Revised: 10/2020

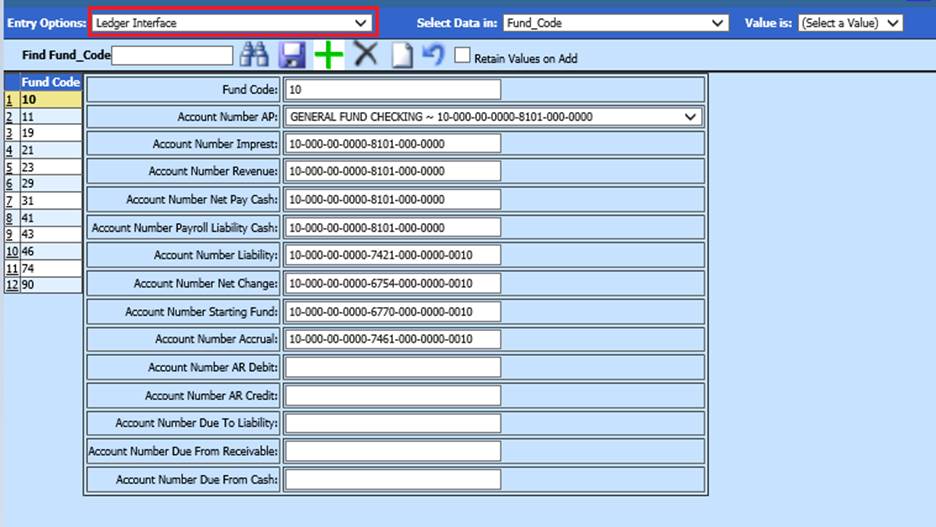

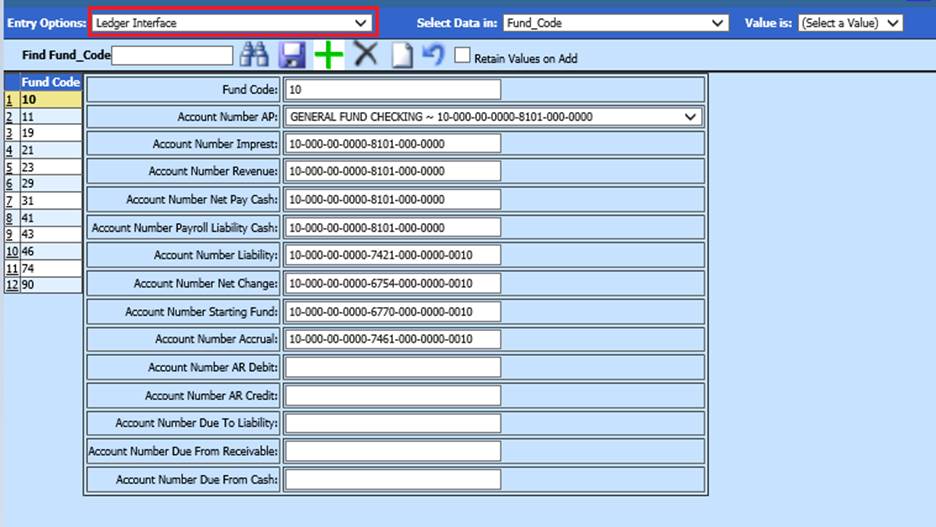

The Ledger Interface is how the system determines which Balance Sheet accounts to post to as you process activity in the system. This setup requires an entry for each fund that you have in your database.

This area is found by selecting the following.

1. Select Master File and Code Entry Options

2. Select Master File Vertical Data Entry and Changes or Master file Horizontal Data Changes

3. Entry Options: Select Ledger Interface

In this area each fund will have one entry for the setup process.

1. Fund Code: This is the Fund number.

2. Account Number AP: The Account Number AP is the cash account that will be credited (decreased) as the accounts payable invoices are made permanent (posted to the Ledger).

3. Account Number Imprest: The Imprest Account or Petty Cash is another cash account that will be credited (decreased) as the accounts payable invoices for the Imprest or Petty Cash Account are made permanent (posted to the Ledger).

4. Account Number Revenue: The Account Number Revenue is the cash account that will be debited (increased) as the cash receipts are entered.

5. Account Number Net Pay Cash: The Account Number Net Pay Cash is the cash account that will be credited (decreased) as the Payroll Transaction is transferred to the General Ledger.

6. Account Number Payroll Liability Cash: The Account Number Payroll Liability Cash is the cash account that the will be credited (decrease) when the payroll liabilities are made permanent (posted to the Ledger).

7. Account Number Liability: The Account Number Liability is the liability account that your accounts payable invoices will post to as the invoices are entered. As you enter accounts payable invoices, this account will be credited (increased). Once a check has been processed for these invoices and the checks have been made permanent (posted to the Ledger), the system will debit (decrease) this account.

8. Account Number Net Change: The Account Number Net Change on the Balance Sheet is the difference between the revenues and expenditures. When you close the last month of your finance fiscal year the amount that is in this account will move from this account and will posted into the Account Number Starting Fund.

