Revised 8/2019

The 401k Payroll file creates a file and uses the starting

and ending date ranges for the period that is to be reported.

1. Select Payroll Processing

2. Select State/Federal Reportinga and 3rd Party Data Export

3. Select Your State: Select Penserv

4. Select a Report: 401k Payroll File

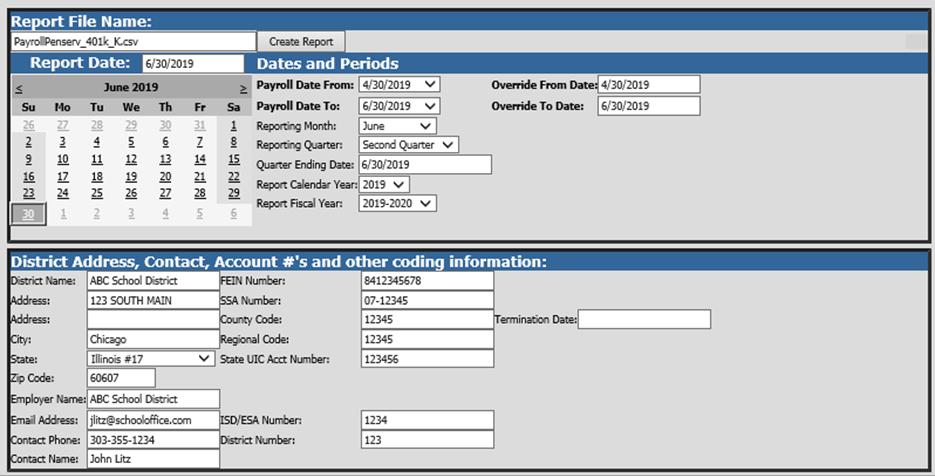

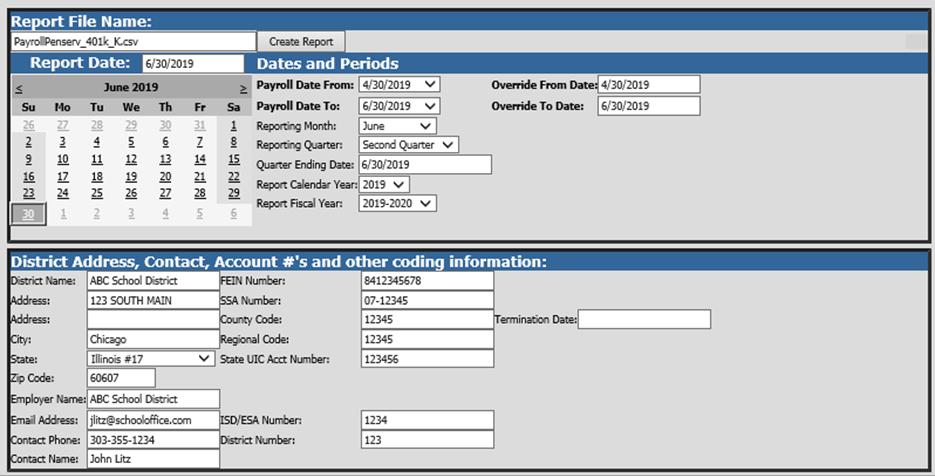

Fill in the following items on the 401K report screen:

5. Report Date: Select calendar date for reporting

6. Payroll Date From: This is the starting date of the payroll(s) in the SDS payroll calendar that need to be reported on the 401k report.

7. Payroll Date To: This is the ending date of the payroll(s) in the SDS payroll calendar that need to be reported on the 401k report.

8. Reporting Month.

9. Report Calendar Year.

10. Report Fiscal Year.

11. District Address, Contact, Acount #’s and other coding information: update/verifiy information listed.

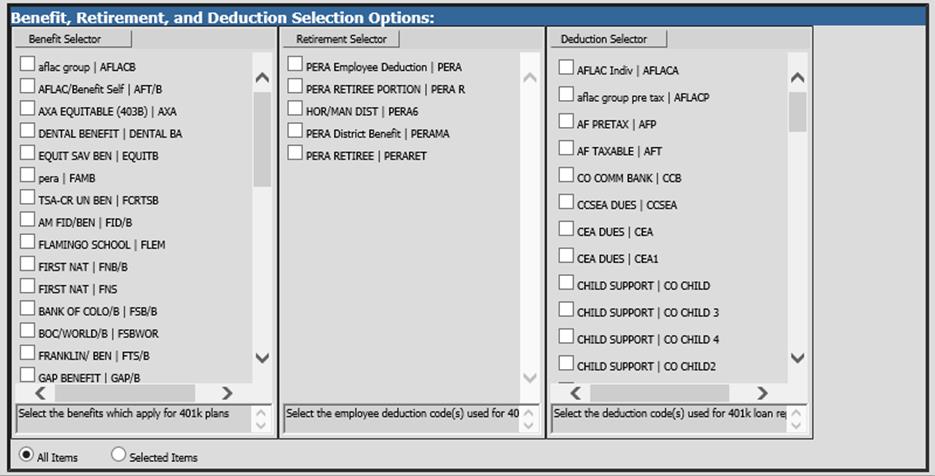

There are 3 list boxes for you to select codes that are to be reported. It is important that you only select the codes that apply to each of these otherwise amounts will not be reported in the proper fields in the file.

•Benefit Selector: This is to be used to select the employer paid benefit codes that apply to 401k’s (as per the instructions at the bottom of the Benefit Selector box)

•Retirement Selector: This is to be used to select the employee deduction codes that apply to employee contributions for 401k’s (as per the instructions at the bottom of the Retirement Selector box)

•Deduction Selector: This is to be used to select the employee deduction codes that apply to employee deductions for 401k loan repayments (as per the instructions at the bottom of the Deduction Selector box)

12. Select Create Report.

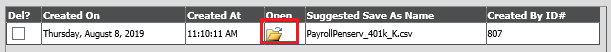

•The file that is created will be listed at the top of the screen when first created. When you re-enter this report it will be displayed under Show/Hide Historic Reports. All files created will have a date and time stamp on them for when they were created.

13. To open the file to review, click on the yellow folder under the open column.

14. You must save the file before submitting it. To save the file, right click on the folder and select save target as. Then save the file on your desktop or other desired location on your computer. You can then upload your 401k Payroll File to the Penserv site.