Full-Year Employees: The following 2 examples show Correct and Incorrect Entries for the Offer of Coverage/Safe Harbor Reason Codes and Employee Share Amounts

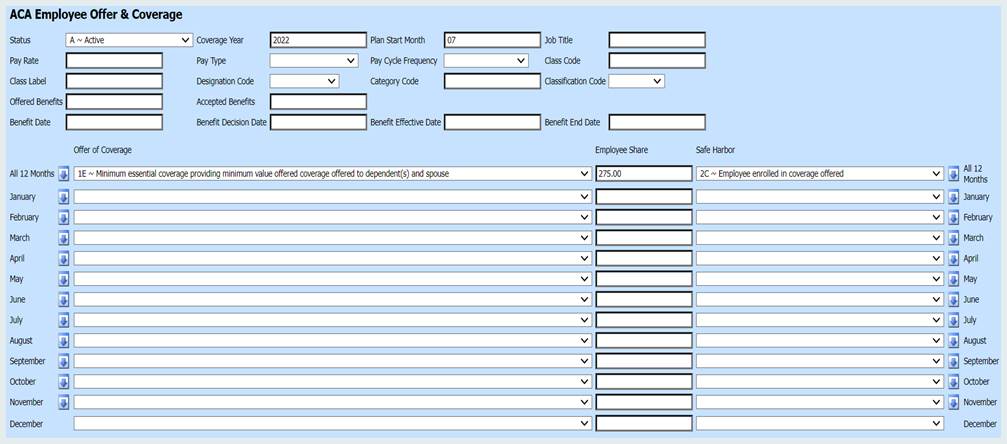

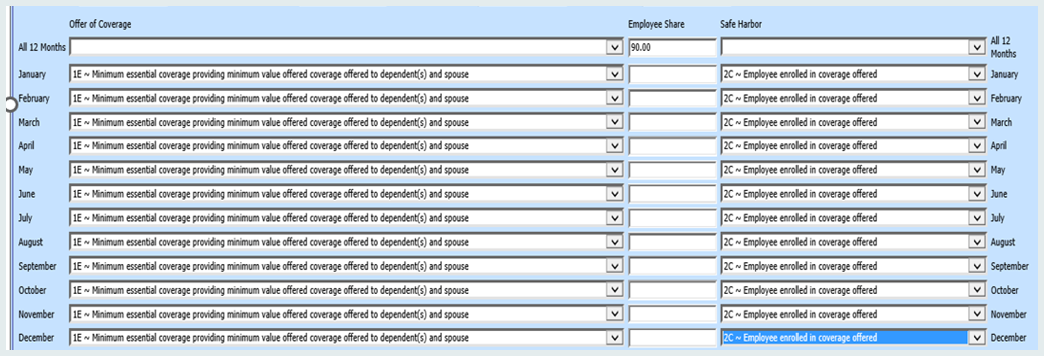

Correct Example

When Offer of Coverage, Employee Share, & Safe Harbor is the same for all months, put values in “All 12 Months” and leave individual months blank.

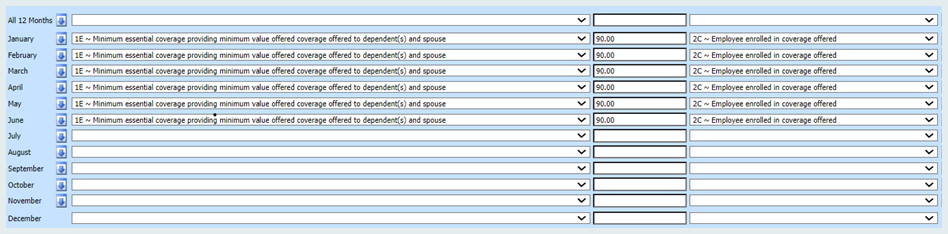

Incorrect Example

Below, is an example of an incorrect entry for ACA Employee Offer & Coverage. When all three columns are the same for all 12 months, then the values should be entered in “All 12 Months” and individual months should be blank.

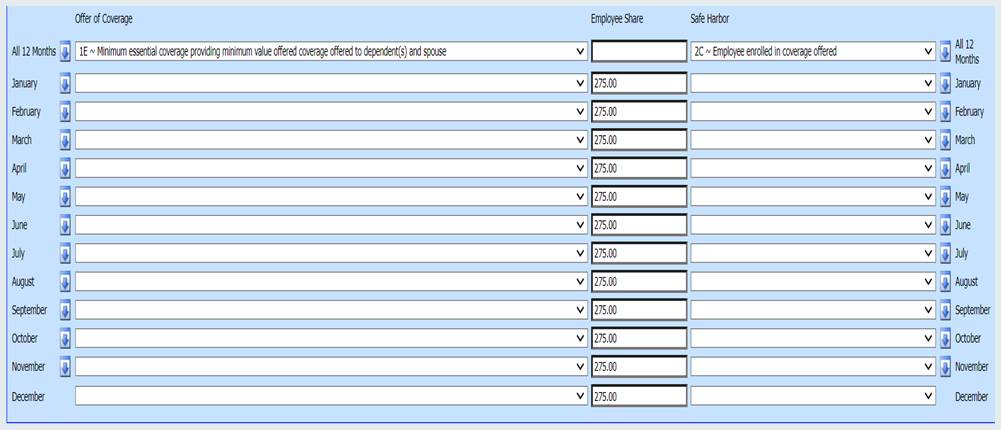

Correct Example:

This would be an example of a correct entry of an employee who had differing “Employee Share” amounts during the year. In this case, the fields of: “Offer of Coverage”, “Employee Share”, and “Safe Harbor” should be entered for EACH month. “All 12 Months” should be left blank.

