Revised: 12/2020

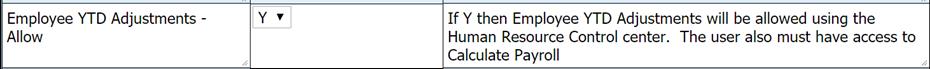

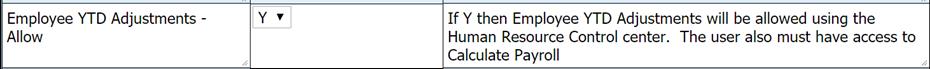

Activate Employee YTD Adjustment Option

1. Select Administrative Utilities

2. Select SDS Web Office Settings

3. Select Payroll

4. Employee YTD Adjustments

a. The setting should be “Y”, to make changes to an employee’s year to date records.

5. If any changes made, select Save Changes

6. Log out and back in for changes to be completed

Note: When this setting is a “Y”, any user with access to “Compute a Payroll” will also be able to adjust an employee’s year to date amounts.

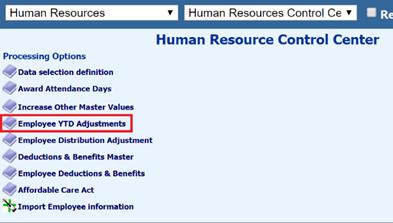

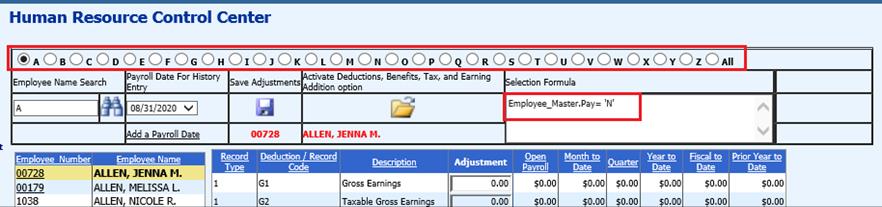

Entering Employee YTD Adjustments

1. Select Human Resources

2. Select Human Resources Control Center

3. Select Employee YTD Adjustments

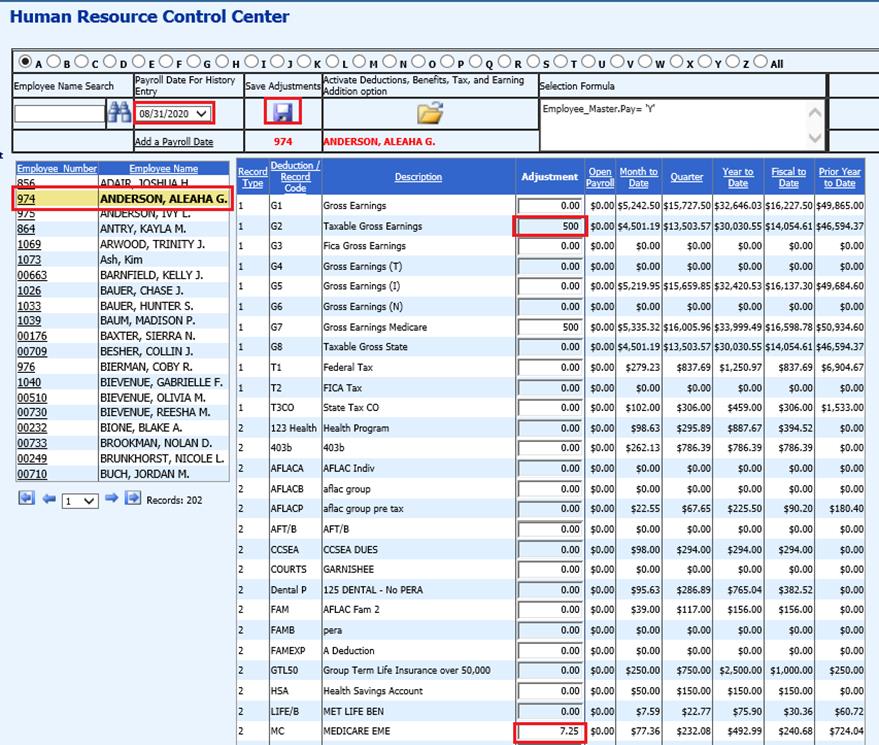

4. Select employee to be adjusted

5. Payroll Date for History Entry: Select a payroll date within the reporting period(s) you wish to have affected.

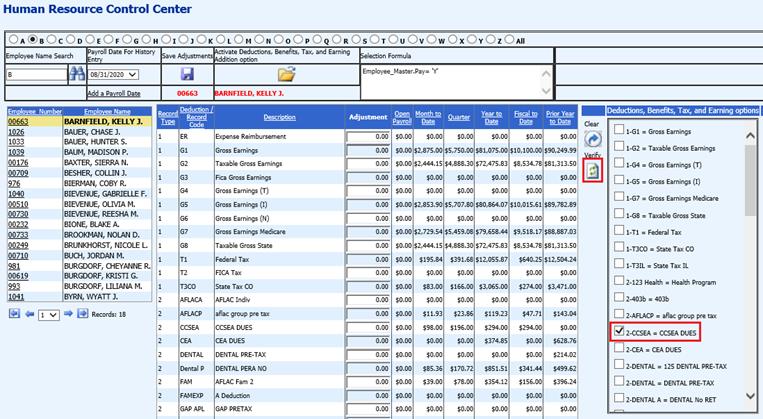

6. Adjustment: Enter amount into the “Adjustment” field, for the code(s) to be updated.

7. Select Save Adjustments

Note: If an employee does not appear in the list of employees’ the employee is not active under the Employee Demographics area. To view this employee, change the formula to read “Employee_Master.Pay=’N’. Then select the alphabet letter and the system will refresh. Inactive employees will display.

