Revised: 10/2020

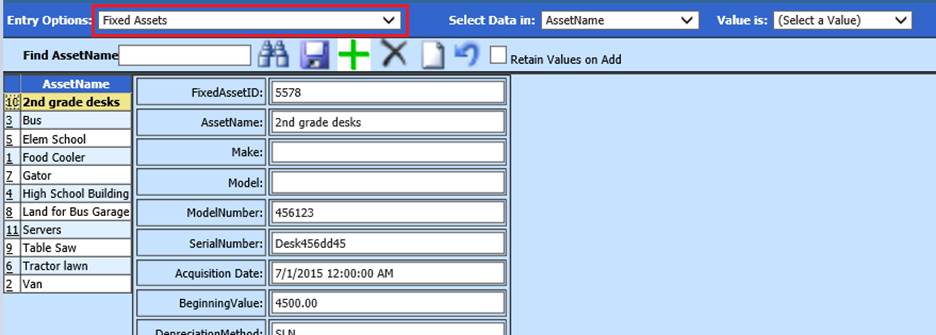

In Fixed Asset Inventory master

you can add, delete or edit Fixed Assets. All required GASB fields are available

for entry. Fixed Asset additions can also be done in the Accounts Payable Fixed

Asset area. For more information on adding Fixed Assets in the Accounts Payable

area search for “Entering Fixed Assets through Accounts Payable Invoice

Disbursement Area”

Easily track assets by Category: Land, Equipment,

Building etc. Asset Classification: Group by governmental and non-governmental

accounts. Track the depreciation of the value of the items entered.

Add a new Fixed Assets

1. Select Master File and Code Entry Options

2. Select Master File Vertical Data Entry and Changes

3. Entry Options: Select Fixed Assets

Enter in the following fields as needed: Fixed Asset ID, Asset Name, Make, Model and Serial Number.

•Fixed Asset ID: Each fixed asset must have an indivual ID number

•Assett Name: Enter Asset Name

•Make: Enter Make, if applicable

•Model: Enter Model, if applicable

•Model Number: Enter Model Number, if applicable

•Serial Number: Enter Serial Number

•Acquisition Date: This field represents the date the asset was purchased.

•Beginning Value: This field contains the original cost of the asset.

•Asset Category – In this field you need to enter in the asset category. The asset categories are listed below.

§ ♣ L = Land and easements

§ ♣ B = Building

§ ♣ E = Equipment

§ ♣ M = Machinery

§ ♣ V = Vehicles

§ ♣ I = Infrastructure (roads, bridges, sewers, dams, lighting systems, sidewalk systems and tunnels).

•Class Code – This field is used in the GASB report but will automatically get filled in for you based on the account number used in the account number field. The data in this field is the function or program number of the account number. This field is used when you run the report by function or program.

•Estimated Retirement Date – This date must be filled in. It is the date you estimate you will no longer have this fixed asset in service. This date is used by the system to calculate the depreciation for the GASB 34 report. If this is not filled in then the GASB report cannot find the estimated life for the asset which is used to calculate the depreciation.

•Salvage Value – In this field you must enter what you feel the asset will be worth at the estimated retirement date.

•Retirement Date – You must fill in this field once you have retired the particular asset. Once a date has been added to this field this asset will stop depreciating.

•The system calculates depreciation using the full month convention method. This means that in the month the item is acquired the depreciation will start and when the item is disposed of there will not be any depreciation calculated.

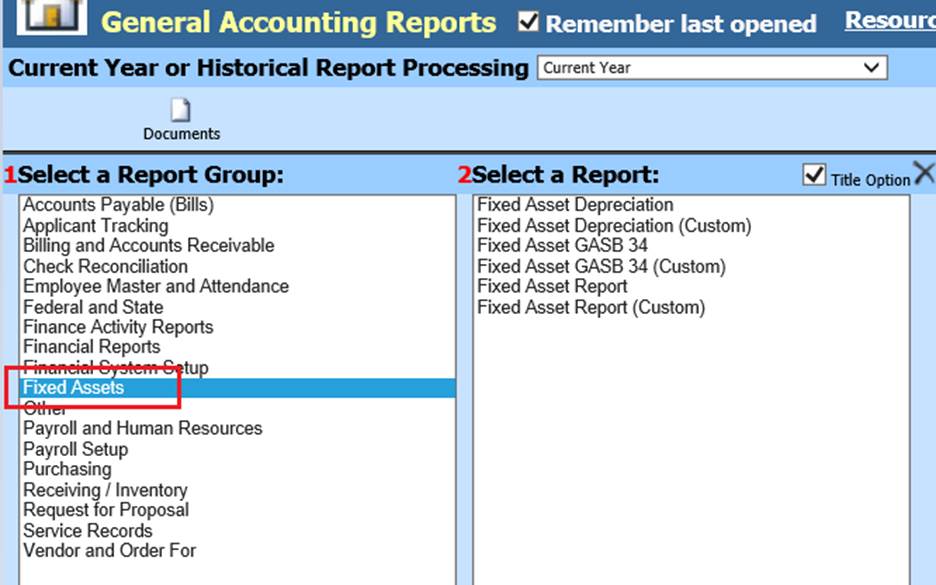

Reporting Options

To run Fixed Asset reports follow the

steps below to access them.

1. Select Reports

2. Select General Accounting Reports

3. 1 Select a Report Group: Fixed Assets

4. Verify reports by school, room or the asset category.