Click on the video below for a walk-through on ordering W2’s and/or 1099 forms.

Do you need to order End of Year forms, i.e. w2’s and 1099’s, envelopes?

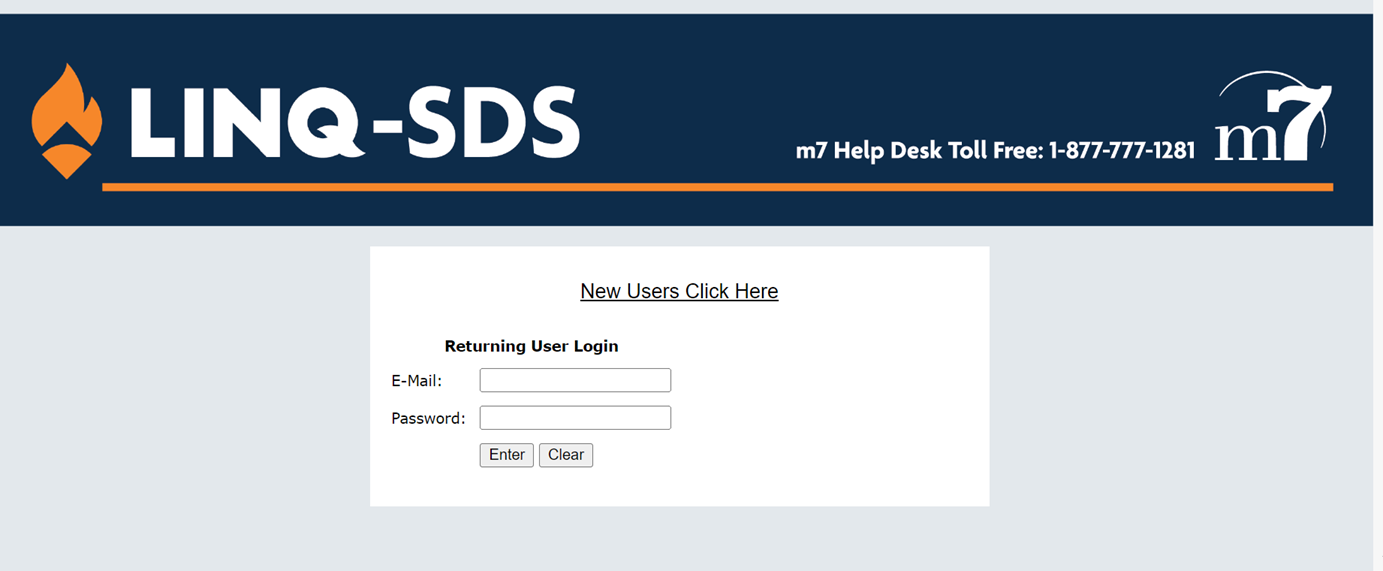

Link to our Forms Vendor site: Online Ordering Login (m7businesssystems.com)

•First time Users will click “New Users Click Here” to create an account.

•Already have an account? Go to Returning User Login and enter login credentials.

•This site has images of each product that you can click on, for more information.

•Forms ordered for tax year 2022 and prior is not stored on this site but any order, going forward, will be kept in history on the site.

•Print on plain paper or order perforated forms from SDS.

•Direct Link: Online Ordering Login (m7businesssystems.com)

•Note: Must order Red forms

Do I need to run W2’s before running the first PR in 2022?