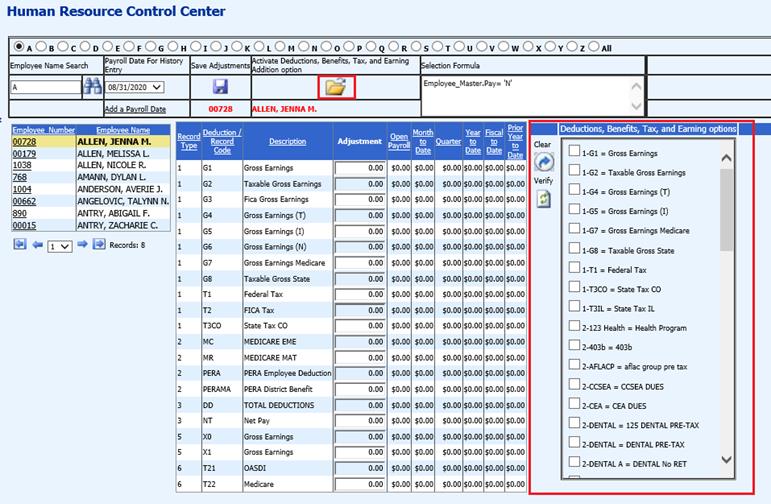

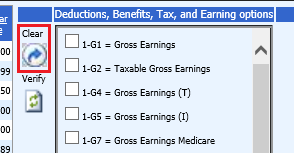

Activate Deductions, Benefits, Tax and Earning Addition option

1. Select Folder, to Activate Deductions, Benefts, Tax, and Earning Additions selection option

2. Check items to be added to employee record

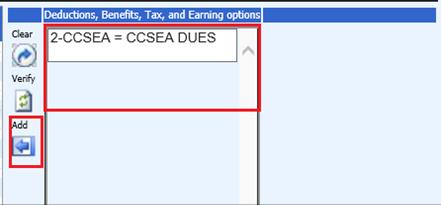

3. Select Verify

4. Deductions, Benefits, Tax, and Earning options: Review items listed, select Add to apply to employee record

5. Select Clear, to clear out any selections

What happens in the system when an Employee Year to Date Adjustment is completed?

1. If an August payroll date is selected in the current year than the value entered will adjust the month selected such as (August), it will also adjust the third Quarter, the calendar year and the fiscal year the date is in.

2. If the date is selected in the current month then the MTD, QTR, YTD and FTD will be adjusted.

3. If today’s date is 12/9/2020 and payroll date August 2020 is selected, then the month of August 2020 will be adjusted as well as the third Quarter, and the current Calendar YTD.

Note: See Data selection definition detailed instructions, for grouping employees in this entry view: http://help.schooloffice.com/FinanceHelp/#!Documents/humanresourcescontrolcenterdataselectiondefinition.htm