Revised: 4/2021

Districts pay stipends for many duties such as, tutoring, mentoring, coaching, etc.

Pay for those stipends can be entered as a contract, if it is paid over multiple payrolls, or processed through Gross Pay Entry and Adjustments entry view.

If the need is to keep the federal tax deduction at a lower rate on stipend pay, the Flat Fed Tax field can be used on contract pay or the Flat Tax % Y/N field for gross pay entry.

The flat fed tax option is an override to the normal computation of federal tax, which uses the employee Times Paid (Tax Table) field number by taxable gross and applies it to the federal tax table.

•Example: Coach Stipend $2,500 x 24 = $60,000 annual taxable gross. Tax would compute on an annual gross of $60,000 vs. a one-time pay of $2500, which in turn, deducts a higher tax amount, than as a one-time pay.

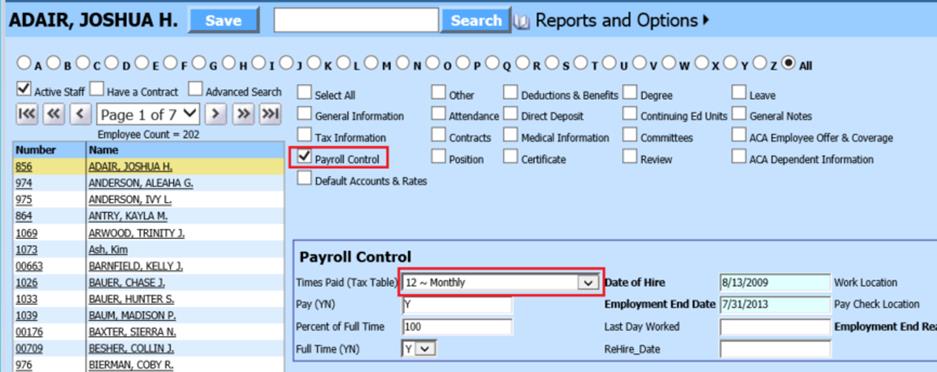

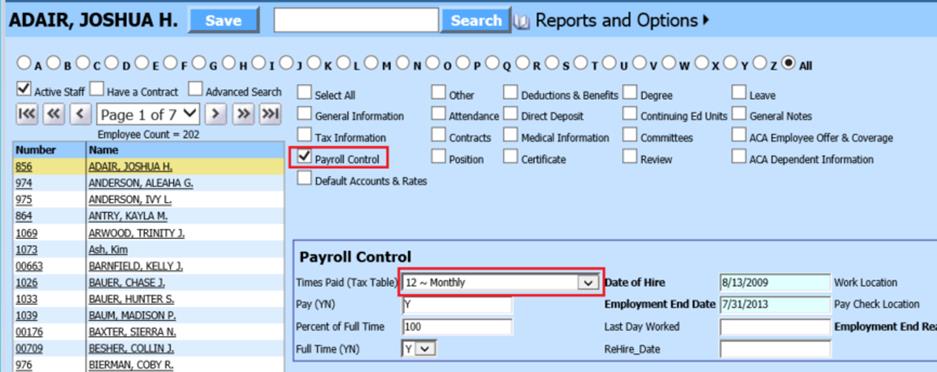

To verify the set up for Times Paid on an individual employee:

1. Select Human Resources or Payroll Processing

2. Select Add, Change Employee Information

3. Select Payroll Control

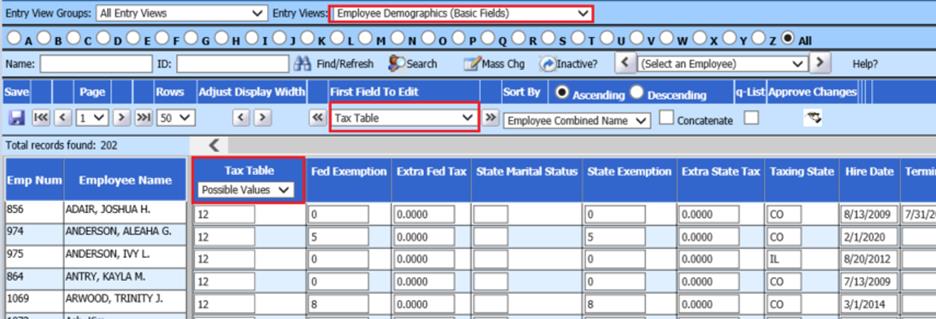

To verify the set up for Times Paid (Tax Table) for Multiple Employees:

1. Human Resources or Payroll Processing

2. Select Employee Horizontal Data Changes

3. Entry Views: Employee Demographics (Basic Fields)

4. First Field to Edit: Select Tax Table

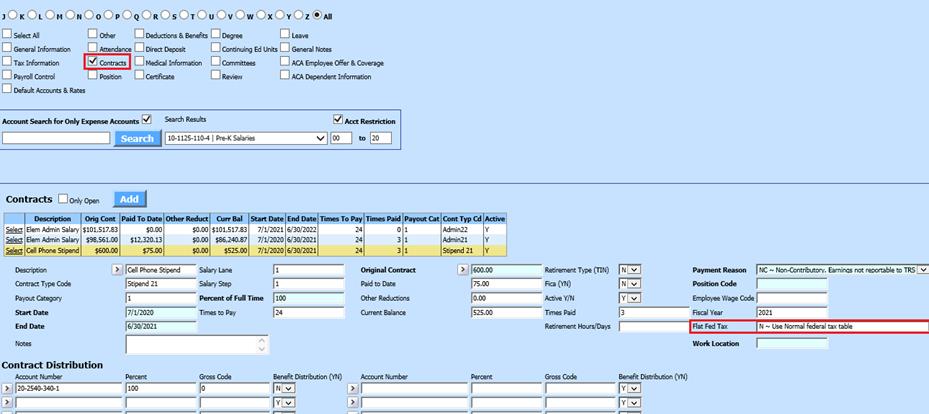

Codes to be used in the Flat tax field:

•Flat Fed Tax: Enter how the federal taxes should be calculated.

o N: Use normal federal tax table

o A: Use Annual/Normal pay/tax bracket % for this contract

o Y: Use flat tax for this contract

o F: Use flat tax for all earnings

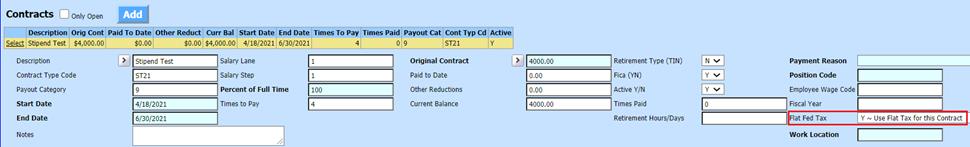

Entered as an Contract Stipend Pay: Verify/update the Flat Fed Tax field in the Employee Contract.

1. Select Human Resources or Payroll Processing

2. Select Add, Change Employee Information

3. Select Contracts

See below link for additional information on entering an Employee Contract:

http://help.schooloffice.com/financehelp/#!Documents/enteringanemployeecontract.htm

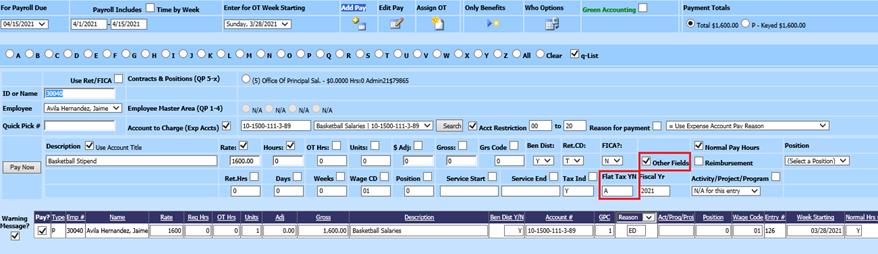

Entered as an Gross Pay Entry Stipend: Update Flat Fed Tax field with Employee Time Card entry.

