Revised: 3/2020

The “Benefit Only” processing

option provides the tools necessary to process fringe benefits for employees

during a normal payroll process, who are not being paid. This process must be

completed with other employee(s) receiving a Gross Pay amount during normal

payroll processing..

If this option is not used then fringe benefits like

board paid health insurance can only be expensed and added to an employee’s

records if they were being paid. This results in either expensing benefits

during a period other than the time the benefit is for or making manual entries.

Follow the below steps to process an employees benefits through payroll:

Set up employee to be available for Benefit Only processing:

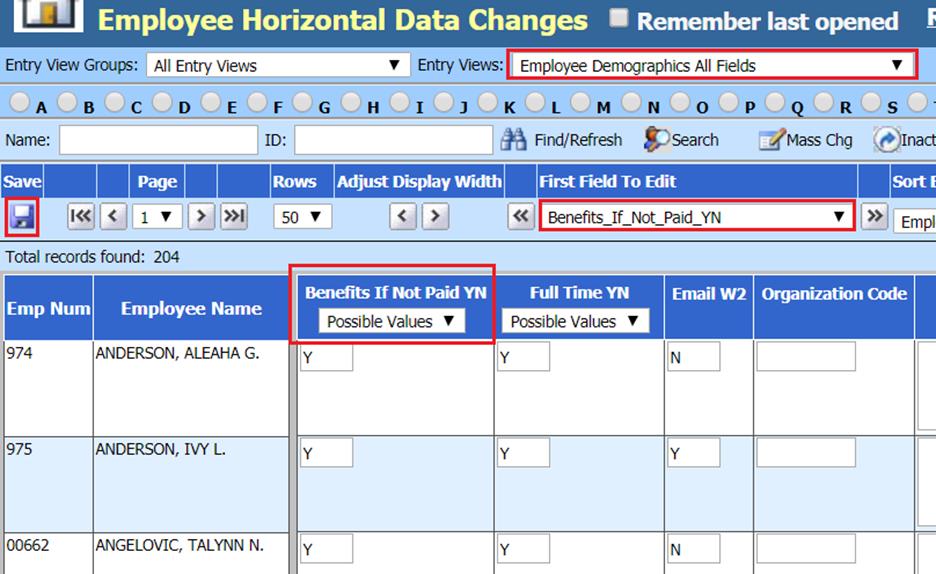

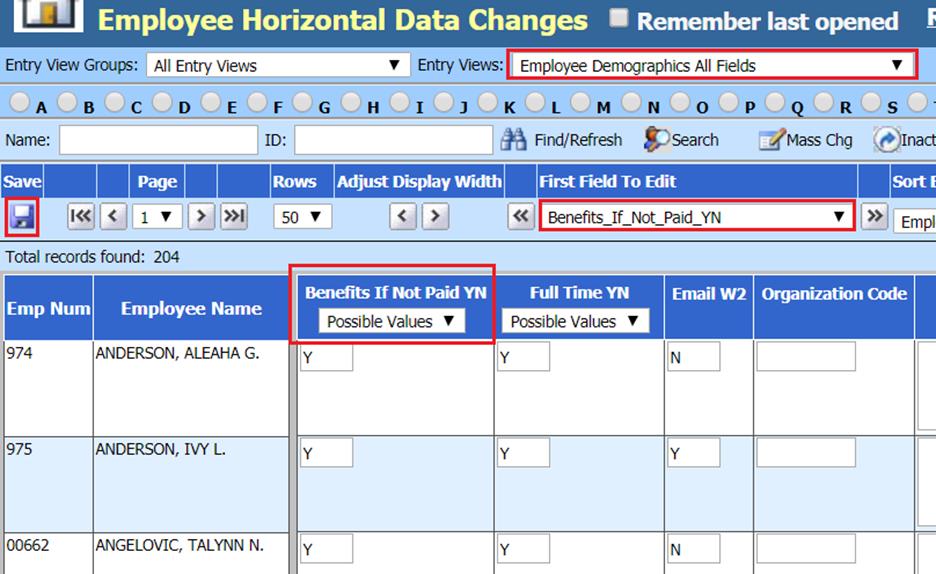

1. Select Human Resources or Payroll Processing

2. Select Employee Horizontal Data Changes

3. Entry Views: Select Employee Demographics All Fields

4. First Field to Edit: Select Benefits_if_Not_Paid_YN

a. Enter a “Y”