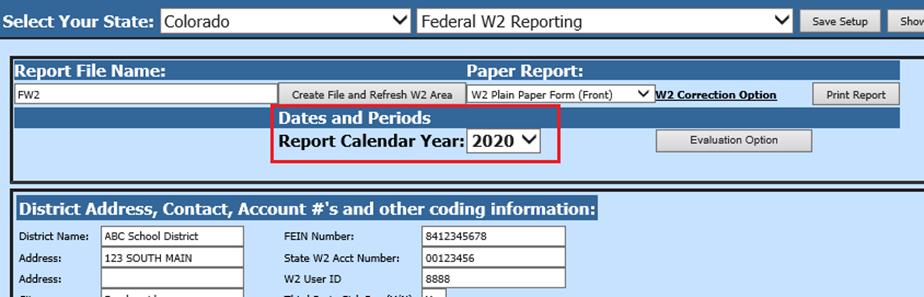

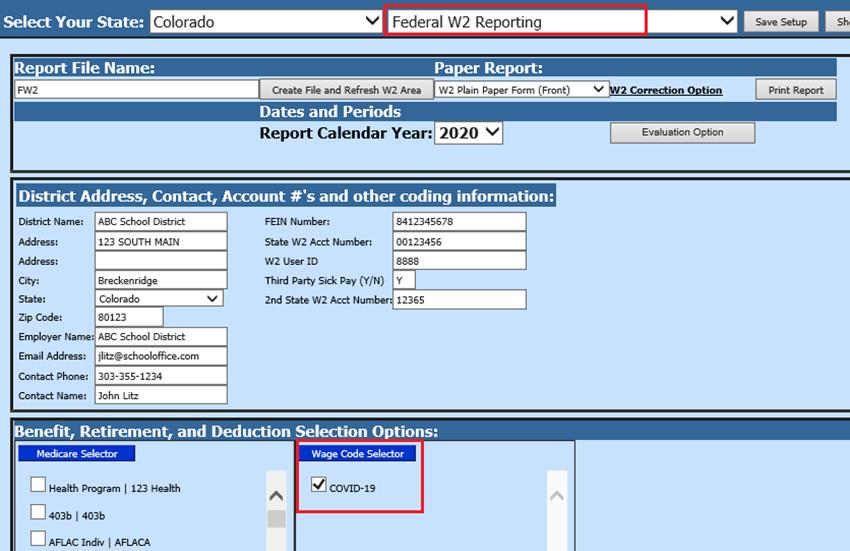

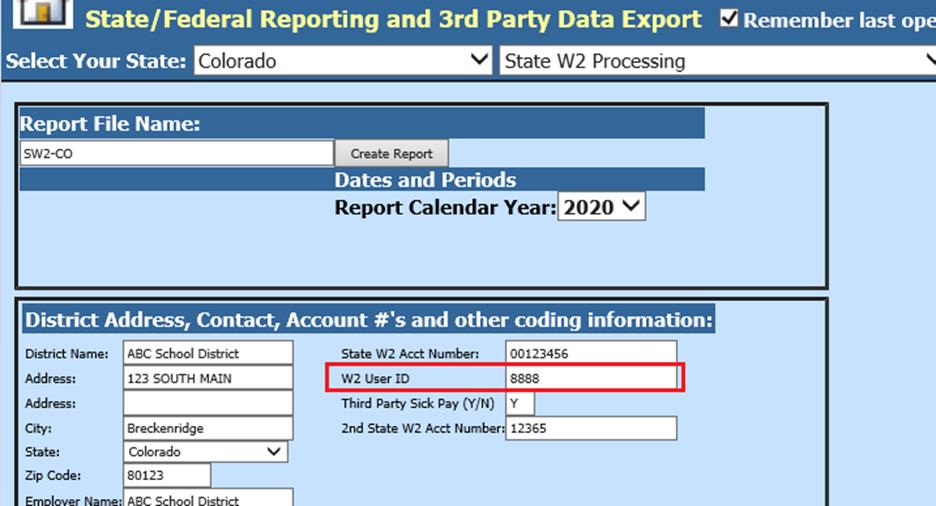

•No. When in Payroll Processing, State/Federal Reporting, Federal & State W2 Reporting: You will be selecting the Report Calendar Year 2020, upon printing W2 forms.

What codes are to be used in Box 12 & Box 14?

•See IRS instructions page 19 for Box 12 & page 22 for Box 14 definitions: https://www.irs.gov/pub/irs-pdf/iw2w3.pdf

•If unsure what code to use, talk with auditor, accountant or IRS to determine it.

