ACA Q&A 2022

Q: Should we have employees verify their info and update dependents via the Employee Portal before we do any of this?

A: Yes, we recommend doing that.

Q: Is the SSN and Birthdate required on dependents?

A: The IRS prefers the SSN for dependents but will also accept the birthdate. You must have at least one of those pieces of information the form per dependent.

Q: Can we print the forms double-sided with the instructions on the back to save paper?

A: No. Do not print double sided unless you get permission from the IRS.

Q: I am a brand-new payroll -- how do I obtain that number you mentioned that I will need to file electronically

A: You will need to apply for the ACA TCC number with government.

Q: Is the ACA TCC number assigned to “users” who submit the file, or assigned to the business?

A: User specific

Q: On page 5 of the manual, it talks about Single Monthly Cost. Let's say we offer the choice of HMO coverage for $100 per employee and PPO coverage for $200 per employee. Do we put $100 in all the Single monthly cost boxes? What about for family coverage?

A: The employee share of the monthly cost for the lowest-cost, self-only, minimum essential coverage providing minimum value that is offered to the employee. The amount that goes into line 15 on the 1095C form may not necessarily be the amount that the employee contributes. Contact your health insurance company if you have further questions.

Q: Our insurance coverage changed from one provider to another, and our single monthly premium changed. Will everyone who has coverage over that period need to have the single monthly rate filled in per month and nobody will be "all 12 months"?

A: That is correct. Rule of Thumb is that when nothing changes in Offer of Coverage, Single Monthly Cost, Safe Harbor then you would use the All 12 month column. If any one of those change, then you must leave All 12 columns blank and fill in January through December. When filling in individual months, ALL months must have codes entered.

Q: When are these forms due to the IRS and to the employee?

A: Please refer to the IRS for due dates

Q: Do you have to have your Employee ACA data updated to do a test file?

A: No. As of this recording, Dec 15th, 2022 we are still waiting for a software ID from the IRS so files will not be accepted yet. Once we get the software ID we will send out an email to our users indicating that you are able to upload files.

@Kathy, no

Q: Do you have any tips on printing forms?

A: If you enrolled in the course, make sure to watch the ACA course’s video as that is covered extensively. Some key things to remember is that for those who are mailing forms to the IRS, our forms were approved to print on plain paper. However, there are some requirements on your end. Those requirements are:

•Make sure to print forms at Actual size. Any scaling should be turned off.

•Print all pages, unless told by the IRS

•Do not double-side print unless told by IRS.

Q: Can I print a 1094 from the program?

A: We do not have a printable 1094 form so if you are mailing in your forms, get the 2022 1094 (B or C, depending on which form you are sending) from the IRS.gov website and fill it in appropriately. Any questions on how to fill that in, refer to your team that is familiar with your unique situation. The verification report “ACA Employee Data Review” summary page may be useful in filling out the monthly numbers. If you are sending the file electronically, then the 1094 information is included in the file.

Q: I can’t get an amount to print on the form for offer of coverage 1A, even though I have it entered. What am I doing wrong?

A: Nothing! The employee share amount for code 1A is not supposed to print. See the instructions for line 15, on the form. You will notice that 1A is not included in the list of codes requiring an employee share amount.