5. Select Save

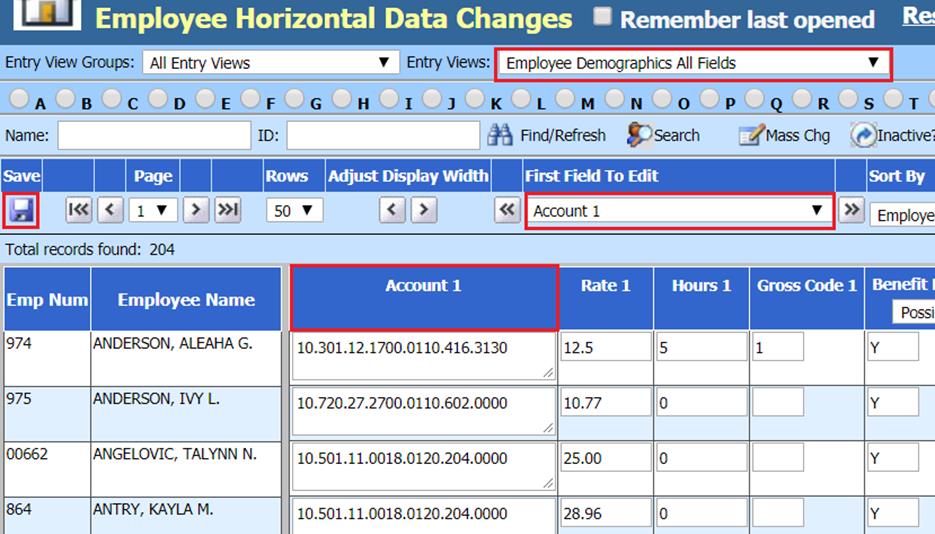

6. Change First Field to Edit to Account #1

a. Verify/update salary account number to expense benefits

7. Select Save

Set up Benefit Master for Benefit Only processing:

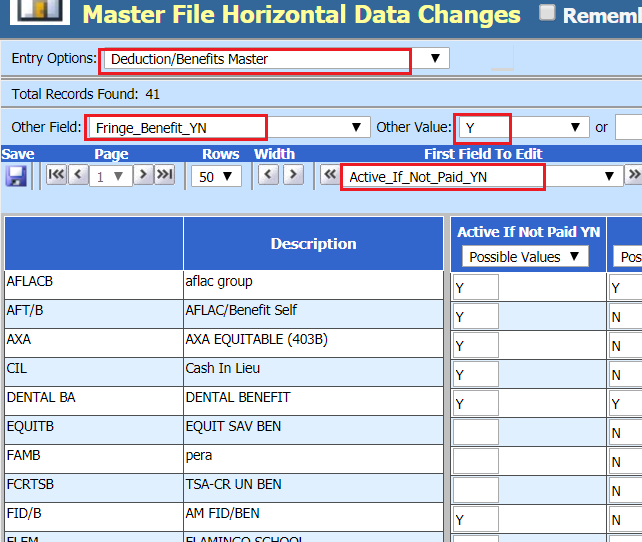

8. Select Master File and Code Entry Options

9. Select Master File Horizontal Entry View

10. Entry Options: Select Deduction/Benefit Master

11. If you wish to sort out Benefits Only codes:

a. Other Field: “Fringe Benefit YN”

b. Other Value: “Y”

12. First Field to Edit: Select Active if Not Paid YN

a. Enter a “Y”

13. Select Save

Processing Payroll with Benefits Only

14. Select Payroll Processing

15. Activate/Open a Payroll

a. Set up Payroll date and Activate/Open, as normally completed

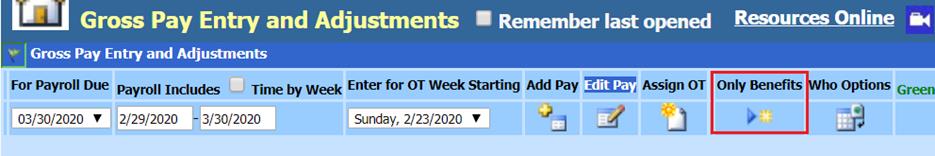

16. Select Gross Pay Entry and Adjustments

a. Select “Only Benefits”

