Revised: 6/2021

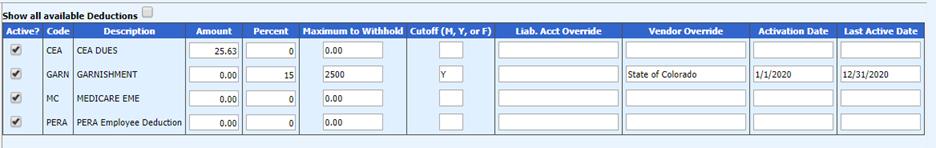

This allows Maximum to Withhold amounts to be entered on

each individual employee benefit/deduction and designate period cutoffs (i.e.

calendar, fiscal or month). Below are the processing options.

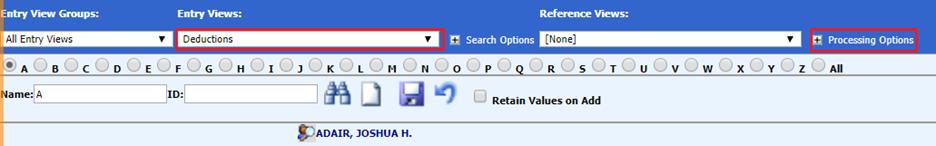

1. Select Human Resources or Payroll Processing

2. Select Employees, Contracts, Deductions/ Benefits, etc.

3. Entry Views: Select the Deductions or Benefits table

4. Select Employee

5. Select the + next to Processing Options

6. Select Activate Maximum to Withhold & Acct. Override Fields

•Enter the Maximum to Withhold.

•Enter the cut off period for the maximum to withhold, Y= Calendar Year, F= Fiscal Year and M= Month

•Enter Liab. Acct. Override, as needed

•Enter Vendor Override, as needed

•Enter in the Override and Date fields, as needed

7. Select  to save.

to save.