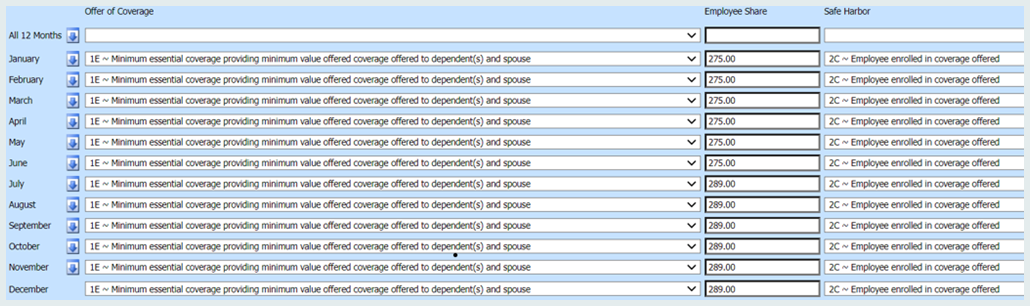

Incorrect Example

This would be an example of an incorrect entry. Since the offer of coverage, employee share amount, and safe harbor are the same January through December, “All 12 months” should be filled in. January through December should be blank.

2023 Terminated Employees/Partial-Year: The following example shows an Incorrect and Correct data Entry for the Offer of Coverage/Safe Harbor Reason Codes and Employee Share Amounts. Note: The months that the employee was not employed need to include codes, too. A common code is 1H Offer of Coverage and 2A Safe Harbor, but there may be situations where those will vary. Check with “your team” if you are in doubt.

The ACA Utility will auto-fill the IH and 2A for months outside of employees’ Hire and Termination dates.

Incorrect Example:

The following shows an employee that was terminated in June and no longer had coverage beginning in July . This is incorrect because it has months that are missing offer of coverage and safe harbor coding.

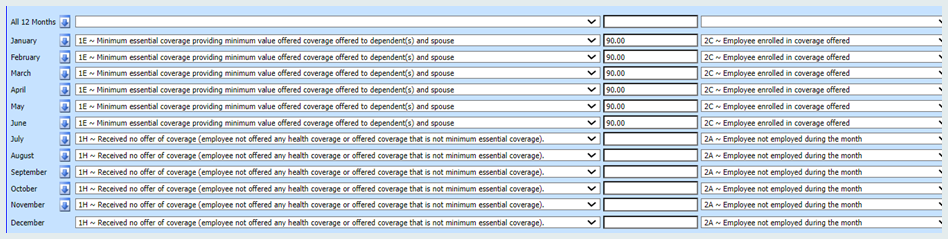

Correct Example:

The following shows that terminated employee above with all 12 months filled in. 1H (Received no offer of coverage) and 2A (was not employed that month) fit in most terminated employee situations. If employee has a situation that requires different coding, that will need to be changed manually. The ACA Utility will auto-fill the IH and 2A for months outside of their employment, based on Hire and Termination date.

6. The Plan Start Month is REQUIRED in 2023. You may want to use the “First Field to Edit”, in the horizontal view, and select “Plan Start Month” to make entry of this information easier. The horizontal view will also allow for mass changes, a quicker option. This holds the two digit month (01-12) that the plan year began for the health plan offered to the eligible employee.

7.

Click  before

leaving each page if you have entered or changed any information in this

view.

before

leaving each page if you have entered or changed any information in this

view.

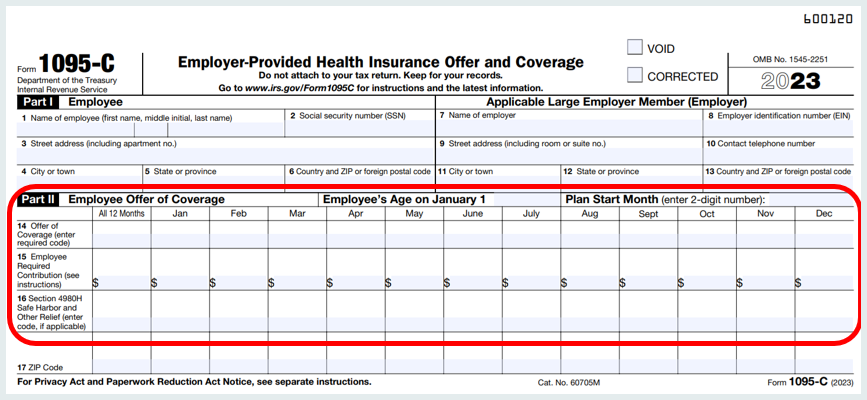

Data entry in the ACA Offer & Coverage section of the program corresponds to Part II on the 1095C form. Line #14 is Offer of Coverage. Line #15 is Employee Share Amount. Line #16 is Safe Harbor.