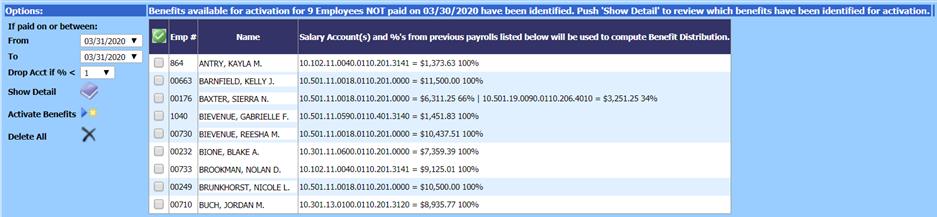

b. Verify the “For Payroll Due” date. Employees listed are employees not being paid on the selected date with a “Y” in “Benefit If Not Paid YN”.

c. Under the Options area select from and to payroll dates. To be listed an employee must have been paid on one or more payroll dates in the selected range.

d. Employees will display salary accounts the employee was paid from, the total gross by account and the percentage for each account. The percentage will be used to distribute the fringe benefit expense cost to the appropriate accounts.

e. Use the “Drop Acct if % <” option to eliminate incidental payments which should be ignored when creating the benefit distribution information. Default value will drop less than 1% values. Example is set to drop less than 10%.

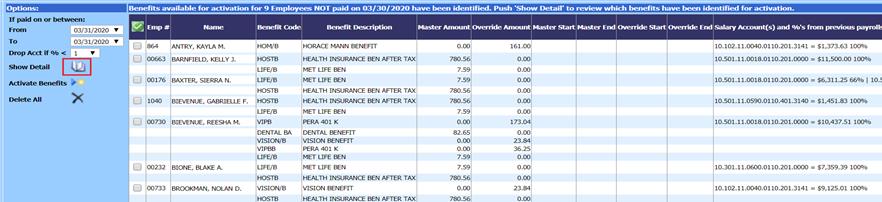

f. The “Show Detail” options indicate the benefits that will be considered for processing. Remember the final decision of what benefits will be taken during a payroll is based on the Deduction/Benefit timing code section made when the calculation program is run.

g. Check the employees you wish to activate “Only Benefit” processing for

h. Select “Activate Benefits” option.

i. If you determine you want to start over push the option “Delete All”. This will remove the activated benefits for the selected payroll date.

17. Complete payroll as normal

a. The employees benefit information (YTD’s) will be updated.

b. The benefit expense distribution will be computed and incorporated as part of the payroll transaction.

c. The benefit disbursements to the appropriate vendors will be incorporated as part of the accounts payable entry created for the current payroll.

d. The benefit only employees will appear on the Deduction/Benefit reports.

Benefit Only Reporting Options:

