The biggest change of the 2023 tax year form filing is that the threshold to be able to mail in 1095 forms, has been reduced from 250 forms to 10 forms, in aggregate across 1095, 1094, and 1099 forms. This change effectively requires all districts to e-file, starting January 1, 2024. This means that someone from each district will need to have their own TCC in order to upload to the IRS’s AIR system. TCC’s are specific to a person, not to a district, and for those people that work at multiple districts, they are specific to the person and district. It is also recommended to have a backup person apply for a TCC as well, since the process can take up to 45 days, according to the IRS website.

Note: The TCC for 1099’s are different, as they are used on a different system called the FIRE system. The TCC used to upload 1099’s cannot be used to upload 1095’s

How does e-file differ from printing and mailing in your forms? The obvious answer is that you will now send a file to the IRS with all of the information that was on the 1094 and 1095 forms. When you send the file, it sends both the 1094 and 1095 info at the same time. This process saves time and paper.

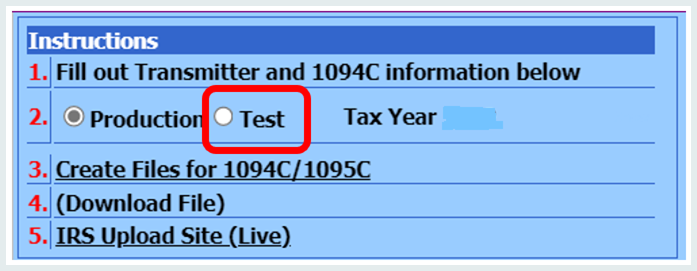

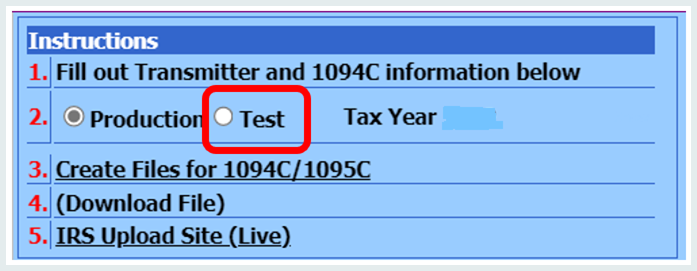

TCC’s are initially sent to users in the “test mode”. The first time that a TCC is used, you must send a TEST file. This is a choice that you will make on the screen where you create the E-file, see the screen print below. Make sure to put the dot in TEST for your first upload. The test file does not transmit your data, it transmits test data.

The first time you use your TCC, you must send a Test File.

When you get notified that you transmitted a successful Test file, YOU must then contact the IRS and let them know that you had a successful Test file. At that point, the IRS will move your TCC mode, in their system from Test to Production mode. The IRS will not do that automatically, you must contact them.

The importance of getting your TCC in production mode is that is the required mode to send your district’s actual data. Once you contact the IRS and inform them that you have had a successful test file, that process to move your TCC into production mode generally takes 48 to 72 hours for the IRS to change that designation in their system and be able to upload the production file. Remember: the IRS will not automatically change your mode after a successful test file. You must contact them to let them know.

Note: Sending the test file is only done the first year that you use it. After that, all subsequent years, you can skip this process and go straight to production mode.