•Box 14 allows up to a 6 characters, to be used

•Box 14 displays up to 4 codes

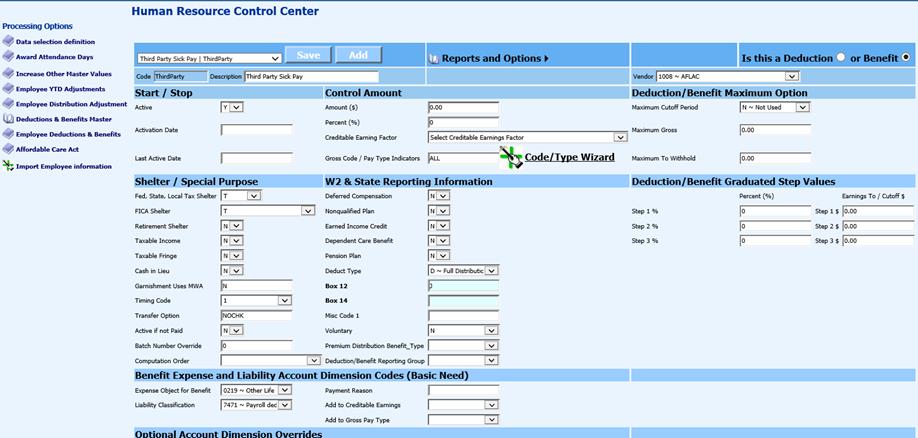

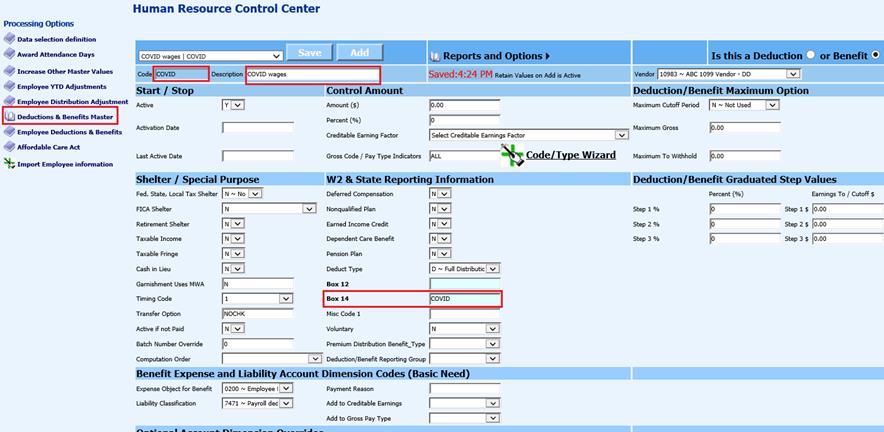

•Update Deduction/Benefit Master with correct codes determined by you following IRS instructions or auditor assistance:

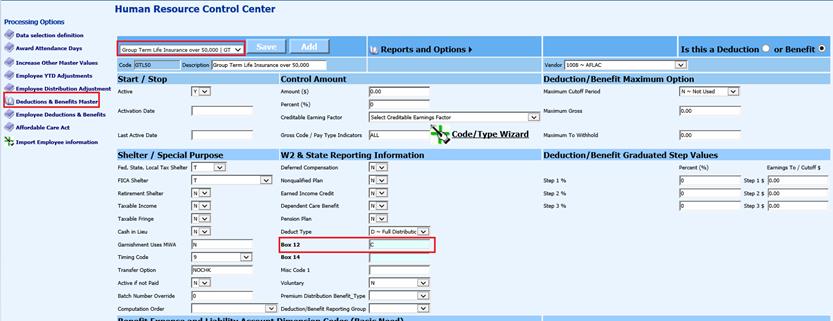

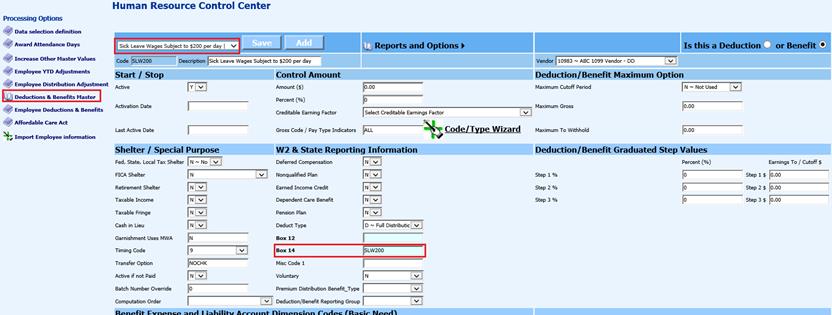

o From Human Resources Control Center: Select Deductions & Benefits Master, then select Deduction or Benefit code. Update Box needed, then select Save.

o Box 12 Example: GTL50, Group Term Life Insurance over $50,000 Benefit:

See link for detailed instructions for setup of Group Term Life Insurance over $50,000: http://help.schooloffice.com/financehelp/#!Documents/2021costofgrouptermlifeinsuranceover500001.htm

o Box 14 Example: Sick Leave Wages Subject to $200 per day. Update with code, needed.

