Revised: 4/2021

Employees may request information regarding how changes on their W4 or on a voluntary deduction may affect their pay. There is an option for allowing you to share with them the result of these changes on their pay without having to have an open payroll or having to run the changes on an open payroll. (Keep in mind that some changes would facilitate the employee filling out a new W4 form).

1. Select Payroll Processing

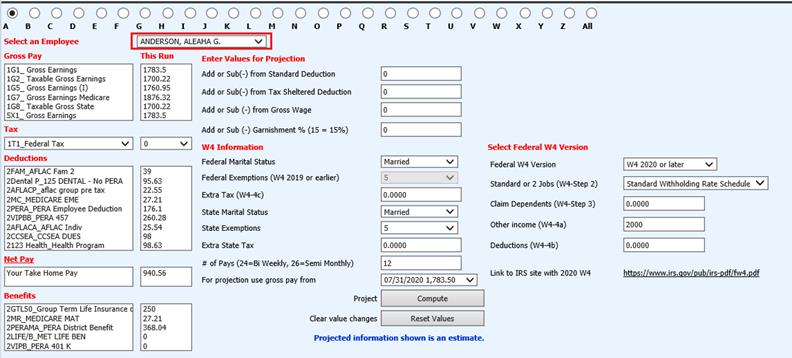

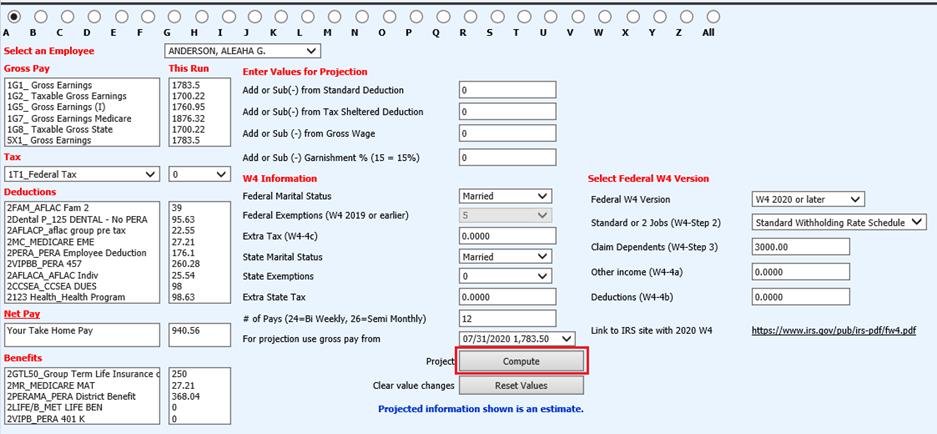

2. Select Individual Employee Payroll Projection

3. Select the Employee on which to run a projection

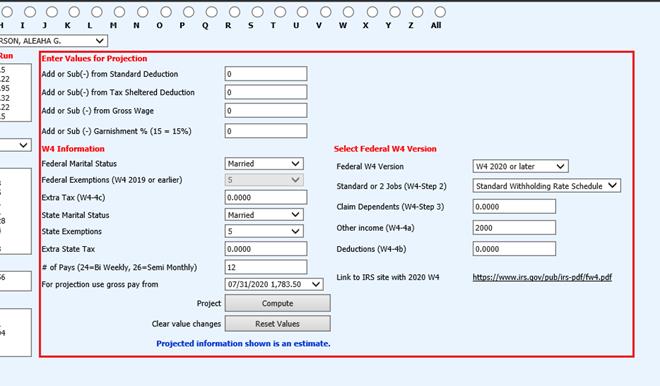

4. Under the column “Enter Values for Projection”, make the changes the employee is requesting in the appropriate columns (add/subtract an amount from a deduction/tax sheltered deduction, change tax settings.

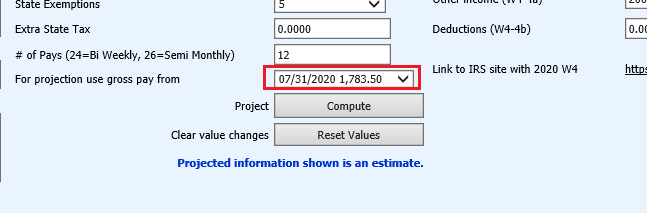

5. Select the payroll date to use for the projection from the drop down box

6. Select Compute

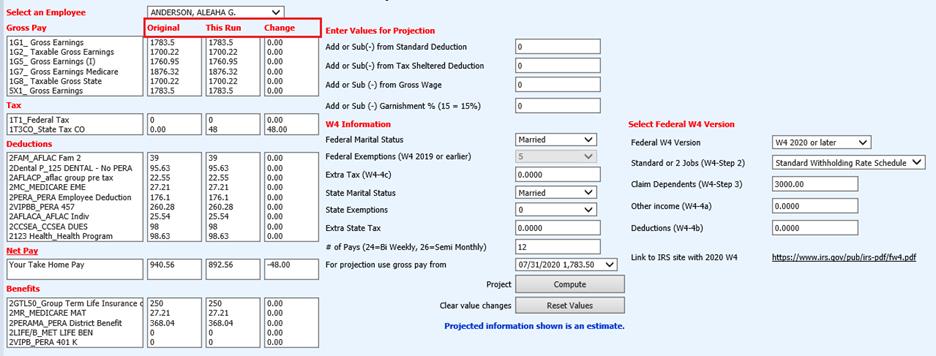

7. Look at the columns labeled Original, This Run, and Change Original shows the original amount for the payroll date selected. This Run shows the amounts that would compute based on the values of change applied for this projection run. Change shows the areas of payroll that would have a different amount based upon this applied change.

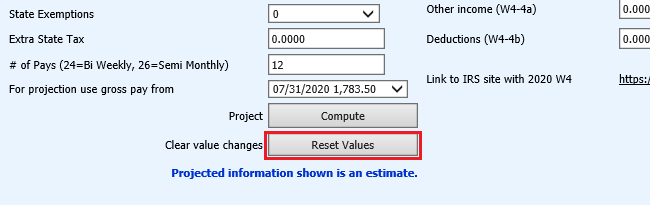

8. Review the Changes. If you wish to reset the values back to the original settings, select the Reset Values Button.

9. You may continue to test various changes through use of the Compute Button and the Reset Values Button.

Note: Using this option does not change any settings under Employee Demographics. This option does not make any changes to any payroll data. If a current payroll is open, use of this option does not make any changes to that open payroll. This area is used only as a “test” area for running projections for changes to a specific employee’s payroll.