9. Account Number Starting Fund: The Account Number Starting Fund account is the starting fund balance for each year. As you move from the last month of your finance fiscal year to the new month of the next finance fiscal year the amount that is in the Account Number Net Change will add to the balance that is in this account. This will become the new balance for the new Finance Fiscal Year.

10. Account Number Accrual: The Account number Accrual is for the payroll accrual process. As you run the payroll accrual process at the end of the finance fiscal year, this is the liability account that the net pay, deductions and benefits will post to until the actual payrolls are paid in the next fiscal year. This will allow the system to post the payroll expenses in the current fiscal year for payrolls that will be paid out in the next fiscal year.

11. Account Number AR Debit: The AR Debit account is for the Accounts Receivable invoice billing process. This is the account that will be debited (increased) as the Accounts Receivable invoices are created. There are additional steps to setup the Accounts Receivables process. Review the documentation below for the additional steps. http://help.schooloffice.com/financehelp/#!Documents/accountsreceivable.htm

12. Account Number AR Credit: The AR Credit account is for the Accounts Receivable invoice billing process. This is the account that will be credited (decreased) as Accounts Receivable payments are received. If an account number is not filled into this field, the account number that is used in the “Account Number AR Debit” below will be used. There are additional steps to setup the Accounts Receivables process. Review the documentation below for the additional steps. http://help.schooloffice.com/financehelp/#!Documents/accountsreceivable.htm

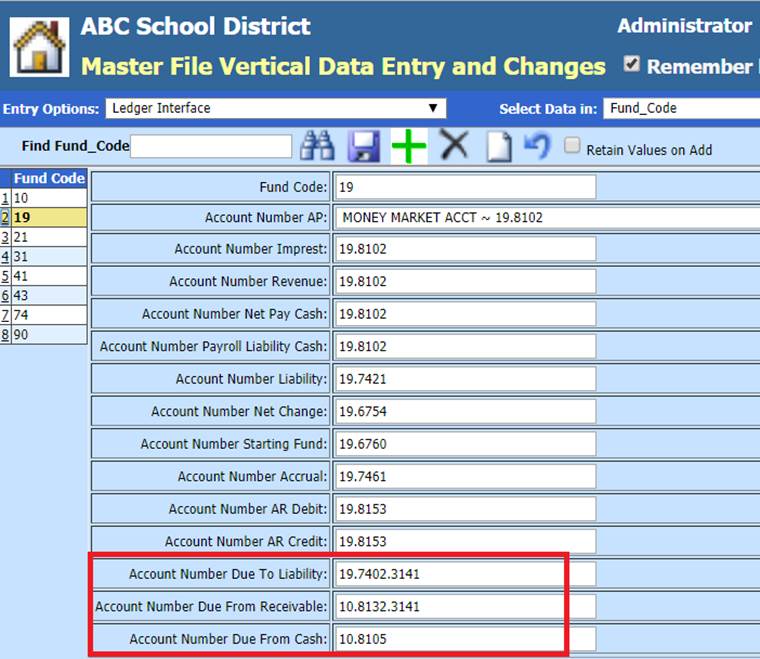

13. Account Number Due to Liability: The Account Number Due to Liability is needed in the Fund that a liability account will be posted to for invoices that will be paid from another fund.

Note: Additional steps are needed to complete the setup for the Due to Due from process. Review the following link for the setup process and examples of the posting process for the Due to Due from entries.

http://help.schooloffice.com/financehelp/#!Documents/duetoduefromsetupandprocessing.htm

14. Account Number Due From Receivable: The Account Number Due From Receivable will be setup in the same Fund’s ledger interface as you used above in Step 13. However, this account number will be the receivable account from the fund that will be paying the invoices.

Note: Additional steps are needed to complete the setup for the Due to Due from process. Review the following link for the setup process and examples of the posting process for the Due to Due from entries.

http://help.schooloffice.com/financehelp/#!Documents/duetoduefromsetupandprocessing.htm

15. Account Number Due From Cash: The Account Number Due From Cash will be setup in the same Fund’s ledger interface as you used above in Step 13 and 14. However, this will be the cash account number from the fund that will be paying the invoices.

Note: Additional steps are needed to complete the setup for the Due to Due from process. Review the following link for the setup process and examples of the posting process for the Due to Due from entries.

http://help.schooloffice.com/financehelp/#!Documents/duetoduefromsetupandprocessing.htm

A. The screen shot below is an example of the setup that has been discussed in Steps 13, 14, and 15.

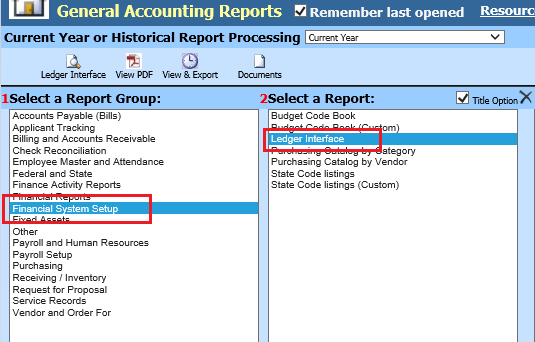

To print a Ledger Interface Report:

1. Select Reports

2. Select General Accounting Reports

3. Select Financial System Setup

4. Select Ledger Interface

5. Preview/Print Report