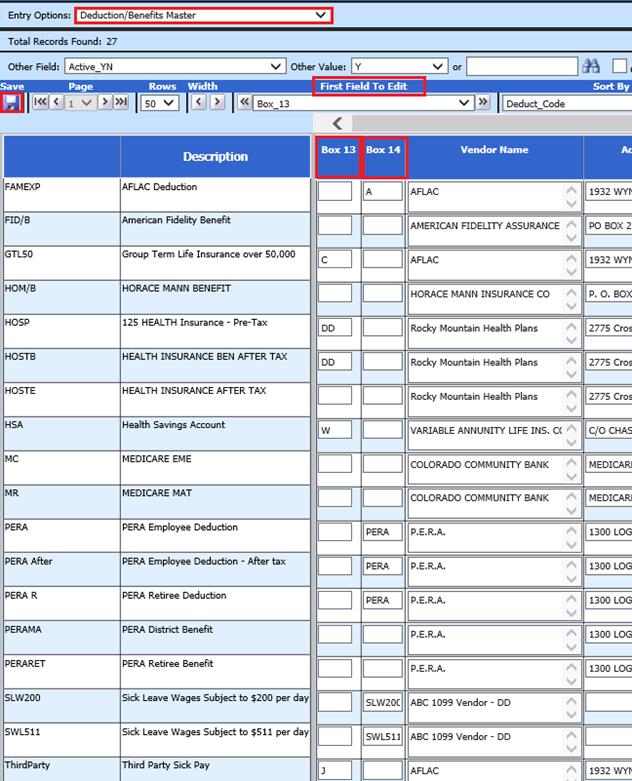

o From Master File and Code Entry Options, Master File Horizontal entry view: Select Deductions & Benefits Master, First Field to Edit, Select Box 13 (this is reported in Box 12 on W2 form). Update fields, as needed, then select save.

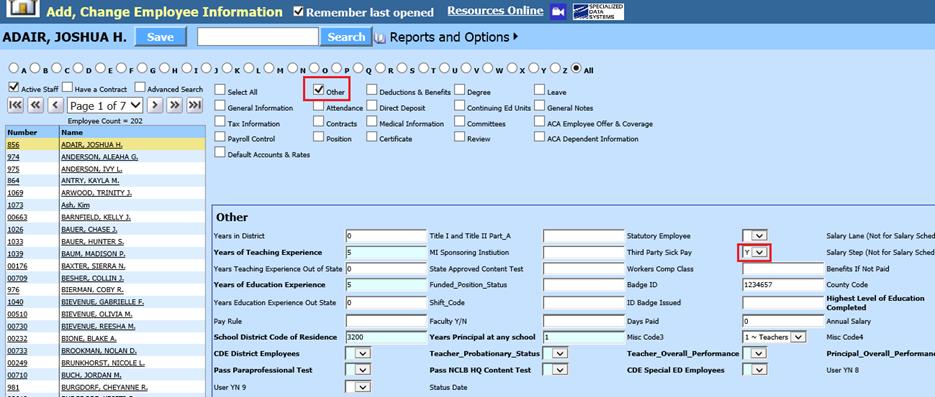

Does a new Benefit code need to be setup for Third Party Sick Pay?

•If you have not setup a Third Party Sick Pay Benefit code before, a new code must be setup and assigned to employees. Use Human Resources Control Center, Deductions & Benefits Master to add this new benefit code:

See link for detailed instructions setting up a new benefit: http://help.schooloffice.com/financehelp/#!Documents/humanresourcescontrolcenterdeductionsbenefitsmaster1.htm

•Assign Code to employee, then place a check mark in Add, Change Employee Information, under Other in “Third Party Sick”

