiscal Year

Earnings

Time_Cards (Gross_Pay)

Calendar Year

Hours

Time_Cards (Reg_Hrs + Ot_Hrs + Retirement_Hrs_days)

Calendar Year Earnings

Employee_YTD_Detail (G4 & G5 Wages)

NOTE: The

following fields come from the deductions/benefits selected from the

screen

Employee PD

Contributions

Employee_YTD_Detail (Deductions)

Employee PD Benefit

Adj

Employee_YTD_Detail (Deductions)

Additional Contributions

fixed

Employee_YTD_Detail (Deductions)

Additional Contributions

variable

Employee_YTD_Detail (Deductions)

Tax Deferred additional

fixed

Employee_YTD_Detail (Deductions)

Tax Deferred additional

variable

Employee_YTD_Detail (Deductions)

Employer PD additional

fixed

Employee_YTD_Detail (Benefits)

Employer PD additional

variable

Employee_YTD_Detail (Benefits)

Home Address

1

Employee_Master (Street_Address_One)

Home Address

2

Employee_Master (Street_Address_Two)

Home Address

City

Employee_Master (City)

Home Address

State

Employee_Master (State)

Home Address Zip

Code

Employee_Master (Zip_Code)

Date Stamp System Date

Time Stamp System

Date