Revised: 4/2021

1. Select Human Resources or Payroll Processing

2. Select Add Change Employee Information

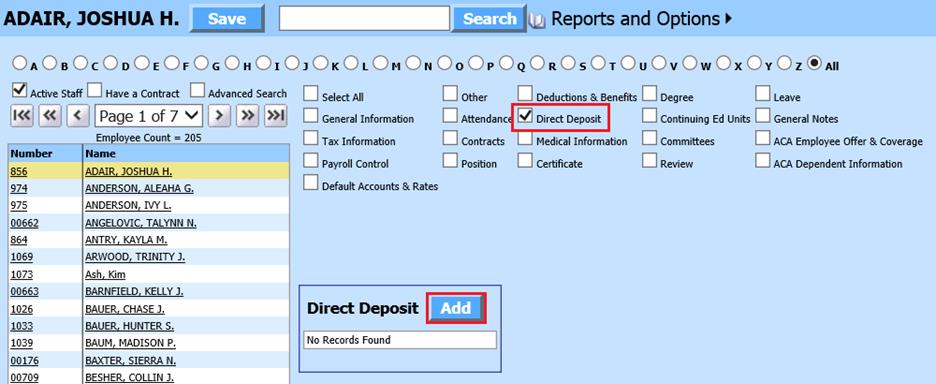

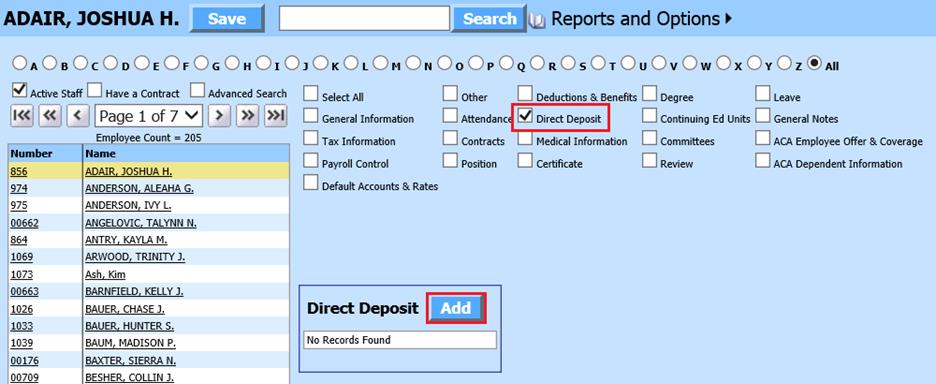

3. Place a check in Direct Deposit

4. Select the Employee from the employee list at the left side of the screen

5. Direct Deposit: Select Add

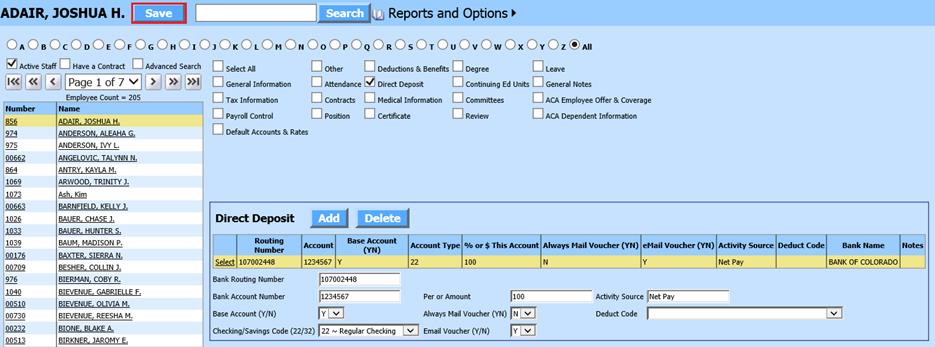

o Bank Routing Number: Enter the employee’s bank routing number

o Bank Account Number: Enter the employee’s bank account number

o Base Account YN: When you have more than one record, this determines which account is the main account

o Checking/Savings Code 22/32: Enter 22, 23, 32, or 33. (Odd # = Pre-Note and even # = Approved). These codes come directly from the Federal Government and have specific meanings. With these record types the system is designed to allow you to run a pre-note to verify the Bank can read the file and validate the employee’s accounts before you go live. If the employee has more than one direct deposit record and using the pre-note option; all records must have the Pre-Note code. This process will help you eliminate errors. The numbers to use in this column for the pre-note are:

§ 23 for Pre-Note Checking

§ 33 for Pre-Note Savings

§ After your pre-note has been approved, you will need to go back and change the pre-note numbers to the following set of numbers:

1. 22 for Approved Checking

2. 32 for Approved Savings

§ Note: An employee may want to have their payroll check deposited in more than one bank or they may want a portion of it in a checking account and the rest in a savings account. You will need to complete a line in this area for each account the employee wants their payroll dollars deposited to.

o Per or Amount:

Enter the percent or flat dollar amount the Employee wants to deposit to this

bank. The number 1 in this column will be interpreted by the system to mean

100%. If an employee only has one location that they want their net pay

deposited to you need to place the number 1 in this column equaling 100% of

their net pay. If the employee wants to split their net pay into two or more

accounts, the first and or second record needs to contain a specific dollar

amount that the employee wants deposited into that account. The last record for

the employee will need to have a .99 in this column, which tells the system to

put the balance of the employee’s net pay into this account. You can also split

the net pay into various accounts using percentages (i.e. .33, .33, .34).

The individual percentages must equal 100

o Always Mail Voucher YN: This allows the employee to always have their voucher mailed to them regardless whether they have a login to the employee portal or are having it emailed to them.

o eMail Voucher YN: If you wish for this voucher to be emailed to the employee

o Activity Source: “Net Pay”

o Deduct Code: Select Deduct code for direct deposit

6. Select Save