Q. Can the ACA Current Status field be blank, if an employee isn’t to get a form?

A. Yes, you can leave it blank.

Q. Which employees do not get a 1095? Any one who waives insurance benefits?

A. That is a question for your “team”, auditor/accountant/Health Insurance/IRS.

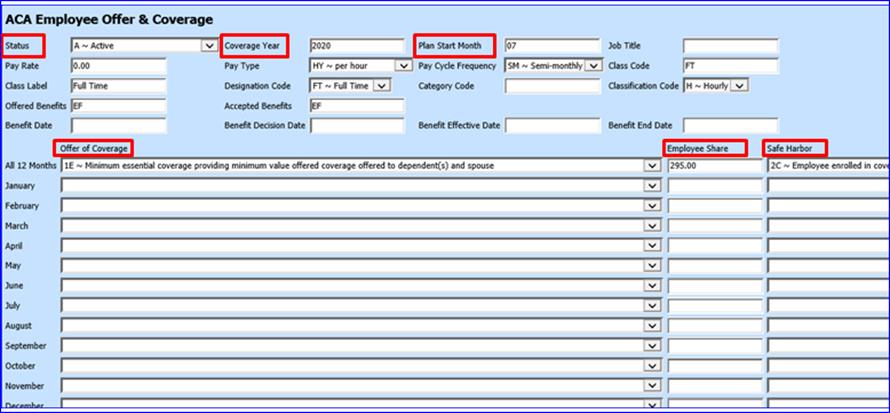

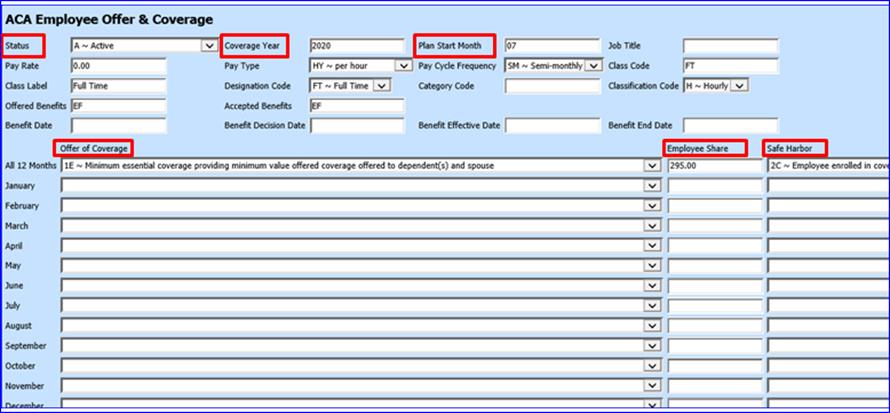

In the ACA Employee & Offer View, which fields are necessary for 1095 reporting?

A. The only fields that need to be populated in this view, for ACA reporting are 6 fields as follows:

1. Status

2. Coverage Year

3. Plan Start Date

4. Offer of Coverage

5. Employee Share (if applicable to the code in Offer of Coverage)

6. Safe Harbor

Note: If you have other fields, i.e. Pay Rate, filled in from other areas of the program, that is fine but the ACA production process doesn’t use those other fields for anything.

Figure 4 The 6 fields above, are the required fields, in Employee Offer & Coverage.

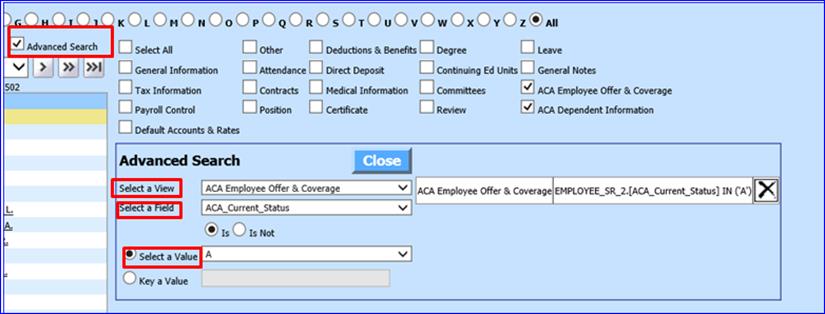

Q. In the Add, Change View, is there a way to show only employees that are active and will be getting a 1095 form?

A. Yes. When in the Add, change area, put a check in the “Advanced Search” box. Choose the ACA Employee Offer & Coverage view. Choose the ACA Current Status. Select all of the values that you are using for active employees.

Figure 5 If you have multiple codes in the ACA Current Status, choose each code that represents active employees.

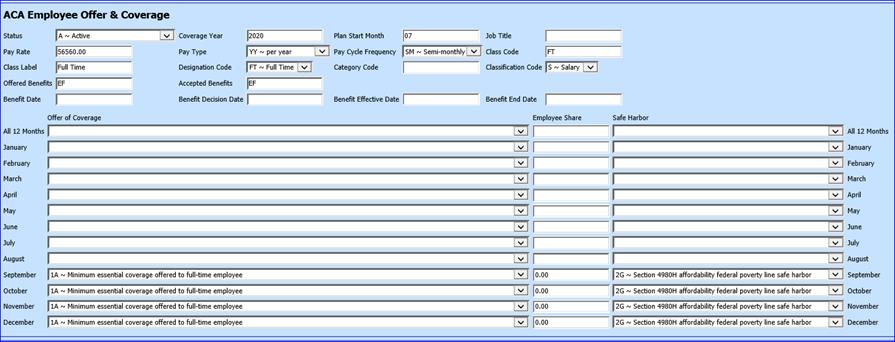

Q. If the Employee share amount didn’t change all year, do I use the All 12 months?

A. Possibly. IF Employee’s offer of coverage AND Employee Share AND Safe Harbor didn’t change all 12 months then you can use the three “All 12” fields. Basically if nothing changed for the entire calendar year, then you can use the three All 12 fields. If ANY of those items changed, then you CANNOT use the All 12 fields, you must leave those blank and fill in all 12 months. Note: when you have to use the individual months you must fill in every month from January through December.

Q. If an employee was not there all 12 months, do I still have to fill in all 12 months in the Offer & Coverage area?

A. YES, when using the individual months every month must be filled in! Check with your “team” as to what codes to use for the months that an employee was not at your district. Common coding is Offer of Coverage 1H for “Not offered coverage” or Safe harbor 2A “not employed during the month” but confirm the proper coding to be used in each unique situation. Blanks will fail the error checker

Figure 6 This will fail the IRS error checker. You must fill in January through December. Check with your team if you are not sure of the codes to use.