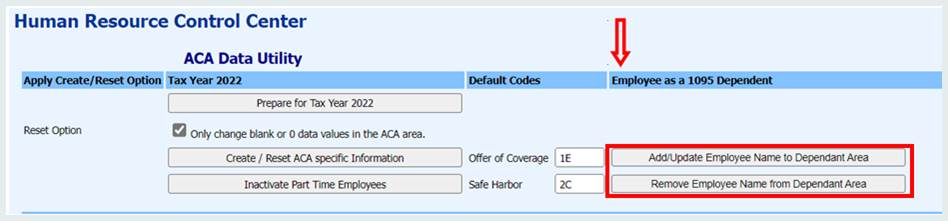

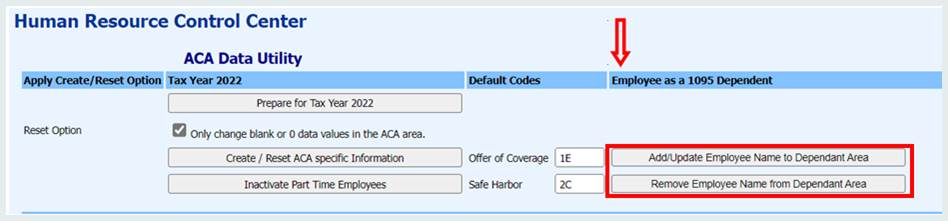

Find out if you need to have your employees’ names listed, along with other dependents, in the Covered Individuals section of the 1095 form, Part IV of Form 1095-B or Part III of Form 1095-C. The IRS may require it depending on your situation. If you have any questions concerning whether the employee should/should not be listed in the “Covered Individuals” section of the 1095 forms, please consult your auditor, accountant, or the IRS.

To add the employee’s name in the “ACA Employee Dependent View

1. Select Human Resources

2. Select Human Resources Control Center

3. Select “Affordable Care Act”

4. Select “Add/Update Employee Name to Dependent Area

To remove Employee’s name in the Employee Dependent View (This will NOT remove dependents names, only the employee’s name)

1. Select Human Resources

2. Select Human Resources Control Center

3. Select “Affordable Care Act”

4. Select “Remove Employee Name from Dependent Area”

You have the ability to add or remove an EMPLOYEE’S name from the Dependent Section of the 1095 B or C form, using the ACA Data Utility’s “Employee as a 1095 Dependent” buttons.