Revised: 10/2023

It is always good to know a few tips to try if you are having trouble balancing. Below are several balancing tips when the month end is not running as smooth.

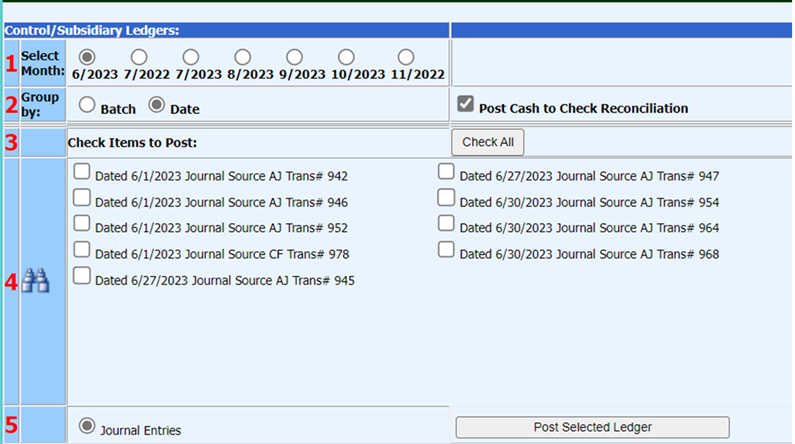

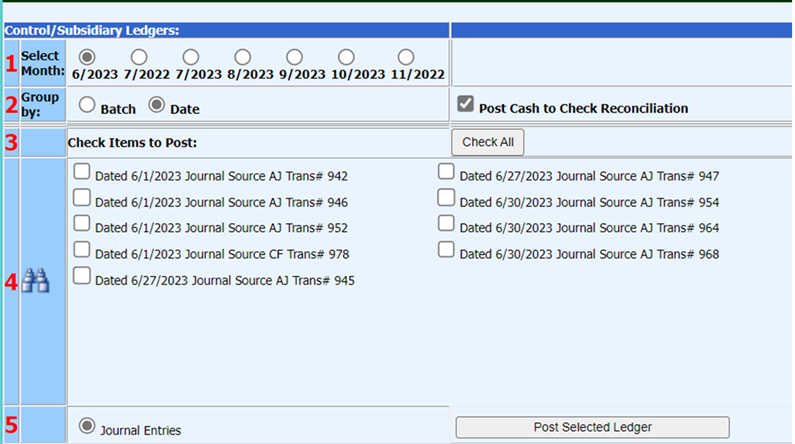

•Basic balancing requires that at the end of the month, ALL areas should be posted/made permanent. This includes Accounts Payable/AP, Cash Receipts/CR, and General Ledger/GL entries. (see screen print below for example of what not to do)

•Each month, take the time to make sure that your payroll is balanced. This will prevent you from fixing mistakes later! An ounce of prevention is worth a pound of cure!

Figure 1 INCORRECT: Making your entries permanent is an important step to balancing. Below, is an example where that was NOT done. There should be no dates left in the "Select a Month" area.

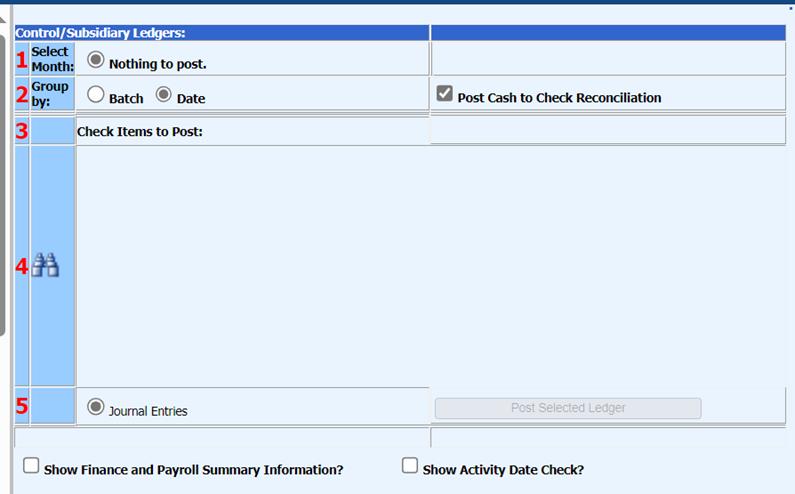

Figure 2 CORRECT: The General Ledger Processing: Make New Entries Permanent, should look like below at the end of each month. “Nothing to Post”

I’m having trouble finding out where numbers are coming from on my balance sheet?

