Revision: 5/2023

A Partial Accrual is the result of SOME, but not all, payroll expenses needing to be expensed into the current Fiscal Year (FY23). For example – If your retirement expenses are budgeted to FY23, but your salaries, health insurance, dental insurance, vision insurance and all other payroll expenses for the July and August Teacher Payrolls are budgeted to FY24, you will use the Partial Payroll Accrual method. There has been an enhancement to the payroll process to allow for this Partial Accrual method to be done through payroll. No more manual Journal Entries are necessary unless you have a special circumstance.

Setting up Your System to Allow for Partial Accrual Process

This is a one-time setup. You need to update your Web Office Settings to turn on the Partial Accrual option.

1. Select Administrative Utilities

2. Select SDS Web Office Settings

3. Select the Payroll tab

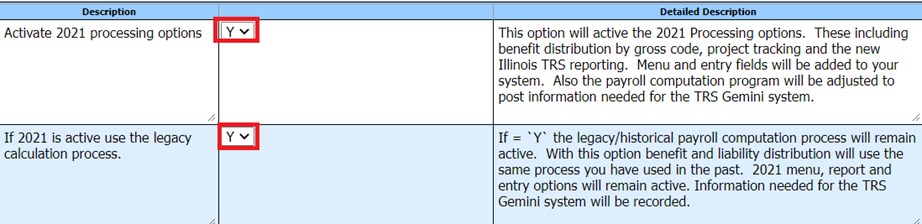

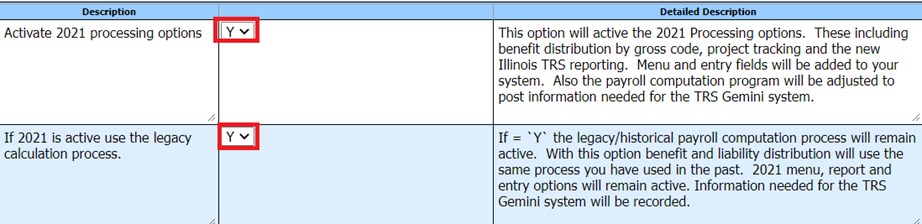

4. Locate “Activate 2021 processing options” and change the setting to Y.

5. Locate “If 2021 is active use the legacy calculation process” and change the setting to Y.

6. Select Save Changes

7. Log out of your system

8. Log back in to your system

Setting up the Payroll Expense Accrual Account

This is a one-time setup. If you have used an accrual process previously, this step should already be completed.

Create a Balance Sheet Account for Accrual Use

Setup a Balance Sheet Accrual Account for each fund used for the accrual payroll.

1. Select Master File and Code Entry Options

2. Select Master File Vertical Data Entry and Changes

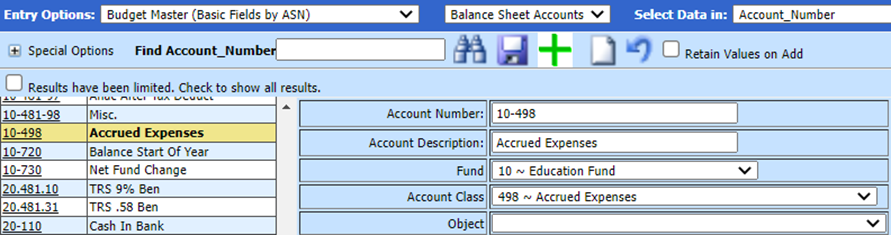

3. Entry Options: Budget Master (Basic Fields by ASN)

4. Select the Balance Sheet Accounts

5. Select the Green + sign

6. Enter the account number, description, fund and account class (if you are unsure about the account class, please contact your auditor)

7. Select Save

See below link for more information on Budget Master Account creation:

https://help.schooloffice.com/financehelp/#!Documents/budgetmasterbasicfieldsbyasn.htm

Add Accrual Account to the Ledger Interface

After creating the balance sheet accounts, add them to the corresponding fund(s) record in the Ledger Interface.

