Revised: 4/2021

SDS uses the Annual tax tables for calculating payroll

taxes. Therefore, making sure the correct tax table is used is important to both

the school district and the employee. The Federal Tax tables, FICA tax tables,

and State tax tables in the system are located by selecting the

following.

1. Select Master File and Code Entry Options

2. Select Master File Horizontal Data Changes

3. Entry Options: Select one; Federal Tax Table, FICA Tax Tables, or State Tax Tables to review the information on these items.

4. The Federal Tax Tables are updated whenever they are changed by the Federal Government.

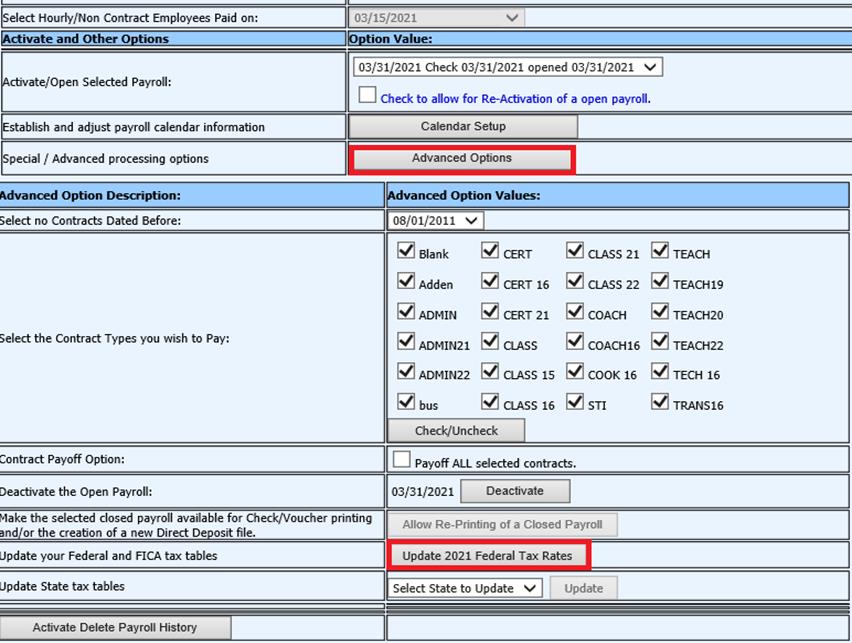

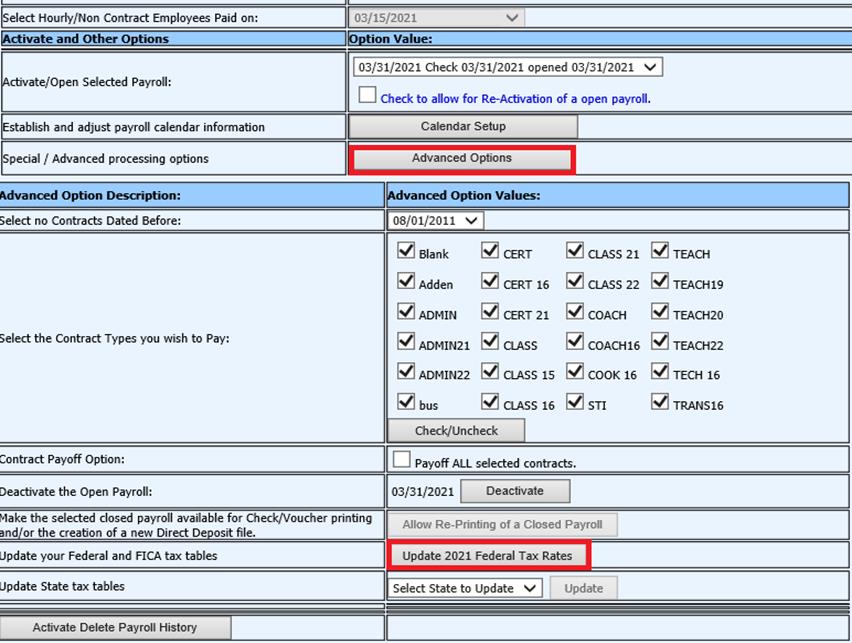

5. The State Tax Tables are updated when you select the option, under Activate Open a Payroll, Advanced Options

The tax tables used within SDS are the Annual tax tables each district needs to assign to each employee how the tables will be converted when the payroll is calculated.

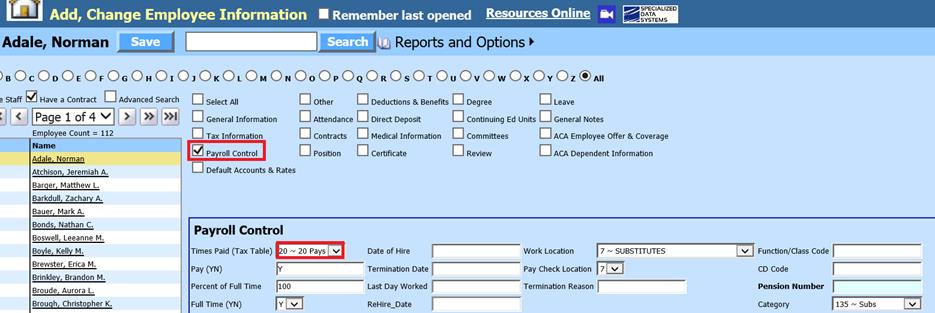

Assigning number of pays within SDS:

•Human Resources/Add, Change Employee Information

•Check mark Payroll Control

•Use drop down arrow to select number of pays

This is done by assigning the number of payrolls (Times Paid) to the employee that will be paid out during the year.

Example:

•If your district pays once a month, the Tax Table should be a “12”

•If your district pays bi-weekly, the Tax Table should be a “26”

•If your district pays semi-monthly, the Tax Table should be a “24”

•If your district pays weekly, the Tax Table should be a “52”

•If you district pays certified staff monthly and non-certified staff semi-monthly, then the tax table will be a “12” or a “24” depending on the employee.

•