Revised: 4/2021

The below steps will assist

with printing third party vendors on one accounts payable check AND report

separately on the EPARS report.

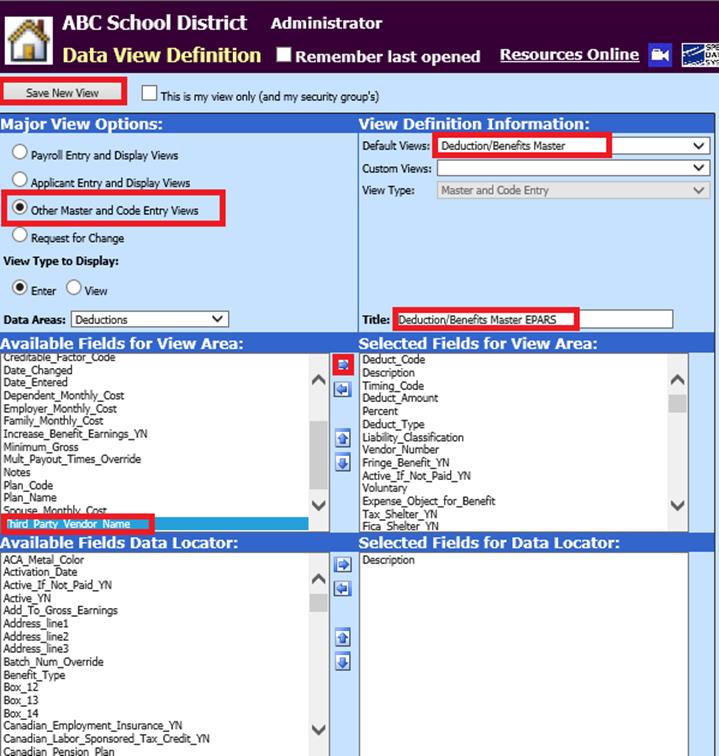

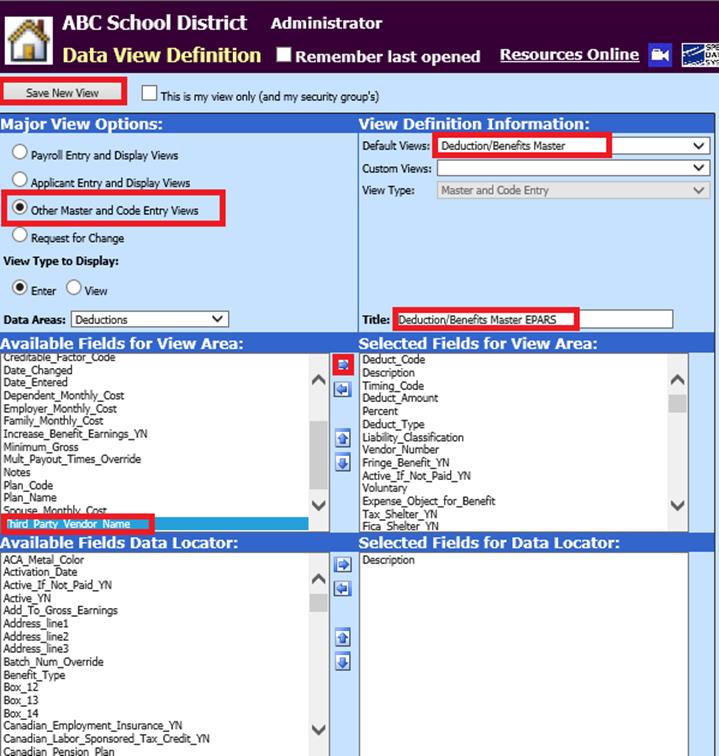

Setting up the new view:

1. Select Administrative Utilities

2. Select Data View Definition

3. Select Other Master & Code Entry Views

4. Select Default Views = Deduction/Benefits Master

5. Title = Type a new title for the view in the “Title” field. See Screen shot for title idea.

6. Available Fields for View Area = highlight “Third_Party_Vendor_Name” and move it to the right using the blue arrow pointing right.

7. Save New View

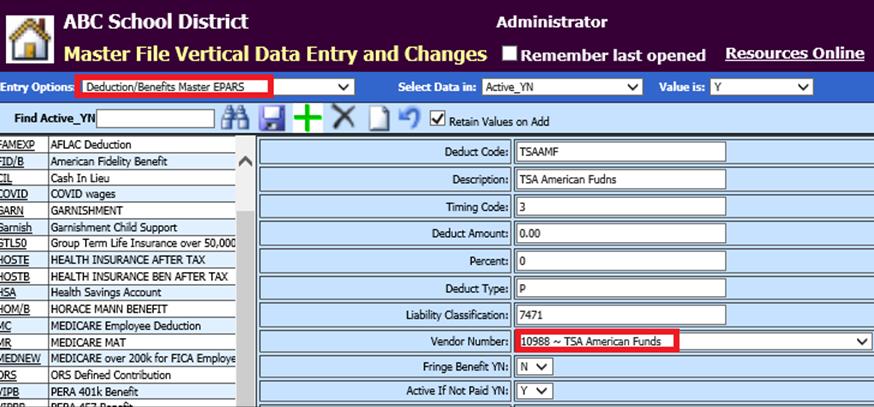

Adding vendor information to the new view:

1. Select Master File and Code Entry Options

2. Select Master File Data Entry and Changes

3. Entry Options = “the new view you just created”

4. Select the deduction code(s) that are reported on the EPARS.

5. Vendor Number = “the third party administrator (i.e., TSA, CPI, etc)”

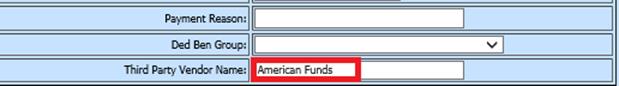

6. Scroll to bottom of the screen to find the field “Third_Party_Vendor_Name”. In this field, put the specific name of the fund (i.e., MetLife, Valic, American Funds, etc.). This is what you want printed on the EPARS report.

7. Save

8. Complete this for EACH of the deduction codes that are reportable on the EPARS Report.

The last field would be the Third Party Vendor if you did not move it when creating the view:

Making sure all the vendors share the same remit to vendor:

1. Master File and Code Entry Options

2. Master File Data Entry and Changes

3. Entry Options = Vendor (Basic Fields)

4. Select each vendor that is associated with the individual deduction codes and confirm they all have the same “Remit Vendor Number.” This will tell the accounts payable system to print the separate invoices on one check/direct deposit for remittance purposes.

5. Save

Payroll Processing/Payroll Liability Processing

You can now precede with your

payroll and payroll liabilities as normal. When you transfer the liabilities to

accounts payable, the individual deduction invoices should print on one check to

your third party vendor.

Creating the EPARS report

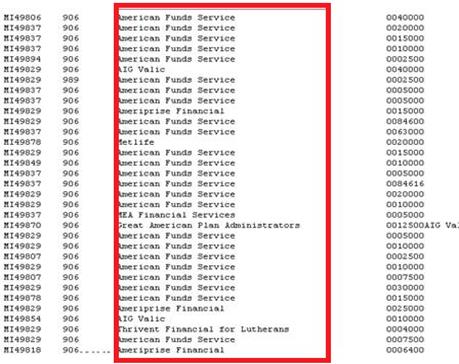

Now when you create your EPARS report, the

individual vendors will be reported as required (see below).