Ø If Cash Balances are off:

ü Make sure all A/P and Cash Receipt entries are made permanent

ü Run A/P Reports (Open Accounts Payable, Bills Payable, Paid Accounts Payable Reports) and check all entries

ü Run a Cash Receipt Edit List and verify the entries are complete and correct

ü Select Look and Browse and type in the cash account in question and check all detailed information and postings for the month

ü Verify all transaction dates are in the month to be expensed or credited in.

Ø If the A/P Liability account shows a balance:

ü Check if all A/P items have a check number/check date, if not, check if this is the balance showing

ü Print an Open Accounts Payable Report to see if there are open Accounts Payable items.

ü Print a Paid Accounts Payable Report by Check Number by Check Date (affects Cash) and Expense on Date (affects General Ledger)

ü Mark off cleared checks with the bank statement if you don’t balance in check reconciliation view.

ü Make sure all items are made permanent for Accounts Payable

Ø If Liability Accounts show a balance:

ü Check if PR Liabilities and PR Transactions have been posted for payroll

ü Select Look and Browse and type in one account that has a balance to check all detailed information to see if A/P posting/entries match the Transaction entries

Ø If Net Fund Change Accounts need to be checked:

ü Run a Revenue Report from July 1 through the current month ending date

ü Write down the YTD Total Revenue for the fund in question from the report

ü Run an Expenditure Report from July 1 through the current month ending date

ü Write down the YTD Total Expenditures for the fund in question from the report

ü Take the Total Revenue figure minus the Total Expenditure figure for the fund in question. That amount should equal to the Net Fund Change YTD Activity Amount for the Fund being checked.

Ø If Balance Sheet is not balanced:

ü Under Accounting Status Display or Make items Permanent, check mark Show Finance Summary Information. This will show any unbalanced transaction or entries not completed correctly.

ü Look over all Funds. Is there a positive balance in one fund and negative in another for the same amount, possibly completed a journal entry and crossed funds without involving the cash or due to/from accounts for each fund.

ü You may take the Accounts Payable Fund Summary, Cash Receipts Fund Summary and the Payroll Summary of each payroll and compare the totals to the cash accounts. They should equal.

My check Reconciliation is off, what should I look at?

ü Make sure the Reconciliation View is selected

ü Make sure the Bank Balance is equal to the ending balance from your bank statement

ü Review the checks that display as outstanding for validation

ü Select “Display Cash Accounts” and verify the cash accounts match to the cash accounts on the balance sheet

ü Make sure all items have been made permanent (A/P, Cash Receipts, Journal Entries).

ü Review the amount listed in Check Rec as the “Difference” see if this amount sticks out as a specific entry for the month to target

ü Review A/P and Cash Receipt Reports to try to locate the amount listed as the “Difference”

ü Review Outstanding Check Report and Reconciliation Report for accuracy.

ü Verify entries are in the Check Reconciliation - To get a check reconciliation report to match with Accounts Payable Check Register and Cash Receipt edit list, “clear” deposits and checks that are not for that month. Run the report then unclear them

ü Verify date is not in the future months. Uncheck show using to/ from dates.

SDS reports don’t balance to my treasurer’s manual report, what should I look at?

ü Compare Monthly Receipts on the Treasurer’s Report to the Cash Receipt Edit List from SDS. If there are any differences, note them.

ü On the Cash Receipt Edit list, are there any entries to expenditure accounts, note them. Is this the difference between SDS and the Treasurer’s Report receipts for the month?

ü Compare Monthly Expenditures on the Treasurer’s Report to the A/P Paid Accounts Payable Report(s) from SDS. Is there any differences, note them.

ü If the Monthly Expenditures from the Paid Accounts Payable Reports do not match the Treasurer’s Report, print an Open A/P Report. Does that have a total? Is that what you’re off by? If so, there are items that do not have a check number/check date.

ü Make sure all items are made permanent for A/P and Cash Receipts.

ü Did you have to make any journal entries in SDS during the month? Does the treasurer’s report reflect that?

ü Did you have to do any voids through A/P, Cash Receipts, or in Payroll during the month? If so, does the treasurer’s report reflect those voids?

ü Review the reports shared with the Treasurer to make sure the totals were inclusive of all data/transactions.

For additional Check Reconciliation tips and tricks, see the following link:

http://help.schooloffice.com/FinanceHelp/#!Documents/checkreconciliationtips.htm