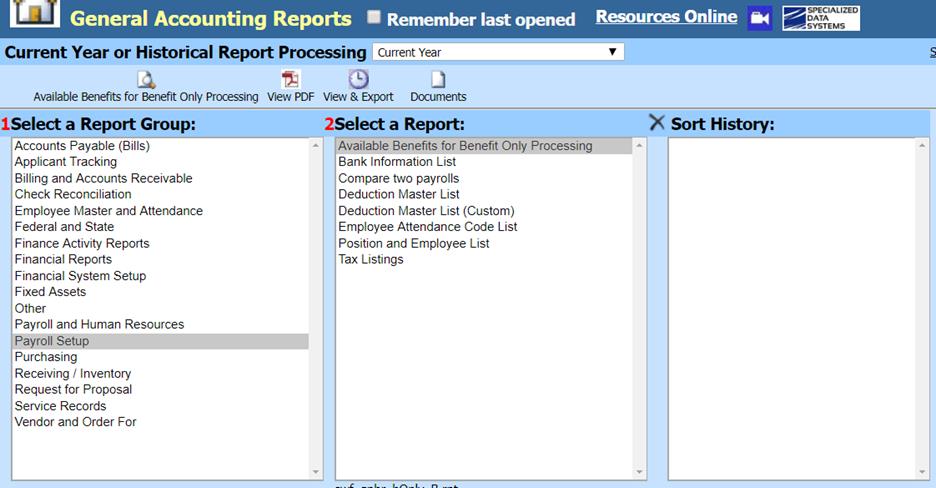

1. Select Reports

2. Select General Accounting Reports

3. Select a Report Group: Payroll Setup

4. Select a Report: Available Benefits for

Benefit Only Processing

a. Employees reported have a “Y” in the field “Benefit If Not Paid YN”.

b. Benefits reported have a “Y” in the field “Active If Not Paid YN”.

c. In addition the employee must have the benefit assigned to them in the benefit area.

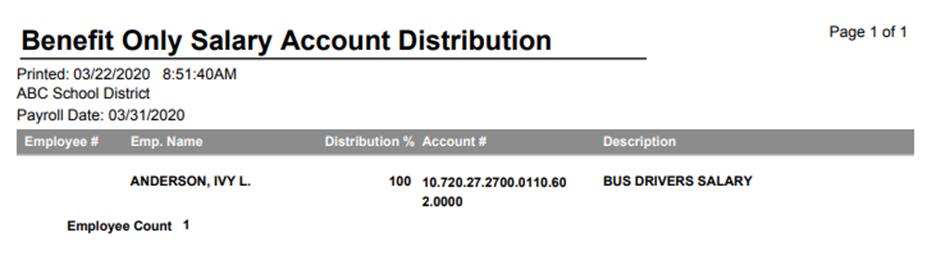

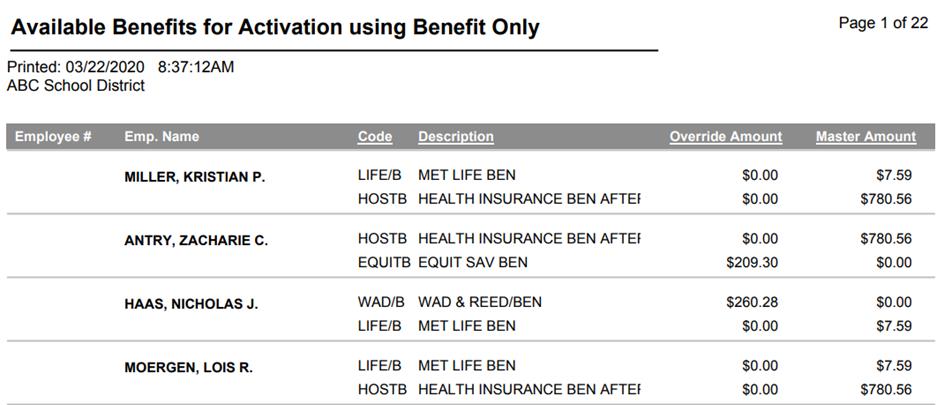

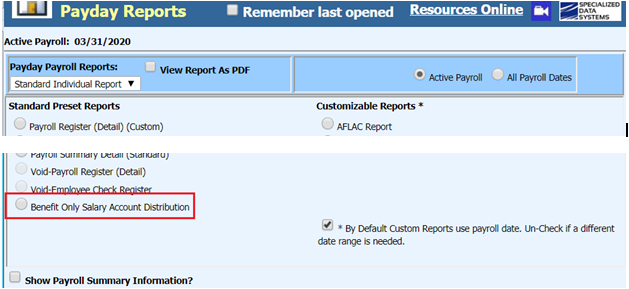

d. The Benefit only employees with activated benefits for a specific payroll date may be evaluated by selecting the report “Benefit Only Salary Account Distribution” located on from the “Payday Reports” screen.

e. This report includes employees selected for benefit only processing. The accounts and percentages are used to determine the distribution of any fringe benefits to the appropriate expense accounts. The normal distribution and benefit reports will contain the employees being paid normally and the benefit only employees.