1. Master File Vertical Data Entry and Changes

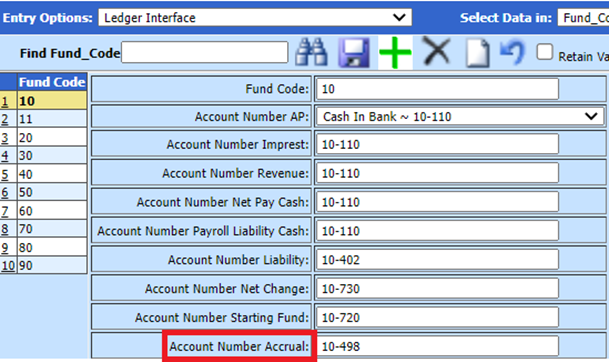

2. Entry Options: Select Ledger Interface

3. For each fund being used, key the accrual number in the “Account Number Accrual” field:

4. Select Save

See below link for more information on Ledger Interface:

https://help.schooloffice.com/financehelp/#!Documents/ledgerinterface1.htm

Setting up Benefits for Partial Accrual

This is a one-time setup. This is the first year for implementing this setup, therefore, it must be done to allow for these benefits to be accrued with this method.

1. Select Human Resources

2. Select Human Resources Control Center

3. Select Deductions & Benefits Master

4. Locate the benefit codes necessary for accrual

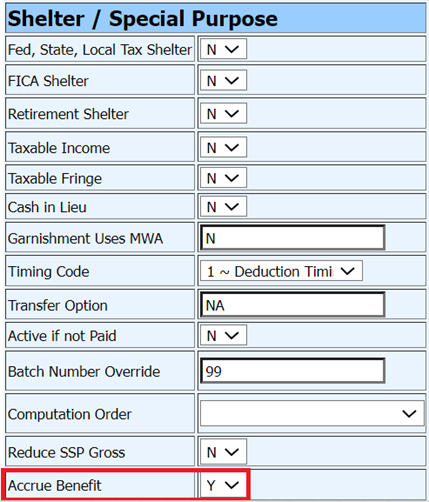

5. Locate the “Accrue Benefit” field and set it to “Y”

6. Select Save

Processing the July & August Payrolls

•Process and complete your June 2023 payrolls

•When done with the June payrolls, we recommend that you print out the Open Contract Report, located in the General Accounting Reports/Employee Master and Attendance Group, in case your auditors want that information.

•July and August payrolls will be processed one at a time.

