Revised: 3/2021

New Hybrid Plan/DTL4 Record

Setup

The

Defined Contribution and PHF Deductions and Benefits will be reported on the

Michigan ORS Retirement Report. A detail record (DTL4) is required to

report the gross wages, Employee Defined Contributions, Employer Defined

Benefits, PHF Employee and Employer information. This record will only be added

if the employee has deduction & benefit records completed.

For the program to identify the Defined Contribution and PHF Codes, you must complete the following steps.

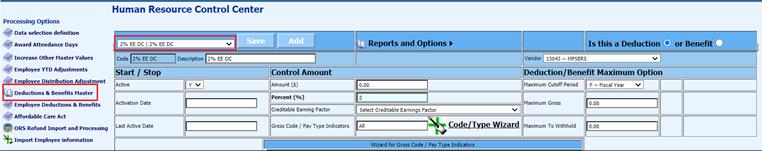

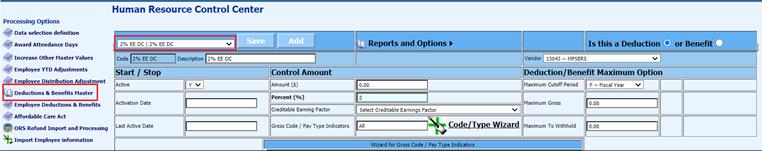

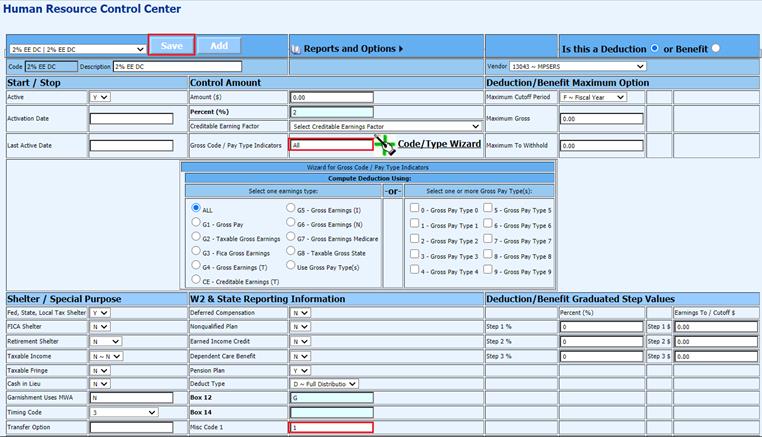

12. Defined Contribution Deduction/Benefits

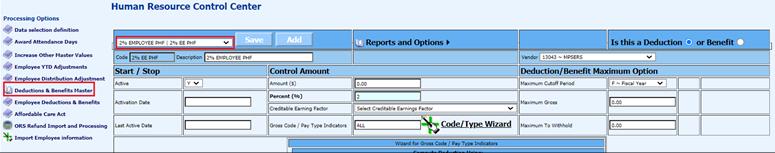

1. Select Human Resources

2. Select Human Resources Control Center

3. Select Deduction/Benefit Master

4. Select a deduction or benefit that should be reported as a “Defined Contribution” Retirement Item

5. Gross Code / Pay Type Indicators: Enter ALL

6. Misc_Code 1: Enter “1”

7. Select Save

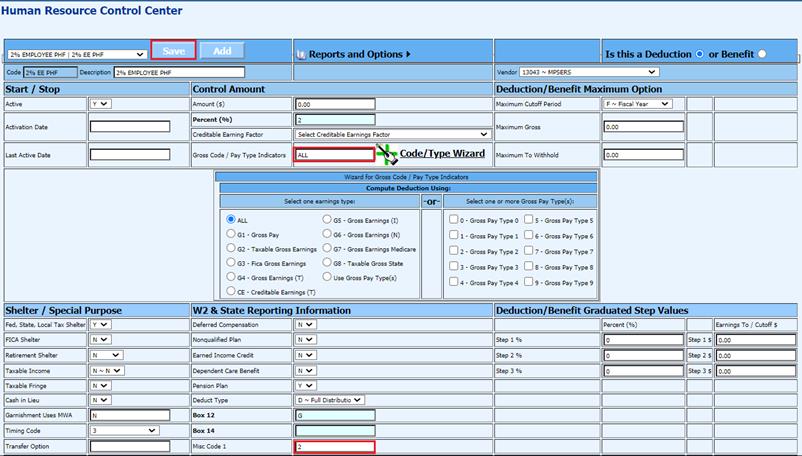

13. PHF Deductions/Benefits

1. Select Human Resources

2. Select Human Resources Control Center

3. Select Deduction/Benefit Master

4. Select a deduction or benefit that should be denoted as a “PHF” Retirement Item

5. Gross Code / Pay Type Indicators: Enter ALL

6. Misc_Code 1: Enter “2”

7. Select Save