Electronic Filing Requires a Transmittal Control Code (TCC). The TCC that you use for your 1099’s is probably different from the one you will need to use for your 1094/1095 files, so make sure you are using a TCC specific to your ACA forms. When creating the e-file it contains both 1094 & 1095 information.

To file your 1094/1095 electronic submissions, use the information below. For any questions regarding this electronic submission, please consult with your accountant, auditor, or the IRS.

1. Select Payroll Processing

2. Select State/Federal Reporting and 3rd Party Export

3. Select Affordable Care Act Reporting

4. In the menu to the right, select “1094C-1095C Electronic Submission”

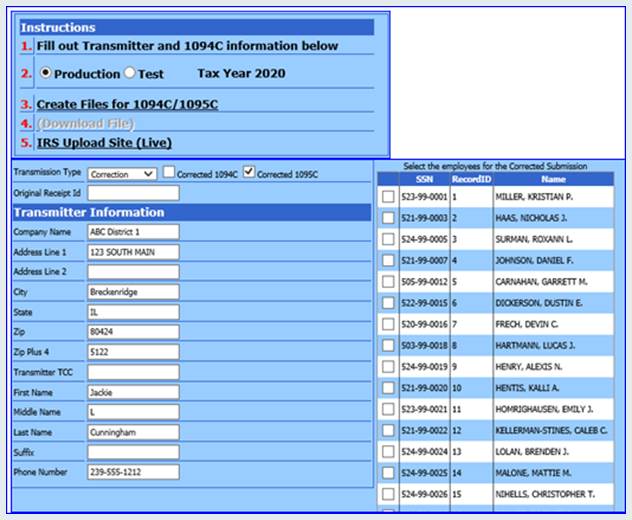

5. Fill out the Transmitter and 1094c information which starts under the “Instructions” box with Instruction Numbers 1-5. There are several areas which must be completed. Be sure to scroll all the way down the screen so no areas are missed. Pay careful attention to ALL areas on the screen and answer accordingly for your filing. If you have ANY questions on how to answer these questions or which questions you need to answer, please consult the IRS or your accountant/auditor.

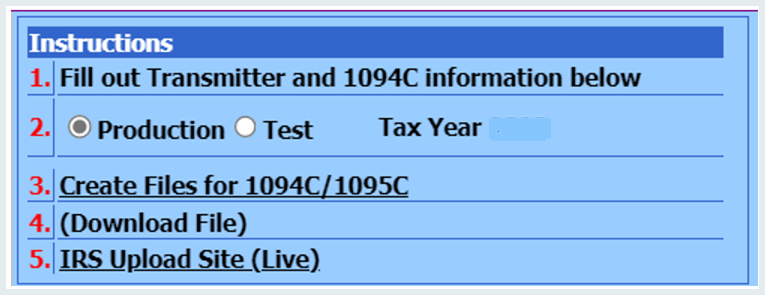

6. When submitting information to the IRS, you will either be submitting TEST information or PRODUCTION information.

•If you have submitted an ACA File electronically through SDS in the past using the same TCC, select PRODUCTION when creating your electronic file.

•If you have not submitted an electronic file through SDS and have a new TCC, or you had an outside firm submit your ACA Forms in the past, select TEST to create a Test File for submission.

a. After the Test File has been accepted by the IRS, you will receive a Transmittal Number.

b. With that Transmittal Number in hand, call the IRS and inform them that you had a successful test file upload.

c. They will move your TCC from test to production mode, which takes about 48-72 hours.

d. Proceed to create a Production ACA File for submission.

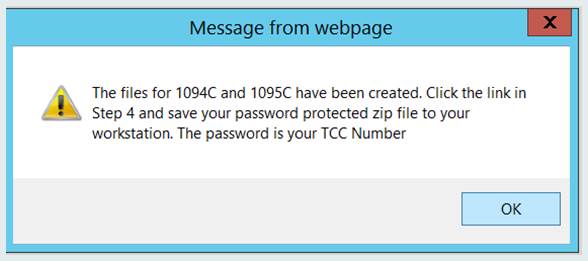

7. Select “Create Files for 1094c/1095c” to create data files. These files will be formatted per the current IRS specifications. Upon creation of the files, a message will direct you to select the link in Step 4 and save your password protected file to your workstation.

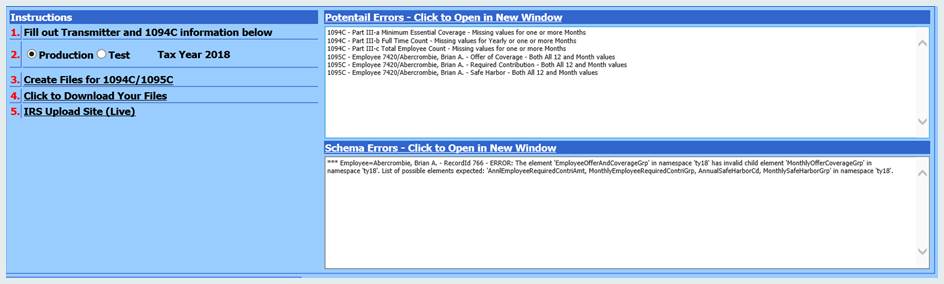

8. Look at right side of the screen for Potential Errors and Schema Errors. Identify and Correct all displayed errors and recreate a new file prior to filing with the IRS.

Potential Errors System detected errors that are inconsistent with the IRS electronic ACA Filing requirements. Click on the title (link), of the section, to view the errors in a new window.

Schema Errors Errors that will be detected upon IRS filing. Click on the title (link), of the section, to view the errors in a new window.

9. Select “Download File” to save the created data files to a location of your choosing. A password has been added to the download file because of the sensitive nature of the data being saved.

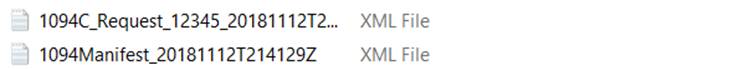

•The file that is created will be a zip file.

•![]() You must extract the files from this zip

file prior to uploading the file. There will be 2 files in the zip file

(as shown below)

You must extract the files from this zip

file prior to uploading the file. There will be 2 files in the zip file

(as shown below)

•The password, needed for unzipping this file, will be your TCC number.

10. Select “IRS Upload Site (Live)”. Log into the IRS website and follow their directions to transmit either the Test files or the Production Files. Submit each extracted file (Request and Manifest) in the requested area on the IRS Site.

1095 Correction Tips

After submitting your electronic 1095 File, if you receive any messages from the IRS regarding correcting records for a specific Record ID, the following steps may help with identifying the employee’s record for correction.

1. Select Payroll Processing

2. Select State/Federal Reporting

3. Select ACA Reporting

4. Select 1094C-1095C Electronic Submission

5. Select the Transmission Type Dropdown box

6. Select “Correction”

7. Select “Corrected 1095c”

8. A list of employees will be displayed along with a “Record ID” column.

9. Locate the “Record ID” associated with the IRS message you received to identify the employee that will need corrected.

10. Make any needed corrections, then follow the IRS guidelines for submitting the Corrected 1095 file.