Revised: 12/2022

Q: Can you clarify if everyone needs to change the code in the Special/Custom feature activation key or was that a question that another user asked....I was still connecting and missed part of that explanation

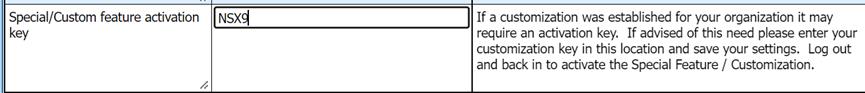

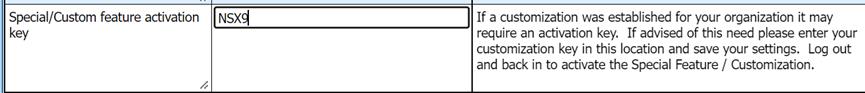

A: That custom key X9 was for Pcard vendors if you need to report those merchant vendors on a 1099 form. The X9 code needs to be added to:

Administrative utilities

SDS Web Office Settings

Product Activation

Q: What is Last Yr Calendar Year we don't have it

A: You would need to create a new view for Vendor 1099.

Select Administrative Utilities/Data View Definition

Major View Options: Other Master and Code Entry Views

Default Views: Vendor (Basic Fields)

Available Fields for View Area: Select Last Calendar Year and Last Yr 1099 Amount

Move both over with the blue arrow

Title: Save with a new Title (e.g. Vendor with 1099 fields

Save New View

Q: The IRS does not require payments made to a vendor by credit card subject to 1099. IRS 1099 instructions say "payments made with a credit card are reported on form 1099-K by the Settlement Entity and are not subject to reporting on form 1099-NEC". I'm confused why you say ccd purchases may be subject to 1099

A: That would be the 1099 Misc. form (As apposed to the NEC- Non-Employee Compensation form)

Q: What happens if the vendor has two different address one to remit and the other to mail 1099

A: You would use the vendor that you remit the 1099

Q: We import our PCard information into SDS, so instead of doing this, we would enter the information?

A: That is correct, that will help you in the future so it picks it up properly for 1099 purposes.

Q: If you move your finance month to January can you move it back to a prior month if necessary?

A: Yes, you may. You would do that under General Ledger Processing/Financial Month and Auditor Control. Please submit a case and one of our staff members will help get that done.

Q: Can 1099 vendor Y/N field be added to the Vendor Publication report?

A: That report is formatted for a specific purpose. We can help you create a report in a different way to add that field to that report. Please submit a case and one of our support staff will help you get that done.

Q: Earlier this morning you said the W-2 program was not to process 2022 W-2's yet....is the 1099 reporting ready to go now?

A: It is not ready. There should be an announcement in the next newsletter email that will let you know that the forms are now updated and ready to go.

Q: I just tried printing my 1099's and the print is does not print on the forms correctly and I chose the Scale in printer preferences as Default

A: I understand you purchased the pre-printed forms. Please submit a case and one of our staff will get you in touch with someone to help align those forms for you.

Q: Does SDS print on preprinted 1096's

A: You can order a 1096 form and you will need to fill it out if your district mails the forms in. If you send the forms in electronically that form and the totals are included in the Header/Footer of the file.

Q: Did you cover how to submit the 1099 form electronically? Can you send us the link for the website?

A: Please follow the link below to IRS Website for instruction on filing 1099’s electronically through the IRIS System:

https://www.irs.gov/filing/e-file-forms-1099-with-iris

Q: Where do you find the report that will indicate a Y for 1099 for each vendor?

A: You can create a Vendor report (Quick report) to bring in this field, please submit a support case and out support staff will be happy to assist in building this report.

Q: Do the forms take long to get from SDS?

A: The sooner you get them ordered the sooner you will get them. It depends on the volume of forms being processed.