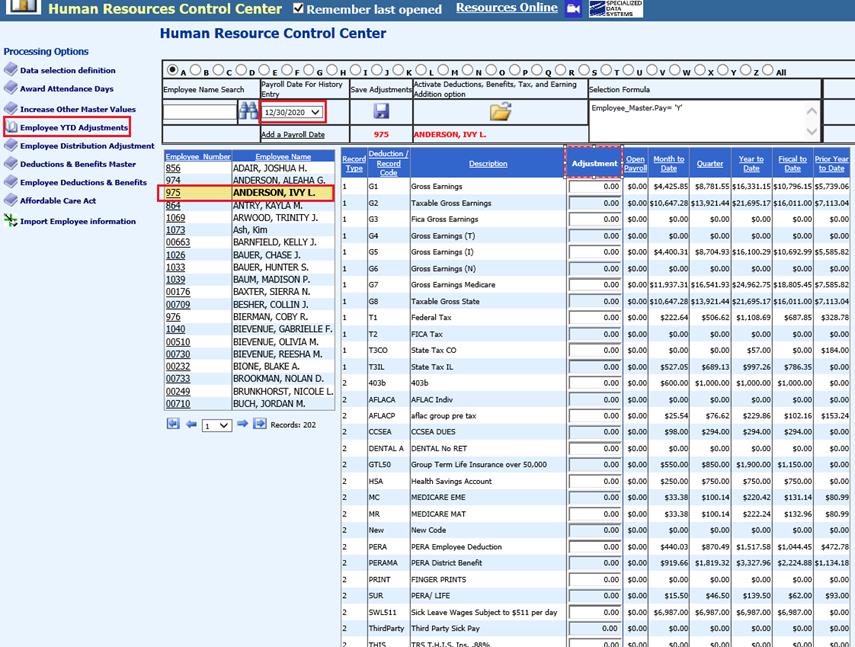

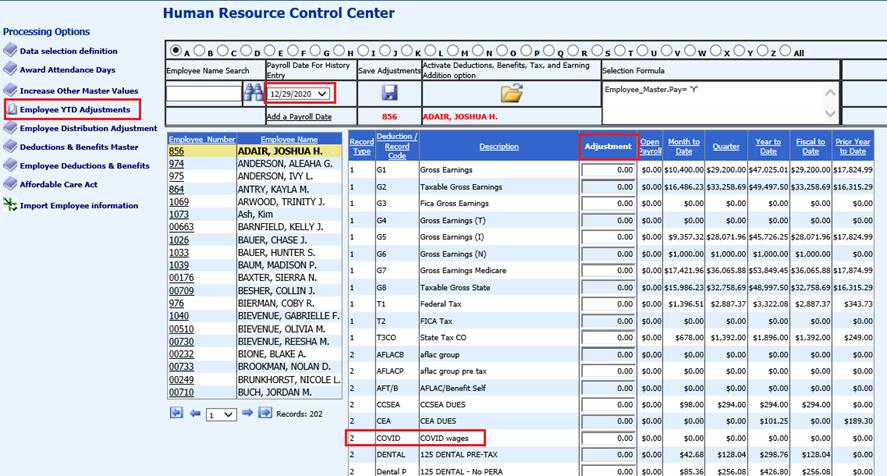

•If not processing through final 2020 payroll, under Human Resources Control Center, Employee YTD Adjustments, make sure to complete all fields needed.

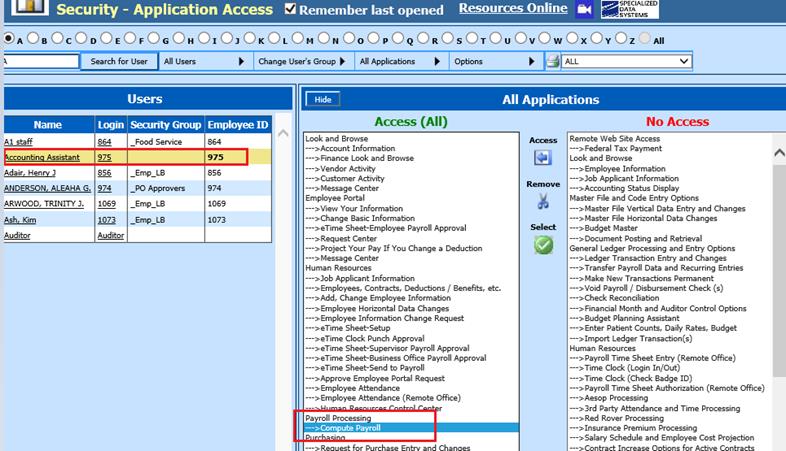

How do I receive access to Employee YTD Adjustments entry view?

•Must have access to Compute Payroll in security restrictions

o Security – Application Access, verify user has access to Compute Payroll

Which is best sending out W2’s to staff, Email or Employee Portal:

You can determine which way is best for your school and employees.

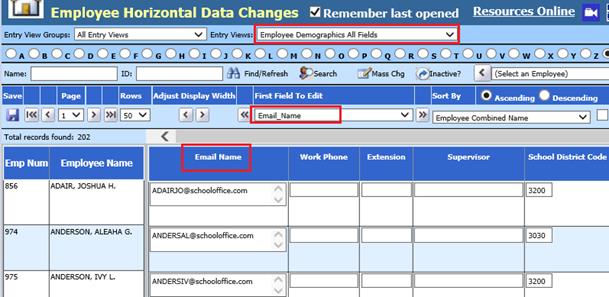

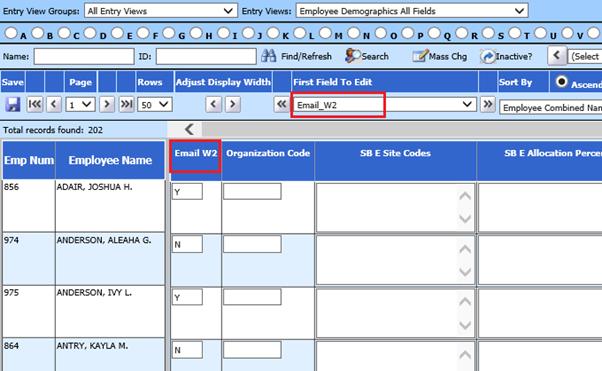

•Verify Employee email is completed to send email communication to staff. In Employee Horizontal, Employee Demographics All Fields entry view, verify email address and Email W2 field are completed, as needed.