1. Complete the entire payroll process (Enter, compute, and verify the payroll)

2. Create your checks, direct deposit vouchers, and create the direct deposit file.

3. Select Close / Make Active Payroll Permanent

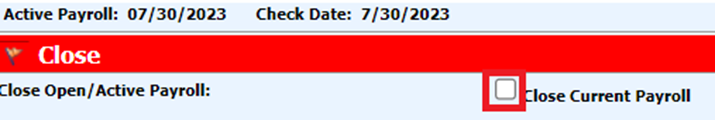

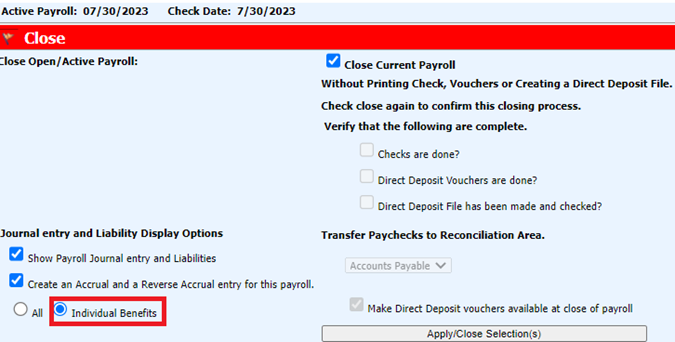

4. Select “Close Current Payroll”

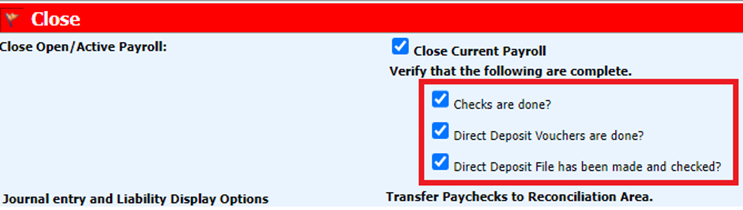

5. Verify that checks are done, Direct Depost Vouchers are done, and the Direct Deposit File has been made and checked.

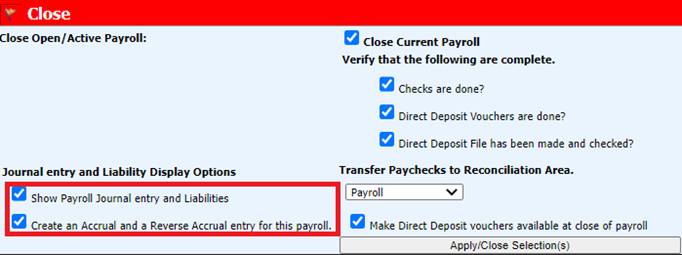

6. Select “Create an Accrual and a Reverse Accrual entry for this payroll”

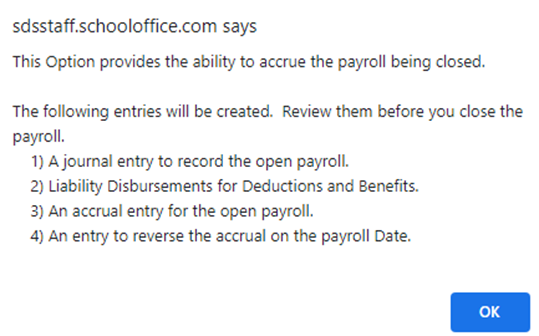

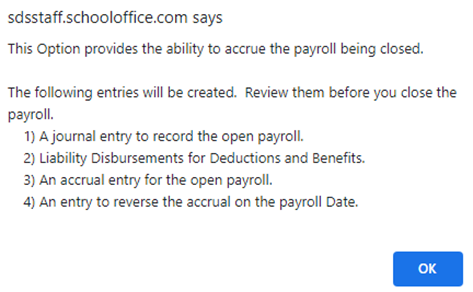

7. A message will appear. Select OK.

8. Select “Individual Benefits”

9. The same message will appear again. Select OK.

10. June 30, 2023 will be the default accrual date on the calendar. That accrual date can be used for each payroll.

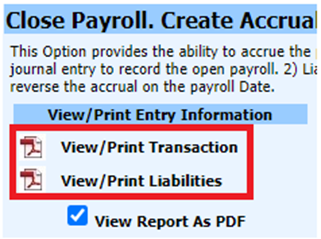

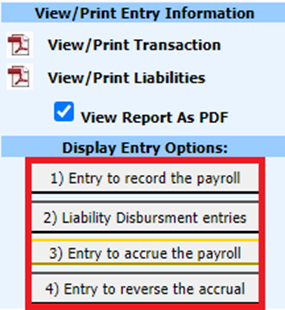

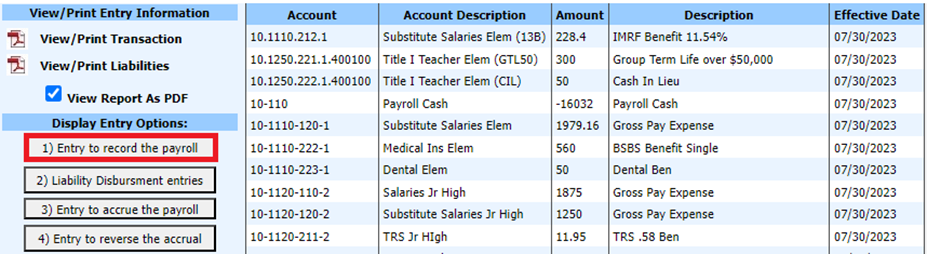

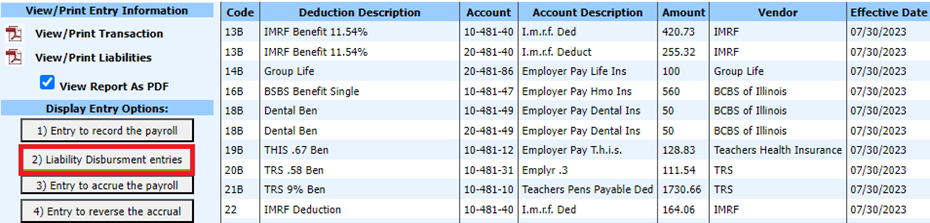

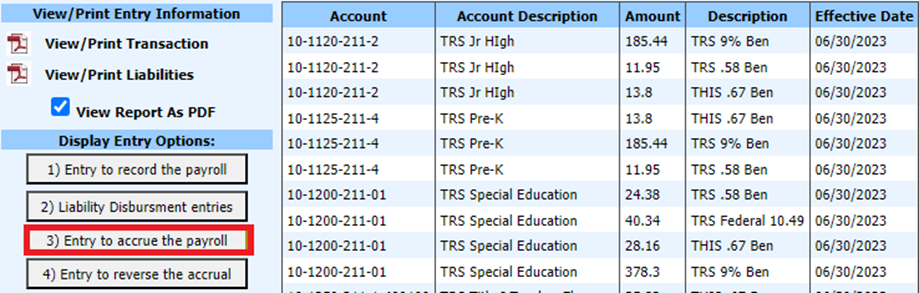

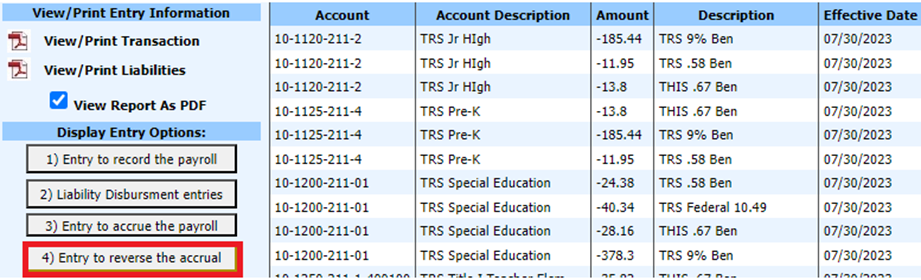

o The “View/Print Transaction” and “View/Print Liabilities” will produce the Payroll Transaction report and the Payroll Liability report for the payroll date.

o When selected, the options in the Display Entry Options section will show the journal entries for each selection or the liability disbursement entries.

o These are demonstrated in the following screen shots:

Entry to Record the Payroll – Shows the journal entry that will post for the payroll date in the “Effective Date” column. This will post the expenses and liabilities.

Liability Disbursement Entries – This is a list of the liabilities for the payroll date in the “Effective Date” column.

Entry to Accrue the Payroll – This is the journal entry that will post to June to accrue these individual benefits. This entry will debit (+) the expense accounts and credit

(-) the Accrual Account that was set up.

Entry to reverse the accrual – This is the entry that will post for the payroll in the “Effective Date” column to reverse the expenses from “Entry to record the payroll” transaction. This entry will credit (-) the expenses and debit (+) the accrual account so that it nets to zero.

