Revised: 4/2021

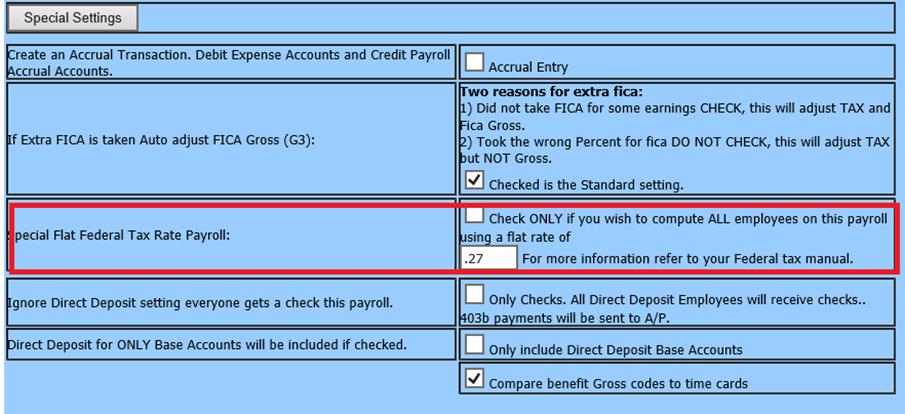

Special circumstances sometimes require that a flat

amount be withheld for federal tax. This option computes a flat federal tax on

the employees selected for this payroll and will override any federal

withholding settings entered for these employees.

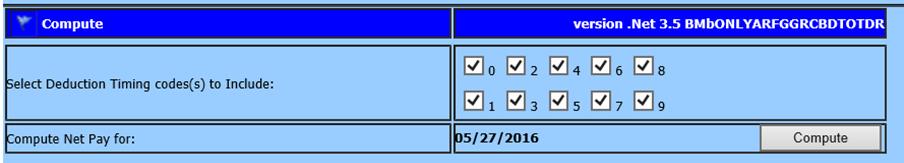

1. From the menu tree select Payroll Processing |Compute Payroll.

2. Select the Timing Codes to be used in this payroll.

3. Select the Special Setting button.

4. In the Special Flat Federal Tax Rate enter your percentage to be used in computing this payroll. Enter it as a decimal (I.e. .27 for 27%)

5. Click on the box ‘check only if you wish to compute ALL employees on this payroll using a flat rate.’

6. Select the Compute button.

7. You may now continue with your regular payroll process.