Email Name field:

Email W2 field:

•Note: Once email has been sent, no retracting the W2 email if changes are required.

Employee Portal

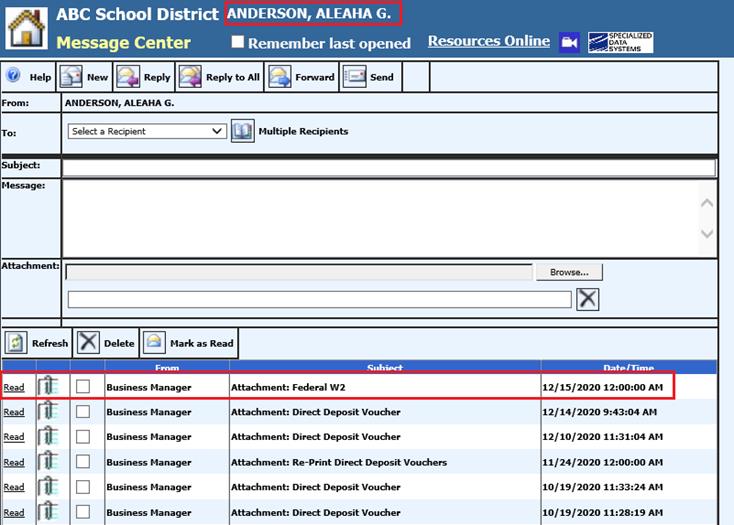

•Employees login to secure SDS site, using their employee ID or email address to view W2 in the Employee Portal Message Center

•Note: Once sent to employee portal message center, can be retracted if changes are required.

Where do the COVID-19 wages come from? I do not see the Wage Code Selector, to choose from.

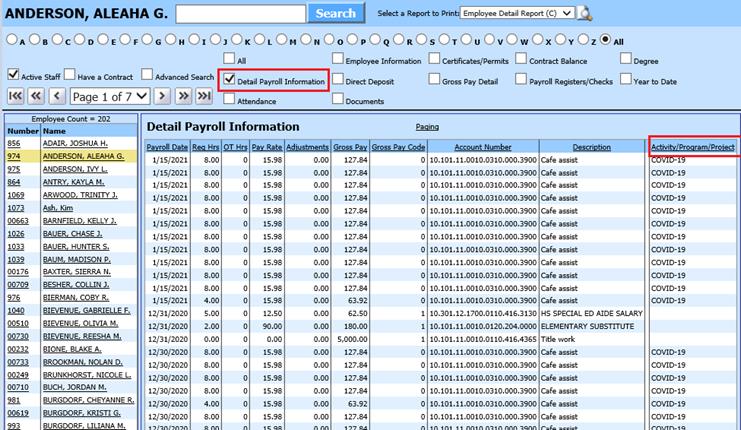

•Verify Time Card(s) have the activity code for COVID applied to a time card record. Look & Browse, Employee Information, check mark Detail Payroll Information, select “Show All” if needed to verify all time card line entries

Do we have to run COVID pay through payroll?

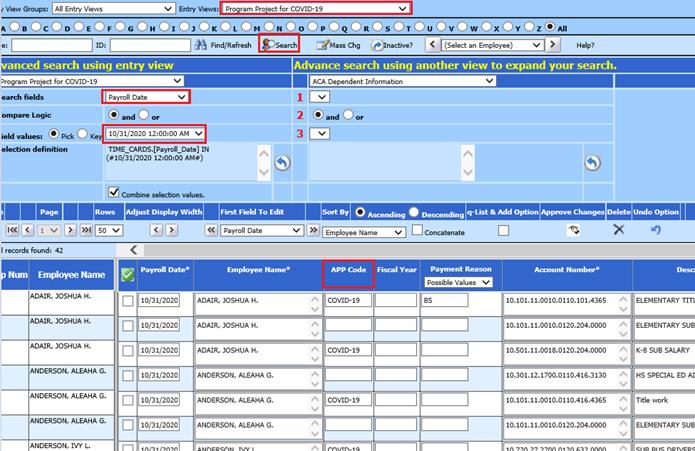

•If you did not process payroll with time card entries labeled with COVID or may have miss applied COVID wages to a time card record, update through Employee Horizontal entry view, Program Project for COVID-19, update APP code field. Use the Search option, to narrow down time card selection

Do we have to update the timecard records to produce this or can we set up a benefit code? & if COVID wages are already included in their regular wages, can we just do something to report COVID wages in Box 14?