11. Select

12. Select OK to the message

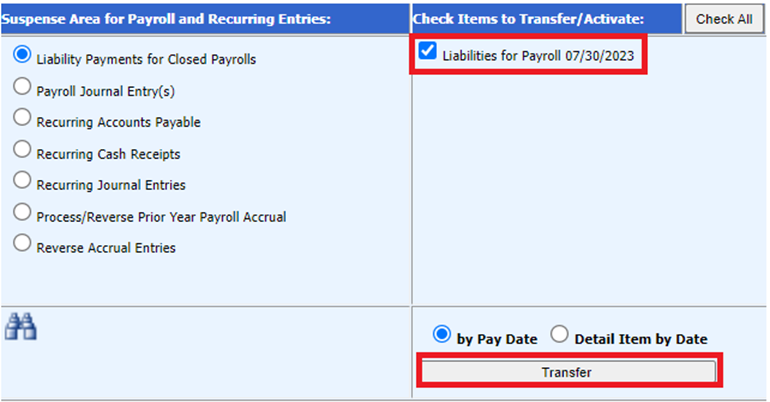

13. Go to General Ledger Processing on the Main Menu

14. Select Transfer Payroll Data and Recurring Entries

15. Select Liability for Closed Payrolls

16. Select Transfer

17. Select OK to the message

18. Select OK to the next message.

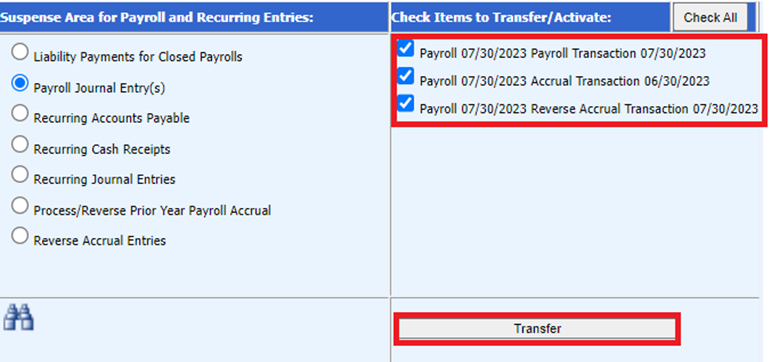

19. Select Payroll Journal Entry(s)

20. Select each of the Payroll Journal Entries. There will be 3 journal entries to transfer.

a. The Accrual

b. The Reverse Accrual

c. The Payroll Transaction for the payroll date

21. Select Transfer

22. Select OK to the message

23. Select OK to the message.

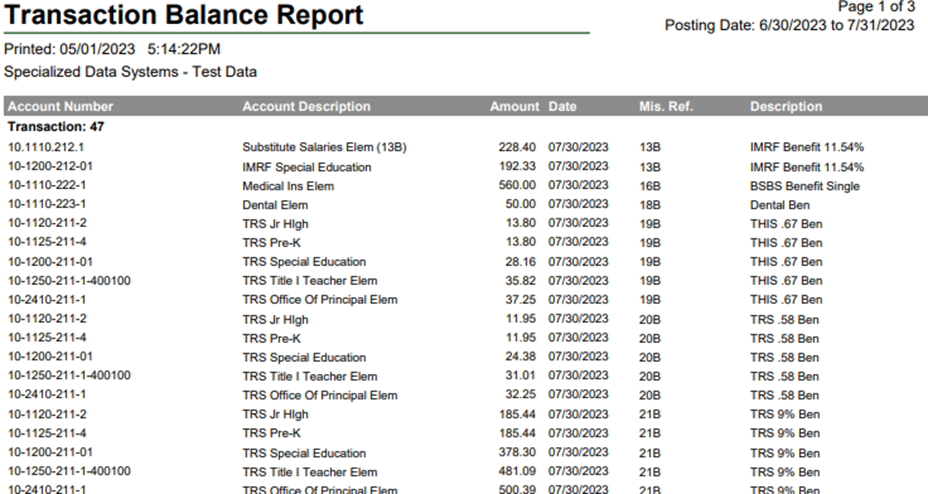

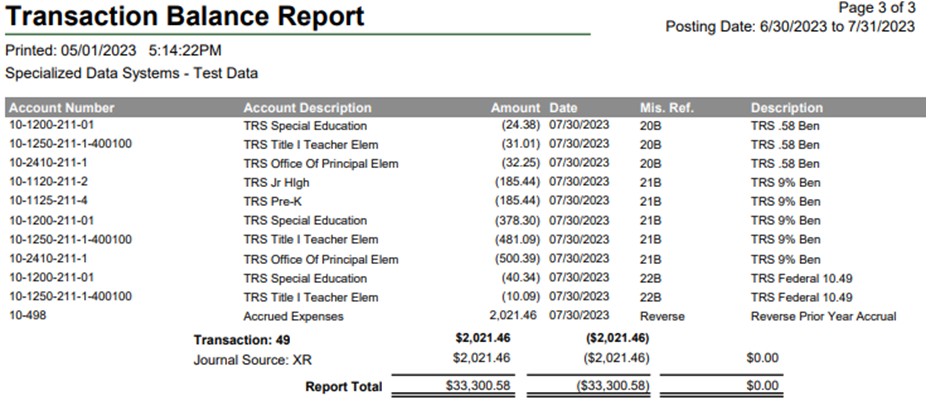

24. Run a Transaction Balance report for the 3 transactions.

a. Select Reports

b. Select General Accounting Reports

c. Select Finance Activity Reports

d. Select Transaction Balance Report

e. Set the calendar date to include the accrual date and the payroll date

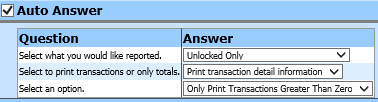

f. Set the Auto Answer questions to the below settings:

g. Preview/Print the report (if other transactions show on the report, make them permanent, so that you will only see the payroll and accrual you are processing. Go to the report area and print the report.)

25. Make the Payroll and Accrual Transactions Permanent

a. Select General Ledger Processing and Entry Options

b. Select Make New Transactions Permanent

c. Select 6/2023

d. Select the transaction

e. Select Post Selected Ledger

f. Select 7/2023 (or 8/2023) and repeat the process

Partial Payroll Accrual Processing has been completed. Important: You will then process your payroll liability checks as usual.