Revised: 8/2020

The steps below will assist you with IMRF reporting.

1. Select Payroll Processing

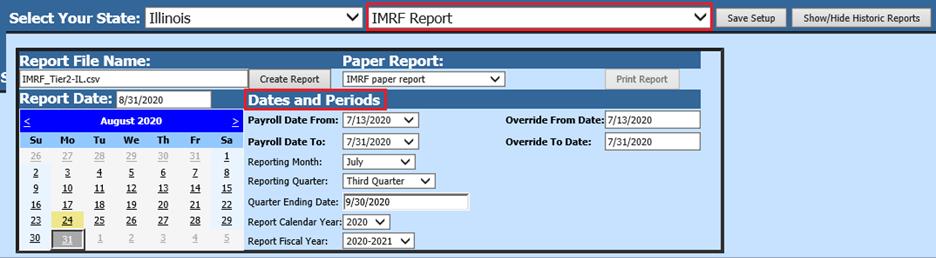

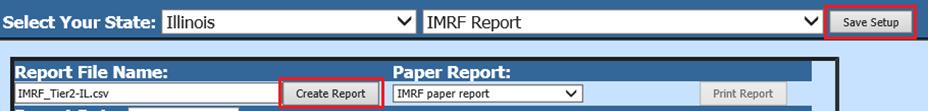

2. Select State and Federal Reporting

3. Select Your State: Choose Illinois

4. Select IMRF Report from the dropdown menu

5. Complete the required information as shown below

6. Dates and Periods:

a. Select Payroll Date From

b. Select Payroll Date To

c. Verify the other Reporting selections listed, updated as needed

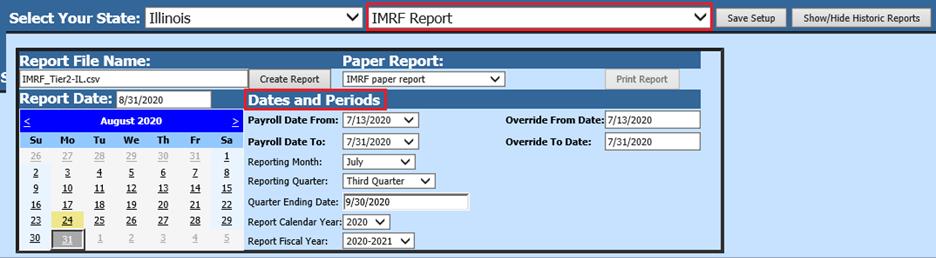

7. In the IMRF Member Plan Code enter RG01.

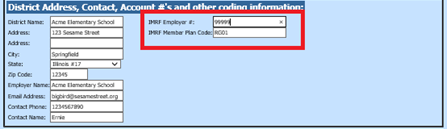

a. Employees hired after 01/01/2011 may have a plan code of RG03 indicating a Tier II employee. You will need to specify the plan level by entering either the RG01 or the RG03 in the Plan Code field in the Other information area located under Payroll Processing or Human Resources, Add/Change Employee Information.

b. Note: Although the report setup indicates the RG01 plan code, your RG03 Tier II employees will also be included in this report.

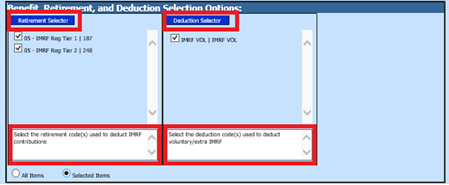

8. Under the Retirement Selector, select the retirement code(s) used to deduct IMRF contributions. These are deductions only, not employer paid benefits.

9. Under the Deduction Selector, select the deduction codes(s) used to deduct voluntary/extra IMRF.

10. After all of the items have been filled in on the screen, select Save Setup

11. To create the file, select the Create Report button.

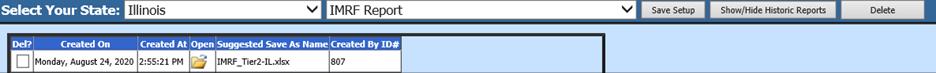

a. The file that is created will be listed at the top of the screen. When you re-enter this report area they can be displayed under Show/Hide Historic Reports. All files will have a date and time stamp showing when it was created.

12. To review your file, an IMRF report may be printed for your records by selecting “Print Report” next to the IMRF Paper Report. This report is for your use only and is not submitted to IMRF.

13. After verification of printed report, right click on the yellow file folder to save the file to your local computer. Then using File/Save As and selecting the desired destination on your computer. This file is formatted for submission to IMRF and does not require any modification prior to submission.

14. The file is now ready to be uploaded to IMRF.