This section explains how to indicate the Deduction/Benefit records that represent your health insurance records. This process is vitally important to the process as each individual for whom a 1095 form will be printed needs to be tied to one of the Health Insurance Deduction or Benefit Records.

1. Select Master File and Code Entry Options

2. Select Master File Horizontal Data Changes

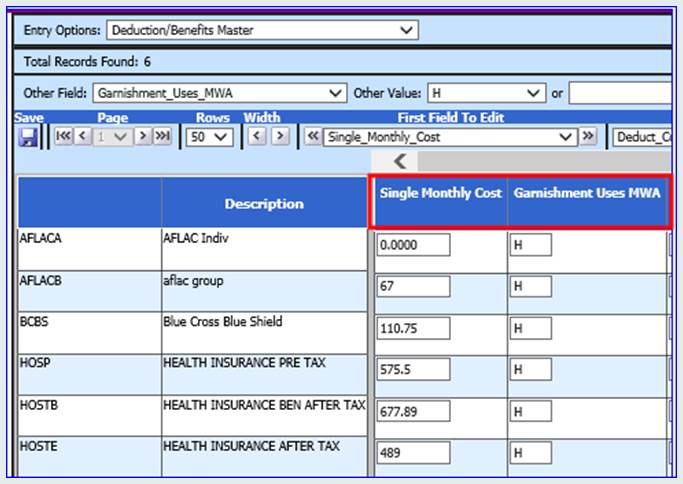

3. At the top of the screen, select the “Entry Options” dropdown menu, and select “Deduction/Benefits Master”

4. Select the following sorts :

a. Under “First Field to Edit” select “Single_Monthly_Cost”. This field will be displayed as the first column to edit. See screen print below.

b. To the right of that selection under “Sort By” select “Garnishment_Uses_MWA”. This will sort your records based on this field.

5. Find the Deduction/Benefit Record(s) that represent health insurance coverage for your district. In each record, in the column Single Monthly Cost, enter the amount for the employee’s share of the lowest cost monthly premium. This amount should be the self-only minimum essential coverage providing minimum value that your employer offers to their employees. If applicable this amount will be reported in Part II line 15 on form 1095-C.

6. On the same Health Insurance Records, enter an “H” in the “Garnishment Uses MWA” field to the right of that amount.

1. The field “Garnishment Uses MWA” is normally used when processing Garnishments through payroll. The Garnishments field uses an “H” to indicate Health Insurance. For 1095 processing, this field will serve a double duty and will be used to indicate which deduction/benefit items are Health Insurance Codes. If you don’t know which deductions on which to enter the code of “H”, please contact your insurance company, auditor, or the IRS.

NOTE: If you are processing Form 1095-B, the system will look at each employee, determine if they have a deduction or benefit that is indicated with an “H”, and if the employee has a YTD figure for that deduction or benefit, the system will use the Vendor Information from that Deduction/Benefit Record to populate Part III of the 1095-B Form.

7.

Click Save

The Single Monthly Cost and Garnishment Wages MWA are relevant to ACA processing

In the Deduction/Benefit Master make sure that any Health care related item that is reportable on the 1095 has the following fields filled in PRIOR to running the ACA Utility.

• Single Monthly Cost

• Garnishment Uses MWA