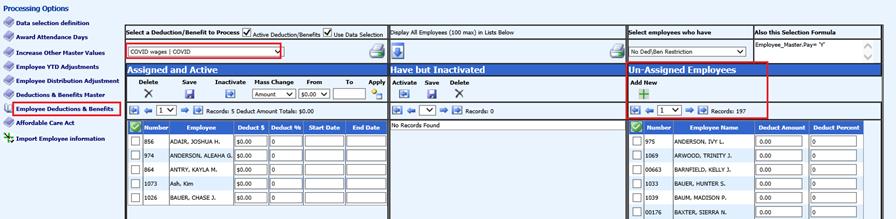

•No, you can set up a Benefit code and adjust Employee YTD amounts as needed:

•Under Employee Deductions & Benefits, assign benefit code to employee (s)

•Under Employee YTD Adjustments, select payroll date and update all fields needed.

Is the W2 User ID the same every year?

•Contact Business Services Online, to verify this code: https://www.ssa.gov/bso/bsowelcome.htm

Plain Paper requirements from IRS and Printing Notes:

•When printing W2’s on plain paper, the IRS has requirements that must be met to use this option (refer to publication 1141 section 2.4). This publication can be found on https://www.irs.gov/pub/irs-pdf/p1141.pdf. If you are unsure about meeting these requirements or have any questions on printing W2’s on plain paper, it is strongly suggested that you contact the IRS directly.

•When printing with Adobe: Verify settings are printing with Actual Size. Any settings with “Scaling” will reduce the font and not print correctly or fit into envelopes.

•When printing with other options, i.e Chrome: Verify scaling settings are “Default”. Any settings outside of Default will not print correctly or fit into envelopes.

•When folding W2 forms, place the folded side in envelope first

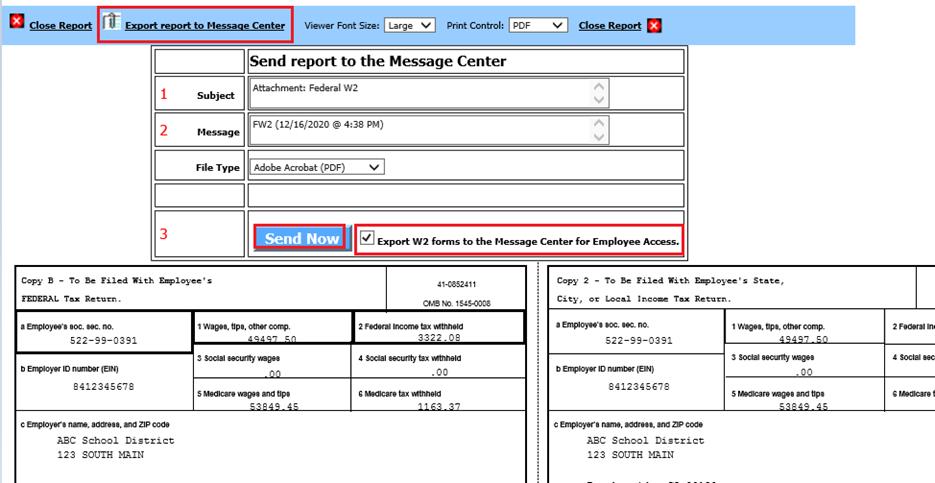

Export report to message center

Selecting this option allows W2’s to go to Portal Message Center, and prepare to email outside SDS

•After viewing W2 forms, Check mark Export W2 forms to the Message Center for Employee Access

