Revised: 4/2021

The system allows an employee

to determine the exact amount they would like to have withheld from their pay.

There are two data areas available for Flat Tax. One for Federal “Flat

Tax” and one for State “Flat Tax State”.

The flat tax options allow for a

fixed dollar amount or a fixed percent to be withheld for an employee.

If

the amount entered is less than 1.0 then the value will be treated as a fixed

percent. If 1.0 or greater than the value will be considered a flat dollar

amount.

1. Select Human Resources or Payroll Processing

2. Select Add, Change Employee Information

3. Place a check in Tax Information

4. Flat Tax

5. Change the “First Field to Edit” to “Flat Tax” See the screen example below.

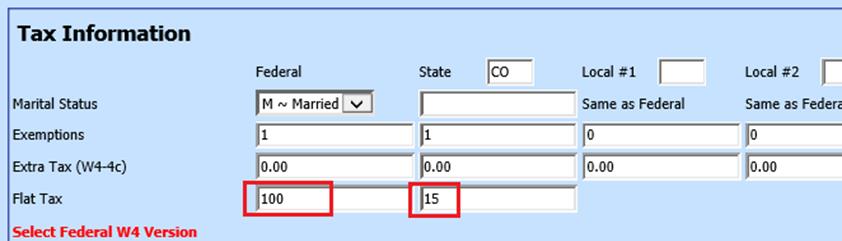

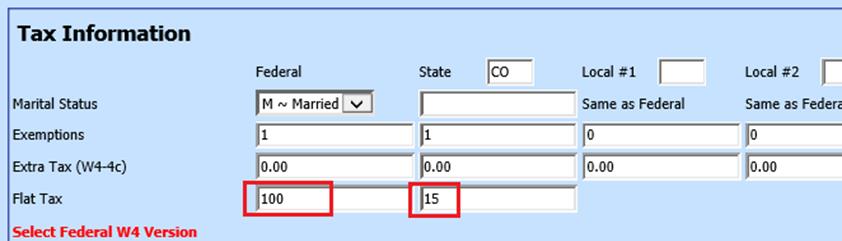

§ Example below: This employee has elected to have a flat dollar amount of $100 withheld for Federal tax and $15 for State tax.

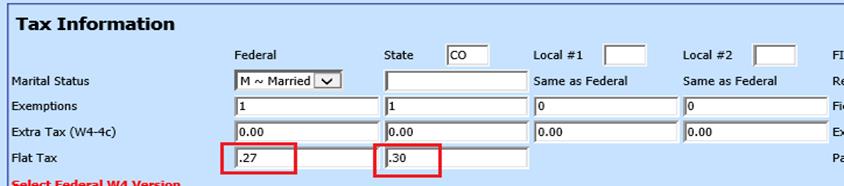

§ Example below: This employee has elected to have a fixed percent of 27% withheld for Federal Tax and a fixed percent of 30% for state tax.

§ These values override all factors related to tax computation and will withhold exactly as they are entered.

§ One exception to this is the field for extra tax. The

Extra Federal and Extra State tax will still be added to the final value.