1. Select Payroll Processing

2. Select Gross Pay Entry and Adjustments

3. Select Add Pay

4. Select Other Fields

a. Flat Tax % Y/N field.

See below link for additional information using Gross Pay Entry and Adjustments entry view: http://help.schooloffice.com/financehelp/#!Documents/grosspayentryandadjustments.htm

Examples, of using the flat tax option are below: Examples are based off of W4-2020 or later.

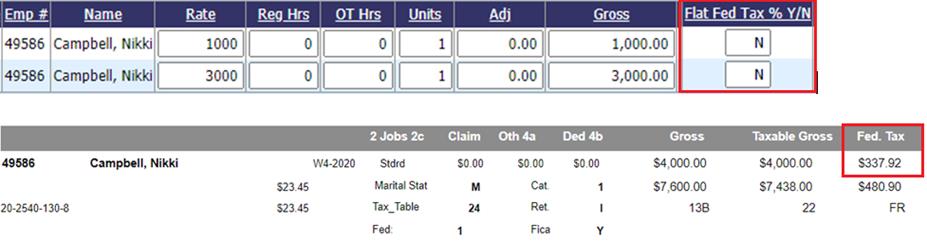

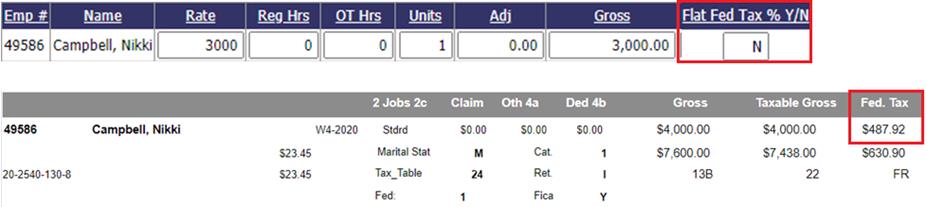

Example 1: Taxing two payroll entries with Flat Fed Tax option N:

•$3,000 Flat Fed Tax % Y/N: N (Normal Fed Tax Table)

•$1,000 Flat Fed Tax % Y/N: N (Normal Fed Tax Table)

This computes $4,000 for 24 payments using the federal tax table.

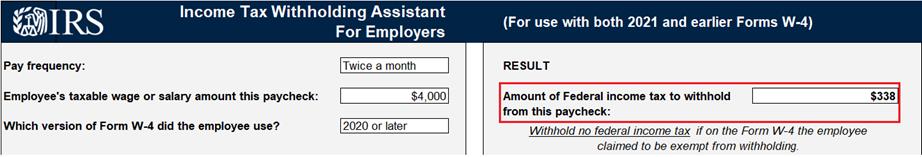

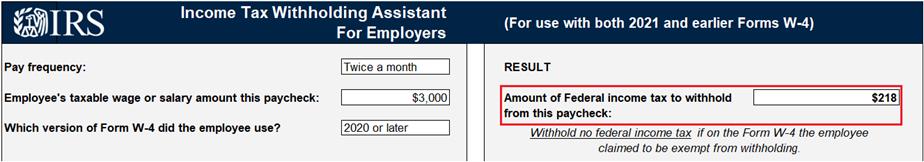

To verify the correct amount withheld, see IRS Income Tax Withholding Assistant: The Tax Withholding assistant is no longer available, after 2022. IncomeTaxWithholdingAssistantForEmployers2022b.xlsx (live.com)

