This option simply involves going to the ACA Dependent Information entry view and typing in the dependent information.

2. Select Human Resources

3. Select Employee Horizontal Data Changes or Add, Change Employee Information

4. Select the “Entry Options” dropdown menu and select “ACA Employee Dependent Information”

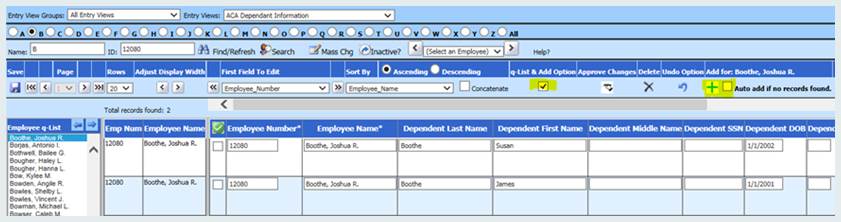

5. Review all columns to the right of the employee name.

IN ORDER FOR A DEPENDENT TO APPEAR ON THE 1095 FORM, MAKE SURE THE FIELD “COVERAGE YEAR” IS POPULATED.

TWO OPTIONS FOR DEPENDENT ENTRY

1. Employee Horizontal Data Changes

a. TO ADD A DEPENDENT:

i. Place a check in “q-List & Add Options”

ii. Select the employee’s name under “Employee q-list” on the far left.

iii. Click on the plus sign + to add a dependent.

iv.

Enter in the data and click save  .

.

v. Tip: If a Dependent’s LAST name is the same as the employee’s LAST name, enter just the Dependent’s FIRST name. When the entry is complete, select the Save icon and the Last Name Field will be automatically populated with the last name of the employee.

vi. Check the box “Auto add if no records found” to automatically add a new Dependent record if a selected employee does not already have a dependent record. This will save you the step of selecting the + (add icon) to add the first dependent record for each employee.

b. TO EDIT A DEPENDENT:

i. Select the employee’s name under “Employee q-list” on the far left.

ii. Enter in

the correct data and click save  .

.

c. TO DELETE A DEPENDENT:

i. Place a check in the box to the left of the “Employee number*” field for the dependent you want deleted and click the “X” icon under Delete.

ii. Click save

.

.

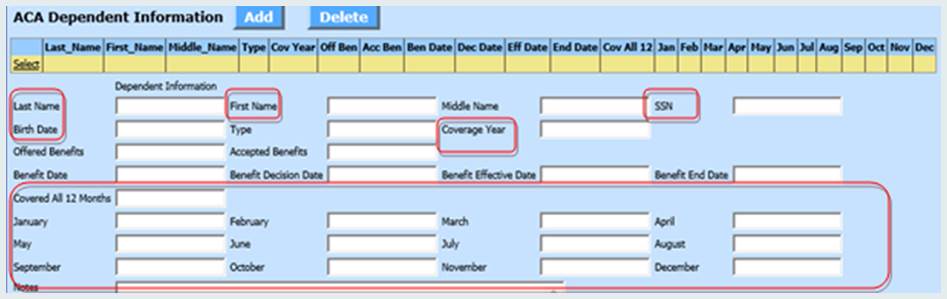

2. Add, Change Employee Information

A new entry option may also aid in efficient entry of “ACA Dependent Information”

• Select Human Resources

• Select Add, Change Employee Information

• Select the Employee for Entry of Dependent Information

• Check the box “ACA Dependent Information” at the top of the screen

• Enter the Information for the Dependent

Required fields are

•Name

•SSN and/or Birthdate

•Coverage Year

•“Y” in Either All 12 Months or the individual months (if less than all year).

• Select the “SAVE” button at the top of the screen to record the time stamp for saving the data. Benefit fields are not required for 1095 processing.