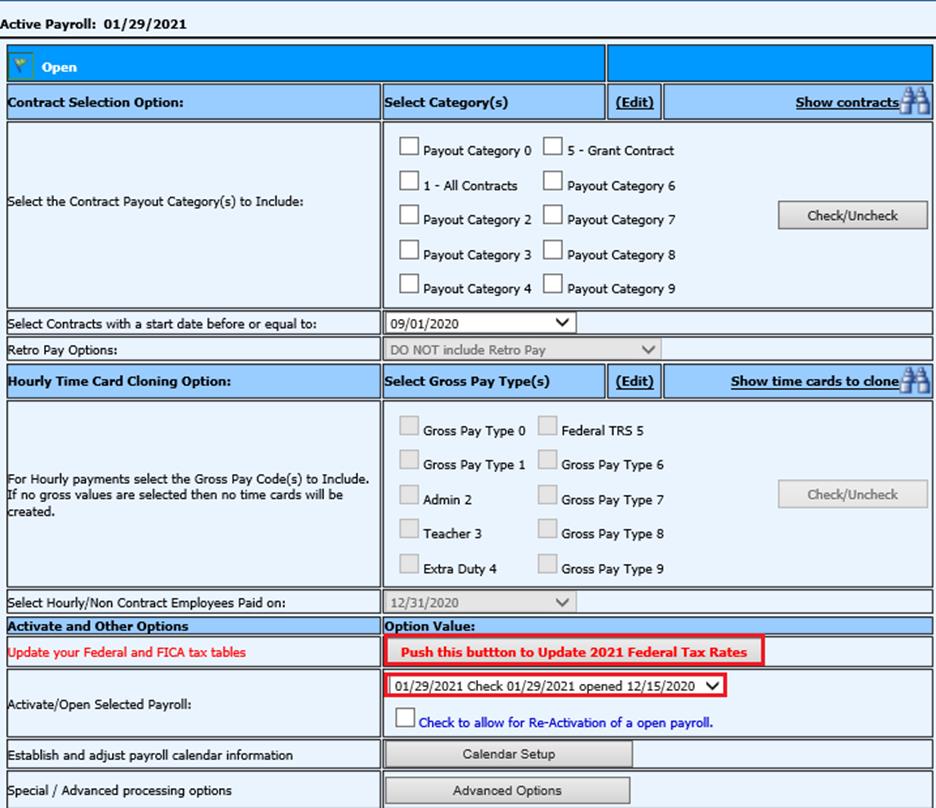

New payroll for January 2021

How do I update the tax Rates for 2021?

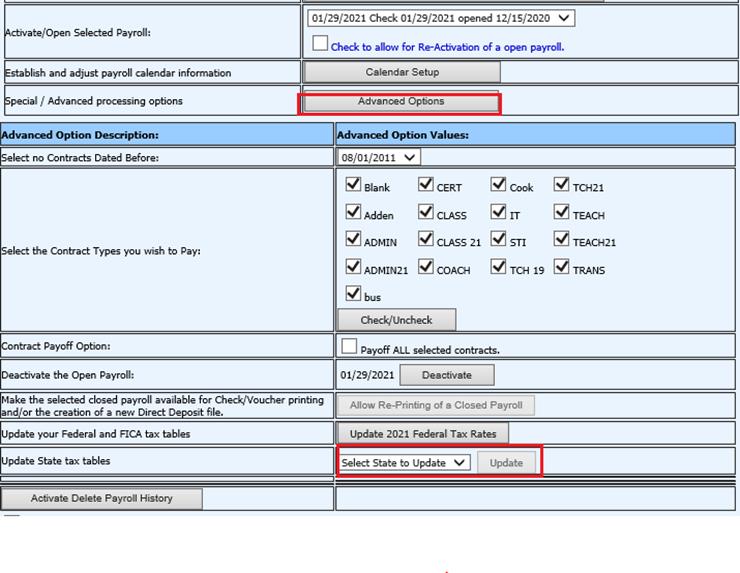

•Update 2021 Tax Rates. Setup and Activate payroll date for 2021

•Select Push this button to Update 2021 Federal Tax Rates

•Under Advanced Options, update State Tax Table (s)

Where do I verify tax rates updated for 2021 tax tables?

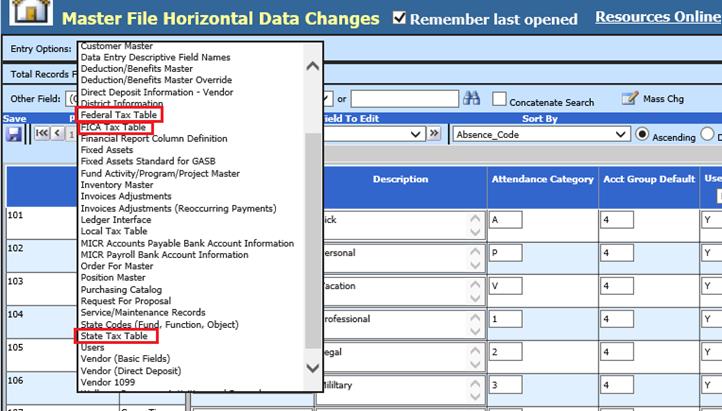

•Verify 2021 tax tables under Master File Horizontal entry view. Select Tax table needed

•The instructions to compute Federal Withholding using the percentage method can be found on pages 5 and 6, in IRS link: https://www.irs.gov/pub/irs-pdf/p15t.pdf