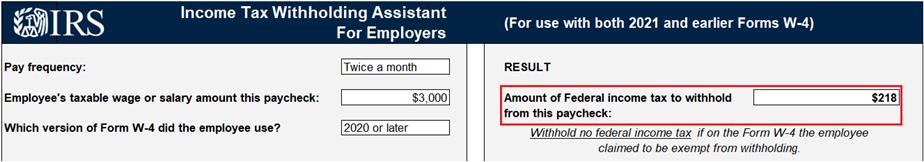

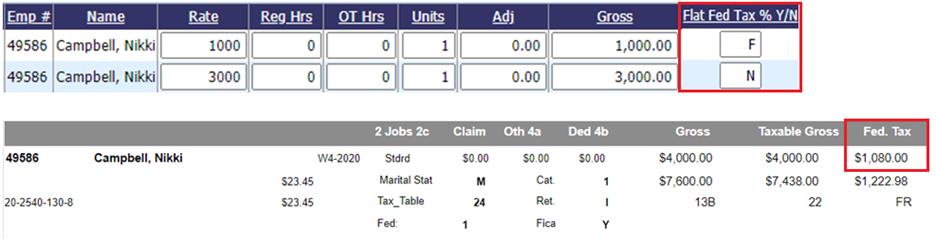

Example 2: Taxing two payroll entries with Flat Fed Tax option N and a contract with Flat Fed Tax % Y/N: Y ~ Use Flat Tax for this Contract:

•$3,000 Flat Fed Tax % Y/N: N (Normal Fed Tax Table)

•$1,000 Flat Fed Tax % Y/N: Y (Flat Tax for this Contract)

This computes $3,000 x 24 payments using the federal tax table and $1,000 x the federal fixed tax percent currently 27%.

•$1,000 x 27% = $270 $218 + $270 = $488

Example 3: Taxing two payroll entries with Flat Fed Tax option N and Flat Tax (F):

•$3,000 Flat Fed Tax % Y/N: N (Normal Fed Tax Table)

•$1,000 Flat Fed Tax % Y/N: F - Flat tax for all earnings

Flat Tax (F) computes all salaries x the federal fixed tax percent currently 27%.

$4,000 x 27% = $1,080

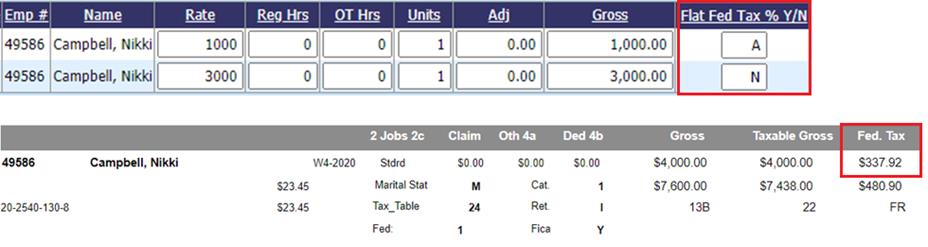

Example 4: Taxing two payroll entries with Flat Fed Tax option N and Flat Tax (A):

•$3,000 Flat Fed Tax % Y/N: N (Normal Fed Tax Table)

•$1,000 Flat Fed Tax % Y/N: A (Annual Tax Bracket Percentage)

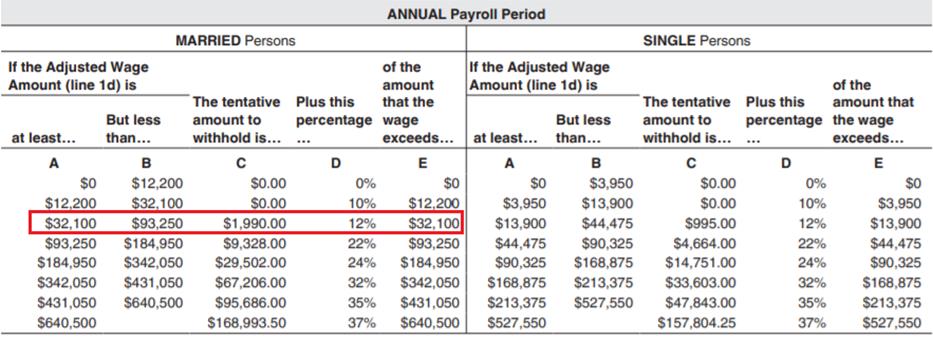

Flat Tax (A) assumes this is a one time $1,000 payment increasing the annual gross and does not repeat during the year. In this example, the $3,000 is multiplied by 24 giving taxable gross of $72,000 and $1,000 x 12%.

•$1,000 x 12% = $120 218 + 120 = $338

Current Publication 15-T: https://www.irs.gov/pub/irs-pdf/p15t.pdf